|

市場調查報告書

商品編碼

1686198

北美休閒車:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)North America Recreational Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

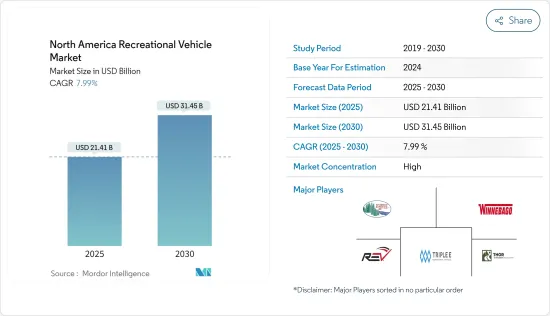

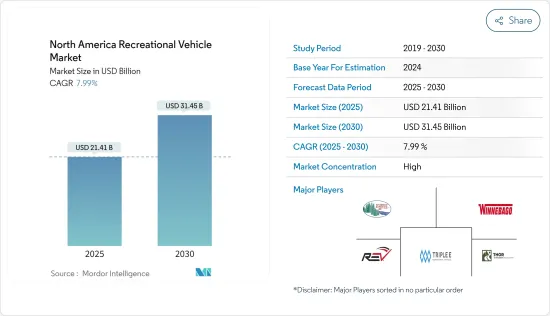

北美休閒車 (RV) 市場規模預計在 2025 年達到 214.1 億美元,預計到 2030 年將達到 314.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.99%。

北美休閒車(RV)市場是一個充滿活力和蓬勃發展的行業,其驅動力有多種因素,包括消費者可支配收入的增加以及投資旅行和戶外探險等休閒活動的能力。隨著人們對戶外休閒和露營的偏好日益濃厚,尤其是千禧世代和家庭,人們對房車的需求也在成長,因為房車是探索大自然和享受開放車道自由的一種方式。

然而,市場上也存在一些限制因素,包括購買房車的前期成本較高,這可能會讓對價格敏感的消費者望而卻步。燃料價格的波動也會影響房車旅行的可負擔性,進而影響消費者對休閒活動的決定。此外,授權要求和分區限制等監管挑戰可能會成為某些地區進入和營運的障礙,從而限制市場成長。

儘管有這些挑戰,北美房車市場仍有許多成長和創新的機會。共享經濟的興起帶來了P2P房車租賃平台和共用所有權模式的出現,為消費者提供了靈活、實惠的房車旅行體驗選擇。此外,拓展年輕人口、居住者和國際市場等新市場將使基本客群多樣化並刺激市場擴張。

北美房車市場主要由 Thor Industries、Forest River、Winnebago Industries 和 REV Group 等大公司主導。這些公司在產品創新、品牌聲譽、定價和分銷網路等多種因素上競爭,以保持市場佔有率並獲得競爭優勢。規模較小的公司和利基製造商透過提供針對特定客戶偏好和需求的專用房車,為市場帶來多樣性,進一步豐富了整體市場格局。

北美房車市場趨勢

電動房車是最大的細分市場

隨著旅行和旅遊業在世界各地越來越受歡迎,人們正在尋求獨特而冒險的體驗。對體驗式、沉浸式旅行體驗的渴望導致了對電動房車的需求增加。許多國家缺乏可用的露營地也推動了對電動房車的需求。

此外,美國、加拿大等北美國家對旅居車的需求正大幅成長。日益富裕和休閒車停車位的廣泛普及正在推動北美休閒車的普及。

自新冠疫情爆發以來,許多人出於安全考慮計劃度假時避免乘坐公共交通工具,導致休閒車的需求激增。在新冠疫情期間,幾家北美休閒車公司的預訂量均大幅成長。

近年來,B級和C級旅居車因其優勢,其需求量也隨之增加。近年來,參加美國夏令營的人數一直呈上升趨勢。

- 預計 2023 年將有超過 5,700 萬人在美國享受露營,而 2022 年這一數字約為 5,500 萬人。

- 2023年美國從製造商到經銷商的旅居車批發出貨量約為45,900輛。

預計這些綜合因素將在預測期內推動該地區對電動房車的需求。

預計美國將主導市場

該國露營地數量的增加證明人們對使用旅居車進行休閒旅行的偏好日益成長。美國有超過 230 家連鎖店,當地旅居車經銷商買賣旅居車,旅居車。這些經銷商提供最先進的旅居車以及最新型的旅居車車,受到許多車隊營運商的青睞。為了與日益發展的電動車時代競爭,大多數房車製造公司都在生產電動休閒車以在市場上佔據優勢。

