|

市場調查報告書

商品編碼

1640670

先進製程控制:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Advanced Process Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

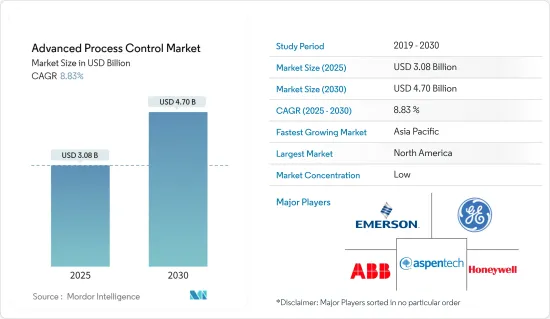

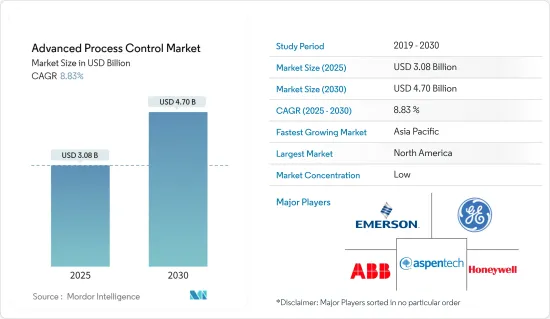

先進製程控制市場規模預計在 2025 年為 30.8 億美元,預計到 2030 年將達到 47 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 8.83%。

先進製程控制(APC)是指工業製程控制系統中使用的一組複雜的技術和技巧,以提高製造過程的性能和效率。 APC是基本製程控制的補充,其實施是為了實現特定的績效或經濟效益。儘管 APC 已成立 30 多年,但隨著全球各地的工廠都優先考慮流程最佳化,其影響力近年來不斷擴大。這些解決方案無縫整合了資訊、控制、電力和安全,以滿足對經濟高效能源日益成長的需求,遵守嚴格的政府法規並降低開支。

關鍵亮點

- APC 採用硬體和軟體的高階互動來最佳化控制迴路。 APC 的主要目標是提高生產關鍵流程的效能。透過保持一致的控制,APC不僅簡化了生產流程,而且使輸出結果更加可預測。

- 越來越多的產業開始採用自動化解決方案來提高生產力和業務效率。 APC 系統利用先進的演算法和預測模型來簡化流程、最大限度地減少停機時間並提高整體效能。隨著企業尋求提高生產產量同時降低成本,APC 技術的整合變得至關重要。這一趨勢是由對營運績效的不懈追求和在快速變化的市場環境中保持競爭力的需要所驅動的。

- 隨著業界面臨越來越嚴格的安全標準,APC 系統正在被採用來提高營運安全性。這些系統可以自動化安全通訊協定,即時監控流程並快速識別可能導致不安全情況的異常。透過最大限度地減少人為錯誤並縮短回應時間,APC 系統可以防止事故並確保遵守安全法規。

- 將 APC 系統與現有基礎設施和舊有系統整合面臨巨大的挑戰。許多行業仍在使用過時的技術,這使得無縫整合先進的控制解決方案變得複雜。這種複雜性意味著更高的成本和更長的實施時間,使得潛在的採用者不願意投資這些技術。

- 隨著傳統控制系統的老化,工業參與企業越來越注重對其進行升級和現代化改造,以保持競爭力。現代化通常涉及整合更先進的控制演算法、增強的數位功能和提高整體系統的穩健性。

- 例如,2024年8月,ABB在日本德山南陽水泥廠安裝了先進的製程控制解決方案ABB Ability Expert Optimizer系統。 ABB Ability Expert Optimizer 的試運行使德山能夠將其窯爐的熱能消費量減少約 3%,同時保持其南陽廠(日本最大的單一工廠之一)的運作品質。該工業軟體利用先進的製程控制技術,包括線性和非線性模型預測控制、模糊邏輯和神經網路,以持續、準確地自動做出最佳操作決策。

