|

市場調查報告書

商品編碼

1521653

全球休閒車金融市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Recreational Vehicle Financing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

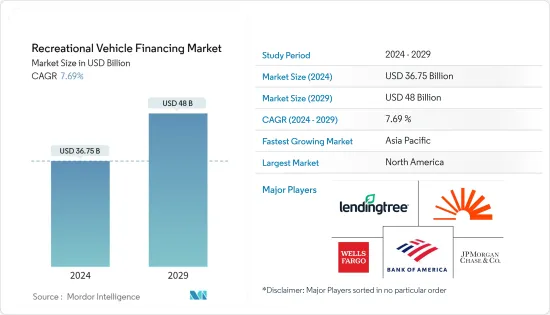

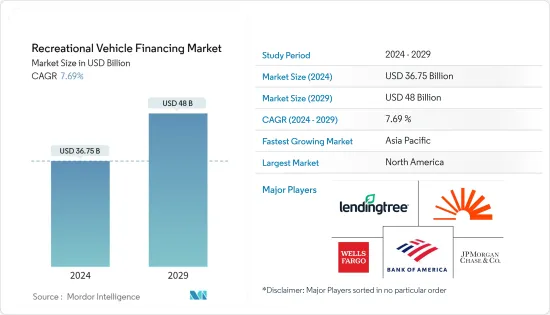

預計2024年全球休閒車金融市場規模將達367.5億美元,2024年至2029年複合年成長率為7.69%,2029年將達480億美元。

休閒車金融市場表現出適度的整合,由 LendingTree、LightStream、富國銀行、美國銀行、大通銀行(摩根大通)等幾家大型全球參與者主導。這些公司透過廣泛的產品組合、技術進步和策略聯盟在這個市場上建立了據點。

近年來,由於房車出行的日益普及、房車技術的進步以及創新融資解決方案的出現等因素,房車金融領域經歷了顯著的成長。據休閒車行業協會稱,僅在美國,休閒車產業每年就產生 500 億美元的經濟影響。目前,該行業已有超過23,000家公司,創造了約45,000個直接就業機會和30億美元的直接工資。因此,房車金融業已成為更廣泛的房車市場不可或缺的一部分。

休閒車融資需求增加有幾個促進因素。首先,COVID-19 大流行已將消費者的偏好轉向國內旅行和戶外活動,以尋求比國際旅行更安全的替代方案。此外,休閒車技術的進步正在創造出更省油、更環保、技術更先進的車輛,這些車輛對越來越多的人越來越有吸引力。此外,零工經濟和遠距工作的興起導致更多的人延長假期,增加了對休閒車作為舒適靈活的住宿選擇的需求。最後,我們方便用戶使用的線上平台和融資選項使潛在買家可以更輕鬆地研究、比較和確保為其所需的休閒車融資。

房車金融市場面臨許多挑戰與機會。主要挑戰之一是休閒車產業的周期性,它受到經濟波動和消費者情緒的影響。在景氣衰退時期,由於潛在買家對支出變得更加謹慎,房車銷售和融資可能會下降。但這也是休閒車金融公司提供有吸引力的優惠和獎勵以鼓勵在此期間購買的機會。很快,促進環保休閒車和永續實踐的創新融資方案就可以克服這些挑戰,並為產業創造更永續的未來做出貢獻。

隨著市場不斷發展以滿足不斷變化的消費者需求,休閒車金融的未來看起來充滿希望。此外,休閒車中智慧技術和連接功能的日益整合將推動對這些高科技車輛量身定做的先進融資解決方案的需求。最後,對永續性的持續關注將導致綠色融資選擇的增加,支持綠色休閒車模式的開發,並促進負責任的旅行實踐。總體而言,休閒車融資市場預計將繼續成為整個休閒車產業充滿活力和不可或缺的一部分。

休閒車金融市場趨勢

由於消費者偏好的變化,市場需求增加

人們對休閒車 (RV) 融資的興趣增加,很大程度上是因為自 COVID-19 大流行以來,人們越來越關注國內旅行和戶外活動。消費行為的這些變化增加了對房車作為度假和旅行舒適便捷的住宿設施的需求。

