|

市場調查報告書

商品編碼

1687833

印刷基板(PCB) 產業:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Printed Circuit Board (PCB) Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

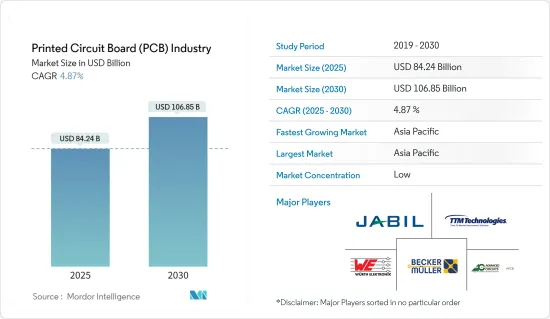

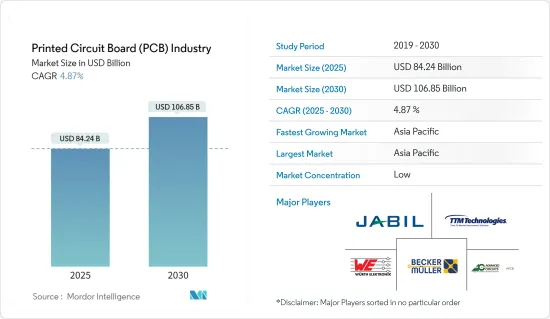

印刷基板(PCB) 市場規模預計在 2024 年將達到 803.3 億美元,預計到 2029 年將達到 965.7 億美元,在預測期內(2024-2029 年)的複合年成長率為 4.87%。

主要亮點

- 由於廉價智慧型手機產量的增加,預計行動電話PCB產量將會增加。據日本電產株式會社稱,儘管智慧型手機銷量正在下滑,但全球每年的出貨量仍有13億部。這些趨勢為 PCB 帶來了巨大的機遇,因為它們是連接和支援各種電子元件(如微處理器、記憶體晶片、感測器和其他積體電路)的關鍵行動電話元件。

- 雖然消費性 PCB 並不是新鮮事物,但 PCB 在電子產品中的應用及其製造所使用的材料已經發展了一段時間。鑑於小型化的趨勢,這是尤其不可避免的。此外,現代電子設備和電腦應用需要具有高導熱性的 PCB 來散發產生的熱量。由於使用的電器產品種類繁多,因此對各種 PCB 的需求也很大。例如,智慧型手錶所需的 PCB 與電腦不同。

- PCB 體積小、重量輕,非常適合可攜式電子設備。 PCB 組裝產業的成長和效率源自於消費性電子設備高度依賴精心設計和組裝的印刷電路基板。高效能基板的有效整合可以最佳化各種家用電子電器,使其無縫執行您的日常業務。由於 PCB 設計緊湊且能夠容納複雜電路,因此對於智慧型手機、電視、筆記型電腦和遊戲機等各種消費性電子產品至關重要。

- 推動 PCB 市場成長的一個主要趨勢是 5G 等先進技術的日益普及,這在很大程度上得到了各政府機構和私人組織不斷增加的投資的支持。

- 例如,2024年3月,愛立信宣布將建立一個新的專門的營業單位,以推動美國聯邦政府由5G主導的數位轉型。這項聲明是在 5G通訊日益重要的情況下發布的,因為它對美國國家和經濟通訊至關重要,也是美國國防現代化計畫的關鍵組成部分。

- 人們對印刷電路基板(PCB)等電子廢棄物的擔憂日益增加,這是一個必須解決的重大環境問題。 PCB 含有多種有害物質,包括鉛、汞、鎘和溴化阻燃劑。如果處理不當,這些物質會滲入土壤和水中,對人類健康和環境構成威脅。

- 不當處置 PCB,例如掩埋或焚燒,可能會造成嚴重的環境後果。當 PCB 被丟棄在垃圾掩埋場時,有害物質會滲入土壤並污染地下水。當 PCB 被焚燒時,有毒氣體和微粒會被釋放到大氣中,造成空氣污染。

