|

市場調查報告書

商品編碼

1536892

界面活性劑:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Surfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

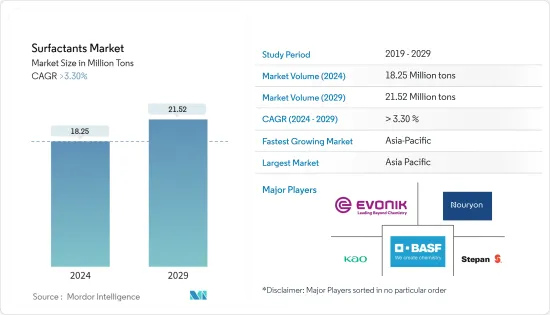

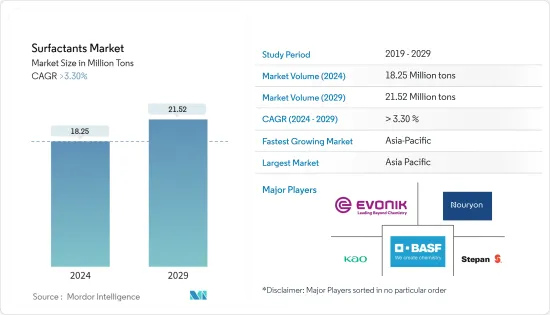

預計2024年全球界面活性劑市場規模將達到1825萬噸,2024-2029年複合年成長率將超過3.30%,2029年將達到2152萬噸。

主要亮點

- 短期內,個人護理和化妝品行業的崛起以及清潔劑和清潔劑製造中用量的增加預計將推動表面活性劑市場的成長。

- 然而,人們對使用界面活性劑的環保意識不斷增強,預計將阻礙市場成長。

- 表面活性劑領域的新發明和生物基表面活性劑的引入可能會創造更多機會。

- 亞太地區在市場上佔據主導地位,預計在預測期內仍將保持最高的複合年成長率。

表面活性劑市場趨勢

陰離子界面活性劑可望主導市場

- 陰離子界面活性劑屬於一類界面活性試劑,其中界面活性劑聚合物的頭部保持帶負電荷。這使其能夠與懸浮在液體中的雜質和顆粒結合。

- 陰離子界面活性劑約佔整個界面活性劑市場佔有率的一半。由於對環境法規的興趣增加,預計對陰離子界面活性劑的需求將會增加。

- 陰離子界面活性劑廣泛應用於工業及家庭清洗及農藥配方。在陰離子界面活性劑中,生物分解性的直鏈烷基苯磺酸鹽(LAS) 是最常見的,存在於污水系統和河水中。

- 陰離子界面活性劑最適合去除污垢、黏土和一些油性污漬。陰離子界面活性劑透過電離作用發揮作用。當添加到水中時,陰離子界面活性劑會電離並帶有負電荷。帶負電的界面活性劑與帶正電的顆粒(例如黏土)結合。陰離子界面活性劑可有效去除顆粒污垢。

- 最常用的陰離子界面活性劑包括磺酸鹽、醇硫酸鹽、磷酸酯、烷基苯磺酸鹽和羧酸鹽。

- 陰離子界面活性劑因其優異的起泡、清洗、增稠、增溶、乳化、抗菌、滲透增強等特殊功效,在個人護理應用的護膚護髮產品中廣受歡迎,化妝品的需求量日益增加。預計將提振需求。

- 目前,市場對環保替代品的需求正在推動對生物基陰離子界面活性劑的需求。

亞太地區預計將主導市場

- 在亞太地區,中國預計將主導市場。化妝品和個人護理品是中國成長最快的行業之一。人口持續成長也是推動該國個人護理、肥皂和清潔劑需求的一個因素,從而擴大了表面活性劑市場。

- 中國化學工業的產品對於肥皂、清潔劑和化妝品等多種產品至關重要。日本有60多家清洗劑、護理劑、清潔劑的製造商。然而,該市場由BASF公司和贏創工業公司等跨國公司主導。中國也是最大的肥皂和清潔劑產品出口國之一。

- 此外,印度也是世界上最大的肥皂生產國之一。印度人均香皂和沐浴皂消費量為800公克。印度約65%的人口居住在農村地區,可支配收入的增加和農村市場的成長正在推動消費者轉向奢侈品。預計這一轉變將推動印度表面活性劑市場的發展。

- 據印度品牌資產基金會稱,到 2025 年,美容、化妝品和美容市場預計將達到 200 億美元。

- 根據日本經濟產業省統計,2022年國內生產總值為46,090噸,與前一年同期比較增加3%以上。

- 韓國的油漆和塗料市場是亞太地區第四大市場。 KCC、Samhwa Paints、Kangnam Jevisco(原 Kunsul Chemical Industrial Company,俗稱 KCI)、Noroo Paints 和 Chokwang Paints 是主要的油漆和塗料製造商。他們主導著韓國塗料市場。

