|

市場調查報告書

商品編碼

1519870

汽車租賃:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Car Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

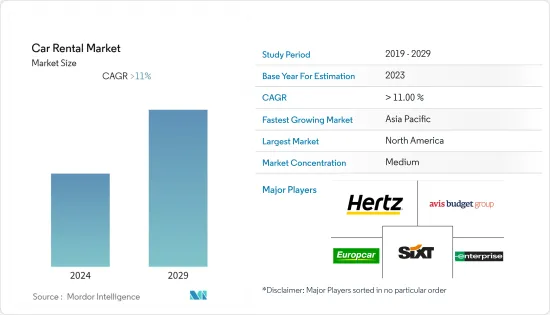

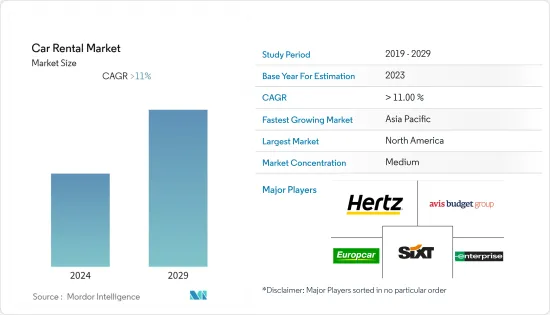

汽車租賃市場規模預計到2024年將達到1,321億美元,預計到2029年將達到2,201億美元,在預測期內(2024-2029年)複合年成長率將超過10.75%。

COVID-19 大流行對世界各地的旅行和旅遊業產生了重大影響。這對汽車租賃和乘車共享交通領域產生了重大影響。疫情導致企業評級下調和市場波動。然而,一旦限制放鬆,市場就開始表現出韌性。

此外,晶片短缺阻礙了 2021 年全球汽車生產,鑑於汽車租賃服務提供的維護和擁有成本較低,消費者轉向汽車租賃。

汽車租賃市場的積極成長軌跡受到多種因素的推動,例如遊客和商務旅行者數量的增加、出於健康考慮而改變的消費者偏好以及汽車租賃數位平台的便利性。

此外,將休閒與商務旅行相結合的趨勢日益明顯,尤其是年輕的商務旅客正在被公司招募以提高員工留任率。此外,各地政府對購車和駕駛的更嚴格監管也支持了租車業務的擴張。

隨著網路租車平台的增多,汽車租賃業越來越火爆。超過 60% 的人口可以上網,這一事實預計將大大促進市場成長。

由於全球旅行和旅遊業的崛起,預計未來幾年市場將保持強勁。

租車市場趨勢

線上汽車租賃服務需求的成長在市場中發揮重要作用

資訊科技的日益普及正在改變汽車租賃行業,並使營運商能夠為客戶提供更好的服務。這包括利用最佳化的公司和客戶資訊管理以及開發方便的網際網路預訂應用程式。

線上預訂模型處於識別信標和近場通訊(NFC) 應用的最前沿。 Zipcar 和 BlaBlaCar 等新參與者正透過使用汽車共享等創新經營模式和採用遠端資訊處理等技術而獲利。 Uber 和 Lyft 正在利用行動技術和設備來更好地滿足消費者的個人交通需求。這些努力正在加劇汽車租賃業的混亂。

此外,線上預訂還可用於多種服務,例如驗證租車者的文件、向租車者提供有關汽車的資訊、在特定地點還車或取車、電子簽章合約、無現金交易、等等。目的。此外,使用者越來越依賴智慧型手機來執行傳統上在電腦上執行的各種活動,也有助於改變客戶的汽車租賃體驗。

Enterprise a Car 和 Europ Car 等汽車租賃公司也透過擴大在西班牙旅遊機場的汽車租賃服務業務來鞏固其在這一領域的地位。儘管主要公司在西班牙擁有強大的影響力,但他們並沒有採用最新的發展和積極的策略,因此貨車租賃市場的需求較低。

以需求為導向的全面行動解決方案的可用性不斷增加,進一步強化了這一點。 Sixt SE、Uber 和 Avis 等行業參與者推出了行動應用程式,讓客戶可以輕鬆地從他們的產品組合中選擇車輛並進行預訂。

