|

市場調查報告書

商品編碼

1519919

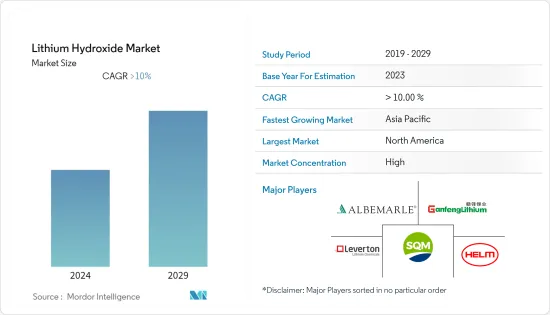

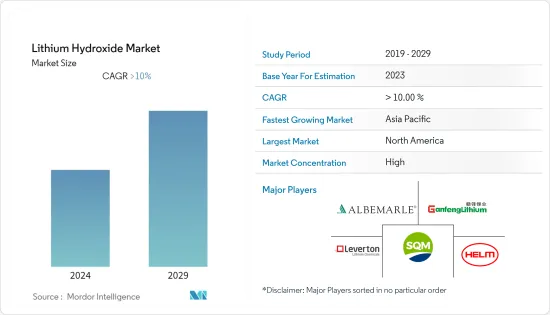

全球氫氧化鋰市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Lithium Hydroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計2024年全球氫氧化鋰市場規模將達196.5LCE千噸,2024年至2029年複合年成長率為23.51%,2029年將達564.78LCE千噸。

COVID-19 阻礙了氫氧化鋰市場。疫情導致電動車和消費性電子產品中使用的鋰離子電池的需求下降。汽車產量下降,非必需消費品支出下降,工業活動放緩,導致對氫氧化鋰和其他電池材料的需求減少。不過,各地區的封鎖措施已經解除,經濟活動也逐漸恢復。因此,電動車和家用電器的需求增加,帶動了氫氧化鋰的需求。

推動氫氧化鋰市場的主要因素是使用鋰離子電池的電動車需求的增加以及使用氫氧化鋰NCA正極的電動工具的需求的增加。

然而,對氫氧化鋰毒性和高生產成本的日益擔憂預計將限制氫氧化鋰市場的成長。

鋰礦床的開拓和對行動電子設備日益成長的需求預計將在未來為市場相關人員提供各種機會。

由於電動車產業的需求不斷成長,亞太地區在氫氧化鋰市場上佔據主導地位。

氫氧化鋰市場趨勢

電池領域佔據市場主導地位

- 氫氧化鋰的主要消費者是鋰離子電池,佔總消費量的大部分。攜帶式電子產品、電動車和能源儲存系統對鋰離子電池的需求不斷成長是氫氧化鋰市場的主要驅動力。

- 向電動車的過渡是鋰離子電池市場最重要的驅動力之一。隨著世界各國政府實施更嚴格的排放法規並鼓勵採用電動車,對鋰離子電池的需求不斷增加,推動了對氫氧化鋰的需求。

- 根據國際能源總署(IEA)發布的預測,2022年全球電動車保有量預計約2,590萬輛。

- 根據國際能源總署(IEA)預測,電動車市場正在快速成長,預計到2022年銷量將超過1,000萬輛。三年內,電動車佔總銷量的佔有率從 2020 年至 2022 年的 4% 增至 14%。

- 電動車銷量的成長預計將持續到 2023 年。第一季購買量超過230萬台,比去年同期成長25%。 2023年終,銷量將達到1400萬台,與前一年同期比較成長35%。因此,到 2023 年,電動車將佔所有汽車銷量的 18%。

- 透過持續研發努力提高電池性能、能量密度和安全性,鋰離子電池在氫氧化鋰市場的主導地位進一步加強。技術進步正在推動鋰離子電池在廣泛的應用中被採用,並鞏固其作為氫氧化鋰主要消費者的地位。

