|

市場調查報告書

商品編碼

1403751

3D/4D技術:市場佔有率分析、產業趨勢/統計、2024年至2029年成長預測3D & 4D Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

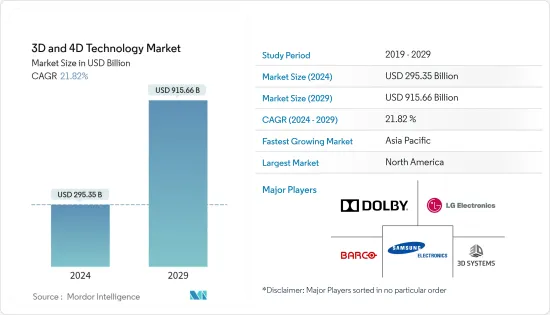

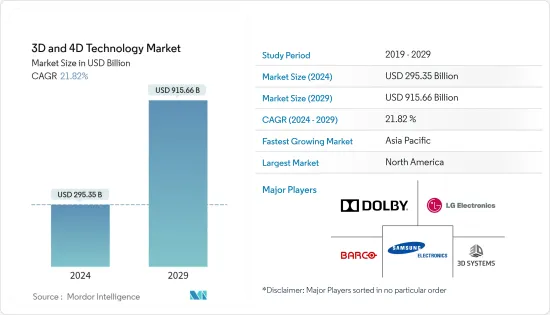

預計2024年3D/4D技術市場規模為2,953.5億美元,2029年將達到9,156.6億美元,在預測期間(2024-2029年)複合年成長率為21.82%。

憑藉其先進的視覺效果、動畫和圖形功能,3D/4D 技術在醫療保健、娛樂、教育、製造和汽車等各個行業中迅速普及。 3D和4D技術為手繪動畫和物理衝擊提供了一個綜合平台。由於其技術卓越,3D/4D 技術的採用正在加速,並可能推動市場成長。

主要亮點

- 家用電子電器對 3D 感測器的需求不斷增加,以及汽車產業對 3D 感測器的採用不斷增加,預計將在預測期內推動市場成長。家庭遊戲產業為消費者提供了 3D 感測的首批實際應用之一,飛行時間 (ToF) 感測器捕捉玩家的動作和手勢,以創造新的互動式遊戲體驗。然而,3D 感測的到來在當今的智慧型手機技術中最為明顯。面向使用者的 3D 掃描透過臉部辨識增強安全性,面向全球的 3D 感測為高效能深度感測攝影和擴增實境創造了新的機會。隨著 3D 相機技術需求的增加,照明源、LAS 濾光片和人工漫射器的產量預計將迅速增加。

- 此外,生物識別掃描和其他 3D 感測應用正在重新定義家用電子電器的世界。平板電腦和筆記型電腦正在擴大 AR/VR、運動感測和行動裝置安全的創新。例如,微軟 Kinect 的手勢姿態辨識功能徹底改變了家庭遊戲產業,現已擴展到包括多人 3D 位置感測、臉部表情偵測和非接觸式心率監測。

- 臉部辨識已添加到 3D 感測應用中,提高了筆記型電腦和行動裝置的安全性,並提高了數位照片的影像品質和解析度。此外,生物辨識掃描和其他 3D 感測應用正在重新定義消費性電子產品的世界。平板電腦和筆記型電腦正在擴大 AR/VR、運動感測和行動裝置安全的創新。例如,微軟 Kinect 的手勢姿態辨識功能改變了家庭遊戲產業,現已擴展到包括多人 3D 位置感測、臉部表情偵測和非接觸式心率監測。

- 如今,仍然使用混合材料和技術產品(例如電路基板)進行製造。由於 3D 列印產品是由層組成的,因此它們不如採用射出成型等傳統技術製造的零件堅固。製造商現在對 3D 列印機生產的產品尺寸提出了更高的要求。這項技術在徹底改變大規模製造之前還有很長的路要走。即使現在,3D 列印機也經常用於一次性原型和小規模列印。因此,與 3D 列印技術相關的成本、可得性和材料問題正在阻礙市場成長。

