|

市場調查報告書

商品編碼

1521894

永續電子商務包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Sustainable E-Commerce Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

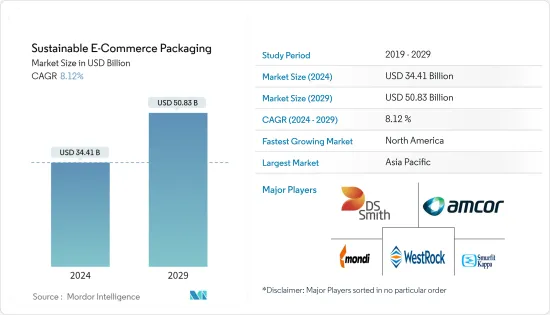

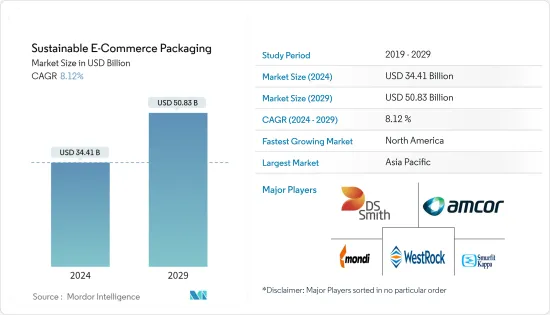

預計2024年永續電子商務包裝市場規模將達到344.1億美元,2029年將達到508.3億美元,預計在預測期內(2024-2029年)複合年成長率為8.12%。

製造商和消費者越來越意識到包裝廢棄物對環境的影響,導致對減少廢棄物和使用環保材料的永續包裝解決方案的需求不斷增加。歐洲和北美等已開發地區具有環保意識的消費者行為傾向於採用可回收、生物分解性或可堆肥材料製成的永續包裝。

主要亮點

- 永續性是電子商務中購買決策和品牌親和性的關鍵促進因素。零售商和電子商務包裝供應商正在採取行動,採用永續包裝,包括由回收材料製成的瓦楞紙箱、紙質替代品以及減少材料使用的簡單設計。

- 電子商務相關人員實際上已經意識到,如果向此類平台供應產品的中小企業要實現其目標,就必須實現永續包裝。與此同時,多個政府和個體零售商正在探索限制一次性塑膠使用的方案。多家電子商務公司已禁止在其包裝供應鏈中使用一次性塑膠。

- 例如,2023 年 7 月,沃爾瑪宣布了一項開創性的決定,透過減少與線上購買相關的包裝廢棄物,使日常購物體驗更加永續。該公司正在從塑膠郵件過渡到可回收紙質郵件。尺寸合適的瓦楞紙箱包裝使客戶能夠統一運輸電子商務訂單,並消除一次性塑膠袋的使用。預計到年終,這項舉措將從美國垃圾掩埋場清除 6,500 萬件(即超過 2,000 噸)塑膠廢棄物。

- 近年來,消費者購買不斷從實體店轉向電子商務。近年來,美國網路購物的使用量有所增加。根據美國人口普查局的數據,電子商務零售額占美國零售總額的比例將從2017年的9.1%增加到2023年的15.4%。網上購物的激增需要有效、環保和永續的包裝選擇。

- 但原料價格波動,加上突發地緣政治事件(如烏克蘭與俄羅斯衝突、其他國家貿易緊張局勢等)引發的供應鏈相關問題持續存在,將在一段時間內持續影響市場可能會導致營收下降。原物料價格的波動會影響總製造成本,並最終影響成品和服務的定價。

- 隨著電子商務領域的發展,技術不斷進步,以確保客戶的安全和安心。此類進步的例子包括永續RF 和 RFID 標籤促進的運輸應用,這些標籤有助於追蹤產品、製造商設施、承運人資訊和托運人倉庫。網路購物在印尼和印度等已開發市場和新興市場越來越受歡迎,客戶利用方便的包裝解決方案在運輸和交付過程中監控產品訊息,這提供了利潤豐厚的市場機會。

永續電子商務包裝市場趨勢

家用電子電器產品的線上銷售預計將推動收入成長

- 家用電子電器包裝產品製造商擴大使用保護性包裝產品,例如氣泡膜、空氣枕和其他充氣包裝產品來保護他們的設備。未來,預計這種替代包裝將滿足所有電子類別的要求。小型消費品的泡殼包裝正在有效發揮作用。這種塑膠包裝突出了產品的特色,並具有防拆封功能,同時易於打開。

- 環保電子產品包裝越來越受歡迎。監管和政府當局正在大力推廣環保包裝。品牌和消費者都認知到需要保護環境免受不可生物分解性的包裝廢物的影響。例如,2023 年 1 月,Flipkart 推出了一家提供永續產品的電子商店。該公司希望做到透明、以消費者為中心、環保,同時也做出改變並鼓勵明智的購買決策。

