|

市場調查報告書

商品編碼

1519933

重力壓鑄:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Gravity Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

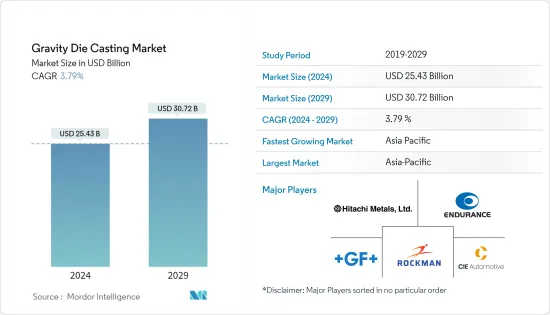

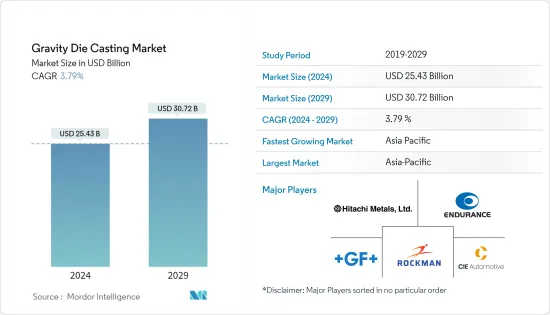

2024年重力壓鑄市場規模為254.3億美元,預計到2029年將達到307.2億美元,在預測期內(2024-2029年)複合年成長率為3.79%。

重力壓鑄是最古老的壓鑄方法之一。這種壓鑄方法用於製造尺寸精確、形狀精細、表面光滑或有紋理表面的金屬零件。重力鑄造的基本優點是生產速度快。可重複使用的模具使我們每天能夠生產數百個鑄件。高精度零件可降低加工成本,高表面光潔度可節省精加工成本。

由於其高導熱性,在預測期內,電氣和電子行業對鋁壓鑄件的需求可能會增加。由於汽車業對輕質金屬的偏好和汽車銷售的增加,壓鑄機械的需求量很大。

從長遠來看,市場預計將受益於可再生能源發電的開拓以及消費性電子、電腦和通訊產業的快速擴張。

隨著新技術的發展,汽車零件在最近的趨勢中不斷進步和創新。尤其是使用輕質材料生產汽車零件正在引起全國的關注。此外,由於 CAFE 標準和 EPA(美國環保署)減少車輛排放氣體和提高燃油效率的政策,汽車製造商正在使用非鐵金屬來減輕車輛重量。因此,過去的汽車市場擴大使用壓鑄零件來減輕重量。

重力鑄造市場趨勢

汽車產業可望獲得主要市場佔有率

重力壓鑄是製造一些高精度汽車零件的標準製程。該工藝非常適合引擎相關零件等零件,因為永久模具中熔體的快速定向硬化可產生具有有吸引力的機械性能的精細緻密結構。

然而,從內燃機到電動車等替代引擎的趨勢對壓鑄零件的需求產生了不可避免的影響。例如,內燃機有大約 200 個鑄件,但電動傳動系統只需要大約 25 個,即十分之一。

二氧化碳排放的減少、政府推動汽車輕量化的舉措以及汽車壓鑄機技術的快速發展等因素預計將刺激市場需求。

在生態學和經濟要求的推動下,全球汽車產業正在創造新的白色車身設計,其中結構壓鑄件有助於顯著減輕重量。此外,由於鑄件功能的融入、新的鋁合金概念和新的零件設計趨勢,壓鑄結構件的產量進一步增加。此外,乘用車和商用車的銷售量都在增加,預計將支持市場成長。