先進製程控制市場趨勢

石油和天然氣產業是最大的終端用戶

- 在石油和天然氣領域,生產最佳化對於提高產量並降低成本至關重要。 APC 系統利用即時資料分析和預測模型來更有效地管理生產流程。例如在儲存管理中,APC可以監控和控制壓力、溫度和流量等參數。透過分析歷史資料和當前情況,這些系統能夠預測未來的生產趨勢並相應地調整操作以最大限度地提高產量。

- 在採用提高採收率(EOR) 的油田中,APC 可以透過最佳化注入策略和監測各種採油技術的有效性來發揮關鍵作用。操作員可以根據即時回饋動態調整參數,以顯著提高回收率並提高整體生產效率。

- 根據能源實驗室的資料,美國是世界原油產量最大的國家。 2023年,美國產量將達到1,940萬桶/日,較2010年大幅成長,主要得益於傳統型緻密油開採的進步。繼美國之後,沙烏地阿拉伯和俄羅斯則位居第二和第三,產量分別約為1,140萬桶/日和1,110萬桶/日。值得注意的是,石油生產有多種形式,包括原油、頁岩油、油砂和液態天然氣。石油產量的增加可能會刺激探勘市場的需求。

- 據能源實驗室稱,2023年,全球石油產量大部分產自中東,約佔當年全球產量的31.5%。阿拉伯聯合大公國、科威特、巴林和沙烏地阿拉伯等國家持續致力於增加石油和天然氣產量。

- 阿拉伯聯合大公國投入巨資提高其碳氫化合物生產能力並加強其中游和下游基礎設施。此外,該國正積極實現生產地點多元化。截至2023年初,阿拉伯聯合大公國已探明原油蘊藏量估計為1,110億桶,高於一年前的1,070億桶。預計全球石油產量的增加將大幅刺激探勘市場的需求。

- APC系統可以協助鑽井作業期間的即時決策。例如,如果偵測到意外的地質條件,系統可以自動調整鑽井參數或提醒操作員採取糾正措施。此功能不僅提高了效率,而且還降低了代價高昂的鑽井事故和設備故障的風險。

- 據貝克休斯公司稱,世界上大多數石油鑽井平台都位於陸地上。截至年終,全球將有1,337座陸地石油鑽機及240座海上鑽機運作中。 2021年,全球共有1,309座陸上石油鑽機投入運作。北美在石油和天然氣鑽機持有居世界之冠。截至 2024 年 8 月,該地區共有 781 個陸上鑽機,另有 23 個海上鑽機。全球強勁的石油鑽機活動可能會推動所研究市場的大幅成長。

預計北美將佔據較大的市場佔有率

- 在北美,隨著新型智慧工廠的不斷湧現,先進製程控制預計將佔據很大的市場佔有率。此外,新發電廠的建立、主要半導體製造業的存在以及工業自動化的需求預計將推動北美 APC 系統市場的發展。

- 美國是該地區市場的主要貢獻者。該國正處於能源轉型時期,各個終端用戶產業都採用先進技術。水力學和頁岩水力壓裂技術的進步正在推動石油和天然氣產量的成長。

- 由於面臨來自中國製造商的激烈競爭,美國製造商迅速採用了這些解決方案。由於這些因素,大規模部署日趨成熟,技術升級的需求是需求的主要驅動力。

- 針對製造業日益增多的網路安全威脅帶來了重大挑戰。這些挑戰包括智慧財產權盜竊、供應鏈攻擊和民族國家攻擊、設備破壞和內部入侵,需要採取全面的、多層次的安全方法。顯然,傳統的防禦手段已遠遠不夠,需要採取積極主動的情報主導策略來識別威脅,並在威脅蔓延之前減輕威脅。

- 全球市場對工業4.0的採用進一步凸顯了對先進製程控制系統的需求。第四次工業革命是去年達沃斯世界經濟論壇的焦點,預計其範圍和影響將產生變革性的影響。這場工業革命預計將顛覆各個已開發國家的整個產業,並改變包括美國在內的整個生產、管理和管治體系。

- 2024 年 4 月,美國內政部 (DOI) 批准在公共土地上建造超過 25 吉瓦的可再生能源容量。內政部已核准在公共土地上興建超過 29 吉瓦的太陽能、風能和地熱發電設施。內政部下屬機構土地管理局 (BLM) 表示,目前正在辦理 66 個公用事業規模清潔能源計劃的許可證。

