|

市場調查報告書

商品編碼

1643180

IT人員編制:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)IT Staffing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

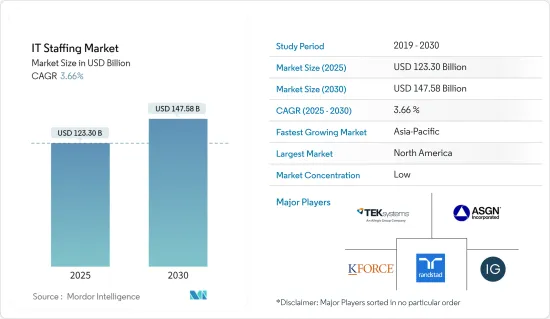

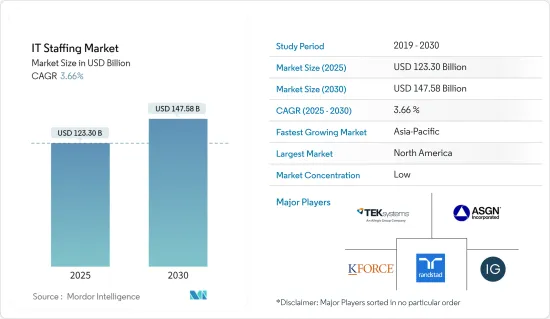

2025 年 IT人員編制市場規模預估為 1,233 億美元,預計到 2030 年將達到 1,475.8 億美元,預測期內(2025-2030 年)的複合年成長率為 3.66%。

主要亮點

- 市場成長的動力來自於人力資源業務外包的增加以及人工智慧和高階分析等先進技術的興起,預計這些技術將推動多個終端使用者領域對 IT 專業人員的需求。

- 招聘中分析解決方案的使用日益增多,預計也將推動對專業人力資源服務的需求。根據 LinkedIn 最近的一份報告,約 92% 的專家認為分析將成為印度等新興國家招募的關鍵。

- 人力資源分析透過對績效、留任和招募等關鍵因素進行預測來幫助提高人力資源服務的生產力。所有這些因素都在推動市場擴張。人力資源分析可以幫助人力資源部門做出基於資料決策來管理人員流失並確定可以實施自動化的領域。您還可以利用該解決方案的功能從員工回饋表中獲取見解。

- 人力資源分析還可以引入人工智慧招募人員來自動化面試安排,為員工提供即時回饋,並改善巨量資料人力資源分析的處理。這不僅節省了人力資源主管的時間,也節省了金錢。

- 此外,跨終端用戶領域的多家企業正在遷移到雲端,以繼續向客戶提供解決方案並確保關鍵業務的連續性。據Microsoft 365稱,該公司雲端服務的使用量增加了775%。預計這將導致雲端運算和網路安全專業人員數量的大幅增加。

- 由於各行業的數位化不斷提高,以及 IT 和通訊業對熟練員工的需求不斷成長,全球 IT人員編制正在成長。例如,根據 Nasscom 的報告,印度科技業預計將在 2023-24 會計年度增加 6 萬個就業崗位,使總勞動力人數達到 543 萬人。

- 根據美國稅法近期變化帶來的機遇,預計企業將進一步擴大並加速人才招募。預計民營企業平均利潤成長5%。領導人也預計未來 12 個月經濟將繼續成長。因此,許多公司正在投資人力資本。這些趨勢與 IT 人員的趨勢一致。

- 為了在當今充滿活力的商業環境中保持領先地位,您需要擁有一支擁有最新技能的員工。據世界經濟論壇稱,到2029年,44%的工人將擁有過時的技能。公司文化必須優先考慮技能提升和再培訓工作。這樣做將釋放員工潛力,提高工作滿意度,促進參與度,並最終提高生產力和留任率。