汽車工業消耗了全球 60% 以上的鑄件產品。因此,考慮到與汽車和運輸行業相關的成長機會,市場上的幾家公司正在專注於擴大其製造工廠。例如

- 2022 年 11 月:通用汽車宣布將投資 4,500 萬美元擴建位於印第安納州貝德福德的鋁壓鑄造廠,為底特律都會區的兩家生產電動車的組裝廠供貨。

- 2022 年 8 月:Stellantis 宣布向 Kokomo 鑄造廠投資 1,400 萬美元。用於將現有壓鑄機和電池改造為 1.6 升 i-4 渦輪增壓裝置的鑄造廠投資將完成,該裝置具有直接燃油噴射和混合電動車 (HEV) 應用的靈活性。

與砂型鑄造等其他方法相比,此方法還提供更好的公差和表面光潔度。因此,這是一項經過驗證的技術,可生產 1,000 至 10,000 件的相當大批量的產品。然而,模具成本各不相同,通常高於砂型鑄造方法。

因此,製造商預計將根據不斷變化的市場環境調整其產品組合,預計將在預測期內推動市場發展。

亞太地區主導市場

由於製造業和基礎設施發展投資增加,亞太地區正在經歷快速工業化。預計該地區航太、國防和建築等行業將顯著成長,這將為重力壓鑄市場創造新的機會。

由於多種因素,包括對輕質部件的需求增加、可支配收入的增加以及對能源效率和永續性。

亞太地區的重力壓鑄市場很大程度上是由全球最大的汽車市場中國推動的。由於政府鼓勵使用輕質和節能部件,預計重力壓鑄在中國的需求將會很高。此外,電動車在中國的普及預計將為市場打開新的大門。

可支配收入的增加和對燃油效率的日益關注正在推動亞太地區另一個重要市場印度對輕質零件的需求。隨著印度政府鼓勵使用輕質且節能的零件,預計印度對重力壓鑄的需求將會增加。此外,市場預計將受益於印度電動車的日益普及。

汽車的高需求也導致了更多目標商標產品製造商和汽車零件製造商的出現。因此,印度在汽車和汽車零件方面發展了專業知識,增加了對印度製造的壓鑄汽車零件的需求並促進了市場成長。

根據工業製造商協會(ACMA)預測,到2026年,印度汽車零件出口預計將達到300億美元。預計到2026年,汽車零件產業的收益將達到2,000億美元。

該地區正在經歷重大的技術進步,預計將增加重力壓鑄的使用。材料科學、設計軟體和自動化技術的進步預計將提高重力壓鑄的效率和質量,使其對各個行業更具吸引力。

重力鑄造產業概況

市場的主要企業包括 Rockman Industries、Endurance Group、Minda Corporation、Hitachi Metals、Georg Fischer Limited、MAN Group (Alucast)、Zollern GmbH、Esko Die Casting 和 CIE Automotive。市場主要企業正在擴大產能以滿足不斷成長的需求。例如

- 2023 年 6 月,中國汽車零件供應商 Asiaway Automotive Components 在墨西哥聖路易斯波托西投資 4,140 萬美元的新廠第一期工程運作。這層級層級生產鋁,組裝生產鋅汽車零件。

- 2023年9月,Rox Motor Tech與北京汽車股份有限公司共同創立的汽車品牌Polestones宣布獲得山東瀟夏先鋒集團10億美元戰略投資。這筆資金將用於全鋁車身研發、整合壓鑄技術以及短期智慧製造工廠計劃。

- 2022 年 5 月:GF 位於沙夫豪森(瑞士)的分店GF Casting Solutions 宣布將利用其經驗來改進電動車零件 (EV) 的開發。透過從設計和概念的早期階段與客戶合作,公司能夠創造出滿足客戶要求的產品。在聯合開發階段,GF Casting Solutions 為兩款雷諾混合型打造了輕質晶粒電池外殼。機殼由鋁合金製成,可實現出色的功能整合和冷卻迴路整合。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 汽車產業的成長推動重力壓鑄市場的需求

- 市場限制因素

- 高加工成本可能阻礙市場擴張

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 目的

- 車

- 電力/電子

- 工業用途

- 其他用途

- 原料

- 鋁

- 鋅

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Rockman Industries

- Endurance Group

- Minda Corporation

- Hitachi Metals

- Georg Fischer Limited

- MAN Group(Alucast)

- Zollern GmbH

- Harrison Castings

- Esko Die Casting

- CIE Automotive

第7章 市場機會及未來趨勢

- 電動車的擴張

The Gravity Die Casting Market size is estimated at USD 25.43 billion in 2024, and is expected to reach USD 30.72 billion by 2029, growing at a CAGR of 3.79% during the forecast period (2024-2029).