有幾個因素促成了這一變化。首先,健康和安全問題導致國際旅行吸引力下降,國內度假需求激增。房車度假比傳統飯店度假便宜60%以上,因此人們購買房車主要是為了家庭露營和節省成本。流行的房車類型包括旅行拖車、A 型旅居車、第五輪和公園型休閒車 (PMRV)。在美國,五分之一的房車是旅行拖車,第五輪越來越受歡迎。

此外,隨著人們尋求享受大自然和逃離家園,這種流行病激發了人們對戶外活動和體驗的興趣。房車為探索國家公園、風景優美的路線和各種戶外景點提供了舒適的基地。此外,消費者對房車融資偏好的變化是由與家人和朋友重新聯繫的願望所驅動的。因為房車為家人和朋友一起旅行提供了獨特的機會,同時保持安全和私密的環境。

一個家庭的平均房車貸款額超過 45,000 美元。在美國,有4000萬人參加房車露營,其中美國是最大的市場參與企業。千禧世代擴大參與房車露營,佔露營者的 38%,但 X 世代和嬰兒潮世代仍然主導著市場。擁有房車的典型家庭的收入約為 62,000 美元,每年平均使用房車四週。自2001年以來,美國的房車擁有量增加了16%,與1980年相比,現在有60%的家庭擁有房車。

最後,遠距工作的興起使許多人能夠享受更長的假期並在不同地點工作。房車為這些遠距工作者提供了便捷舒適的生活空間,讓他們在探索新目的地的同時保持工作與生活的平衡。總而言之,消費者對休閒車融資偏好的變化是由健康和安全考慮、靈活性、可負擔性、對戶外體驗的渴望以及與家人和朋友聯繫的能力等因素驅動的,所有這些都使得房車越來越住宿。

預計亞太地區在預測期內將實現最高成長

預計休閒車(RV)金融市場在預測期內將成為亞太地區成長最快的市場。這一成長歸因於多種因素,包括可支配收入的增加、中階人口的成長以及國內旅遊業的成長。隨著亞太地區經濟持續成長,可支配所得不斷增加。可支配收入的增加使更多人能夠購買休閒車,從而增加了休閒車融資的需求。 2022年,亞洲家庭可支配所得將達21.2兆美元,高於2019年(19.4兆美元)。因此,金融機構和貸方正在提供各種融資選擇來服務這個不斷成長的細分市場。

亞太地區的中階正在迅速擴大,這群人擴大尋求休閒活動,包括房車旅行。隨著越來越多的中階投資房車,房車融資的需求也不斷增加,推動了該地區房車融資市場的成長。除了便利、節省成本和健康問題之外,亞太地區的國內旅遊業也出現了顯著成長。房車為這些國內旅客提供了舒適靈活的住宿選擇,使他們能夠按照自己的步調探索各種目的地。國內旅遊業的成長導致對休閒車的需求增加,反過來又增加了休閒車的融資。

在日本等國家,人口老化也推動了對提供舒適便捷的旅行和觀光的房車的需求。日本人口正在老化,超過28%的人年齡在65歲以上。該人群擴大尋求露營和觀光等休閒活動。大篷車和房車為老年人提供了一種舒適便捷的方式來旅行和探索日本美麗的風景。根據日本房車協會預測,2022年日本露營車的年總銷售額將達到約762.5億日圓。這說明房車金融成為人們更好的選擇。

此外,亞太地區各國政府正在透過開發和改善房車公園和露營地的基礎設施來促進國內旅遊業。隨著越來越多的人投資房車來探索自己的國家,這些舉措為房車金融市場的發展創造了有利的環境。在印度,政府計劃允許私人參與者在森林、堡壘基地、山站和水壩等緩衝區的私人和國有土地上建立大篷車公園。房車公園也可以建在馬哈拉斯特拉邦旅遊發展公司(MTDC)住宿設施和農業旅遊中心附近的空地上。