- 電動車對鋰離子電池的高需求正在增加鋰離子電池領域在氫氧化鋰市場的主導地位。

亞太地區主導市場

- 亞太地區有幾家重要的氫氧化鋰生產商,包括中國、日本、韓國和澳洲。這些國家已經建立了鋰開採和加工業,並供應了世界上大部分的氫氧化鋰供應。

- 根據美國地質調查局預測,到2023年,中國將成為全球第三大鋰生產國。預計2023年中國鋰礦產量將達3.3萬噸。

- 中國大部分鋰蘊藏量位於西藏自治區、青海省和四川省。然而,儘管擁有大量蘊藏量,但由於國內需求遠超過產能,中國仍是鋰的淨進口國。

- 亞太地區引領全球電動車市場,韓國、日本、中國等國家是電動車的重要生產國和消費國。隨著電動車在該地區的不斷普及,對鋰離子電池和氫氧化鋰的需求也在增加。

- 根據中國工業協會預測,2022年中國電池式電動車銷量約540萬輛,較2021年成長83.95%。同年,中國插電式混合動力汽車銷量達約150萬輛,與前一年同期比較成長151.91%。

- 亞太地區正在迅速擴大其可再生能源產能,特別是在中國和印度等國家。由氫氧化鋰驅動的鋰離子電池在再生能源來源的能源儲存系統中發揮重要作用,並推動了該地區對氫氧化鋰的需求。

- 根據國際可再生能源機構(IRENA)發布的估計,印度可再生能源裝置容量已從2018年的118.19吉瓦增加到2022年的162.96吉瓦。

- 因此,受上述因素影響,預計未來亞太地區對氫氧化鋰的需求將會增加。

氫氧化鋰產業概況

氫氧化鋰市場得到鞏固。主要企業(排名不分先後)包括 SQM SA、Albemarle Corporation、贛鋒鋰業集團、Livent 和 LevertonHELM Limited。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 電動車需求增加

- 電動工具需求增加

- 抑制因素

- 人們越來越擔心毒性

- 生產成本高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:基於數量)

- 目的

- 鋰離子電池

- 潤滑脂

- 精製

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 土耳其

- 俄羅斯

- 北歐的

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- SQM SA

- Albemarle Corporation

- Fitz Chem LLC(Nagase America LLC)

- Ganfeng Lithium Group Co., Ltd

- KANTO KAGAKU

- LevertonHELM Limited

- Livent

- Nemaska Lithium

- Shangai China Lithium Industrial Co. Ltd

- SICHUAN BRIVO LITHIUM MATERIALS CO., LTD.

- Tianqi Lithium

第7章 市場機會及未來趨勢

- 鋰礦床

- 對攜帶式電子設備的需求增加

The Lithium Hydroxide Market size is estimated at 196.5 LCE kilotons in 2024, and is expected to reach 564.78 LCE kilotons by 2029, growing at a CAGR of 23.51% during the forecast period (2024-2029).

COVID-19 hampered the lithium hydroxide market. The pandemic led to reduced demand for lithium-ion batteries that are used in electric vehicles and consumer electronics. Automotive production declined, consumer spending on discretionary items decreased, and industrial activity slowed down, resulting in lower demand for lithium hydroxide and other battery materials. However, as lockdown measures were lifted, economic activities gradually resumed across regions. This led to increased demand for electric vehicles and consumer electronics, driving the demand for lithium hydroxide.

Major factors driving the lithium hydroxide market are the increasing demand for electric vehicles that use lithium-ion batteries and the increasing demand for power tools that use lithium hydroxide NCA cathode.

However, rising concerns regarding the toxicity of lithium hydroxide and the high production costs are expected to restrain the growth of the lithium hydroxide market.

Development in lithium deposits and the rising demand for portable electronic devices are expected to offer various opportunities to the market players in the upcoming period.

Asia-Pacific dominates the lithium hydroxide market due to the increasing demand from the EV sector.

Lithium Hydroxide Market Trends

Batteries Segment to Dominate the Market

- Lithium-ion batteries are the primary consumer of lithium hydroxide, accounting for a significant portion of its total consumption. The growing demand for lithium-ion batteries in portable electronic devices, electric vehicles, and energy storage systems is a significant driver of the lithium hydroxide market.

- The transition to electric mobility is one of the most significant drivers of the lithium-ion battery market. As governments worldwide implement stricter emissions regulations and incentivize the adoption of electric vehicles, the demand for lithium-ion batteries increases, thereby driving the demand for lithium hydroxide.