- 此外,台灣在半導體產業的重要性日益提升,以及半導體製造設備多樣化的重要性日益提高等因素,可能會影響未來 PCB 的供需結構。

印刷基板(PCB)市場趨勢

消費性電子領域將成為最大的終端使用者產業

- 隨著消費性電子產業對 PCB 的需求不斷成長,政府已採取舉措傳播有關 PCB 製造的意識並為學生提供必要的培訓。

- 例如,2024 年 2 月,麻薩諸塞大學洛威爾分校宣布成立麻省電子製造業進化研究所 (MEME),以協助培訓 PCB 設計和製造的學生和產業工作者。該計劃將獲得馬薩諸塞州技能資本津貼金 50 萬美元,用於購買設備。麻薩諸塞州勞動力技能內閣提供由州政府透過資本預算資助的津貼計畫。

- PCB原型製作設施是現代技術的重要組成部分,使美國、印度和中國等國家的企業家能夠創造出可在全球銷售的尖端產品。

- 2023 年 3 月,印度最大的原型設計中心 T-Works 與高通合作建立了最先進的多層印刷基板(PCB) 製造廠。新工廠預計將支援多種產品的開發,包括醫療設備、電動車、家用電器和工業自動化產品。

- 在家電產業,企業正在開發穿戴式物聯網設備,以減少用戶對智慧型手機的依賴。這些設備包括智慧型手錶和恆溫器等簡單、實惠的小工具,以及先進的智慧家庭自動化應用程式、智慧服飾、手錶、可聽設備和眼鏡。這些設備正在改變人們工作、溝通和完成日常業務的方式。消費級物聯網設備的使用和普及度已顯著成長,隨著人們對更實惠、更快、更強大、更安全的物聯網設備的需求,這一趨勢預計還將持續。愛立信預計,2027年智慧家電等近距離物聯網設備數量將達到251.5億台,可望推動市場成長。

- 此外,物聯網的普及和對連網型設備的需求不斷成長預計將推動市場的發展。 IoT Analytics 的最新報告《2023 年春季物聯網狀況》宣布,2022 年全球物聯網連線數量將成長 18%,達到 143 億個活躍物聯網端點。

- 到 2023 年,全球連網物聯網設備數量將成長 16%,達到 167 億活躍終端。儘管2023年的成長率將略低於2022年,但預計物聯網設備連接仍將持續成長多年。此外,亞太地區中國、泰國和越南居民的連網型設備擁有率已經很高。

預計亞太地區將出現顯著成長

- 隨著中國電子產業的快速發展,多家中國PCB廠商已成為全球PCB市場的主導企業,並正在搶佔亞太地區的市場佔有率。這些製造商提供廣泛的服務和能力,包括 PCB 設計、製造和組裝,具有競爭力的價格和快速的交貨時間。這些製造商包括 JLCPCB、Graperain、Fulltronics、YMS PCB Assembly 和 Hitech Circuits。

- 目前中國當地約有2500家PCB製造商。中國PCB產業主要分佈在珠三角、Delta、環渤海Delta,這些地區元件市場集中,交通運輸條件、水力發電條件良好。

- 推動中國PCB市場成長的關鍵因素是整體成本的下降和營運效率的提高。第一,雖然中國人口紅利即將結束,但人事費用仍低於日本、韓國、台灣地區,甚至低於歐美。第二,中國的環保、工會、福利等領域的成本相對較低。

- 而且,作為全球最大的製造業大國,我國PCB產業擁有從銅箔、玻璃纖維、樹脂、覆銅板到PCB的完整產業鏈。 PCB接近最終產品,許多電子產品也在中國完成。

- 受惠於全球PCB產能轉移到中國以及下游電子終端產品的蓬勃發展,中國PCB產業呈現快速發展態勢。電子資訊產業是我國重大發展的戰略性、基礎性、先導性支柱產業。 PCB產業作為電子資訊產業發展的基石,已成為國家鼓勵發展的計劃之一。