IT人員編制市場趨勢

軟體開發人員市場需求旺盛

- 軟體開發人員設計電腦應用程式和程式。與軟體工程師相比,開發人員通常更具創造力和開發意識,在整個軟體開發生命週期中使用現成的工具來建立軟體和應用程式。

- 新冠肺炎疫情嚴重影響了全球各種規模的經濟體,但世界各地的資訊科技 (IT) 公司已經能夠抵禦大部分景氣衰退。這主要歸功於採用了分散式 IT 開發、遠端維護和遠端 IT 營運。 Google、IBM、Accenture、微軟、DXC、SAP、TCS、Wipro 和 Infosys 等大型 IT 公司已要求員工在疫情期間在家工作。此外,為了適應在家工作的限制,零售、娛樂、教育和醫療保健等行業對 IT 服務和軟體開發人員的需求也在增加。

- 透過在 IT 人才開發和管理中使用人工智慧,公司可以評估其人才庫,並利用現有員工的歷史技能資料將個人與管理人員發布的合適空缺職位進行匹配。人工智慧還可以幫助分析技能鄰接性、過去的經驗和預期的職業道路。員工可以更了解公司內部他們通常無法接觸到的各種計劃和經驗,同時還可以透過個人化建議獲得合適的機會。預計到2030年,沙烏地阿拉伯將在人工智慧領域投資200億美元。這可能為市場相關人員提供將人工智慧納入其勞動力管理解決方案的機會。

- 此外,全球 IT 產業發展健康,隨著技術更新和發展,對軟體開發人員的需求正以驚人的速度成長。預計到 2030 年,攻讀 IT 或軟體工程課程的學生將擁有蓬勃發展的職業道路。此外,根據《Tech World Times》的報導,全球軟體開發人員群體超過 2,640 萬,即使在印度這樣的開發中國家,軟體開發也已成為主流職業。

- 此外,由於整個產業正在發生的數位轉型和Start-Ups文化的興起,IT人員編制產業預計對軟體開發人員的需求和收益將發生模式轉移。由於技術的不斷創新以及應用開發對軟體開發技能的需求,預計各個終端用戶行業的新產品開發將具有最大的影響力和需求。

- 然而,軟體開發人員的 IT人員編制面臨多重挑戰。例如,雲端基礎設施供應商 DigitalOcean共用的一份報告發現,42% 在疫情期間沒有換工作的軟體開發人員正在或可能考慮今年離職。此外,報告發現,這些軟體開發人員換工作有兩個主要動機:更好的薪水和完全遠端或彈性的職場環境。

亞太地區可望成為成長最快的市場

- 亞太地區是全球領先的IT服務市場。該地區的公司繼續投資於擁有適當技能的新人才。過去20年,中國IT產業快速成長,已成為中國經濟的關鍵產業。目前的五年計畫已將 IT 產業列為七大戰略產業之一,重點致力於將其從廉價勞動力製造地轉變為世界一流的創新主導IT 產業。預計這些努力將推動市場發展。

- 「數位印度」計畫旨在透過改善IT基礎設施和增強網路連接,以電子方式向公民提供政府服務。此外,該計劃還旨在將舊有系統轉變為雲端基礎的整合模型。該雲端平台預計將為公民提供電子服務。

- 例如,科技公司 Zoho Corporation 旗下部門 Manage Engine 進行了一項調查,調查了全球 3,300 名 IT 和其他商業專業人士。在印度,300 名私部門決策者接受了調查,詢問他們對 IT 和其他關鍵業務任務的看法。調查將參與者分為兩組:IT決策者(ITDM)和業務決策者(BDM)。調查顯示,91%的印度決策者同意近年來IT與業務之間的協作有所改善。此外,53% 的印度 ITDM 表示他們的公司已經成功分散了其 IT 結構。相比之下,全球平均為 64%。 IT 採用率的提高可能會推動對 IT人員編制解決方案的需求,並相應增加全部區域IT人員編制解決方案的需求。

