|

市場調查報告書

商品編碼

1640620

非接觸式付款終端:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Contactless Payment Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

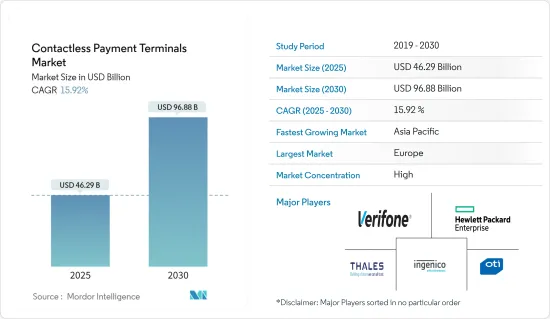

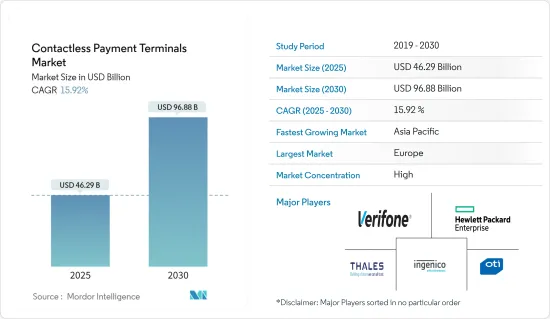

預計到 2025 年非接觸式付款終端市場規模將達到 462.9 億美元,到 2030 年將達到 968.8 億美元,預測期內(2025-2030 年)的複合年成長率為 15.92%。

主要亮點

- 由於企業和消費者數位轉型趨勢日益增強以及智慧型手機的廣泛使用,全球付款和交易格局正在迅速變化。智慧型手機、數位付款卡和零售銷售點終端的技術進步正在推動市場成長。

- 隨著越來越多的國家尋求邁向無現金經濟,它們正在透過獎勵消費者使用數位付款來促進數位付款提供者的發展。此外,全球非接觸感應卡交易的成長正在推動各個終端用戶產業對非接觸式付款終端的需求。

- 非接觸式付款由於其便利性和偏好,獲得了廣泛的支持。因此,各種穿戴式裝置製造商都在其大多數裝置上近距離場通訊(NFC) 技術作為標準,從而消除了擺弄錢包、錢袋或行動電話的需要,增加了便利性。

- 此外,全球消費者擴大採用在銷售點系統中以非接觸式付款方式進行的基於智慧型手機的付款,這促使卡片和金融服務提供商透過智慧型手機或第三方供應商提供解決方案。

- 此外,由於全球金融詐騙增多,政府監管機構近年來也致力於確保付款交易的安全。客戶期望安全可靠的數位交易,因此使用安全付款流程的需求也隨之增加。因此,這些監管機構對 POS 終端的採用產生了積極影響。隨著全球行動化趨勢的不斷增強,行動POS系統也越來越受歡迎。隨著無現金交易技術的出現,POS 的採用率有望提高。

- 此外,技術進步正在塑造非接觸式付款終端市場的未來。進入市場的供應商專注於開發靈活、高效的付款管道,同時也致力於提高非接觸式付款的採用和普及。例如,去年 2 月,數位付款公司 Infibeam Avenues Limited (IAL) 表示,它將透過推出無硬體、非接觸式行動銷售點 (POS) 來擴大其付款解決方案組合。

- 在新冠肺炎疫情期間,世界各地的消費者開始尋找避免人際接觸的方法來保護自己免受感染。這導致了非接觸式付款需求的增加,許多產業對各種非接觸式付款終端(如非接觸式 POS 終端)的需求正在成長。此外,即使疫情過後,由於新興國家數位付款的普及,非接觸式付款終端的需求預計仍將快速成長。

非接觸式付款終端市場趨勢

零售業可望佔據主要市場佔有率

- 非接觸式付款終端在零售業的使用日益增多,引入非接觸式付款終端具有諸多好處,例如促銷、提高顧客滿意度等,因此市場佔有率較高。透過提供非接觸式付款選項,零售商可以提高結帳流程的速度和效率,透過更順暢、更快速的交易培養客戶忠誠度。

- 這個細分市場的關鍵促進因素是經銷店和零售店結帳時對行動電子錢包的偏好。行動 POS(mPOS)的發展涉及連接到平板電腦或智慧型手機上的基本 ePOS 應用程式的讀卡器,使商家入職變得簡單,同時提供計量收費模式的服務。在零售業,類似的案例很可能會導致非接觸式付款終端的引入。