隨著亞太地區越來越多的人認知到房車旅行的好處,包括節省成本、靈活性和與自然的聯繫,對房車和房車融資的需求預計將成長。房車的日益普及可能會導致亞太地區在預測期內實現最高成長。

房車金融業概況

休閒車金融市場呈現適度整合的格局,由 LendingTree、LightStream、富國銀行、美國銀行、大通銀行 (JPMorgan Chase) 等幾家大型全球參與者主導。這些公司透過廣泛的產品系列、技術進步和策略聯盟在這個市場上站穩了腳跟。

2023 年 12 月,KKR 收購了價值 72 億美元的優質休閒車貸款組合。此舉表明 KKR 對不斷成長的房車行業的持續興趣,並加強了 KKR 在消費金融領域的影響力。

2023 年 7 月,美國銀行宣布與 Rollick 合作開發一個新的休閒車和船隻線上市場。該平台旨在為客戶提供無縫的購物體驗,提供融資選擇以及有關房車和船隻購買的專家建議。

2023年12月,盛德代表KKR收購了價值70億美元的投資組合。這項交易標誌著 KKR 持續擴大其在消費金融業(尤其是休閒車領域)業務的另一個重要里程碑。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 可支配收入的增加和金融機構的低利率將增加市場需求

- 市場限制因素

- 高初始成本可能會抑製成長

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- PESTLE分析

第5章市場區隔

- 搭車

- Motorhomes

- A級

- B級

- C級

- Caravans

- 旅行拖車

- 第五輪圈

- 玩具搬運工

- 卡車露營車

- 彈出預告片

- 折疊式露營拖車

- Motorhomes

- 按資金來源

- 銀行/信用合作社

- 房車經銷商融資

- 製造商融資

- 線上渲染

- 政府貸款

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 併購

- 公司簡介

- LendingTree

- LightStream

- Wells Fargo Bank

- SouthEast Financials

- Bank of America

- Chase(JPMorgan Chase)

- GreatRVLoan

- Good Sam

- Camping world finance

- Thor Industries Inc.

- Swift Group

- Knaus Tabbert GmbH

- Eura Mobil GmbH

- Avant Garde India

第7章 市場機會及未來趨勢

The Recreational Vehicle Financing Market size is estimated at USD 36.75 billion in 2024, and is expected to reach USD 48 billion by 2029, growing at a CAGR of 7.69% during the forecast period (2024-2029).

The recreational vehicle financing market exhibits a moderately consolidated landscape, dominated by a few major global players such as LendingTree, LightStream, Wells Fargo Bank, Bank of America, Chase (JPMorgan Chase), and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

In recent years, the recreational vehicle financing sector has experienced substantial growth, driven by factors such as the increasing popularity of recreational vehicle travel, advancements in recreational vehicle technology, and the emergence of innovative financing solutions. As per the Recreational Vehicle Industry Association, in the US alone, the recreational vehicle industry creates USD 50 billion in economic impact annually. More than 23,000 businesses are currently involved in the industry, creating nearly 45,000 direct employment opportunities and USD 3 billion in direct wages. As a result, the recreational vehicle financing industry has become an essential component of the broader recreational vehicle market.

Several driving factors have contributed to the increasing demand for recreational vehicle financing. Firstly, the COVID-19 pandemic has shifted consumer preferences toward domestic travel and outdoor activities as people seek safer alternatives to international vacations. Additionally, advancements in recreational vehicle technology have resulted in more fuel-efficient, eco-friendly, and technologically advanced vehicles, making them increasingly appealing to a wider audience. Furthermore, the rise of the gig economy and remote work has enabled more individuals to take extended vacations, fuelling the demand for recreational vehicles as a comfortable and flexible accommodation option. Lastly, user-friendly online platforms and financing options have made it easier for potential buyers to research, compare, and secure financing for their desired recreational vehicle.