- 根據 NASSCOM 的數據,印度業務流程管理 (BPM) 和 IT 服務分別佔全球需求的 14% 和 10% 以上。預計這一趨勢將隨著全球雲端運算採用率的持續成長而持續下去。政府正在透過各種獎勵計劃來支持日益成長的 IT 和基礎設施需求。印度 IT 服務的成長預計將積極推動市場成長。

- 隨著公有雲端處理的普及,越來越多的企業將業務系統重新分配到雲端平台。資料安全、租戶隔離、存取控制等問題越來越成為這些企業關注的焦點,從而推動了人才需求。

IT人員編制產業概覽

IT人員編制市場比較分散。市場上有多個參與者,迎合不同的終端用戶群。主要參與者包括 TEKsystems Inc.、Allegis Group Holdings Inc.、ASGN Incorporated、Insight Global LLC、Randstad NV 和 Kforce Inc.這些公司透過建立策略聯盟、收購、合併、創新和投資來保持其在市場上的地位。

- 2024 年 5 月,總部位於新加坡的 impress.ai 針對中型企業推出了 impress.ignite。這項新服務有望帶來招募領域的革命性轉變,使不斷擴張的企業能夠在一小時內啟動招募流程。

- 2024 年 3 月:iCIMS 推出其先進的生成式 AI 招募副駕駛,幫助世界各地的人才招募 (TA) 團隊做出更明智的招募決策並提高整體效率。這項創新解決方案為數百萬用戶提供了無與倫比的功能,並為業界樹立了新的標準。

- 2023 年 1 月:總部位於美國的 BrightPlan 推出新的勞動力財務健康指標,為組織提供資料主導的洞察,以揭示中東和北非地區關鍵勞動力的優勢和差距。 BrightPlan 的資料主導全面財務健康解決方案使用取得專利的AI 技術將原始資料轉化為有價值的見解,並為雇主和員工提供建議。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 新興技術(人工智慧和物聯網)

- 人力資源活動外包增加

- 市場限制

- 特定技術人才短缺

第6章 市場細分

- 按技能組合

- 軟體開發者

- 測試員

- 系統分析師

- 技術支援專業人員

- 網路與安全專家

- 其他技能

- 按最終用戶產業

- 電信

- BFSI

- 衛生保健

- 製造業

- 零售

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- TEKsystems Inc.(Allegis Group Holdings Inc.)

- ASGN Incorporated

- Insight Global LLC

- Randstad NV

- Kforce Inc.

- Artech Information Systems LLC

- Consulting Solutions International Inc.

- MATRIX Resources Inc.

- NTT DATA Corporation

- Beacon Hill Staffing Group

第8章投資分析

第9章:市場的未來

The IT Staffing Market size is estimated at USD 123.30 billion in 2025, and is expected to reach USD 147.58 billion by 2030, at a CAGR of 3.66% during the forecast period (2025-2030).

Key Highlights

- The market's growth can be attributed to the increasing outsourcing of HR activities and the emergence of advanced technologies such as AI and advanced analytics, which are expected to create robust demand for IT professionals across multiple end-user segments.

- The growing usage of analytics solutions in recruitment is also expected to increase the need for specialized HR services. According to a recent LinkedIn report, around 92% of professionals consider analytics to be the key to recruitment in emerging economies such as India.

- HR analytics aids in improving the productivity of HR services by making predictions about crucial factors, such as performance, retention, and recruiting. These elements are all driving the market's expansion. By using HR analytics, HR departments can make data-backed decisions about managing attrition and spot areas where automation can be introduced. It can leverage the solution capabilities to capture insights on employee feedback forms.

- HR analytics can also implement AI recruiters to automate interview scheduling, provide real-time feedback to employees, and improve the handling of big data HR analytics. This will help HR executives save not only time but also money.

- Moreover, multiple firms across end-user segments are also migrating toward the cloud to continue delivering solutions to their clients and ensuring the continuity of their critical operations. According to Microsoft 365, the company witnessed a massive 775% increase in the usage of its cloud services. This is expected to create a significant spike for cloud and cybersecurity professionals.