- 總體而言,預計該地區的表面活性劑市場在預測期內將穩定成長。

表面活性劑產業概況

界面活性劑市場高度分散,排名前五的公司佔比重微乎其微。市場主要企業(排名不分先後)包括Nouryon、Evonik Industries AG、Kao Corporation、 BASF SE、Stepan Company等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 個人護理和化妝品行業的全球需求不斷成長

- 增加在清潔劑和清潔劑製造的使用

- 市場限制因素

- 環境問題和法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格分析

第5章市場區隔(市場規模:數量)

- 按類型

- 陰離子界面活性劑

- 直鏈烷基苯磺酸鹽(LAS 或 LABS)

- 醇乙氧基硫酸鹽 (AES)

- α-烯烴磺酸鹽(AOS)

- 二次性磺酸鹽(SAS)

- 磺酸甲酯(MES)

- 磺基琥珀酸

- 其他陰離子界面活性劑

- 陽離子界面活性劑

- 季銨化合物

- 其他陽離子界面活性劑類型

- 非離子界面活性劑

- 醇乙氧基化物

- 乙氧基化烷基酚

- 脂肪酸酯

- 其他非離子表面活性劑

- 兩性界面活性劑

- 矽膠表面活性劑

- 陰離子界面活性劑

- 按用途

- 家用肥皂和清潔劑

- 個人護理

- 潤滑油/燃油添加劑

- 工業和設施清洗

- 食品加工

- 油田化學品

- 農業化學品

- 纖維加工

- 乳液聚合

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟和協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema

- Ashland

- BASF SE

- Bayer AG

- Cepsa

- Clariant

- Croda International PLC

- Dow Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Galaxy Surfactants

- Geo Speciality Chemicals

- Godrej Industries Limited

- Huntsman International LLC

- Innospec

- Kao Corporation

- KLK Oleo

- Lankem

- Lonza

- Nouryon

- Oxiteno

- P&G Chemicals

- Reliance Industries Ltd

- Sanyo Chemical Industries Ltd

- Sasol

- Sinopec(China Petrochemical Corporation)

- Solvay

- Stepan Company

- Sulfatrade SA

- Sumitomo Chemical Co. Ltd

- Taiwan NJC Corporation Ltd

- TENSAC

- YPF SA

第7章 市場機會及未來趨勢

- 擴大生物基界面活性劑的應用基礎

- 特種表面活性劑應用的創新可能性

簡介目錄

Product Code: 56859

The Surfactants Market size is estimated at 18.25 Million tons in 2024, and is expected to reach 21.52 Million tons by 2029, growing at a CAGR of greater than 3.30% during the forecast period (2024-2029).

Key Highlights

- Over the short term, the rising personal care and cosmetic industry and the growing usage in the manufacturing of detergents and cleaners are expected to drive the growth of the surfactant market.

- However, the increasing environmental awareness against the use of surfactants is expected to hinder the growth of the market.

- New inventions in the field of surfactants and the introduction of bio-based surfactants are likely to create more opportunities.

- Asia-Pacific is expected to dominate the market, and it is likely to witness the highest CAGR during the forecast period.

Surfactants Market Trends

Anionic Surfactants are Expected to Dominate the Market

- Anionic surfactants belong to the class of surface-active reagents, in which the head of the surfactant macromolecule remains negatively charged. This allows it to bind to impurities and particles suspended in the liquid.

- Anionic surfactants account for approximately half of the total share of the surfactants market. A growing focus on environmental regulations is expected to increase the demand for anionic surfactants.

- Anionic surfactants are widely used for industrial and household cleaning and for pesticide formulations. Of the anionic surfactants, biodegradable linear alkylbenzene sulfonates (LAS) are the most common and can be found in wastewater systems and river water.

- Anionic surfactants work best to remove dirt, clay, and some oily stains. They work through ionization. When added to water, the anionic surfactants ionize and take a negative charge. The negatively charged surfactants bind to positively charged particles like clay. Anionic surfactants are effective in removing particulate soils.

- Some of the most used anionic surfactants are sulfonic acid salts, alcohol sulfates, phosphoric acid esters, alkylbenzene sulfonates, and carboxylic acid salts.

- The increasing demand for anionic surfactants in cosmetic products, such as skincare and hair care products in personal care applications, owing to their superior characteristics, such as foaming, cleansing, thickening, solubilizing, emulsifying, antimicrobial effects, penetration enhancement, and other special effects, is expected to boost the demand.

- The current market demand for environment-friendly alternatives has led to a boost in demand for bio-based anionic surfactants.

Asia-Pacific is Expected to Dominate the Market

- In Asia-Pacific, China is likely to dominate the market studied. In China, cosmetics and personal care are among the fastest-growing sectors. Continuous growth in population is another factor fuelling the demand for personal care, soaps, and detergents in the country, which augments the surfactants market.