- 此外,根據可靠產業機構的經驗資料顯示,台灣在全球PCB產值中持續佔據主導地位,佔有較大的市場佔有率。值得注意的是,韓國PCB製造商已經超越日本PCB製造商,在區域範圍內佔據第三的位置。

印刷基板(PCB) 產業概況

印刷基板(PCB)市場高度分散,既有全球性參與者,也有中小型企業。市場的主要參與者包括 Jabil Inc.、Wurth Elektronik Group(Wurth Group)、TTM Technologies Inc.、Becker &Muller Schaltungsdruck Gmbh 和 Advanced Circuits Inc. 市場參與者正在採用夥伴關係和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2024 年 4 月 - TTM Technologies Sdn Bhd 是一家射頻 (RF) 組件和先進印刷電路基板等技術解決方案的全球製造商,該公司在馬來西亞檳城開設了第一家製造工廠,投資額為 2 億美元。據該公司介紹,新工廠將建在檳城科學園區內,並將擁有高度先進和自動化的 PCB 製造能力。

2023 年 11 月 - Jabil Inc. 在墨西哥奇瓦瓦州開設第三家生產工廠,標誌著其持續發展和對該地區承諾的一個里程碑。該工廠面積超過25萬平方英尺。此次擴張對於支援能源、汽車和交通、醫療保健、數位印刷和零售業的客戶至關重要。新工廠將提高業務效率和靈活性,增強我們提供高品質產品的能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 的副作用和其他宏觀經濟因素將如何影響市場

第5章 市場動態

- 市場促進因素

- 對技術小型化的需求日益增加

- 終端用戶產業需求不斷成長

- 市場限制

- 對電子廢棄物的擔憂日益加劇

第6章 市場細分

- 依產品類型

- 標準多層 PCB

- 剛性 1-2 面 PCB

- HDI/微孔/積層

- 軟性 PCB

- 軟硬複合板

- 其他

- 按最終用戶產業

- 工業電子

- 衛生保健

- 航太和國防

- 車

- 消費性電子產品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Jabil Inc.

- Wurth elektronik group(Wurth group)

- TTM Technologies Inc.

- Becker & Muller Schaltungsdruck Gmbh

- Advanced Circuits Inc.

- Sumitomo Electric Industries Ltd(Sumitomo Corporation)

- Murrietta Circuits

- Unimicron Technology Corporation

- Tripod Technology Corporation

- AT&S Austria Technologie & Systemtechnik AG

- Nippon Mektron Ltd(nok Group)

- Zhen Ding Technology Holding Limited

第 8 章供應商市場佔有率

第9章投資分析

第10章:未來市場展望

The PCB Market size is estimated at USD 80.33 billion in 2024, and is expected to reach USD 96.57 billion by 2029, growing at a CAGR of 4.87% during the forecast period (2024-2029).

Key Highlights

- Increased production of budget smartphones means that phone PCB production is expected to increase. According to Nidec, despite the downfall, 1.3 billion smartphones are shipped annually worldwide. These trends largely represent real opportunities for the PCB, as it is a vital mobile phone component that connects and supports various electronic components such as microprocessors, memory chips, sensors, and other integrated circuits.

- While consumer PCBs are certainly nothing new, the applications for PCBs for electronics and the materials used to make them have evolved over some time. This is inevitable, especially on account of the growing trend of miniaturization. Moreover, modern electronics and computer applications require PCBs with high thermal conductivity so that the heat generated can be dissipated. Different PCBs are needed for the many kinds of appliances in use. For example, the PCB needed to power a smartwatch is different from the PCB required for a computer.