- 然而,實施 3D/4D 技術可能需要大量的初期成本,包括硬體、軟體、內容創建和培訓。這種成本障礙可能會限制採用,特別是對於預算緊張的小型企業和行業。

- 此外,COVID-19 對整個市場產生了各種影響。在封鎖的早期階段,供應鏈中斷和消費者支出減少對市場產生了負面影響。然而,在隨後的階段,在封鎖和限制期間,隨著遠距工作變得越來越普遍,對協作和身臨其境型技術的需求也隨之增加。

3D/4D技術市場趨勢

3D列印應用在各個最終用戶產業中不斷增加

- 3D 列印機應用於眾多行業,包括教育、航太、醫療保健和非客自訂原型製作。此外,3D列印技術還可用於開發新的製造流程。市場預計將受益於創新的 3D 和 4D 製造鞋。該鞋的 4D 緩震技術是專為專業運動員和普通運動消費者打造的現代創作。

- 此外,金屬 3D 列印的潛力將使在眾多應用中創建稀有和停產的替換零件成為可能。維修店可以為各種客戶提供服務,線上零售商可以列印獨特的零件並透過即時庫存方法提供更多產品。

- 汽車產業正在迅速使用 3D 列印來製作新車模型原型。它也用於航太工業製造備件和替換零件。此外,在醫療保健領域,3D 列印具有廣泛的應用,從牙科模具到義肢,再到用於複雜手術的 3D 列印模型。它還有望防止 POS 系統和 ATM 上的刷卡詐騙。例如,銀行現在使用 3D 列印來設計和製造防止信用卡盜刷的 ATM 零件。

- 例如,3D列印機製造商Anycubic最近發布了Anycubic Kobra系列和Anycubic Photon M3系列3D列印機,配備了先進的Anycubic LeviQ自動平整技術和Anycubic LighTurbo矩陣光源。 Kobra Max 3D 列印機的建造體積為 17.7 x 15.7 x 15.7。配備/45 x 40 x 40 cm(HWD)的列印體積,可輕鬆列印大型物件。

- 此外,美國3D 列印機製造商 3D Systems 最近與人工智慧 (AI) 醫療公司 Enhatch 合作,以更有效地設計和交付針對患者的醫療設備。透過合作,兩家公司將結合各自的專業知識和技術,為醫療設備製造創建最佳化、自動化和可擴展的工作流程。

- 根據Sculpteo 的《2021 年3D 列印狀況》報告,36% 的受訪者選擇增加產品開發作為2021 年的主要優先事項之一,20% 的受訪者表示增加特別版和限量版產品的生產。他們希望您專注於創作。這種對重點領域的顯著偏好凸顯了公司努力利用有價值的工具來加速創新並將新產品推向市場。

預計北美將佔據重要市場佔有率

- 美國是採用3D/4D技術的先驅之一,預計將佔據3D技術市場的很大佔有率。此外,導致器官和組織移植的慢性病數量不斷增加以及器官捐贈者數量有限也是推動市場成長的關鍵因素。

- 據器官採購和移植網路 (OPTN) 稱,大約 7,500 人在等待器官移植期間死亡。此外,該國還有超過107,501人正在等待器官移植。這種器官短缺問題可以透過使用 3D 生物列印來解決日益成長的移植需求。

- 此外,以 1-5 級 ADAS 和 AD 感測技術而聞名的 LeddarTech 公司宣布推出 Leddar PixSet,這是一個用於 ADAS 和自動駕駛研發的感測器資料集。此資料集包含 3D 固態閃光 LiDAR 感測器 Leddar Pixell 的完整波形資料。資料集免費提供用於學術和研究目的,預計將加速設備開發並推動市場成長。

- 據資訊稱,布法羅大學的科學家最近開發了一種快速的新型 3D 生物列印方法,這可能是朝著完全列印人體器官邁出的重要一步。研究人員開發了一種基於 Vat-SLA 的方法,可將充滿細胞的水凝膠結構的製備時間從 6 小時縮短至 19 分鐘。這種最新的生物製造方法能夠創建植入的血管網路,這是高效生產 3D 列印器官的重要一步。