The recreational vehicle financing market faces several challenges and opportunities. One of the primary challenges is the cyclical nature of the recreational vehicle industry, which is influenced by economic fluctuations and consumer confidence. During economic downturns, recreational vehicle sales and financing may decline as potential buyers become more cautious with their spending. However, this also presents an opportunity for recreational vehicle financing companies to offer attractive deals and incentives to encourage purchases during these periods. Soon, innovative financing options that promote eco-friendly recreational vehicles and sustainable practices can help overcome these challenges and contribute to a more sustainable future for the industry.

The future of recreational vehicle financing looks promising as the market continues to adapt and evolve to meet the changing needs of consumers. Additionally, the increasing integration of smart technology and connectivity features in recreational vehicles will drive demand for advanced financing solutions tailored to these high-tech vehicles. Lastly, the ongoing focus on sustainability will lead to more environmentally conscious financing options, supporting the development of eco-friendly recreational vehicle models and promoting responsible travel practices. Overall, the recreational vehicle financing market is expected to remain a dynamic and essential component of the broader recreational vehicle industry in the years to come.

Recreational Vehicle Financing Market Trends

Shift in Consumer Preferences Increases the Demand in the Market

The growing interest in recreational vehicle (RV) financing is primarily due to the increased focus on domestic travel and outdoor activities, which has become more prominent since the COVID-19 pandemic. This shift in consumer behavior has led to a higher demand for RVs as a comfortable and convenient accommodation choice for vacations and trips.

Several factors have contributed to this change. Firstly, concerns about health and safety have made international travel less appealing, causing a surge in demand for domestic vacations. People buy RVs mainly for family camping and cost savings, as an RV vacation can be over 60% cheaper than a traditional hotel-based vacation. Popular RV types include travel trailers, Type A motorhomes, fifth wheels, and park-model recreational vehicles (PMRVs). In the United States, one in five RVs is a travel trailer, while fifth wheels are gaining popularity.

Additionally, the pandemic has sparked an interest in outdoor activities and experiences as people seek to enjoy nature and escape their homes. RVs provide a comfortable base for exploring national parks, scenic routes, and various outdoor attractions. Furthermore, the shift in consumer preferences for RV financing is driven by the desire to reconnect with family and friends, as RVs offer a unique opportunity for families and friends to travel together while maintaining a safe and private environment.

The average RV financing amount for a household is over USD 45,000. In the United States, 40 million people participate in RV camping, with Americans being the largest market segment. Millennials are increasingly engaging in RV camping, accounting for 38% of campers, although Generation X and Baby Boomers still dominate the market. The typical RV-owning household has an income of around USD 62,000 and uses their RV for an average of four weeks per year. Since 2001, there has been a 16% increase in RV ownership in the US, and 60% more households own an RV compared to 1980.

Lastly, the rise of remote work has enabled many individuals to take extended vacations and work from various locations. RVs provide a convenient and comfortable living space for these remote workers, allowing them to maintain their work-life balance while exploring new destinations. In summary, the shift in consumer preferences for recreational vehicle financing is driven by factors such as health and safety concerns, flexibility, affordability, the desire for outdoor experiences, and the ability to connect with family and friends, all of which contribute to the growing popularity of RVs as a preferred accommodation option for domestic travel and vacations.

Asia-Pacific is Anticipated to Register the Highest Growth During the Forecast Period

Asia-Pacific is anticipated to register the highest growth during the forecast period for the Recreational Vehicle (RV) Financing Market. This growth can be attributed to several factors, including increasing disposable income, a growing middle-class population, and rising domestic tourists. As economies in Asia-Pacific continue to grow, disposable incomes are increasing. This growth in disposable income enables more people to afford RVs, leading to a higher demand for RV financing. In 2022, the household disposable income in Asia accounted for USD 21.20 trillion, which is greater than 2019 (USD 19.04 trillion). As a result, financial institutions and lenders are offering various financing options to cater to this growing market segment.

The middle class in Asia-Pacific is expanding rapidly, and this demographic is increasingly seeking recreational activities, including RV travel. As more people from the middle class invest in RVs, the demand for RV financing also increases, driving the growth of the RV Financing Market in the region. In addition to convenience, cost savings, and health concerns, there has been a significant increase in domestic tourism in Asia-Pacific. RVs offer a comfortable and flexible accommodation option for these domestic travelers, allowing them to explore various destinations at their own pace. This rise in domestic tourism has led to a higher demand for RVs and, consequently, RV financing.

