|

市場調查報告書

商品編碼

1537677

汽車資料收益:市場佔有率分析、產業趨勢與成長預測(2024-2029)Automotive Data Monetization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

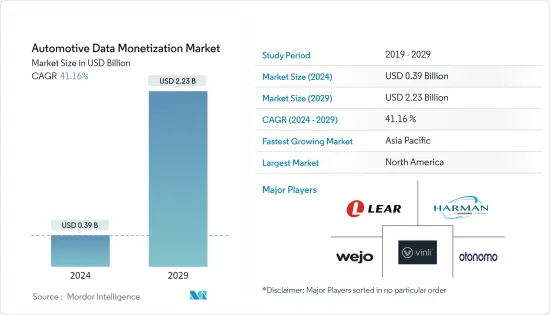

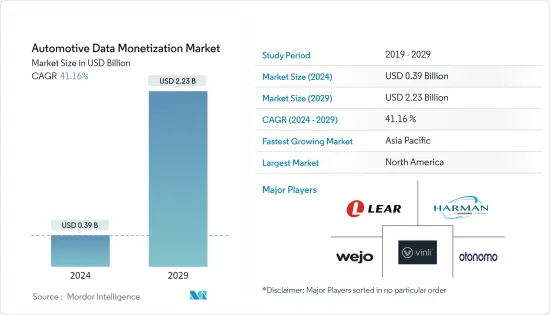

預計到 2024 年,汽車資料收益市場規模將達到 3.9 億美元,預計到 2029 年將達到 22.3 億美元,在預測期內(2024-2029 年)複合年成長率為 41.16%。

人工智慧、機器學習和資料分析技術的進步使汽車公司能夠從大型資料集獲得有價值的見解。這些見解可以在資料驅動產品和服務的開發、最佳化業務營運、識別新的收益來源等過程中收益。

主要亮點

- 汽車資料收益市場是由汽車應用中巨量資料和高級分析的日益利用所推動的。這一趨勢旨在引入新穎的功能和服務、降低營運成本並提高駕駛員和乘客的安全。隨著車輛的互聯程度越來越高,加上道路基礎設施的進步和感測器部署的激增,產生的資料量呈爆炸性成長。

- 聯網汽車數量的增加、消費者接受度和啟動率以及確保車輛資料穩定收益流的數位創新需求等因素正在推動汽車資料收益市場的成長。為了保持競爭力,汽車製造商正在專注於實施新的收益系統並提高其軟體部署能力。聯網汽車的整合及其資料收益在交通和汽車領域變得越來越流行。

- 隨著連網型車輛產生大量資料,從遠端資訊處理到駕駛員行為,資料管理和收益已成為主要挑戰。區塊鏈技術是一種強大的解決方案,可提供安全的車輛資料收益。大眾汽車、Bosch(與 IOTA)和保時捷(與 XAIN)等公司已經在探索區塊鏈應用程式,以開闢資料收益的新途徑。

- 聯網汽車和自動駕駛汽車的進步正在重塑汽車產業,引發了網路安全、與資料收益相關的法律影響、產品品質等方面的擔憂。這些擔憂具有巨大的影響,直接影響消費者的信任、安全和監管基準的遵守。

- COVID-19 大流行導致全球供應鏈中斷,導致汽車零件短缺以及隨後的生產延誤。這些中斷也影響了資料收集和收益所必需的連網型車輛技術和物聯網設備的可用性。因此,汽車原始設備製造商 (OEM) 和供應商在啟動資料主導和推出新的連網型汽車服務方面面臨挑戰。

汽車資料收益市場趨勢

數位轉型領域的進步正在推動市場

- 隨著先進技術和聯網汽車的興起,車輛資料正在迅速增加。認知到這一潛力,產業參與者正在積極開發車輛資料收益的機制和基礎設施。目的是增強他們的服務並在市場上獲得競爭優勢。

- 根據國際能源總署 (IEA) 的數據,電動車市場正在經歷顯著成長,預計到 2022 年將銷售超過 1,000 萬輛。值得注意的是,近年來電動車佔總銷售量的比例大幅上升,從2020年的4%上升到2022年的14%。這一趨勢將持續到2023年,光是第一季電動車銷量就超過230萬輛,比去年成長25%。預計2023年終銷量將達到1,400萬台,與前一年同期比較35%。總體而言,電動車預計將佔年度汽車銷量的 18%,進一步推動市場擴張。