- The growing digitization across various sectors and the increasing demand for skilled employees in the IT and telecommunication industry have augmented the growth of IT staffing worldwide. For instance, according to a Nasscom report, the Indian tech industry is set to add 60,000 jobs in the fiscal year 2023-24, bringing the total workforce to 5.43 million employees.

- Based on opportunities afforded by recent changes to the US tax code, companies are expected to expand further and accelerate their staffing efforts. Private businesses are expected to receive an average 5% increase in their bottom line. Their leaders also anticipate continuous economic growth for the next 12 months. As a result, many firms are investing their dollars in human capital. These moves coincide with the IT staffing trends.

- Staying ahead in the current dynamic business landscape hinges on a workforce equipped with the latest skills. According to the World Economic Forum, by 2029, 44% of workers will see their skills become obsolete. Corporate cultures must prioritize upskilling and reskilling efforts. By doing so, they unlock employee potential, boost job satisfaction, drive engagement, and ultimately enhance productivity and retention rates.

IT Staffing Market Trends

The Software Developer Segment Expected to Generate Considerable Demand

- Software developers design computer applications or programs. In contrast to a software engineer, a developer is usually more creative-minded and focuses on the development aspect, using ready-made tools to build software and applications in the entire software development life cycle.

- While the COVID-19 pandemic severely impacted global economies of all scales, information technology (IT) companies worldwide managed to survive much of the economic downturn. This was primarily due to the adoption of distributed IT development, remote maintenance, and remote IT operations. Major IT companies such as Google, IBM, Accenture, Microsoft, DXC, SAP, TCS, Wipro, and Infosys asked their staff to work at home during the pandemic. Additionally, to meet the constraints of working from home, the demand for IT services and software developers increased across industries, including retail, entertainment, education, and healthcare.

- Companies can utilize AI in IT staffing development and management to assess the talent inventory and leverage the historical skill data of their existing employees to match individuals with appropriate open positions advertised by managers. AI may also help analyze skills adjacency, prior experiences, and intended career paths. Workers receive better visibility into a diverse pool of projects and experiences available within their company that would otherwise be inaccessible due to the value-add of personalized recommendations that serve appropriate opportunities. Saudi Arabia is expected to invest USD 20 billion in artificial intelligence by 2030. This may create opportunities for the market players to incorporate AI in workforce management solutions.

- Additionally, the IT industry is sound globally, and with the upcoming technical updates and development, the requirement for software developers is increasing alarmingly. Students pursuing IT or software engineering courses are expected to have a booming career trajectory by 2030. Moreover, according to the Tech World Times report, with a global community of more than 26.4 million software developers, software development has become a mainstream career option in developing nations like India.

- Moreover, the IT staffing industry is expected to observe a paradigm shift in demand and revenue for software developers, owing to increasing digital transformation across industries and the emergence of start-up culture. New product developments across various end-user industries are estimated to have the highest impact and demand because of constant innovations and the requirement of software development skillsets to develop applications.

- However, IT staffing for software developers faces a few challenges. For instance, according to a report shared by cloud infrastructure provider DigitalOcean, 42% of software developers who have not switched jobs during the pandemic are considering or may consider quitting this year. Furthermore, according to the report, these software developers were driven by two motivating factors to switch jobs, i.e., better compensation and fully remote or flexible work environments.

Asia-Pacific Expected to be the Fastest Growing Market

- Asia-Pacific is the leading IT service market across the world. The companies in the region are continuing to invest in new resources that have the right skill sets. Over the past two decades, the IT industry in China has witnessed impressive growth and evolved as a key industry in the country's overall economy. In the current 5-year plan, the country has significantly focused on making IT one of the seven strategic industries that will help it move from a cheap-labor manufacturing hub to a world-class, innovation-driven IT industry. These initiatives are expected to drive the market.