- 例如,2023 年 3 月,總部位於南加州的汽車製造商 Harbinger 向 THOR Industries交付了專用的中型電動車底盤。 THOR 計劃在印第安納州埃爾克哈特的 THOR美國創新實驗室將底盤升級為電動 A 級房車。

美國從新冠疫情中迅速而穩定地復甦,創造了更健康的資金籌措環境,推動了美國旅居車市場的發展。目前,中國是全球最大的房車市場。

旅居車廣泛用於度假旅行、車尾聚會、攜帶寵物旅行和商務。它也是戶外運動和其他休閒活動的熱門交通方式。

這些車輛為露營者提供舒適的睡眠區和所有必需品,以及冰箱、熱水、空調和暖氣等豪華設施。然而,由於體積小,它們缺少一些功能,例如全尺寸娛樂系統和洗衣設施。

預計上述因素將在預測期內促進整個市場的發展。

北美房車行業概況

北美房車市場的主要企業有 Thor Industries Inc.、Forest River Inc.、Winnebago Industries 和 REV Group。休閒車市場在主導企業之間競爭非常激烈。公司之間不斷競爭,選擇收購、大力投資研發計劃等策略,同時在其車輛上提供更多豪華服務。

- 2023 年 4 月,First Hydrogen 與 EDAG 集團合作推出了一款採用燃料電池技術的新型零排放休閒車 (RV)。此次合作旨在將燃料電池電動技術應用於大型車輛,與電池電動車 (BEV) 相比,休閒車具有有效負載容量更大、續航里程更長的優勢。第一代廂型車的設計行駛里程為 249 至 373 英里(加滿油五分鐘),第二代車輛的預期行駛里程尚未公佈。

- 2023 年 1 月,Winnebago Industries 在坦帕舉行的佛羅裡達房車超級展上推出了首款全電動房車 eRV2。這種排放氣體排放車型以電力運行所有系統,包括房屋和動力傳動系統,並且僅使用電池即可支援長達七天的野外露營。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 旅遊業的成長推動了市場需求

- 市場限制

- 休閒車租賃將對市場產生長期影響

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按類型

- 拖曳式房車

- 旅行拖車

- 第五輪拖車

- 折疊式露營拖車

- 卡車露營

- 旅居車

- A型

- B型

- C型

- 拖曳式房車

- 按應用

- 個人

- 商業的

- 按國家

- 美國

- 加拿大

- 北美其他地區

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Thor Industries Inc.

- Winnebago Industries Inc.

- Forest River Inc.

- REV Group

- NeXus RV

- Triple E Recreational Vehicles

- Tiffin Motorhomes Inc.

- Entegra Coach Inc.

- Cruiser RV

第7章 市場機會

- 自動駕駛房車重塑旅行體驗

The North America Recreational Vehicle Market size is estimated at USD 21.41 billion in 2025, and is expected to reach USD 31.45 billion by 2030, at a CAGR of 7.99% during the forecast period (2025-2030).

The North American RV (recreational vehicle) market is a dynamic and flourishing industry, driven by various factors, such as the rising disposable income among consumers, enabling them to invest in leisure activities such as travel and outdoor adventures. There is a growing preference for outdoor recreation and camping, especially among millennials and families, fostering increased demand for RVs as a means to explore nature and enjoy the freedom of the open road.

However, the market also faces certain restraints, including the high initial cost of purchasing an RV, which may deter price-sensitive consumers. Fluctuating fuel prices also impact the affordability of RV travel, influencing consumer decisions regarding leisure activities. Moreover, regulatory challenges such as licensing requirements and zoning restrictions can pose barriers to entry and operation in certain regions, potentially limiting the market's growth.

Despite these challenges, the North American RV market presents numerous opportunities for growth and innovation. The rise of the sharing economy has led to the emergence of peer-to-peer RV rental platforms and shared ownership models, providing consumers with more flexible and affordable options for experiencing RV travel. Furthermore, expanding into new markets, such as younger demographics, urban dwellers, and international markets, can diversify the customer base and stimulate market expansion.

Major players such as Thor Industries, Forest River Inc., Winnebago Industries, and REV Group dominate the North American RV market. These companies compete on various factors such as product innovation, brand reputation, pricing, and distribution networks to maintain market share and gain a competitive edge. Smaller players and niche manufacturers contribute to market diversity by offering specialized RVs tailored to specific customer preferences and needs, further enriching the overall market landscape.

North America RV Market Trends

Motorized RVs are the Largest Segment by Type

With travel and tourism gaining popularity worldwide, people are seeking unique and adventurous experiences. The desire for experiential and immersive travel experiences has contributed to the increased demand for motorized RVs. The shortage of available campgrounds in many countries has also contributed to the demand for motorized RVs.