- 隨著太陽能、風能和水力發電等可再生能源發電能力的擴大,對能夠最佳化其產出的系統的需求也日益成長。 APC 系統可以根據不斷變化的環境條件(例如太陽輻射或風速的波動)不斷調整運行參數,從而提高能源生產效率。這種最佳化對於最大限度地提高能源產量和確保電網穩定性至關重要。

先進製程管制產業概況

競爭程度取決於影響市場的各種因素,例如品牌身份驗證、強大的競爭策略和透明度。這種力量的關鍵促進因素之一是市場創新。市場參與者透過技術創新比競爭對手具有顯著優勢,性能卓越的新產品正在更快地被採用。市場上的每家公司都在投入巨資以獲得競爭力。

APC 市場擁有多家全球和地區參與企業,在競爭激烈的市場空間中爭奪關注。這些參與企業的存在和不斷的創新使得市場競爭異常激烈。由於ABB有限公司、艾默生電氣公司、橫河電機公司、霍尼韋爾國際公司和施耐德電氣公司等大公司的存在,市場上競爭對手之間的競爭非常激烈。

這些公司不斷努力透過開發產品系列和專業知識來獲得競爭優勢。市場滲透率相對較高且分銷受到嚴格控制。例如,ABB 是發電領域的市場領導者,在石油和天然氣領域也佔有重要地位。霍尼韋爾也擁有大量製程自動化系統的安裝基礎。

所研究的市場預計將經歷中等程度的集中,並預計在預測期內經歷穩定的成長。整體來看,競爭對手之間的敵意比較強烈。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 分析新的 APC 系統並對現有系統進行現代化改造

第5章 市場動態

- 市場促進因素

- 各行業對自動化解決方案的需求不斷增加

- 日益成長的安全問題預計將推動對 APC 系統的需求

- 市場限制

- 相關複雜度挑戰市場成長

第6章 技術簡介

第7章 市場區隔

- 按類型

- 嚴格監管

- 模型預測控制

- 其他

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 藥品

- 飲食

- 能源動力

- 水泥工業

- 金工

- 紙漿和造紙

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- ABB Ltd

- Aspen Technology Inc.

- Emerson Electric Co.

- General Electric Co.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Onto Innovation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corp.

- SUPCON Technology Co. Ltd

- Shanghai Glorysoft Software Co. Ltd

- Hollysys Automation Technologies Ltd

第9章 市場展望

The Advanced Process Control Market size is estimated at USD 3.08 billion in 2025, and is expected to reach USD 4.70 billion by 2030, at a CAGR of 8.83% during the forecast period (2025-2030).

Advanced process control (APC) refers to a set of sophisticated techniques and technologies used in industrial process control systems to enhance the performance and efficiency of manufacturing processes. APCs are supplementary to basic process controls and are introduced to target specific performance or economic enhancements. Despite being established over 30 years ago, APC has surged in prominence recently, with global factories prioritizing process optimization. These solutions seamlessly merge information, control, power, and safety measures, addressing the rising demand for cost-effective energy, adhering to strict government regulations, and reducing expenses.

Key Highlights

- APC encompasses a sophisticated interplay of hardware and software, working in unison to optimize control loops. The primary objective of APC is to enhance the performance of processes integral to production. By maintaining consistent control, APC not only streamlines the production process but also renders the output results more predictable.

- Industries are increasingly turning to automation solutions to boost productivity and enhance operational efficiency. APC systems leverage sophisticated algorithms and predictive modeling to streamline processes, minimize downtime, and elevate overall performance. As businesses aim to amplify output while curtailing costs, the integration of APC technologies becomes indispensable. This trend is driven by the relentless pursuit of operational excellence and the need to stay competitive in a rapidly evolving market landscape.

- As industries face heightened scrutiny regarding safety standards, APC systems are being adopted to improve operational safety. These systems can automate safety protocols, monitor processes in real-time, and quickly identify anomalies that could lead to hazardous situations. By minimizing human error and enhancing response time, APC systems help prevent accidents and ensure compliance with safety regulations.