- According to the estimate released by the International Energy Agency (IEA), the total estimated number of electric vehicles in use globally will be approximately 25.9 million in 2022.

- According to the estimate released by the International Energy Agency, the electric vehicle market is experiencing exponential growth, with more than 10 million vehicles sold in 2022. Within three years, the share of electrical vehicles in overall sales has increased from 4% to 14% between 2020 and 2022.

- The increase in EV sales was expected to continue through 2023. In the first quarter, over 2.3 million of these vehicles were bought, a 25% increase compared to last year. By the end of 2023, sales had reached 14 million and accounted for a 35% year-on-year increase, while new purchases accelerated in the second half of the year. As a result, in 2023, electric cars accounted for 18% of total car sales.

- The dominance of lithium-ion batteries in the lithium hydroxide market is further strengthened by continued R&D efforts to improve battery performance, energy density, and security. Technological advancements drive the adoption of lithium-ion batteries in a wide range of applications, reinforcing their position as the leading consumer of lithium hydroxide.

- The high demand for lithium-ion batteries in electric vehicles drives the dominance of the lithium-ion batteries segment in the lithium hydroxide market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is home to several critical manufacturers of lithium hydroxide, including China, Japan, South Korea, and Australia. These countries have well-established lithium mining and processing industries, providing a significant portion of the global supply of lithium hydroxide.

- According to the US Geological Survey, China will be the world's third-largest lithium-producing nation in 2023 based on production volume. The mine production of lithium in China amounted to an estimated 33,000 metric tons in 2023.

- Most of China's lithium reserves are located in the Tibet Autonomous Region, Qinghai Province, and Sichuan Province. However, despite having substantial reserves, China is a net importer of lithium due to the fact that its domestic demand far exceeds its production capacity.

- Asia-Pacific leads the global electric vehicle market, with countries such as South Korea, Japan, and China being significant producers and consumers of electric vehicles. There is a corresponding increase in demand for lithium-ion batteries and lithium hydroxide as electric vehicles continue to be adopted in the region.

- According to the estimate released by the China Association of Automobile Manufacturers (CAAM), in China, around 5.4 million battery electric vehicles will be sold in 2022, an increase of 83.95 % compared to 2021. In the same year, sales of plugin hybrid vehicles in China increased by 151.91% compared to the previous year and amounted to around 1.5 million units.

- The Asia Pacific region has been rapidly expanding its renewable energy capacity, particularly in countries like China and India. Lithium-ion batteries, powered by lithium hydroxide, play a crucial role in energy storage systems for renewable energy sources that are driving the demand for lithium hydroxide in the region.

- According to the estimate released by the International Renewable Energy Agency (IRENA), India's renewable energy capacity increased from 118.19 gigawatts in 2018 to 162.96 gigawatts in 2022.

- Thus, the factors mentioned above are expected to increase the demand for lithium hydroxide in the Asia-Pacific region in the upcoming period.

Lithium Hydroxide Industry Overview

The lithium hydroxide market is consolidated. The major players (not in any particular order) include SQM S.A., Albemarle Corporation, Ganfeng Lithium Group Co., Ltd, Livent, and LevertonHELM Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Electric Vehicles

- 4.1.2 Increasing Demand for Power Tools

- 4.2 Restraints

- 4.2.1 Rising concern About the Toxicity

- 4.2.2 High production Costs

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lubricating Greases

- 5.1.3 Purification

- 5.1.4 Other Applications (Polymer Production)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Turkey

- 5.2.3.7 Russia

- 5.2.3.8 NORDIC

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 UAE

- 5.2.5.7 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 SQM S.A.

- 6.4.2 Albemarle Corporation

- 6.4.3 Fitz Chem LLC (Nagase America LLC)

- 6.4.4 Ganfeng Lithium Group Co., Ltd

- 6.4.5 KANTO KAGAKU

- 6.4.6 LevertonHELM Limited

- 6.4.7 Livent

- 6.4.8 Nemaska Lithium

- 6.4.9 Shangai China Lithium Industrial Co. Ltd

- 6.4.10 SICHUAN BRIVO LITHIUM MATERIALS CO., LTD.

- 6.4.11 Tianqi Lithium

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development in Lithium deposits

- 7.2 Rising Demand for Portable Electronic Devices