- 市場上的公司正在為零售商提供創新和智慧的解決方案,這有望推動非接觸式付款終端在零售領域的應用。例如,去年金融服務平台 Square 宣布將向美國數百萬商家推出適用於 iPhone 的 Tap To Pay 服務。此外,新推出的 iPhone 觸碰支付 (Tap to Pay) 功能讓客戶能夠直接從 iPhone 接受非接觸式付款,無需任何硬體或額外費用。

- 此外,預計預測期內零售店和商店中非接觸式簽帳金融卡和信用卡付款數量的增加將推動零售業對非接觸式終端的市場需求。例如,根據Worldplay的統計,簽帳金融卡是去年英國最受歡迎的付款方式,分別佔POS終端所有付款的45%和28%。

歐洲可望佔據非接觸式付款終端市場大部分佔有率

- 由於消費者習慣的改變、監管環境的發展、技術創新和 COVID-19 疫情等各種原因,付款格局正在發生變化,預計歐洲地區將在未來一段時間內佔據相當大的市場佔有率。此外,非接觸式付款終端在各個終端用戶產業的廣泛應用和顯著成長將在未來幾年進一步推動市場的發展。

- 隨著消費者將這種相對較新的付款方式融入日常生活,用於付款的穿戴式裝置在歐洲持續受到歡迎。例如,戒指、穿戴式裝置、手環和智慧型手錶都配備了近距離場通訊(NFC)功能。穿戴式裝置分為「主動」和「被動」。如果您穿著被動式手錶(例如戒指),您可以透過在付款終端輸入 PIN 碼來進行核准的交易,就像使用塑膠卡一樣。如果您戴的是智慧型手錶等活動手錶,密碼就會插入裝置本身,您只需輕輕一按即可付款。

- 此外,新冠肺炎疫情推動了整個歐洲對非接觸式付款的推動,非接觸式卡限額大幅增加。疫情爆發後,該地區越來越多的消費者開始轉向非接觸式付款,預計將進一步推動市場發展。

- 此外,預計預測期內該地區市場供應商的持續產品創新將推動市場發展。例如,PayPal Holdings Inc. 去年 5 月宣佈為英國中小型企業推出 Tap to Pay with Zettle by PayPal 服務。這項新功能允許私人賣家和小型企業直接在其 Android 行動裝置上接受非接觸式面對面付款,無需任何額外的硬體或費用。

非接觸式付款終端產業概況

非接觸式付款終端市場正在整合,僅少數參與者擁有相當大的市場佔有率。此外,由於非接觸感應卡以及對安全問題的擔憂,新參與企業難以進入市場。市場的主要企業包括泰雷茲集團、OTI、VeriFone Systems Inc.、惠普和 Ingenico Group SA。

- 2023 年 12 月,萬事達卡將推出非接觸式付款解決方案,將徹底改變奈及利亞的付款格局。此解決方案使企業能夠透過智慧型手機點擊、透過連結2D碼支付或支付連結快速且經濟高效地進行卡片付款。非接觸式付款使所有相關人員的結帳更快、更方便。非接觸式付款系統使顧客避免了現金支付或刷卡輸入密碼的麻煩。在終端機或行動電話上刷卡可以使交易更加順暢。

- 2023 年 10 月:Softpay 和 Dotykacka 合作在捷克共和國和斯洛伐克推出手機付款解決方案,並由 Nexi 作為收購方。手機支付技術供應商 Softpay 與多功能 POS 系統解決方案供應商 Dotykacka 建立了策略合作夥伴關係,以滿足捷克共和國和斯洛伐克日益成長的非接觸式付款需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估新冠肺炎對產業的影響

第5章 市場動態

- 市場促進因素

- 減少等待時間並加快結帳速度

- 非接觸式付款的便利性和易用性

- 市場限制

- 對數位付款的安全擔憂

第6章 市場細分

- 依技術分類

- Bluetooth

- 紅外線的

- 以職業為基礎

- Wi-Fi

- 其他技術

- 按付款方式

- 基於帳戶

- 信用卡/簽帳金融卡

- 儲值

- 智慧卡

- 其他付款方式

- 按設備

- 整合 POS

- mPOS

- PDA

- 無人碼頭

- 非接觸式讀卡機

- 其他設備

- 按最終用戶產業

- 零售

- 運輸

- 銀行

- 政府

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Thales Group

- On Track Innovation LTD.(OTI)

- VeriFone Inc.