- PCBs are highly suitable for portable consumer electronics due to their small size and lightweight characteristics. The growth and efficiency of the PCB assembly industry can be attributed to the significant reliance of consumer electronic products on well-designed and assembled printed circuit boards. By incorporating high-performance PCBs effectively, various consumer electronic devices can be optimized to carry out everyday tasks seamlessly. The indispensability of PCBs extends to a wide range of consumer electronics, such as smartphones, televisions, laptops, and gaming consoles, owing to their compact design and capability to accommodate intricate circuitry.

- One major trend driving the growth of the PCB market is the increasing adoption of advanced technologies such as 5G, which is significantly favored by growing investment from various government and private organizations.

- For instance, in March 2024, Ericsson announced the establishment of a dedicated entity for delivering a new dedicated entity to deliver 5G-driven digital transformation across the federal United States Government. This announcement was made taking the rising importance of 5G communication into consideration, as it is vital for US national and economic security and a key component of US defense modernization programs.

- The growing concerns regarding electronic waste, like printed circuit boards (PCBs), are a significant environmental issue that needs to be addressed. PCBs contain various hazardous materials, including lead, mercury, cadmium, and brominated flame retardants. When improperly disposed of, these substances can leach into the soil and water, posing a threat to human health and the environment.

- Improper disposal of PCBs, such as landfilling or incineration, can have serious environmental consequences. When PCBs end up in landfills, hazardous materials can seep into the soil and contaminate groundwater. Incineration of PCBs can release toxic gases and particles into the air, contributing to air pollution.

- Furthermore, factors such as the growing importance of Taiwan in the semiconductor industry and the increasing importance of diversifying semiconductor manufacturing facilities are likely to shape the supply and demand structure of PCBs in the future.

PCB Market Trends

Consumer Electronics Segment to be the Largest End-user Industry

- Owing to the growing demand for PCBs in the consumer electronics industry, the government is taking initiatives to spread awareness and provide essential training to students for PCB manufacturing.

- For instance, in February 2024, UMass Lowell announced the establishment of the Massachusetts Electronics Manufacturing Evolution (MEME) laboratory to help train students and industry workers in designing and fabricating PCBs. The project is supported with a USD 500,000 Massachusetts Skills Capital Grant for purchasing equipment for the facility. The Massachusetts Workforce Skills Cabinet offers the grant program, which is funded by the state through its capital budget.

- The PCB prototyping facility is a crucial component of modern technology, enabling entrepreneurs from countries such as the United States of America, India, and China to create cutting-edge products that can be launched globally.

- In March 2023, T-Works, India's largest prototype center, partnered with Qualcomm to establish a state-of-the-art multilayer Printed Circuit Board (PCB) fabrication facility. This new facility is anticipated to support the development of a wide range of products, including medical devices, electric vehicles, consumer electronics, industrial automation products, and more.

- Companies are developing wearable IoT devices in the consumer electronics industry to reduce users' reliance on smartphones. These devices can vary from primary and affordable gadgets like smartwatches and thermostats to advanced smart home automation applications, smart clothing, watches, hearables, and glasses. The way users work, communicate, and perform their daily tasks is being transformed by these devices. The usage and popularity of consumer IoT devices have grown significantly, and this trend is expected to continue as long as people demand IoT devices that are more affordable, faster, capable, powerful, and safer. According to Ericsson, short-range IoT devices like smart home appliances are expected to reach 25,150 million by 2027, which is expected to drive the market's growth.

- Furthermore, the rising IoT deployments and increasing demand for connected devices are expected to drive the market. The latest IoT Analytics "State of IoT-Spring 2023" report presents that the number of global IoT connections grew by 18% in 2022 to 14.3 billion active IoT endpoints.

- In 2023, the global number of connected IoT devices grew by 16% to 16.7 billion active endpoints. While 2023 growth was slightly lower than in 2022, IoT device connections are expected to continue to grow for many years. In addition, ownership of connected devices in the Asia-Pacific region is already high among those living in China, Thailand, and Vietnam.