In countries like Japan, the country's aging population also drives the demand for these products as they offer a comfortable and convenient way to travel and explore the country. Japan has an aging population, with over 28% being 65 years or older. This demographic is increasingly seeking out leisure activities such as camping and sightseeing, as they offer a chance to connect with nature and enjoy a slower pace of life. Caravans and motorhomes provide a comfortable and convenient way for seniors to travel and explore the country's scenic beauty. As per the Japan RV Association, the total annual sales value of camping vehicles in Japan amounted to around JPY 76.25 billion in 2022. This shows that recreational vehicle financing will be the better option for people.

Furthermore, governments in the Asia-Pacific are promoting domestic tourism by developing and improving infrastructure for RV parks and camping sites. These initiatives create a favorable environment for the growth of the RV Financing Market, as they encourage more people to invest in RVs and explore their own countries. In India, the government will allow private players to set up caravan parks on private or government land in buffer zones such as forests, the foot of the fort, hill stations, and dams. Caravan parks can be set up near Maharashtra Tourism Development Corporation (MTDC) accommodations or on their open land, as well as at Agri-tourism centers.

As more people in Asia-Pacific become aware of the benefits of RV travel, such as cost savings, flexibility, and the ability to connect with nature, the demand for RVs and RV financing is expected to grow. This increased popularity of RVs will contribute to the highest growth in Asia-Pacific during the forecast period.

Recreational Vehicle Financing Industry Overview

The recreational vehicle financing market exhibits a moderately consolidated landscape, dominated by a few major global players such as LendingTree, LightStream, Wells Fargo Bank, Bank of America, Chase (JPMorgan Chase), and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

* In December 2023, KKR acquired a USD 7.2 billion portfolio of prime recreational vehicle loans. This move demonstrates KKR's continued interest in the growing RV industry and strengthens its presence in the consumer finance sector.

* In July 2023, US Bank unveiled a new online marketplace for recreational vehicles and boats, developed in collaboration with Rollick. The platform aims to provide a seamless shopping experience for customers, offering financing options and expert advice on RV and boat purchases.

* In December 2023, Sidley represented KKR in the acquisition of a USD 7 billion portfolio. This transaction marks another significant milestone for KKR as it continues to expand its presence in the consumer finance industry, particularly within the recreational vehicle sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing disposable income and Low-interest rates from lenders increase the market demand

- 4.3 Market Restraints

- 4.3.1 High initial costs may obstruct the growth

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Vehicle

- 5.1.1 Motorhomes

- 5.1.1.1 Class A

- 5.1.1.2 Class B

- 5.1.1.3 Class C

- 5.1.2 Caravans

- 5.1.2.1 Travel Trailers

- 5.1.2.2 Fifth Wheels

- 5.1.2.3 Toy Haulers

- 5.1.2.4 Truck Campers

- 5.1.2.5 Pop-up Trailers

- 5.1.2.6 Folding Camping Trailers

- 5.1.1 Motorhomes

- 5.2 By Financing Sources

- 5.2.1 Banks and Credit Unions

- 5.2.2 RV Dealership Financing

- 5.2.3 Manufacturer Financing

- 5.2.4 Online Lenders

- 5.2.5 Government-backed Loans

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 LendingTree

- 6.3.2 LightStream

- 6.3.3 Wells Fargo Bank

- 6.3.4 SouthEast Financials

- 6.3.5 Bank of America

- 6.3.6 Chase (JPMorgan Chase)

- 6.3.7 GreatRVLoan

- 6.3.8 Good Sam

- 6.3.9 Camping world finance

- 6.3.10 Thor Industries Inc.

- 6.3.11 Swift Group

- 6.3.12 Knaus Tabbert GmbH

- 6.3.13 Eura Mobil GmbH

- 6.3.14 Avant Garde India