- Integrating APC systems with existing infrastructure and legacy systems presents significant challenges. Many industries continue to operate with outdated technology, which complicates the seamless incorporation of advanced control solutions. This complexity can lead to increased costs and extended deployment timelines, thereby deterring potential adopters from investing in these technologies.

- As legacy control systems age, industrial players are increasingly focusing on upgrading and modernizing them to stay competitive. Modernization typically involves integrating more advanced control algorithms, enhancing digital capabilities, and improving overall system robustness.

- For instance, in August 2024, ABB implemented its advanced process control solution, the ABB Ability Expert Optimizer system, at the Tokuyama Nanyo cement plant in Japan. With the commissioning of the ABB Ability Expert Optimizer, Tokuyama can now achieve a reduction of approximately 3% in thermal energy consumption in the kiln, all while upholding the operational quality at the Nanyo plant, recognized as one of Japan's largest single factories. This industrial software harnesses advanced process control techniques, including linear and non-linear model predictive control, fuzzy logic, and neural networks, to consistently and accurately automate optimal operational decisions.

Advanced Process Control Market Trends

Oil and Gas Industry to be the Largest End User

- In the oil and gas sector, production optimization is essential for enhancing output while minimizing costs. APC systems utilize real-time data analytics and predictive modeling to manage production processes more effectively. For instance, in reservoir management, APC can monitor and control parameters such as pressure, temperature, and flow rates. These systems can predict future production trends by analyzing historical data and current conditions and adjust operations accordingly to maximize yield.

- In fields employing Enhanced Oil Recovery (EOR) methods, APC can play a vital role by optimizing injection strategies and monitoring the effectiveness of various recovery techniques. Operators can significantly improve recovery rates and enhance overall production efficiency by dynamically adjusting the parameters based on real-time feedback.

- Data from the Energy Institute highlights the United States as the global leader in crude oil production. In 2023, the United States achieved a daily output of 19.4 million barrels, marking a significant increase from 2010, primarily driven by advancements in unconventional tight oil extraction. Following the United States, Saudi Arabia and Russia secured the second and third positions, producing approximately 11.4 and 11.1 million barrels daily, respectively. It is important to note that oil production encompasses various forms, including crude oil, shale oil, oil sands, and natural gas liquids. The upsurge in oil production is likely to aid the demand for the studied market.

- According to the Energy Institute, in 2023, the majority of oil worldwide was produced in the Middle East, which accounted for around 31.5% of the global output that year. Countries such as United Arab Emirates, Kuwait, Bahrain, and Saudi Arabia are continuously focusing on increasing oil and gas production.

- The United Arab Emirates has made significant investments in bolstering its hydrocarbon production capacity and enhancing its midstream and downstream infrastructure. Furthermore, the country is actively diversifying its production locations. As of early 2023, the UAE's proven crude oil reserves were estimated at a substantial 111 billion barrels, marking an increase from the previouyear's's 107 billion barrels. The global increase in oil production is anticipated to significantly drive the demand for the studied market.

- APC systems can assist in real-time decision-making during drilling operations. For example, if unexpected geological conditions are detected, the system can automatically adjust drilling parameters or alert operators to take corrective actions. This capability not only enhances efficiency but also reduces the risk of costly drilling incidents and equipment failures.

- According to Baker Hughes, most of the world's's oil rigs are located on land. At the end of 2023, there were 1,337 operational onshore oil rigs and 240 offshore rigs. In 2021, there were 1,309 operational onshore oil rigs. North America leads the world in hosting oil and gas rigs. As of August 2024, the region boasted 781 land rigs and an additional 23 offshore. The robust oil rigs worldwide are likely to offer significant growth to the studied market.

North America is Expected to Hold Significant Market Share

- The North American region is anticipated to hold a significant share of advanced process control with the region's growing new smart factory announcements. Also, the establishment of new power plants, the presence of leading semiconductor manufacturing industries, and the demand for industrial automation are anticipated to augment the market for North American APC systems.

- The United States is the major contributor to the market in the region. As the country is in the middle of an energy transformation, it is witnessing the adoption of advanced technologies across various end-user industries. Technological advancements in hydraulics and drilling fracturing (fracking) of shale formations have driven the growth in oil and gas production.