- The output from the Chinese chemical industry is essential in various products, including soaps, detergents, cosmetics, etc. There are more than 60 manufacturers of washing, care, and cleaning agents in the country. However, the market studied is dominated by global players like BASF SE and Evonik Industries AG. China is also one of the largest exporters of soaps and detergent products.

- Moreover, India is one of the largest producers of soaps in the world. The per capita consumption of toilet/bathing soaps in the country is around 800 grams. Around 65% of the Indian population resides in rural areas, and the increasing disposable incomes and growth in rural markets make consumers shift to premium products. This shift is expected to drive the Indian surfactants market.

- According to the India Brand Equity Foundation, the beauty, cosmetic, and grooming market is expected to reach USD 20 billion by 2025.

- According to the Ministry of Economy, Trade and Industry (METI), Japan, in 2022, the total production of cationic surfactants in the country stood at 46.09 thousand metric tons, registering an increase of more than 3% compared to the previous year.

- The South Korean paint and coating market is the fourth-largest Asia-Pacific region. KCC, Samhwa Paints, Kangnam Jevisco (formerly Kunsul Chemical Industrial Company, popularly called KCI), Noroo Paints, and Chokwang Paints are the major paint and coating producers. They dominate the South Korean paint and coating market.

- Overall, the market for surfactants in the region is expected to witness steady growth during the forecast period.

Surfactants Industry Overview

The surfactants market is highly fragmented, with the top five companies accounting for a minimal share of the market. Some major players in the market (in no particular order) include Nouryon, Evonik Industries AG, Kao Corporation, BASF SE, and Stepan Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand from the Personal Care and Cosmetics Industry Globally

- 4.1.2 Increasing Usage in Manufacturing of Detergents and cleaners

- 4.2 Market Restraints

- 4.2.1 Environmental Concerns and Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Anionic Surfactants

- 5.1.1.1 Linear Alkylbenzene Sulfonate (LAS or LABS)

- 5.1.1.2 Alcohol Ethoxy Sulfates (AES)

- 5.1.1.3 Alpha Olefin Sulfonates (AOS)

- 5.1.1.4 Secondary Alkane Sulfonate (SAS)

- 5.1.1.5 Methyl Ester Sulfonates (MES)

- 5.1.1.6 Sulfosuccinates

- 5.1.1.7 Other Types of Anionic Surfactants

- 5.1.2 Cationic Surfactants

- 5.1.2.1 Quaternary Ammonium Compounds

- 5.1.2.2 Other Types of Cationic Surfactants

- 5.1.3 Non-ionic Surfactants

- 5.1.3.1 Alcohol Ethoxylates

- 5.1.3.2 Ethoxylated Alkyl-phenols

- 5.1.3.3 Fatty Acid Esters

- 5.1.3.4 Other Non-ionic Surfactants

- 5.1.4 Amphoteric Surfactants

- 5.1.5 Silicone Surfactants

- 5.1.1 Anionic Surfactants

- 5.2 By Application

- 5.2.1 Household Soaps and Detergents

- 5.2.2 Personal Care

- 5.2.3 Lubricants and Fuel Additives

- 5.2.4 Industry and Institutional Cleaning

- 5.2.5 Food Processing

- 5.2.6 Oilfield Chemicals

- 5.2.7 Agricultural Chemicals

- 5.2.8 Textile Processing

- 5.2.9 Emulsion Polymerization

- 5.2.10 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 BASF SE

- 6.4.5 Bayer AG

- 6.4.6 Cepsa

- 6.4.7 Clariant

- 6.4.8 Croda International PLC

- 6.4.9 Dow Inc.

- 6.4.10 Emery Oleochemicals

- 6.4.11 Evonik Industries AG

- 6.4.12 Galaxy Surfactants

- 6.4.13 Geo Speciality Chemicals

- 6.4.14 Godrej Industries Limited

- 6.4.15 Huntsman International LLC

- 6.4.16 Innospec

- 6.4.17 Kao Corporation

- 6.4.18 KLK Oleo

- 6.4.19 Lankem

- 6.4.20 Lonza

- 6.4.21 Nouryon

- 6.4.22 Oxiteno

- 6.4.23 P&G Chemicals

- 6.4.24 Reliance Industries Ltd

- 6.4.25 Sanyo Chemical Industries Ltd

- 6.4.26 Sasol

- 6.4.27 Sinopec (China Petrochemical Corporation)

- 6.4.28 Solvay

- 6.4.29 Stepan Company

- 6.4.30 Sulfatrade SA

- 6.4.31 Sumitomo Chemical Co. Ltd

- 6.4.32 Taiwan NJC Corporation Ltd

- 6.4.33 TENSAC

- 6.4.34 YPF SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Application Base For Bio-based Surfactants

- 7.2 Possible Innovations in the Application of Specialty Surfactants

02-2729-4219

+886-2-2729-4219