預計北美仍將是最大市場

預計2024年至2029年北美將維持其市場主導地位。該地區國內外休閒和商務旅客數量的增加是影響該地區市場成長的突出因素之一。

此外,消費者對租賃服務偏好的持續變化以及 Avis Budget Group 和 Enterprise Rent-a-Car 等知名服務供應商的出現預計將加速 Masu 的產生收入前景。最近,由於服務提供者的活性化努力,這些服務的使用在幾個城市增加。例如,

宣布計劃於 2023 年 6 月將類似 Turo 的P2P汽車租賃服務引入北美。客戶可以按小時或按天租車,並可以在取車地點還車。

此外,電動車的普及以及該地區消費者對低排放氣體的關注和意識不斷增強,也是刺激市場的關鍵因素。此外,超過 70% 的美國人更喜歡租賃電動車,作為在投資電動車之前試駕該技術的一種方式。

所有這些因素預計將在 2024 年至 2029 年期間推動該地區的市場成長。

汽車租賃業概況

汽車租賃市場分散,許多國際和國內公司在世界各地運作。主要參與企業包括 Enterprise Rent-A-Car、赫茲公司、Sixt SE、Europcar 和 Avis Budget Group。這些參與者主要專注於獲取客戶群並增強服務以實現盈利最大化。合作也是產業參與者為鞏固市場地位而實施的關鍵策略。例如

- 2023 年 4 月,赫茲全球和亞特蘭大市長安德烈狄更斯宣布推出赫茲電氣化亞特蘭大計劃,這是一項旨在加速亞特蘭大電動車普及並擴大電氣化的環境和經濟效益的 PPP 計劃。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 旅行和旅遊業的成長推動了租車市場

- 市場限制因素

- 共乘服務的激增對傳統汽車租賃市場構成挑戰

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模:10億美元)

- 預訂

- 離線訪問

- 線上查詢

- 應用

- 休閒/旅遊

- 商業

- 最終用戶

- 自己

- 用螺絲起子

- 車輛類型

- 經濟型/廉價車

- 豪華車

- 租賃期限

- 短期

- 長期

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Avis Budget Group Inc.

- Hertz Global Holdings Inc.

- Enterprise Holdings Inc.

- Sixt SE

- Fast Rent a Car

- Bettercar Rental

- Europcar Mobility Group

- Shenzhen Topone Car Rental Co. Ltd

- China Auto Rental

- TT Car Transit

- Renault Eurodrive

第7章 市場機會及未來趨勢

- 電動車需求的成長為租車市場創造了機遇

The Car Rental Market size is estimated at USD 132.10 billion in 2024, and is expected to reach USD 220.10 billion by 2029, growing at a CAGR of greater than 10.75% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted travel and tourism across the world. This had a huge effect on car rental and the ride-and-share transport segment. The pandemic resulted in company rating downgrades and market volatility. However, the market started showing resilience once the restrictions were eased.

Additionally, the chip shortage hampered global vehicle production in 2021, and consumers shifted toward car rental, considering the cost-saving offered by car rental services in terms of maintenance and ownership.

The positive growth trajectory of the car rental market is fueled by various factors, including the increasing number of tourists and business travelers, changes in consumer preferences due to health concerns, and the convenience of digital platforms for car hire.

Further, the increasing trend of combining leisure with business trips, particularly by younger business travelers, is being adopted by companies to promote staff retention. Additionally, the stringent government regulations on car buying and driving across different regions also favor the expansion of the car rental business.

The popularity of the car rental industry is rising as the number of online rental platforms increases. The fact that more than 60% of the population has access to the internet is anticipated to contribute significantly to the market's growth.

In coming years, the market is expected to continue thriving on a positive track owing to the flourishing travel and tourism industry worldwide.

Car Rental Market Trends

Increasing Demand for Online Car Rental Services to Play a Key Role in the Market

Increased adoption of information technology is transforming the car rental industry and enabling operators to deliver improved services to their customers. This includes the utilization of optimized corporate and customer information management and the development of convenient internet booking applications.