- 公司採用資料收益有多種原因,包括提高合規性、提高盈利以及能夠提供更有價值的產品和服務。 Salesforce 就是這項措施的典範,該公司於 2023 年 11 月宣布了汽車雲端創新。這些創新旨在為汽車公司提供資料和人工智慧功能,以提供個人化的車內體驗、簡化車隊管理並簡化借貸流程。 Salesforce 的汽車雲端整合了從遠端資訊處理到客戶記錄的各種資料來源,為駕駛者提供即時見解和個人化體驗。 Salesforce 專注於即時資料、人工智慧和自動化,正在為軟體定義汽車成為常態的未來鋪平道路。

- 同樣,由人工智慧主導的汽車資料平台 CerebrumX Labs Inc. 於 2023 年 11 月與 Guidepoint Systems 合作。 Guidepoint Systems 是汽車產業遠端資訊處理和 SaaS 解決方案的領導者,它與 CerebrumX 合作,以滿足車隊管理和經銷商業務中對資料解決方案不斷成長的需求。此次合作旨在最佳化業務、改善客戶體驗並最終提高這些業務的盈利。

- 總體而言,汽車產業的數位轉型正在徹底改變資料收益。物聯網連接、人工智慧分析和雲端運算的進步使汽車製造商能夠從車輛資料中提取有價值的見解。這透過預測性維護、個人化保險和目標廣告等服務開拓了新的收益來源。

亞太地區預計將出現顯著成長

- 隨著聯網汽車和先進資料分析的普及,亞太地區已成為全球汽車資料收益市場的主要企業。強勁的汽車產業和快速擴張的數位基礎設施為資料收益舉措提供了肥沃的土壤。

- 亞太地區是資料收益中心,是新興企業以及騰訊、豐田、現代和本田等主要企業的所在地。這些公司正在大力投資資料主導的解決方案,以改善消費者體驗、簡化業務並實現收益來源多元化。

- 2023 年 9 月,沃爾沃汽車宣佈在新加坡開設技術中心,新加坡是世界領先的技術和先進製造中心之一。此舉符合沃爾沃汽車引領新技術並在 2030 年生產純電動車的雄心壯志。該技術中心對於資料分析、軟體和先進製造至關重要,凸顯了沃爾沃汽車對這些領域的戰略重點。

- 全球聯網汽車市場由日本、中國和韓國等亞太地區國家主導。例如,豐田發布了行動服務平台(MSPF)。它整合了車輛資料和移動服務,以實現有針對性的廣告、預測性維護和增強的導航。

汽車資料收益產業概述

隨著現有國家參與各種研發活動和舉措以創建和部署新的、更有效率的技術和解決方案,汽車資料收益市場變得支離破碎。參與者包括 Xevo Inc.(李爾公司)、Otonomo Technologies Ltd、Wejo Group Limited、Vinli Inc. 和 Harman International(三星電子)。

- 2024 年 2 月,哈曼發布了 HARMAN Ready Connect 5G 遠端資訊處理控制單元 (TCU)。它採用高通技術公司的尖端Snapdragon數位底盤聯網汽車技術,旨在突破連接的界限並使整個汽車連接領域民主化。 HARMAN Ready Connect 5G TCU 基於 Snapdragon Auto 5G Modem-RF Gen 2,是車載連接方面的重大進步,可為消費者提供更豐富的車內體驗,同時縮短上市時間並最大限度地減少OEM工程。

- 2023 年 8 月,Tech Mahindra 將與用於自動駕駛應用的高光譜遙測合成資料生成平台 Anyverse 合作,透過簡化合成資料來加速人工智慧在汽車行業的採用。 Tech Mahindra 將利用該平台提供合成資料集,用於為汽車行業的客戶培訓和檢驗人工智慧系統。此次合作將重點放在車載系統、ADAS(高級駕駛輔助系統)和自動駕駛汽車應用,將人工智慧的採用和軟體檢驗時間縮短 30-40%。 Anyverse 的合成資料平台將使 Tech Mahindra 能夠借助準確的感測器模擬產生合成資料。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- V2X 和其他車輛連接的成長為資料收益提供了合適的平台。

- 汽車產業正在逐漸升溫,在客戶經驗和支援方面使用資料進行決策。

- 數位轉型領域發展良好

- 市場挑戰

- 網路安全、與私人資料收益相關的法律問題以及品質問題

- 汽車資料收益市場的主要使用案例(僅限代表性用例)

- 預測性維護

- 基於使用的保險

- 針對性的廣告宣傳

- 客戶體驗建模

第6章 市場細分

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Xevo Inc.(Lear Corporation)

- Otonomo Technologies Ltd

- Wejo Group Limited

- Vinli Inc.