- The Digital India initiative aims to provide government services to citizens electronically by improving the IT infrastructure and increasing internet connectivity. Moreover, the initiative aims to move legacy and on-premise systems to a cloud-based or integrated model. The cloud platform is expected to host the delivery of e-services to the citizens.

- For instance, a survey by Manage Engine, a division of Zoho Corporation, a technology firm, polled 3,300 IT and other business professionals worldwide. In India, 300 private-sector decision-makers were polled on IT and other essential business tasks. It classified them into two groups, i.e., IT decision makers (ITDMs) and business decision makers (BDMs). The survey stated that 91% of decision-makers in India agreed that collaboration between IT and business departments had strengthened in recent years. According to 53% of Indian ITDMs, their companies successfully dispersed their IT structure. This compares to the global average of 64%. Such a rise in the adoption of IT would increase the demand for IT staffing solutions, which may proportionately drive the need for IT staffing solutions across the region.

- NASSCOM stated that business process management (BPM) and IT services in India contribute to over 14% and 10% of the global demand, respectively. This is expected to continue with the consistent growth in the global cloud adoption rate. The government is supporting the growing demand for IT and infrastructure through various incentive programs. The growth of IT services in India is expected to positively drive the market's growth.

- The increased adoption of public cloud computing has led to more enterprises re-allocating their business systems to cloud platforms. Issues concerning data security, tenant isolation, access control, etc., have gradually become focal points of these enterprises, thereby driving staffing needs.

IT Staffing Industry Overview

The IT staffing market is fragmented in nature. Several players are operating in the market, serving the needs of various end-user segments. Some of the major players in the market are TEKsystems Inc. (Allegis Group Holdings Inc.), ASGN Incorporated, Insight Global LLC, Randstad NV, and Kforce Inc. These companies are making strategic partnerships, acquisitions, mergers, innovations, and investments to retain their market positions.

- May 2024: Singapore's impress.ai, a leading provider of enterprise recruitment software, unveiled impress.ignite, tailored for mid-market firms. This new offering pledges a revolutionary shift in recruitment, empowering expanding businesses to kickstart their hiring processes within a mere hour.

- March 2024: iCIMS introduced an advanced generative AI recruiting copilot, empowering talent acquisition (TA) teams worldwide to make smarter hiring decisions and enhance overall efficiency. This innovative solution equips millions of users with unparalleled capabilities, setting a new standard in the industry.

- January 2023: BrightPlan, a US-based company, launched a new workforce financial wellness gauge, providing data-driven insights for organizations to uncover key workforce strengths and gaps in Middle East and Africa. BrightPlan's data-driven Total Financial Wellness solution, powered by patented AI technology, transforms raw data into valuable insights and provides advice for employers and employees.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Emergence of Technologies (AI and IoT)

- 5.1.2 Increasing Outsourcing of HR Activities

- 5.2 Market Restraints

- 5.2.1 Talent Shortages in Specific Technologies

6 MARKET SEGMENTATION

- 6.1 By Skill Set

- 6.1.1 Software Developer

- 6.1.2 Testers

- 6.1.3 Systems Analyst

- 6.1.4 Technical Support Professionals

- 6.1.5 Networking and Security Experts

- 6.1.6 Other Skill Sets

- 6.2 By End-user Industry

- 6.2.1 Telecom

- 6.2.2 BFSI

- 6.2.3 Healthcare

- 6.2.4 Manufacturing

- 6.2.5 Retail

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TEKsystems Inc. (Allegis Group Holdings Inc.)

- 7.1.2 ASGN Incorporated

- 7.1.3 Insight Global LLC

- 7.1.4 Randstad NV

- 7.1.5 Kforce Inc.

- 7.1.6 Artech Information Systems LLC

- 7.1.7 Consulting Solutions International Inc.

- 7.1.8 MATRIX Resources Inc.

- 7.1.9 NTT DATA Corporation

- 7.1.10 Beacon Hill Staffing Group