Gravity-die casting is one of the oldest methods of die casting. This die-casting process is used to create accurately dimensioned, finely defined, smooth, or textured surface metal parts. The fundamental benefit of gravity die casting is its fast-manufacturing speed. The reusable die tooling enables the production of hundreds of castings per day. High-definition parts reduce machining costs, while higher surface finish saves finishing expenses.

Due to its high thermal conductivity, the electrical and electronics industry is likely to see an increase in demand for aluminum die-casting parts during the forecast period. Die-casting machinery is in high demand as a result of the automotive industry's growing preference for lightweight metals and rising automobile sales.

Over the long term, the market is anticipated to benefit from the development of renewable power generation and the rapid expansion of the consumer electronics, computers, and communication industries.

With the development of new technologies, automotive parts have seen advancement and innovation in recent years. Among them, auto component manufacturing using lightweight materials has received national attention. In addition, automakers are using lightweight non-ferrous metals to reduce the weight of vehicles as a result of CAFE standards and EPA policies to reduce automobile emissions and improve fuel economy. As a result, the former automotive market is witnessing a significant boost from the use of die-cast parts to reduce weight.

Gravity Die Casting Market Trends

Automotive Industry is Expected Capture Major Market Share

Gravity die casting is a standard process for manufacturing some high-integrity automotive parts. This process produces fine-grained and dense structures with attractive mechanical properties, due to the fast and oriented hardening of the melts in permanent metal molds, which makes it ideal for components like engine-related parts.

But the trend away from the combustion engine toward alternatives like electric powered vehicles has inevitable effects on the demand for die-casted parts. For instance, while a combustion engine contains approximately 200 casted parts, only around 25, i.e., one tenth of them, are needed for an electrical drivetrain.

Factors such as lowering carbon emissions increased government initiatives to promote the usage of lighter vehicles, and rapid development of technology in automotive die-casting machines are anticipated to boost demand in the market.

Driven by ecological and economic requirements, the global automotive industry has been creating new body-in-white designs in which structural die-cast components help significantly reduce weight. Moreover, the production of die-cast structural components has increased even more due to incorporating functions into the castings, new aluminum alloy concepts, and new component design trends. Moreover, growing vehicle sales, not only in the passenger car segment but also for commercial vehicles, are expected to support the market's growth.

The automotive industry consumes over 60% of the cast products used worldwide. Thereby, considering the growth opportunities associated with the automobile and transportation industry, several players in the market are focusing on manufacturing plant expansion. For instance,

- November, 2022: General Motors announced an investment of USD 45 million in expanding its aluminum die-casting foundry in Bedford, Indiana, to feed two metro Detroit assembly plants that will produce electric vehicles.

- August, 2022: Stellantis announced an investment of USD 14 million in the Kokomo casting plant. The investment at the Casting Plant will be used to convert existing die-cast machines and cells for 1.6-liter, I-4 turbocharged units with direct fuel injection and flexibility for hybrid-electric vehicle (HEV) applications.

This method also gives better tolerances and surface finish than other methods, like sand casting. Hence, it represents a proven technology to produce fairly large batch quantities of the order of 1,000 to 10,000. But tooling costs vary and are generally higher than the sand-casting method.

Hence, manufacturers are expected to revamp their portfolio to the changing market conditions, which is expected to drive the market over the forecast period.

Asia-Pacific Dominates the Market

The Asia-Pacific region is witnessing rapid industrialization, driven by increasing investments in manufacturing and infrastructure development. This is expected to create new opportunities for the gravity die-casting market, as several industries such as aerospace, defense, and construction are expected to witness significant growth in the region.