- 此外,2022 年 8 月,麻省理工學院的一個研究團隊宣布,他們已經為軌道太空船生產了「第一個數位等離子體感測器」。這種感測器通常稱為延遲電位分析儀 (RPA),衛星使用它來確定大氣的化學成分和離子能量分佈。 3D 列印的基於雷射的硬體的性能與在無塵室中製造的現代半導體等離子體感測器一樣。

3D/4D技術產業概況

全球3D和4D技術市場目前由各行業中少數擁有技術專長的參與者所主導。全球市場預計將走向一體化,市場佔有率突出的龍頭企業將透過策略併購和聯合舉措來提高市場佔有率和盈利,從而擴大基本客群,我們正在專注於擴張。 3D Systems Corporation、Dolby Laboratories, Inc.、LG Electronics Inc.、Barco NV、Samsung Electronics、Autodesk, Inc.、Stratus's, Inc.、Panasonic Corporation、 Sony Corporation是目前市場上的主要參與者。

2023 年 8 月,荷蘭顯示器技術公司 Dimenco 被著名 3D 顯示器硬體和內容服務供應商 Leia Inc. 收購。這項策略決策結合了兩家 3D 產業參與者的優勢,預計將加速跨平台和裝置普及身臨其境型3D 體驗。此次合併可以使尋求基於通用行業標準的單一跨平台解決方案的客戶受益。

2023 年 7 月,3D Systems Corporation 表示,在 Stratasys Ltd. 確定 3D Systems 的合併提案更為優越後,計劃立即終止與 Desktop Metal, Inc. 的合併協議。據3D Systems稱,這項決定是在Stratasys股東表達反對Desktop Metal合併後做出的。 3D Systems 和 Stratasys 之間的合併協議已經完成,目前處於託管階段。 3D Systems 預計 Stratasys 將在不久的將來簽署該協議。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場抑制因素介紹

- 市場促進因素

- 擴大3D技術在各終端用戶產業的應用

- 娛樂產業對 3D 技術的需求不斷成長

- 加大研發投入,加速開發具成本效益3D技術

- 市場抑制因素

- 產品相關成本高且 3D 列印材料的可得性

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對市場的影響

第5章市場區隔

- 依產品

- 3D感測器

- 3D積體電路

- 3D電晶體

- 3D印表機

- 3D遊戲

- 其他產品

- 按最終用戶產業

- 衛生保健

- 娛樂與媒體

- 教育

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章競爭形勢

- 公司簡介

- 3D Systems Corporation

- Dolby Laboratories, Inc.

- LG Electronics Inc.

- Barco NV

- Samsung Electronics Co., Ltd.

- Autodesk, Inc.

- Stratus's, Inc.

- Panasonic Corporation

- Sony Corporation

- Intel Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The 3D & 4D Technology Market size is estimated at USD 295.35 billion in 2024, and is expected to reach USD 915.66 billion by 2029, growing at a CAGR of 21.82% during the forecast period (2024-2029).

3D and 4D technology are swiftly gaining popularity in various industries like healthcare, entertainment, education, manufacturing, automotive, and others due to their advanced visual effects, animations, and graphics capabilities. The 3D and 4D technologies provide a comprehensive platform for hand-drawn animation and physical impact. As a result of their superior technology, the adoption of 3D and 4D technologies has accelerated, which is likely to propel the market's growth.

Key Highlights

- The increasing demand for 3D sensors in consumer electronics and the growing adoption of 3D sensors in the automotive industry is anticipated to drive the market's growth during the forecast period. The home gaming industry offered one of the first practical applications of 3D sensing for consumers, with time of flight (ToF) sensors capturing the movements and gestures of players to create a new interactive gaming experience. However, the arrival of 3D sensing is most noticeable in today's smartphone technology. User-facing 3D scanning enhances security through facial recognition while world-facing 3D sensing creates new opportunities for high-performance depth-sensing photography and augmented reality. As the demand for 3D camera technology grows, illumination sources, LAS filters, and engineered diffuser production volumes are expected to soar.

