|

市場調查報告書

商品編碼

1521640

電動汽車用鎳基電池:市場佔有率分析、產業趨勢與成長預測(2024-2029)Nickel-based Batteries For Electric Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

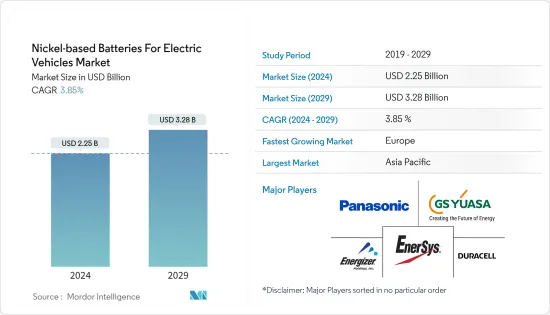

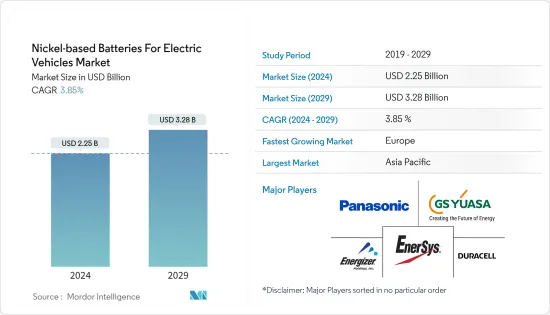

預計到2024年,電動車用鎳基電池的市場規模將達到22.5億美元,在預測期內(2024-2029年)複合年成長率為3.85%,到2029年將達到32.8億美元。

從長遠來看,電動車產業技術的快速發展預計將推動電動車鎳基電池市場的發展。設計和製造的改進、消費者偏好的變化、對永續性和氣候變遷的日益關注以及政府監管壓力和行動繼續改變支持汽車產業的結構和系統。這種轉變的一個例子是電動車需求的激增。

由於電動車相對於傳統汽車具有成本優勢,因此電動車電池市場預計將擴大。此外,政府促進電動車銷售的支持政策預計將在預測期內增加對電動車鎳基電池的需求。

然而,電動車高成本、鈷等關鍵原料供需缺口以及充電基礎設施缺乏預計將抑制市場成長。主要汽車製造商正在與電池公司合作,以利用快速發展的電動車產業。

隨著各大汽車製造商對電動車領域表現出興趣,電動車電池的需求不斷增加。然而,許多電動車製造商正專注於開發自己的電池組。預計這些因素將在預測期內推動市場。

電動車鎳基電池市場趨勢

電池電動車領域預計將主導市場

對永續交通和清潔能源不斷成長的需求正在增加對純電動車的需求。促銷和政府法規正在解決消費者的限制,例如範圍、較高的初始價格、有限的型號可用性和缺乏知識。這些因素預計將影響純電動車的需求,並推動電動車用鎳基電池市場的發展。

- 預計 2022 年純電動車銷量將達到 730 萬輛,高於 2021 年的約 460 萬輛。純電動車銷售的蓬勃發展得益於多種因素,包括消費者對更永續交通的興趣增加以及政府遏制直接交通排放的法規。 2021年銷量較2020年成長一倍多,2022年電動車銷量再創新高。

鎳在電動車電池中發揮重要作用。用於生產電池。這種材料用作鋰離子電池的基礎,鋰離子電池是電動車中非常常見的能源來源。此外,隨著汽車製造商繼續為遠距、高性能和許多入門級新車選擇高鎳電池,電池電動車的鎳重量將在2023年7月每年增加8%。

近年來,一些汽車製造商正在逐步製定考慮電氣化的商業策略,以增加市場佔有率並保持競爭力。公司保持這一立場是為了遵守政策法規或回應政府激勵措施。各公司也宣布計劃增加型號選擇,以便在未來幾年更快推出,從而在預測期內提振鎳基電池市場。

- 全球最大的汽車製造商豐田計劃在 2030 年推出 30 款純電動車。該公司的目標是每年銷售 350 萬輛電動車。Lexus的目標是到 2035 年實現全球 100% 純電動車銷量。

- 福斯汽車宣布,到2030年,歐洲所有電動車銷量將超過70%,中國和美國超過50%。到 2040 年,幾乎 100% 的車輛應實現零排放。同時,沃爾沃致力於在2030年成為一家全電動汽車公司。

由於這些因素,全球範圍內電動車中鎳基電池的採用正在增加。預計這種積極趨勢將在預測期內推動鎳基電池市場的成長。

亞太地區預計將主導目標市場

預計亞太地區將佔據全球鎳基電池市場的大部分佔有率。該地區可支配收入的增加和國內生產總值的成長正在推動市場。預計在預測期內,全部區域地區的目標商標產品製造商和供應商將大力擴張,以滿足汽車零件製造、汽車銷售、政府監管收緊和汽車行業不斷成長的需求。