- Hewlett Packard Enterprise Development LP

- Ingenico Group SA

- Visiontek Products LLC

- PayPal Holdings Inc.

- Castles Technologies

- ID Tech Solutions

- NEC Corporation

第8章投資分析

第9章:市場的未來

The Contactless Payment Terminals Market size is estimated at USD 46.29 billion in 2025, and is expected to reach USD 96.88 billion by 2030, at a CAGR of 15.92% during the forecast period (2025-2030).

Key Highlights

- The global landscape of payments and transactions is changing rapidly, owing to the growing enterprises and consumer propensity toward digital transformation and the proliferation of smartphones. Technological advancements in smartphones, digital payment cards, and retail POS terminals fuel market growth.

- More and more countries are moving toward becoming cashless economies, thus encouraging digital payment providers by incentivizing their consumers' digital forms of payments. In addition, growing contactless card transactions worldwide drive the demand for contactless payment terminals in various end-user industries.

- Contactless payments are gaining significant traction due to their convenience and preference. As a result, various wearable device manufacturers are incorporating near-field communication (NFC) technology as a standard into most devices to provide greater convenience by removing the need to fumble with a wallet, purse, or phone.

- In addition, the global consumer inclination toward payment methods involving smartphones is increasing in the form of contactless payment methods at POS systems, owing to which card and financial service providers are either offering their card solutions on smartphones or via third-party vendors.

- Additionally, the rising financial frauds worldwide have influenced government regulatory bodies to secure payment transactions over the past few years. With customers demanding safe and reliable digital transactions, the need for using secure payment processes has increased. Therefore, these regulatory bodies have positively impacted the adoption of POS terminals. With the increasing mobility trends worldwide, mobile POS systems are gaining traction. With the advent of cashless transactional technologies, POS is expected to witness an increase in adoption rates.

- Moreover, technological advancements are shaping the future of the contactless payment terminals market. Market vendors are focusing on developing payment platforms that are agile and efficient and also increase the penetration and reach of contactless payments. For instance, in February last year, digital payments player Infibeam Avenues Limited (IAL) announced to broaden its payment solutions portfolio by launching a no-hardware contactless mobile point of sale (POS), which will facilitate card payment transactions for small vendors through a tap-on-phone technology.

- During the COVID-19 pandemic, consumers worldwide started finding ways to avoid human contact in order to protect themselves from getting affected. Due to this, the demand for contactless payments has increased, boosting the demand for various contactless payment terminals, such as contactless POS terminals, in multiple industries. In addition, even after the pandemic, the demand for contactless payment terminals is expected to grow rapidly, owing to the proliferation of digital payments in emerging economies.

Contactless Payment Terminals Market Trends

Retail Industry is Expected to Hold Major Market Share

- With the increased use of contactless payment terminals in retail, together with benefits arising from placing them on offer like promotion of sales at merchants and improved customer satisfaction, it is expected to have a strong market share. Retailers provide a contactless payment option to enhance the speed and efficiency of the checkout process, fostering customer loyalty through smoother and quicker transactions.

- Point-of-sale terminals (POS) across retail stores and The primary drivers for this segment are outlets and a preference of mobile wallets to check out from retail stores. The evolution of mobile-based POS (mPOS) includes an card reader connected to a basic ePOS app on a tablet or smartphone, and while Merchant onboarding is simple, where the service is delivered on a 'pay-as-you-go model. In the retail sector, these cases are likely to lead to deployment of Contactless Payment Terminals.

- Market players offer innovative and smart solutions for retailers, expected to drive the adoption of contactless payment terminals in the retail segment. For instance, the previous year, Square, a financial services platform, It's announced to its millions of sellers in the United States that it will be launching a Tap To Pay service for iPhone. In addition, the newly launched Tap to Pay on iPhone enables all sizes of vendors Accepting contactless payments directly from their iPhones without any hardware or additional costs is also available as an application in Square Point Of Sale'siOS point of sale applications.

- Moreover, the growth in contactless debit card and credit card transactions in retail stores and outlets is anticipated to drive the market demand for contactless terminals in the retail sector over the forecast period. For example, the most popular payment method in the UK last year was debit cards which accounted for 45 % and 28 % respectively of all payments made at POS terminals according to statistics from Worldplay.