- Further, biometric scanning and other 3D sensing applications are redefining the world of consumer electronics. Tablets and laptops are expanding on mobile devices' AR/VR, motion sensing, and security innovations. For instance, the gesture recognition capabilities of Microsoft Kinect that revolutionized the home gaming industry expanded to multi-player 3D position sensing, facial expression detection, and touchless heart rate monitoring.

- Face recognition functions have been added to 3D sensing applications, enhancing the security of laptop computers and mobile devices while boosting digital photo quality and resolution. Further, biometric scanning and other 3D sensing applications are redefining the world of consumer electronics. Tablets and laptops are expanding on mobile devices' AR/VR, motion sensing, and security innovations. For instance, the gesture recognition capabilities of Microsoft Kinect that transformed the home gaming industry expanded to multi-player 3D position sensing, facial expression detection, and touchless heart rate monitoring.

- Manufacturing with mixed materials or technological products (such as circuit boards) is still in production. 3D printed products are made of layers, which are not as strong as parts produced by conventional techniques, such as injection molding. Manufacturers currently need more in the size of products they can make with 3D printing. The technology's ability to revolutionize mass-production manufacturing is still a long way off. Even today, 3D printers are still largely used for making one-off prototypes or small-scale print runs. Hence, the cost, availability, and material issues associated with 3D printing technologies hinder the market's growth.

- However, implementing 3D and 4D technologies can involve significant upfront costs, including hardware, software, content creation, and training. This cost barrier could limit adoption, especially for smaller businesses or industries with tighter budgets.

- Further, COVID-19 had a mixed impact on the overall market. During the initial stages of the lockdown, the disruptions in the supply chain and reduced consumer spending negatively impacted the market. However, in the later stages, the need for collaborative and immersive technologies increased as remote work became increasingly common during lockdowns and restrictions.

3D & 4D Technology Market Trends

Increasing Applications of 3D Printing Across Various End-user Industries

- 3D printers are used in numerous industries, including education, aerospace, healthcare, and non-custom prototyping. Further, 3D printing technology can also be employed to develop new manufacturing processes. The market is anticipated to benefit from innovative 3D and 4D-made shoes. The 4D cushioning in shoes is a contemporary creation for professional athletes and ordinary exercise consumers.

- Further, the potential of metal-based 3D printing would allow for the creation of rare, discontinued replacement parts in numerous applications. Repair shops can handle a variety of clientele, and online retailers can print unique parts, providing more products through a just-in-time inventory approach.

- The automobile industry is rapidly using 3D printing to prototype new car models. It is also used to produce spare and replacement parts in aerospace-related sectors. Further, healthcare has a wide variety of 3D printing applications ranging from molds in dentistry to prosthetics and 3D printed models for complex surgeries. It is promising to prevent card-present fraud in point-of-sale systems and ATMs. For instance, banks are now using 3D printing to design and produce ATM components that contain credit card skimming.

- For instance, Anycubic, a 3D printer manufacturer, recently announced its Anycubic Kobra series and Anycubic Photon M3 series of 3D printers, featuring advanced Anycubic LeviQ auto bed leveling technology and Anycubic LighTurbo matrix light source that provides a radically improved user-friendly experience and enhanced print details. The Kobra Max 3D printer features a build volume of 17.7 x 15.7 x 15.7. / 45 x 40 x 40 cm (HWD), which enables large-scale objects to be printed easily.

- Also, the United States-based 3D printer manufacturer 3D Systems recently entered a partnership with artificial intelligence (AI) medical firm Enhatch to design and deliver patient-specific medical devices more efficiently. The companies will combine their respective expertise and technologies to create an optimized, automated, and scalable workflow for fabricating medical devices through the partnership.

- As per Sculpteo's The State of 3D Printing 2021 report, increasing product development was selected as one of their primary priorities by 36% of respondents for 2021, while 20% wished they would concentrate on creating specialized and limited-edition items. Such significant preferences on focus areas highlight the company's initiatives to leverage the valuable tool in accelerating innovation and bringing new products to market.

North America is Expected to be a Significant Market Share Holding Region

- The United States is one of the pioneers in adopting 3D and 4D technology and is expected to hold a prominent share in the 3D technology market. Furthermore, Growing incidences of chronic illnesses leading to organ and tissue transplants and a limited number of organ donors are among the primary factors driving the market growth.