- 根據投資分析公司 Avendus 和印度主要 CA 公司 Dewan PN Chopra &Co. 的預測,印度整體家用電子電器市場規模從 2017 年開始預計將擴大約五倍,到 2025 年達到 306 億美元。因此,全國線上家用電子電器的大幅成長預計將在未來幾年推動可回收、生物分解性和永續包裝選擇的需求。

- 亞馬遜、阿里巴巴和沃爾瑪等跨國公司越來越認知到,其設備對環境的影響也延伸到了包裝上。亞馬遜設定了一個堅定的目標,到 2023年終使所有亞馬遜設備包裝完全可回收,這創下了家用電子電器產業的新紀錄。 2022 年推出的產品中約有 79.5% 是完全可回收的。

- 使用正確的材料對於家用電子電器產品包裝的永續發展至關重要。仔細選擇用於包裝、包裝和運輸電子產品的材料可以幫助公司實現其排放和永續性目標。為電子產品採用永續包裝解決方案不僅有助於實現這些目標,還將吸引越來越多具有環保意識的消費者,他們優先考慮環保選擇。

在預測期內,北美將佔據主要市場佔有率

- COVID-19 大流行加速了美國對環境和永續性的認知。消費者擴大在網路購物,這一趨勢即使在商店重新開業後仍然持續,推動了對環保包裝的需求。在宅配的便利性、全通路商家能力和情境客戶體驗的推動下,美國的電子商務支出正在增加。

- 美國塑膠公約最近發布了年度報告,強調其主要透過重新思考包裝設計來創造塑膠循環經濟的努力。該聯盟已成功實現其最初目標,即確定到 2025 年應從塑膠包裝中消除的有問題和不必要的材料清單。但其他願望,例如使所有塑膠包裝可重複使用、可回收和可堆肥,可能無法在 2025 年截止日期之前實現。

- 該地區的幾家公司一直致力於透過推出產品或透過縱向或橫向整合的方式來推廣生態友善包裝。 2023 年 6 月,永續電子商務平台 Boox 與加拿大無包裝退貨網路 ReturnBear 合作。此次合作旨在透過促進電子商務產業更加循環的系統來加強 Boox 在加拿大市場的產品和服務。因此,Boox 將向加拿大各地的行業合作夥伴擴展其解決方案和服務,在該地區有效實施打包和循環。

- 加拿大的電子商務基礎設施高度發達,與美國緊密結合。加拿大主要的線上零售商包括亞馬遜、沃爾瑪、Canadian Tire、Costco、Best Buy、Hudson's Bay 和 Etsy。整體而言,北美消費者越來越依賴網路下訂單。過去十年,網路消費者銷售額的成長速度快於傳統零售額。

- 電子商務在零售總額中的佔有率正在迅速擴大,尤其是在美國、加拿大等已開發國家。根據美國人口普查局的數據,美國的零售電子商務銷售額大幅成長,尤其是在疫情大流行之後。到2023年,美國電商零售額將超過1,1,180億美元,較2020年的7,626.8億美元大幅成長。總體而言,隨著消費者生活方式和食品需求的變化以及零售商密切合作以滿足這些需求,包裝預計將經歷動態轉變。

永續電商包裝產業概述

所研究的市場是細分的,主要供應商控制著大部分市場佔有率。市場上眾多參與企業的存在會影響服務的定價,並且是一個直接的競爭因素,特別是對於較小的供應商而言。供應商可能會專注於提供一站式服務以確保競爭優勢。該市場的主要參與企業包括 Amcor Group GmbH、Smurfit Kappa Group、WestRock Company 和 DS Smith PLC。

- 2023年9月,全球永續電商包裝公司Smurfit Kappa宣布擬以112億美元收購領先的紙和紙板製造公司WestRock,組成Smurfit WestRock。根據這項聲明,該協議預計將於 2024 年第二季敲定。

- 2023年6月,寶潔中國宣布與領先材料專家陶氏化學公司合作,將空氣膠囊引入電商包裝。此膠囊的創建是為了最大限度地減少不必要的包裝,同時確保產品安全。陶氏表示,這項創新設計的靈感來自於瓦楞小包裹箱,可將材料重量減輕 40%。此外,它還採用全 PE 單一材料成分。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估近期地緣政治情境對產業的影響

第5章市場動態

- 市場促進因素

- 消費者偏好轉向可回收和環保材料

- 全球生態商貿與網路零售快速成長

- 人們越來越青睞小型輕量包裝

- 市場限制因素

- 供應鏈相關問題與原料成本波動

第6章 市場細分

- 依材料類型

- 塑膠

- 紙板

- 金屬

- 按最終用戶

- 時尚/服飾

- 家用電子電器產品

- 飲食

- 藥品

- 個人護理

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Amcor Group GmbH

- Smurfit Kappa Group PLC

- WestRock Company

- DS Smith PLC

- Sealed Air Corporation

- Mondi Group

- International Paper

- Packman Packaging Private Limited

- Pinnacle Packing Industries LLC

- HB Fuller Company

第8章投資分析

第9章 市場機會及未來趨勢

The Sustainable E-Commerce Packaging Market size is estimated at USD 34.41 billion in 2024, and is expected to reach USD 50.83 billion by 2029, growing at a CAGR of 8.12% during the forecast period (2024-2029).