The online booking model is at the forefront of identifying applications for beacons and near-field communications (NFC). Newer players, like Zipcar and BlaBlaCar, are benefiting from using innovative business models such as car-sharing and adopting technologies such as telematics. Uber and Lyft are using mobile technologies and devices to better meet consumers' personal transportation needs. These initiatives are contributing to the disruption of the car rental industry.

Further, online booking also serves a variety of purposes, such as verification of documents of the renter, offering information to the renter regarding the car, services like drop and pick-up of the rented car at a certain place, e-signing contracts, and cashless transactions. Additionally, the rising dependence of users on smartphones to carry out a variety of activities traditionally done by personal computers has significantly helped transform the car rental experience for customers.

Rental companies, such as Enterprise a Car and Europ Car, have also strengthened their position in the sector by expanding their operation of vehicle rental services in Spain's tourist airport. Though key companies have a strong presence in the country, they have not adopted the latest developments or active strategies, so the van rental market is witnessing slow demand.

This is further enhanced by the increased availability of comprehensive demand-oriented mobility solutions. Industry players such as Sixt SE, Uber, and Avis have launched their mobile apps, which allow customers to easily choose vehicles from a portfolio and carry out bookings.

North America is Expected to Remain the Largest Market

North America is expected to retain its dominance in the market between 2024 and 2029. The rising number of leisure and business trips across the region, both locally and internationally, is among the prominent factors influencing the growth of the regional market.

Further, a continuous shift in consumer preference toward rental services and the presence of prominent service providers in the region, like Avis Budget Group and Enterprise Rent-a-Car, are expected to accelerate the revenue generation prospects. Recently, the usage of these services increased in several cities, fueled by increased initiatives by service operators. For instance,

In June 2023, Uber Technologies Inc. disclosed its plan to bring Turo-like peer-to-peer car rental to North America. Customers will be able to rent by the hour or the day and can drop off the rented vehicle wherever it was picked up.

In addition, the rising adoption of electric cars and growing concerns and awareness of lower emissions among consumers in the region are some of the major factors fueling the market. Moreover, over 70% of Americans prefer to rent an EV as a way to test drive the technology before investing in it.

All these factors combined are expected to provide a boost to the positive market growth of the region between 2024 and 2029.

Car Rental Industry Overview

The market is fragmented, with numerous international and domestic companies operating across the world. Key participants include Enterprise Rent-A-Car, The Hertz Corporation, Sixt SE, Europcar, and Avis Budget Group. The primary focus of these players is on enhancing their services to gain a customer base and maximize profitability. Collaboration is another key strategy implemented by industry players to strengthen their positions in the market. For instance,

- In April 2023, Hertz Global and Andre Dickens, the Mayor of Atlanta, launched Hertz Electrifies Atlanta, a PPP aimed at accelerating the adoption of electric vehicles and expanding the environmental and economic benefits of electrification in Atlanta.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Travel and Tourism Industry is Driving the Car Rental Market

- 4.2 Market Restraints

- 4.2.1 Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD billion)

- 5.1 Booking

- 5.1.1 Offlne Access

- 5.1.2 Online Access

- 5.2 Application

- 5.2.1 Leisure/Tourism

- 5.2.2 Business

- 5.3 End User

- 5.3.1 Self-driven

- 5.3.2 Chauffeur-driven

- 5.4 Vehicle Type

- 5.4.1 Economy/Budget Cars

- 5.4.2 Luxury/Premium Cars

- 5.5 Rental Length

- 5.5.1 Short Term

- 5.5.2 Long Term

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.4.1 South America

- 5.6.4.2 Middle-East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Avis Budget Group Inc.

- 6.2.2 Hertz Global Holdings Inc.

- 6.2.3 Enterprise Holdings Inc.

- 6.2.4 Sixt SE

- 6.2.5 Fast Rent a Car

- 6.2.6 Bettercar Rental

- 6.2.7 Europcar Mobility Group

- 6.2.8 Shenzhen Topone Car Rental Co. Ltd

- 6.2.9 China Auto Rental

- 6.2.10 TT Car Transit

- 6.2.11 Renault Eurodrive

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Growing Demand for EVs Presents Lucrative Opportunities for the Car Rental Market