- According to the Organ Procurement and Transplantation Network (OPTN), about 7500 people die while waiting for an organ transplant. Further, over 107,501 people in the country were waiting for an organ transplant. This shortage could be reduced by using 3D bioprinting to counter the increasing need for transplants.

- Moreover, LeddarTech, a prominent player in Level 1-5 ADAS and AD sensing technology, announced the availability of Leddar PixSet, a sensor dataset for ADAS and autonomous driving research and development. The dataset includes full-waveform data from Leddar Pixell, a 3D solid-state flash LiDAR sensor. The datasets offered free of charge for academic and research purposes are expected to further the device development, thereby driving market growth.

- According to an update, Scientists from the University at Buffalo recently developed a rapid new 3D bioprinting method that could represent a significant step toward fully printed human organs. The researchers developed a vat-SLA-based approach to reduce the time to create cell-laden hydrogel structures from 6 hours to 19 minutes. The updated bio-fabrication method has enabled the production of embedded blood vessel networks, making it a significant step towards efficiently creating 3D-printed organs.

- Also, in August 2022, According to an MIT announcement from a research team, the "first digitally made plasma sensors" for orbiting spacecraft have been produced. The sensors, often referred to as retarding potential analyzers (RPAs), are utilized by satellites to ascertain the atmospheric composition's chemical makeup and ion energy distribution. Hardware that was 3D printed and made using lasers performed on par with modern semiconductor plasma sensors made in a cleanroom.

3D & 4D Technology Industry Overview

The global 3D 4D technology market is currently dominated by a few players in their respective industries with technological expertise. The global market is expected to be consolidated in nature, and the major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging strategic mergers and collaborative initiatives to increase their market share and profitability. 3D Systems Corporation, Dolby Laboratories, Inc., LG Electronics Inc., Barco N.V., Samsung Electronics Co., Ltd., Autodesk, Inc., Stratus's, Inc., Panasonic Corporation, and Sony Corporation are some of the prominent players present in the current market.

In August 2023, Dimenco, a Netherlands-based player in display technology, was acquired by Leia Inc., a prominent 3D display hardware and content services supplier. This strategic decision combines the strengths of two 3D industry players and is expected to accelerate the widespread adoption of immersive 3D experiences across platforms and devices. This merger might benefit customers looking for a single, cross-platform solution built on a common industry standard.

In July 2023, 3D Systems Corporation stated that the business anticipates an immediate termination of the merger agreement with Desktop Metal, Inc. following Stratasys Ltd.'s decision to consider 3D Systems' merger proposal superior. According to 3D Systems, the decision was made after Stratasys shareholders expressed their opposition to the Desktop Metal merger. A merger agreement between 3D Systems and Stratasys has already been completed; it is now in escrow. 3D Systems anticipates Stratasys to countersign it soon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Applications of 3D Technology Across Various End-User Industries

- 4.3.2 Increasing Demand for 3D Technology in the Entertainment Industry

- 4.3.3 Increased Investment in R&D to Drive Development of Cost-Effective 3D Technology

- 4.4 Market Restraints

- 4.4.1 High Product Associated Costs and Availability of 3D Printing Materials

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Products

- 5.1.1 3D Sensors

- 5.1.2 3D Integrated Circuits

- 5.1.3 3D Transistors

- 5.1.4 3D Printer

- 5.1.5 3D Gaming

- 5.1.6 Other Products

- 5.2 By End-User Industry

- 5.2.1 Healthcare

- 5.2.2 Entertainment & Media

- 5.2.3 Education

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3D Systems Corporation

- 6.1.2 Dolby Laboratories, Inc.

- 6.1.3 LG Electronics Inc.

- 6.1.4 Barco N.V.

- 6.1.5 Samsung Electronics Co., Ltd.

- 6.1.6 Autodesk, Inc.

- 6.1.7 Stratus's, Inc.

- 6.1.8 Panasonic Corporation

- 6.1.9 Sony Corporation

- 6.1.10 Intel Corporation