- The US manufacturing industry has been among the early adopters of these solutions, given the stiff competition from the Chinese manufacturing industry; owing to such factors, the adoption is mature for large-scale adoption, and technology upgrade needs majorly drive demand.

- The growing cybersecurity threats targeting the manufacturing industry present a significant challenge. These challenges, spanning from intellectual property theft, supply chain attacks, and nation-state attacks to equipment sabotage and internal breaches, require an in-depth and multi-layered security approach. It is clear that traditional defenses are insufficient, and a proactive, intelligence-driven strategy is needed to identify and mitigate threats before they escalate.

- The adoption of Industry 4.0 in the global market further emphasized the need for advanced process control systems. The Fourth Industrial Revolution was the focus of last year's World Economic Forum meeting in Davos, and its scope and impact are anticipated to be transformational. This industrial revolution is anticipated to disrupt every industry from various developed countries, changing entire systems of production, management, and governance, including the United States.

- In April 2024, the US Department of the Interior (DOI) granted permits to over 25 GW of renewable energy capacity on public lands, a milestone earmarked initially by the Biden administration for 2025. The DOI approved over 29GW of solar, wind, and geothermal generation capacity on public lands. The Bureau of Land Management (BLM), a body within the DOI, said it is currently processing permits for 66 utility-scale clean energy projects.

- As the generation capacity of renewable energy sources like solar, wind, and hydropower expands, there is a growing need for systems that can optimize their output. APC systems can enhance the efficiency of energy production by continuously adjusting operational parameters to respond to changing environmental conditions, such as fluctuations in sunlight or wind speed. This optimization is crucial for maximizing energy yield and ensuring grid stability.

Advanced Process Control Industry Overview

The degree of competition depends on various factors affecting the market, such as brand identity, powerful competitive strategy, and degree of transparency. One of the major factors governing this force is market innovation. Companies in the market have a significant advantage over competitors due to technological innovations, with new products offering performance gaining faster adoption. Companies in the market are investing heavily to gain a competitive edge.

The APC market comprises several global and regional players who are vying for attention in a fairly contested market space. These players' presence and constant innovative activities intensify the competition in the market. The intensity of competitive rivalry in the market is very high, owing to the presence of large-scale companies such as ABB Ltd, Emerson Electric Co., Yokogawa Electric, Honeywell International Inc., and Schneider Electric SE.

These companies are struggling to gain a competitive advantage by constantly trying to develop their product portfolio and develop expertise. The level of market penetration is relatively high, with tight control on distribution. For instance, while ABB leads the market in electric power generation, it also has a significant presence in oil and gas. Honeywell also has a large installed base of process automation systems.

The firm concentration ratio has remained moderate in the market studied, and it is expected to grow steadily during the forecast period. Overall, the intensity of competitive rivalry is relatively high.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Analysis of New APC Systems vs Modernization of Existing Systems

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation Solutions across Various Industries

- 5.1.2 Rising Safety and Security Concerns are Expected to Boost the Demand for APC Systems

- 5.2 Market Restraints

- 5.2.1 Associated Complexities Challenge the Market Growth

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Advanced Regulatory Control

- 7.1.2 Model Predictive Control

- 7.1.3 Other Types

- 7.2 By End-user Industry

- 7.2.1 Oil and Gas

- 7.2.2 Chemicals and Petrochemicals

- 7.2.3 Pharmaceutical

- 7.2.4 Food and Beverage

- 7.2.5 Energy and Power

- 7.2.6 Cement Industry

- 7.2.7 Metal Processing

- 7.2.8 Pulp and Paper

- 7.2.9 Other End-user Industries

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB Ltd

- 8.1.2 Aspen Technology Inc.

- 8.1.3 Emerson Electric Co.

- 8.1.4 General Electric Co.

- 8.1.5 Honeywell International Inc.

- 8.1.6 Rockwell Automation Inc.

- 8.1.7 Onto Innovation Inc.

- 8.1.8 Schneider Electric SE

- 8.1.9 Siemens AG

- 8.1.10 Yokogawa Electric Corp.

- 8.1.11 SUPCON Technology Co. Ltd

- 8.1.12 Shanghai Glorysoft Software Co. Ltd

- 8.1.13 Hollysys Automation Technologies Ltd