中國是最大的電動車市場之一,該國增加電動車的採用符合清潔能源政策。此外,中國政府也提供財政和非財政獎勵來鼓勵電動車的採用。

- 例如,2022年,中國純電動車產量約547萬輛,較2021年成長85.8%。同年,中國插電式混合動力汽車產量約159萬輛,與前一年同期比較成長164.2%。

此外,印度政府的目標是到 2030 年將 100% 的二輪車和三輪車轉化為電動車,並將汽車總銷量的 30% 轉化為電動交通。目前,印度依賴其他國家採購電動車電池,導致電動車價格飆升。如果電動車在印度汽車產業普及,預計鋰離子電池的國內生產將得到促進並在經濟上變得可行。

- 2023年6月,日本經濟產業省宣布將向豐田汽車公司等七個與蓄電池及其零件技術開發和資本投資相關的計劃投資1,276億日圓(9億美元)。

由於這些新興市場的開拓,電動車產業預計在預測期內將大幅成長,為鎳基電池市場創造機會。

電動汽車鎳基電池產業概況

電動車鎳基電池市場適度整合。其中包括Panasonic控股、FDK Corporation、Energizer Holdings、GS Yuasa International 和 EnerSys。市場上的幾家公司正致力於改進產品系列以擴大基本客群。其他一些主要企業的目標是透過產品發布、擴大產品範圍、增加製造以及與其他公司結盟來擴大其市場佔有率。例如

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 電動車需求的增加推動市場成長

- 市場挑戰

- 原料短缺可能成為短期障礙

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 競爭公司之間敵對關係的強度

- 替代品的威脅

第5章市場區隔

- 依推進類型

- 電池電動車

- 混合車

- 插電式混合電動車

- 燃料電池電動車

- 按類型

- 鎳鎘

- 鎳金屬氫化物

- 其他(鎳鐵、鎳鋅等)

- 按車型

- 客車

- 商用車

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- EnerSys

- GS Yuasa International Ltd

- Energizer Holdings Inc.

- Panasonic Holdings Corporation

- Duracell

- Varta AG

- FDK Corporation

- BYD Company

- Primearth EV Energy Co. Ltd

- GP Batteries International

- Saft Group

- HBL Batteries

- Alcad ab

第7章 市場機會及未來趨勢

The Nickel-based Batteries For Electric Vehicles Market size is estimated at USD 2.25 billion in 2024, and is expected to reach USD 3.28 billion by 2029, growing at a CAGR of 3.85% during the forecast period (2024-2029).

Over the long term, rapid technological developments in the electric vehicle industry are expected to drive nickel-based batteries for the electric vehicle market. Improvements in design and manufacturing, changing consumer preferences, growing concern about sustainability and climate change, and governmental regulatory pressures and measures continue to transform the structures and systems that underpin the automotive industry. An example of such transformation is the rapid rise in the demand for electric vehicles.

The cost advantages of electric vehicles over conventional vehicles and other factors are expected to help the electric vehicle battery market expand. Moreover, supportive government policies to promote electric vehicle sales are expected to increase the demand for nickel-based batteries for electric vehicles over the forecast period.

However, the high cost of electric vehicles, the demand-supply gap of vital raw materials such as cobalt, and the lack of charging infrastructure are expected to restrain the market's growth. Leading automakers are working with battery companies to take advantage of the rapidly expanding electric vehicle industry.

As a result of major automakers showing interest in the electric vehicle sector, there is a rising need for electric vehicle batteries. However, many electric vehicle manufacturers are focusing on developing battery packs themselves. These factors are expected to drive the market during the forecast period.

Nickel-based Batteries For Electric Vehicles Market Trends

Battery Electric Vehicle Segment Anticipated to Dominate the Market

The rising demand for sustainable transportation and cleaner energy has increased the demand for battery electric vehicles. Promotional activities and government legislation are solving consumer constraints such as vehicle range, greater upfront prices, limited model availability, and lack of knowledge. These factors are expected to impact the demand for battery electric vehicles, which will drive the nickel-based batteries for the electric vehicles market.

- Battery-electric vehicle sales reached an estimated 7.3 million in 2022, up from around 4.6 million in 2021. BEV sales have soared due to several factors, including an increased consumer interest in more sustainable transport and governmental regulations to curb direct transport emissions. In 2021, these sales more than doubled compared to 2020, and 2022 witnessed a new record in all-electric sales volume.

Nickel plays a vital role in electric vehicle batteries. It is used in the production of electric batteries. This material is used as the basis for lithium-ion batteries, which are a very common energy source in electric vehicles. Moreover, nickel weighting in battery electric vehicles jumped 8% yearly to an average of 25.3 kilograms in July 2023 as carmakers continue to opt for high-nickel batteries for long-range, performance, and many entry-level new models.