Furthermore, motorhomes are witnessing a significant growth in demand across North American countries like the United States and Canada. The increasing number of HNWIs and the availability of widespread parking areas for RVs are driving their adoption in North America.

The demand for recreational vehicles has boomed after the COVID-19 pandemic, as most people started planning their holidays while avoiding public transportation due to safety precautions. Several recreational vehicle companies across North America witnessed significant booking growth during the COVID-19 pandemic.

Over the past few years, the demand for Class B and Class C motorhomes has also increased due to their advantages. The population of the United States participating in camping has seen an upward trajectory over the last few years.

- In 2023, the number of users opting for camping in the United States stood at over 57 million compared to the figure of around 55 million in 2022.

- In 2023, The US wholesale shipments of motorhomes from manufacturers to dealers amounted to approximately 45.9 thousand.

All these factors combined are expected to boost the demand for motorized RVs during the forecast period in the region.

United States Expected to Dominate the Market

The increase in campgrounds in the country illustrates the increasing preference for recreational travel with motorhomes. The United States has more than 230 chain outlets and local motorhome dealers are trading motorhomes to meet the increasing demand for them. These dealers provide a range of state-of-the-art motorhomes and the latest-model-year second-hand motorhome units preferred by most fleet operators. To compete in the growing electrical vehicle era, most of the RV manufacturing companies are manufacturing electric recreational vehicles to stay ahead in the market.

- For instance, in March 2023, Harbinger, a Southern California-based automotive manufacturer, delivered a purpose-built medium-duty EV chassis to THOR Industries. THOR plans to upgrade the chassis into an electrified class A RV at its THOR US Innovation Lab in Elkhart, Indiana.

The quick and steady recovery of the United States from the COVID-19 pandemic and the availability of a healthier financing environment drove the motorhome market in the United States. Currently, the country forms the largest market for RVs globally.

Motorhomes are widely used in the country for travels during vacations and for tailgating, traveling with pets, and business. They are also a preferred mode of transportation in outdoor sports and other leisure activities.

These vehicles provide campers with comfortable sleeping quarters and all the necessities, along with some luxurious features, such as a refrigerator, hot water, air conditioning, and heating. However, they miss out on some features, such as a full-sized entertainment system and laundry facilities, owing to their small size.

The factors mentioned above are expected to contribute to the market's overall development during the forecast period.

North America RV Industry Overview

The major players in the North American RV market are Thor Industries Inc., Forest River Inc., Winnebago Industries, and REV Group. The recreational vehicle market is highly competitive amongst the dominant players. The companies are continually competing with each other and are opting for strategies, like acquisitions and heavy investment in R&D projects, while offering more luxurious services in the vehicle.

- April 2023: First Hydrogen introduced a novel zero-emission recreational vehicle (RV), utilizing fuel cell technology in collaboration with the EDAG Group. This partnership seeks to apply fuel cell electric technology to larger vehicles, showcasing the advantage of handling higher payloads and achieving longer ranges compared to battery electric vehicles (BEVs) for RVs. Their inaugural van is designed to cover distances ranging from 249 to 373 miles (400 to 600 kilometers) on a single five-minute refueling, with the expected range for the Gen 2 vehicle yet to be disclosed.

- January 2023: Winnebago Industries debuted its inaugural fully electric RV, the "eRV2," at the Florida RV SuperShow in Tampa. This emission-free model operates all systems, both house and powertrain, on electricity, supporting up to seven days of "boondocking" solely on batteries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Travel and Tourism to Fuel Market Demand

- 4.2 Market Restraints

- 4.2.1 Recreational Vehicle Rental to Affect the Market Over the Long Term

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Value in USD)

- 5.1 By Type

- 5.1.1 Towable RVs

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth Wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhomes

- 5.1.2.1 Type A

- 5.1.2.2 Type B

- 5.1.2.3 Type C

- 5.1.1 Towable RVs

- 5.2 By Application

- 5.2.1 Private

- 5.2.2 Commercial

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thor Industries Inc.

- 6.2.2 Winnebago Industries Inc.

- 6.2.3 Forest River Inc.

- 6.2.4 REV Group

- 6.2.5 NeXus RV

- 6.2.6 Triple E Recreational Vehicles

- 6.2.7 Tiffin Motorhomes Inc.

- 6.2.8 Entegra Coach Inc.

- 6.2.9 Cruiser RV

7 MARKET OPPORTUNITIES

- 7.1 Autonomous RV to Rebuild the Caravanning Experience