Manufacturers and consumers are becoming more aware of the environmental consequences of packaging waste, resulting in an incremental need for sustainable packaging solutions that reduce waste and utilize eco-friendly materials. The behavior of eco-conscious consumers in developed regions like Europe and North America gravitates toward environmentally sustainable packaging, which can be made from recycled, biodegradable, or compostable materials.

Key Highlights

- Sustainability is a major driver of purchase decisions and brand affinity in e-commerce. Retailers and e-commerce packaging vendors are taking action by incorporating sustainable packaging choices like corrugated boxes made from recycled materials, paper-based alternatives, and simplistic designs that decrease material usage.

- E-commerce stakeholders substantially recognize the requirement to make sustainable packaging viable for small businesses that supply products to these platforms to achieve targets. This comes when multiple governments and individual retailers look for options to curb the usage of single-use plastic. Several e-commerce companies are banning single-use plastics in their packaging supply chain.

- For instance, in July 2023, Walmart unveiled its groundbreaking decision to help make the everyday shopping experience more sustainable by reducing packaging waste related to online purchases. The firm is moving from plastic to recyclable paper mailers. Rightly-sized cardboard box packaging would allow customers to consolidate shipping on e-commerce orders and eliminate the use of disposable plastic bags. This switchover was estimated to remove 65 million single-use plastic bag mailers, or over 2,000 metric tons of plastic waste, from United States landfills by the end of 2023.

- The past few years have seen a continual consumer purchasing shift toward e-commerce and away from brick-and-mortar stores. The use of online shopping in the United States has been increasing in the past few years. According to the US Census Bureau, e-commerce retail sales as a percentage of total retail sales in the United States increased from 9.1% in 2017 to 15.4% in 2023. The surge in online purchases necessitates the need for effective, eco-friendly, and sustainable packaging choices.

- However, fluctuations in the raw material prices backed by the constant supply chain-related issues caused by sudden geopolitical events (like the conflict between Ukraine and Russia and other trade tensions between countries) may dent the market's top line in the upcoming period. Fluctuations in the prices of raw materials have the potential to impact the total production expenses and subsequently impact the ultimate pricing of the completed products or services.

- As the e-commerce sector grows, technological advancements are being developed to ensure customer safety and security. Examples of such advances include shipment applications facilitated by sustainable RF and RFID labels, which help track the product, the manufacturer's facility, the information of the delivery partner, and the shipper's warehouse. Online shopping is becoming increasingly popular in both developed and emerging markets like Indonesia, India, etc., and customers are taking advantage of convenient packaging solutions that monitor product information during the shipment and delivery process, providing lucrative market opportunities.

Sustainable E-Commerce Packaging Market Trends

Online Sales of Consumer Electronics is Expected to Drive Top-Line

- Manufacturers of consumer electronics packaging products are increasingly using protective packaging items, such as air bubble wraps, air pillows, and other inflated packaging products, to shield devices. It is anticipated that in the future, these packaging alternatives will satisfy the requirements of all electronic categories. The packaging of small consumer goods in blisters works effectively. This plastic packaging makes the items stand out and offers tamper protection while still being straightforward to open.

- Electronic product packaging that is environmentally friendly is growing in popularity. Regulators and government authorities have vigorously pushed for eco-friendly or green packaging. Brands and consumers alike are recognizing the necessity of protecting the environment from non-biodegradable packaging trash. For instance, in January 2023, Flipkart introduced an e-store for sustainable products. The company hopes that it will be able to make a difference and encourage informed buying decisions while being transparent, consumer-oriented, and eco-friendly.

- According to the investment analysis firm Avendus and a key CA firm based out of India, Dewan P.N. Chopra & Co., the size of the consumer electronics market across India from 2017 is expected to increase almost five times by 2025 to USD 30.6 billion. Therefore, this significant uptick in online consumer electronics across the country is anticipated to push the demand for recyclable and biodegradable sustainable packaging options in the coming years.

- Several global companies like Amazon, Alibaba, Walmart, and others are gradually understanding that the environmental impact of devices extends to packaging as well. Amazon set a robust objective to have all Amazon device packaging completely recyclable by the end of 2023, a new record for the consumer electronics sector. About 79.5% of product launches in 2022 were fully recyclable.