- Harman International(Samsung Electronics Co. Ltd)

- Tech Mahindra Limited

- Caruso GmbH

- SMARTO

- Continental AG

- Infosys Limited

第8章投資分析

第9章市場的未來

The Automotive Data Monetization Market size is estimated at USD 0.39 billion in 2024, and is expected to reach USD 2.23 billion by 2029, growing at a CAGR of 41.16% during the forecast period (2024-2029).

Advancements in artificial intelligence, machine learning, and data analytics technologies allow automotive companies to derive valuable insights from large datasets. These insights can be monetized through the overall development of data-driven products and services, optimization of business operations, and identification of new revenue streams.

Key Highlights

- The automotive data monetization market is being propelled by the increasing utilization of big data and advanced analytics in automotive applications. This trend aims to introduce novel features and services, lower operational costs, and enhance safety for both drivers and passengers. With vehicles becoming more interconnected, coupled with advancements in road infrastructure and a surge in sensor deployment, the volume of generated data is skyrocketing.

- Factors such as the rising number of connected vehicles, the acceptance and activation rates among consumers, and the need for digital innovation to ensure a steady revenue stream from automotive data are all driving the growth of the automotive data monetization market. To stay competitive, automotive manufacturers are focusing on implementing new monetization systems and improving software deployment capabilities. The integration of connected vehicles and the monetization of their data are becoming increasingly prevalent in the transportation and automotive sectors.

- With connected vehicles generating a deluge of data, ranging from telematics to driver behavior insights, data management and monetization pose significant challenges. Blockchain technology is a robust solution, offering secure automotive data monetization. Companies like Volkswagen and Bosch (in collaboration with IOTA) and Porsche (with XAIN) are already exploring blockchain applications to unlock new avenues for data monetization.

- The advancement of connected and autonomous vehicles is reshaping the automotive industry, bringing forth concerns encompassing cybersecurity, legal ramifications tied to data monetization, and product quality. These concerns hold immense significance, directly impacting consumer trust, safety, and adherence to regulatory benchmarks.

- Disruptions in the global supply chain due to the COVID-19 pandemic led to shortages in automotive components and subsequent production delays. These disruptions, in turn, affected the availability of connected vehicle technologies and IoT devices, crucial for data collection and monetization. Consequently, automotive original equipment manufacturers (OEMs) and suppliers encountered challenges in launching data-driven initiatives and rolling out new connected vehicle services.

Automotive Data Monetization Market Trends

Favorable Advancements in the Field of Digital Transformation to Drive the Market

- The rise of advanced technologies and connected vehicles has led to a surge in vehicle data. Recognizing its potential, industry players are actively developing mechanisms and infrastructure for automotive data monetization. Their goal is to enhance their offerings and acquire a competitive advantage in the market.

- According to the International Energy Agency, the electric car market witnessed remarkable growth, with sales surpassing 10 million in 2022. Notably, the share of electric cars in total sales grew significantly in recent years, from 4% in 2020 to 14% in 2022. This trend continued in 2023 as over 2.3 million electric cars were sold in the first quarter alone, marking a 25% increase from last year. Forecasts suggested that sales would reach 14 million by the end of 2023, indicating a 35% year-on-year growth. Overall, electric cars were projected to make up 18% of total car sales for the year, further fueling the market's expansion.

- Companies are embracing data monetization for several reasons, including heightened compliance, increased profitability, and the ability to offer more valuable products and services. This move is exemplified by Salesforce, which, in November 2023, unveiled its Automotive Cloud innovations. These innovations aim to empower automotive companies with data and AI capabilities, enabling them to deliver personalized in-car experiences, streamline fleet management, and simplify lending and leasing processes. Salesforce's Automotive Cloud integrates various data sources, from telematics to customer records, to offer drivers real-time insights and personalized experiences. With a focus on real-time data, AI, and automation, Salesforce is paving the way for a future where software-defined vehicles become the norm.