Europe is Expected to Hold Significant Share in the Contactless Payment Terminals Market

- The European region is expected to hold a significant market share over the upcoming period, owing to the changing payment landscape for various reasons: changing consumer habits, regulatory developments, innovation, and the COVID-19 pandemic. Moreover, the broader adoption of contactless payment terminals in different end-user industries is witnessing significant growth, further driving the market in the coming years.

- In Europe, consumers' wearable devices for payments continue to take off as they grate this relatively new payment method into their daily lives. For example, a ring, a wearable device, a bracelet, or a smartwatch, has Near-field Communication (NFC) capabilities. There exists 'active' and 'passive' wearables. The transaction which can be authorized by entering the PIN code on the payment terminal, just as with a plastic card, if you have your passive wristwatch that is like a ring. When you wear an active watch, such as a smartwatch, the PIN is inserted on your device itself and payments can be made using one tap.

- Additionally, amidst the COVID-19 situation, contactless card limits across Europe grew substantially as contactless payments were promoted across the continent. More and more consumers in the region are moving toward contactless payments after the pandemic, which is further expected to drive the market.

- In addition, continuous product innovation by market vendors in the region is expected to drive the market over the forecast period. For instance, in May last year, PayPal Holdings Inc. launched Tap to Pay with Zettle by PayPal for small businesses in the United Kingdom. The new function will enable individual sellers and small businesses to accept contactless in-person payments directly on Android mobile devices without additional hardware and fees.

Contactless Payment Terminals Industry Overview

The contactless payment terminals market is consolidated because only some players have a significant market share. Moreover, consumers' need for more awareness toward contactless cards and concern over security issues make market entry challenging for new players. Some of the key players in the market include Thales Group, OTI, VeriFone Systems Inc., Hewlett Packard, and Ingenico Group SA.

- December 2023: Mastercard leads the charge in transforming Nigeria's payment landscape as it unveils its contactless payment solutions. The solution will empower businesses to accept card payments quickly and cost-effectively, using a tap on the phone, QR Pay by link, and Payment link on their smartphones. Contactless payments make the checkout experience faster and more convenient for all parties involved. With a contactless payment system, customers can skip paying by cash or swiping their cards and inputting their PIN. They can tap the card against the terminal or mobile phone, making transactions smoother.

- October 2023: Softpay and Dotykacka Collaborate to Introduce Tap-to-phone Payment Solution In the Czech Republic and Slovakia utilizing Nexi as Acquirer. Tap-to-phone technology provider SoftPay has announced a strategic partnership with multifunctional POS system solution provider Dotykacka to meet the growing demand for contactless payment acceptance in the Czech Republic and Slovakia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reduction in Queuing Time and Quicker Checkout Time

- 5.1.2 Convenience and Ease Associated with Contactless Payments

- 5.2 Market Restraints

- 5.2.1 Security Concerns Regarding Digital Payment

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Bluetooth

- 6.1.2 Infrared

- 6.1.3 Carrier-based

- 6.1.4 Wi-Fi

- 6.1.5 Other Technologies

- 6.2 Payment Mode

- 6.2.1 Account-based

- 6.2.2 Credit/Debit Card

- 6.2.3 Stored Value

- 6.2.4 Smart Card

- 6.2.5 Other Payment Modes

- 6.3 Device

- 6.3.1 Integrated POS

- 6.3.2 mPOS

- 6.3.3 PDA

- 6.3.4 Unattended Terminal

- 6.3.5 Contactless Reader

- 6.3.6 Other Devices

- 6.4 End-user Industry

- 6.4.1 Retail

- 6.4.2 Transportation

- 6.4.3 Banking

- 6.4.4 Government

- 6.4.5 Healthcare

- 6.4.6 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Rest of Asia- Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Argentina

- 6.5.4.3 Mexico

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle-East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle-East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thales Group

- 7.1.2 On Track Innovation LTD. (OTI)

- 7.1.3 VeriFone Inc.

- 7.1.4 Hewlett Packard Enterprise Development LP

- 7.1.5 Ingenico Group SA

- 7.1.6 Visiontek Products LLC

- 7.1.7 PayPal Holdings Inc.

- 7.1.8 Castles Technologies

- 7.1.9 ID Tech Solutions

- 7.1.10 NEC Corporation