- Using appropriate materials is crucial in making consumer electronics packaging sustainable. By carefully selecting the materials for wrapping, packing, and transporting electronics, it becomes simpler to achieve business' carbon emission targets and sustainability objectives. Embracing sustainable packaging solutions for electronic products not only helps in reaching these goals but also attracts the increasing population of environmentally conscious consumers who prioritize eco-friendly choices.

North America to Hold Significant Market Share During the Forecast Period

- The COVID-19 pandemic accelerated the transition to e-commerce sales and raised awareness of the environment and sustainability in the United States. Consumers increasingly turned to online shopping, and that pattern endured even when stores reopened, resulting in the demand for eco-friendly packaging. E-commerce spending in the United States is rising, driven by the convenience of home delivery, merchants' omnichannel capabilities, and contextual customer experiences.

- The United States Plastics Pact recently published its annual report, highlighting its efforts to create a circular economy for plastics, primarily through a reassessment of packaging design. The consortium has successfully achieved its initial objective of identifying a list of problematic and unnecessary materials that it seeks to eliminate from plastic packaging by 2025. However, other aspirations, such as ensuring that all plastic packaging is reusable, recyclable, or compostable, may not be met by the 2025 deadline.

- Several players across the region consistently make efforts by launching products or starting initiatives with vertical or horizontal integration to boost environment-friendly packaging for e-commerce channels. In June 2023, Boox, a sustainable e-commerce platform, partnered with ReturnBear, a package-free returns network in Canada. This collaboration aims to enhance Boox's services in the Canadian market by promoting a more circular system within the e-commerce industry. As a result, Boox will extend its solutions and services to industry partners throughout Canada, effectively implementing the packaging loop within the region.

- Canada's e-commerce infrastructure is highly developed and closely integrated with that of the United States. The major online retailers in Canada include Amazon, Walmart, Canadian Tire, Costco, Best Buy, Hudson's Bay, and Etsy. Overall, North American consumers increasingly rely upon the Internet to place orders. Internet consumer sales have grown more in the past decade than traditional retail sales.

- The total percentage of e-commerce is rapidly growing in terms of total retail sales, primarily in developed countries like the United States and Canada. According to the US Census Bureau, the value of retail e-commerce sales in the United States has been growing significantly, especially after the pandemic. In 2023, the value of e-commerce retail trade sales in the United States exceeded USD 1.118 trillion, marking a significant increase from USD 762.68 billion in 2020. Overall, as consumer lifestyles and food demands change and retailers work closely to accommodate those demands, packaging is anticipated to experience a dynamic transformation.

Sustainable E-Commerce Packaging Industry Overview

The market studied is fragmented, with major vendors accounting for most of the market share. The presence of many players in the market impacts the pricing of services, making it a direct competing factor, especially for small-scale vendors. The vendors are expected to focus on providing one-stop-shop services, providing them with a competitive advantage. Some of the major players in the market are Amcor Group GmbH, Smurfit Kappa Group, WestRock Company, and DS Smith PLC.

- September 2023: Global sustainable and e-commerce packaging firm Smurfit Kappa notified its intentions to acquire a key paper and paperboard manufacturing firm, WestRock, for USD 11.2 billion to create Smurfit WestRock, one of the largest global paper packaging company generating a combined annual income of USD 34 billion. Upon the declaration, the agreement was anticipated to be finalized during the second quarter of 2024.

- June 2023: Procter & Gamble (P&G) China unveiled its partnership with Dow, a key material specialist firm, to introduce an air capsule for e-commerce packaging. The capsule has been created to minimize unnecessary packaging while ensuring the products' safety. Dow has stated that the innovative design is inspired by corrugated parcel boxes and results in a 40% decrease in material weight. Additionally, it features an all-PE mono-material composition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Recent Geopolitical Scenario on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials

- 5.1.2 Exponential Growth of Eco-commerce and Online Retailing Penetration Across the Globe

- 5.1.3 Rising Inclination Toward Downsized and Lightweight Packaging

- 5.2 Market Restraints

- 5.2.1 Supply Chain-related Issues and Fluctuating Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Paper and Paper Board

- 6.1.3 Metal

- 6.2 By End User

- 6.2.1 Fashion and Apparel

- 6.2.2 Consumer Electronics

- 6.2.3 Food and Beverage

- 6.2.4 Pharmaceuticals

- 6.2.5 Personal Care

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Smurfit Kappa Group PLC

- 7.1.3 WestRock Company

- 7.1.4 DS Smith PLC

- 7.1.5 Sealed Air Corporation

- 7.1.6 Mondi Group

- 7.1.7 International Paper

- 7.1.8 Packman Packaging Private Limited

- 7.1.9 Pinnacle Packing Industries LLC

- 7.1.10 H.B. Fuller Company