In recent years, a few automakers have been gradually developing business strategies that take electrification into account to increase market share and keep a competitive edge. Companies have kept their stance in a way to comply with policy regulations or in response to government incentives. Companies have also announced their plans with a greater choice of models to be rolled out sooner over the coming years, propelling the nickel-based batteries market over the forecast period.

- Toyota, the world's largest car manufacturer, plans to roll out 30 BEV models by 2030. The company aims for 3.5 million annual sales of electric cars. Lexus aims to achieve 100% BEV sales globally in 2035.

- Volkswagen announced that all-electric vehicle sales would exceed 70% of its European and 50% of its Chinese and US sales by 2030. By 2040, nearly 100% of vehicles should be zero-emissions. On the other hand, Volvo is committed to becoming a fully electric car company by 2030.

Owing to these factors, the adoption of nickel-based batteries in electric vehicles is increasing globally. Such positive trends are expected to enhance the growth of the nickel-based batteries market over the forecast period.

Asia-Pacific Region is Expected to Dominate the Target Market

Asia-Pacific is expected to have a majority share in the global nickel-based batteries market. Rising disposable income and an increase in GDP in the region are driving the market. Ease of manufacturing auto parts, vehicle sales, growing government regulations, and robust expansion adopted by original equipment manufacturers and suppliers in the region to accommodate rising demand from the automotive industry across the region are expected to create a positive outlook for the market during the forecast period.

China is one of the largest markets for electric vehicles, and the increasing adoption of electric vehicles in the country has been in line with the clean energy policy. Moreover, the Chinese government has been providing both financial and non-financial incentives to promote the adoption of electric vehicles.

- For instance, in 2022, China produced around 5.47 million battery-electric vehicles, an increase of 85.8% compared to 2021. In the same year, around 1.59 million plug-in hybrid cars were produced in China, an increase of 164.2% compared to the previous year.

Furthermore, the Government of India is targeting the conversion of two and three-wheelers into 100% electric ones and the total automotive sales to 30% into e-mobility by 2030. Currently, India is dependent on other countries to source EV batteries, which has resulted in the hiked price of EVs. The penetration of EVs in the Indian automotive sector is expected to bolster indigenous manufacturing of Li-Ion batteries and make them economically viable.

- In June 2023, Japan's Ministry of Economy, Trade, and Industry announced that it would invest JPY 127.6 billion (USD 900 million) in Toyota Motor Corporation and other companies for seven projects relating to the technical development and capital investment for storage batteries and their parts.

Due to such developments, the electric vehicles industry is expected to see significant growth and create opportunities for the nickel-based batteries market over the forecast period.

Nickel-based Batteries For Electric Vehicles Industry Overview

The nickel-based batteries for electric vehicles market is moderately consolidated. A few prominent companies include Panasonic Holdings Corporation, FDK Corporation, Energizer Holdings Inc., GS Yuasa International Ltd, and EnerSys. Several companies in the market are focusing on improving their product portfolios to widen their customer base. Some other key players aim to expand their presence in the market through product launches, offerings expansion, manufacturing expansion, and collaborations with other companies. For instance,

- In October 2023, LG Energy Solution and Toyota Motor Corporation signed a long-term deal for Nickel-based lithium-ion battery modules to power Toyota's electric vehicles in the United States. Starting in 2025, LG Energy Solution will supply 20 GWh annually, investing USD 3 billion in the endeavor. The high-nickel NCMA pouch-type cells will be produced at LG Energy Solution's Michigan facility.

- In September 2023, Atlas Materials successfully secured USD 27 million in funding for the electric vehicle nickel-based batteries. This financial support comes ahead of the startup's plans to construct a manufacturing plant in North America. Atlas, headquartered in the United States, targets the commencement of large-scale production at one of three potential locations in Canada or the United States by 2027, aiming for an annual nickel output of 1,800 metric tons.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Electric Vehicles Drive the Market Growth

- 4.2 Market Challenges

- 4.2.1 Shortages of Raw Materials May Create Short Term Hurdles

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET SEGMENTATION

- 5.1 By Propulsion Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-in Hybrid Electric Vehicles

- 5.1.4 Fuel Cell Electric Vehicles

- 5.2 By Type

- 5.2.1 Nickel Cadmium

- 5.2.2 Nickel Metal Hydride

- 5.2.3 Others (Nickel Iron, Nickel Zinc, etc.)

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 EnerSys

- 6.2.2 GS Yuasa International Ltd

- 6.2.3 Energizer Holdings Inc.

- 6.2.4 Panasonic Holdings Corporation

- 6.2.5 Duracell

- 6.2.6 Varta AG

- 6.2.7 FDK Corporation

- 6.2.8 BYD Company

- 6.2.9 Primearth EV Energy Co. Ltd

- 6.2.10 GP Batteries International

- 6.2.11 Saft Group

- 6.2.12 HBL Batteries

- 6.2.13 Alcad ab