The Asia-Pacific region is the biggest and fastest-growing market for gravity die casting because of a number of factors, like the growing demand for lightweight components, rising disposable incomes, and a growing emphasis on energy efficiency and sustainability.

The gravity die-casting market in the Asia-Pacific region is largely driven by China, the largest automotive market in the world. Gravity die-casting is expected to be in high demand in China as a result of the government's efforts to encourage the use of lightweight and energy-efficient components. Also, the rising reception of electric vehicles in China is supposed to set out new open doors for the market.

Due to rising disposable incomes and an increasing focus on fuel efficiency, India, another significant market in the Asia-Pacific region, is experiencing a growing demand for lightweight components. Gravity die casting is expected to be in high demand in India as a result of the government's efforts to encourage the use of lightweight and energy-efficient components. Additionally, the market is anticipated to benefit from the rising popularity of electric vehicles in India.

Significant demand for automobiles also led to the emergence of more original equipment and auto components manufacturers. As a result, India developed expertise in automobiles and auto components, which helped boost the demand for Indian die-casted auto components, propelling the market growth.

As per the Automobile Component Manufacturers Association (ACMA) forecast, auto component exports from India is expected to reach USD 30 Billion by 2026. The auto component industry is projected to record USD 200 Billion in revenue by 2026.

The region is seeing substantial technological advancements, which are projected to increase the usage of gravity die casting. Developments in materials science, design software, and automation technologies are predicted to increase gravity die casting efficiency and quality, making it more appealing to a variety of sectors.

Gravity Die Casting Industry Overview

Some of the major players in the market include Rockman Industries, Endurance Group, Minda Corporation, Hitachi Metals, Georg Fischer Limited, MAN Group (Alucast), Zollern GmbH, , Esko Die Casting, and CIE Automotive. Key players in the market are expanding their production capacity to cater to the increased demand. For instance,

- June 2023, Chinese automotive supplier Asiaway Automotive Components inaugurated the first phase of its new plant in San Luis Potosi, Mexico with an investment of USD 41.4 million. The Tier 2 supplier produces aluminum and zinc automotive components using the die-casting process (HPDC 125T - 6600T), CNC, machining, cleaning, testing, assembly, warehousing and distribution to various Tier 1 companies in San Luis Potosi and throughout northern Mexico.

- September 2023, Polestones, an auto brand jointly established by Rox Motor Tech Co., Ltd. and Beijing Automobile Works, announced that it received a USD 1 billion strategic investment from Shandong Weiqiao Pioneering Group. The funds will be used for all-aluminum vehicle body R&D, integrated die casting technologies, and a short-process intelligent manufacturing plant project.

- May, 2022: GF Casting Solutions, a branch of GF, Schaffhausen (Switzerland), said that it will use its experience to improve the development of electric car parts and components (EVs). The company is able to create goods that satisfy the demands of its clients by cooperating with them from the early design and conceptual phases. In a cooperative development phase, GF Casting Solutions created a lightweight die-cast battery housing for Renault's two hybrid models. The enclosure is built of an aluminum alloy, which allows for great functional integration and an integrated cooling circuit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growth of the Automotive Industry to Drive Demand in the Gravity Die Casting Market

- 4.2 Market Restraints

- 4.2.1 High Processing Cost May Hamper Market Expansion

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Automotive

- 5.1.2 Electrical and Electronics

- 5.1.3 Industrial Applications

- 5.1.4 Other Appplications

- 5.2 Raw Material

- 5.2.1 Aluminum

- 5.2.2 Zinc

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Germany

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Rockman Industries

- 6.2.2 Endurance Group

- 6.2.3 Minda Corporation

- 6.2.4 Hitachi Metals

- 6.2.5 Georg Fischer Limited

- 6.2.6 MAN Group (Alucast

- 6.2.7 Zollern GmbH

- 6.2.8 Harrison Castings

- 6.2.9 Esko Die Casting

- 6.2.10 CIE Automotive

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Electric Vehicles