Asia Pacific Region is Expected to Witness Significant Growth

- With the rapid development of China's electronics industry, many Chinese PCB manufacturers have emerged as leading players in the global PCB market, capturing a market share in the Asia-Pacific region. These manufacturers offer a wide range of services and capabilities, including PCB design, fabrication, and assembly, with competitive pricing and fast turnaround times. They include JLCPCB, Graperain, Fulltronics, YMS PCB Assembly, and Hitech Circuits.

- At present, there are about 2,500 PCB manufacturers in mainland China. The PCB industry in China is mainly distributed in the Pearl River Delta, the Yangtze River Delta, and the Bohai Rim, where they centralize the large component markets, good transportation conditions, and water and electricity conditions.

- Major reasons driving the growth of the PCB market in the Chinese region include lower overall cost and higher management efficiency. First, although China's demographic dividend is ending, labor costs are still lower than those of Japan, South Korea, and Taiwan and even lower than those of Europe and the United States. Second, China's environmental protection, trade unions, and welfare sectors are relatively low-cost.

- In addition, as the world's largest manufacturing country, China's PCB industry has a complete industrial chain from copper foil, glass fiber, resin, copper-clad laminates, and PCBs. PCB is close to the final products, and a great number of electronics are also finished in China.

- Benefiting from the transfer of global PCB production capacity to China and the vigorous development of downstream electronic terminal products, China's PCB industry shows a rapid development trend. The electronic information industry is a strategic, essential, and leading pillar industry for China's key development. The PCB industry, as the cornerstone of the development of the electronic information industry, has become one of the projects encouraged by China.

- Furthermore, empirical data from reputable industry associations underscores Taiwan's continued dominance in global PCB production values, with a major market share. Notably, South Korean PCB manufacturers have surpassed their Japanese counterparts, securing the third position on a regional scale.

PCB Industry Overview

The PCB market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Jabil Inc., Wurth Elektronik Group (Wurth group), TTM Technologies Inc., Becker & Muller Schaltungsdruck Gmbh, and Advanced Circuits Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

April 2024 - TTM Technologies Inc., a global manufacturer of technology solutions such as radio frequency ("RF") components and advanced printed circuit boards, opened its first manufacturing plant in Penang, Malaysia, with an investment of USD 200 million. According to the company, the new facility is built in Penang Science Park and has highly advanced and automated PCB manufacturing capabilities.

November 2023 - Jabil Inc. opened its third production facility in Chihuahua, Mexico, marking a milestone in its continued growth and commitment to the region. The plant spans more than 250,000 square feet. This expansion will be critical in supporting customers across the energy, automotive and transportation, healthcare, digital print, and retail industries. This new facility will enhance operational efficiency, flexibility, and the ability to deliver high-quality products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Miniaturization of Technology

- 5.1.2 Increasing Demand from End-user Industries

- 5.2 Market Restraints

- 5.2.1 Growing Concern Regarding Electronic Waste

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Standard Multilayer PCBs

- 6.1.2 Rigid 1-2 Sided PCBs

- 6.1.3 HDI/Micro-via/Build-up

- 6.1.4 Flexible PCBs

- 6.1.5 Rigid-flex PCBs

- 6.1.6 Others

- 6.2 By End-user Industry

- 6.2.1 Industrial Electronics

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Automotive

- 6.2.5 Consumer Electronics

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jabil Inc.

- 7.1.2 Wurth elektronik group (Wurth group)

- 7.1.3 TTM Technologies Inc.

- 7.1.4 Becker & Muller Schaltungsdruck Gmbh

- 7.1.5 Advanced Circuits Inc.

- 7.1.6 Sumitomo Electric Industries Ltd (Sumitomo Corporation)

- 7.1.7 Murrietta Circuits

- 7.1.8 Unimicron Technology Corporation

- 7.1.9 Tripod Technology Corporation

- 7.1.10 AT&S Austria Technologie & Systemtechnik AG

- 7.1.11 Nippon Mektron Ltd (nok Group)

- 7.1.12 Zhen Ding Technology Holding Limited