- In a similar vein, CerebrumX Labs Inc., an AI-driven automotive data platform, joined forces with Guidepoint Systems in November 2023. Guidepoint Systems, a leader in telematics and SaaS solutions for the automotive industry, collaborated with CerebrumX to cater to the growing demand for data solutions in fleet management and dealership operations. This collaboration aims to optimize operations, enhance customer experiences, and ultimately boost profitability for these businesses.

- Overall, the automotive sector's digital transformation is revolutionizing data monetization. Advancements in IoT connectivity, AI analytics, and cloud computing are enabling automakers to extract valuable insights from vehicle data. This, in turn, opens up new revenue streams through services like predictive maintenance, personalized insurance, and targeted advertising.

Asia-Pacific Expected to Register Major Growth

- With the surge in connected cars and advanced data analytics, the Asia-Pacific region has emerged as a key player in the global automotive data monetization market. Its robust automotive sector and rapidly expanding digital infrastructure make it a fertile ground for data monetization initiatives.

- Asia-Pacific is a hub for data monetization, housing both startups and major players like Tencent, Toyota, Hyundai, and Honda. These companies are investing heavily in data-driven solutions to enhance consumer experiences, streamline operations, and diversify revenue streams.

- In September 2023, Volvo Cars unveiled a tech hub in Singapore, a prominent global technology and advanced manufacturing center. This move aligns with Volvo Cars' ambition to lead in new technologies and produce solely electric vehicles by 2030. The tech hub, pivotal for data analytics, software, and advanced manufacturing, underscores Volvo Cars' strategic focus on these sectors.

- Leading the global connected car market are countries like Japan, China, and South Korea in the Asia-Pacific region. Toyota, for instance, has introduced the mobility services platform (MSPF), which integrates car data with mobility services, enabling targeted advertising, predictive maintenance, and enhanced navigation.

Automotive Data Monetization Industry Overview

The automotive data monetization market is fragmented as the established countries are involved in various research and development activities and initiatives to create and deploy new and more efficient technologies and solutions. Some of the players are Xevo Inc. (Lear Corporation), Otonomo Technologies Ltd, Wejo Group Limited, Vinli Inc., and Harman International (Samsung Electronics Co. Ltd).

- In February 2024, HARMAN launched the HARMAN Ready Connect 5G Telematics Control Unit (TCU), using the state-of-the-art Snapdragon Digital Chassis connected car technologies from Qualcomm Technologies Inc. with the aim to push connectivity boundaries and democratize the overall automotive connectivity landscape. Based on the Snapdragon Auto 5G Modem-RF Gen 2, HARMAN Ready Connect 5G TCU represents a significant advancement in automotive connectivity, providing rich in-cabin experiences for consumers while minimizing time to market and engineering efforts for OEMs.

- In August 2023, Tech Mahindra partnered with Anyverse, a hyperspectral synthetic data generation platform for autonomous applications, to accelerate the adoption of AI in the automotive industry by synthetic data simplification. Tech Mahindra will likely use the platform to provide synthetic data sets to train and validate its automotive client's AI systems. The partnership will focus on in-cabin systems, advanced driver assistance systems (ADAS), and autonomous vehicle applications, accelerating AI adoption and software validation timelines by 30-40%. Anyverse's synthetic data platform will enable Tech Mahindra to generate synthetic data with the help of accurate sensor simulation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in V2X and Other Forms of Vehicular Connectivity Provides a Good Platform for the Monetization of Data

- 5.1.2 The Automotive Industry is Gradually Warming up to the Use of Data for Decision-making in Terms of Customer Experience and Support

- 5.1.3 Favorable Advancements in the Field of Digital Transformation

- 5.2 Market Challenges

- 5.2.1 Concerns Related to Cybersecurity, Legal Issues Related to the Monetization of Private Data, and Quality

- 5.3 Coverage of the Major Use-cases for the Automotive Data Monetization Market (Representative List Only)

- 5.3.1 Predictive Maintenance

- 5.3.2 Usage-based Insurance

- 5.3.3 Targeted Advertising Campaigns

- 5.3.4 Customer Experience Modeling

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 North America

- 6.1.2 Europe

- 6.1.3 Asia-Pacific

- 6.1.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Xevo Inc. (Lear Corporation)

- 7.1.2 Otonomo Technologies Ltd

- 7.1.3 Wejo Group Limited

- 7.1.4 Vinli Inc.

- 7.1.5 Harman International (Samsung Electronics Co. Ltd)

- 7.1.6 Tech Mahindra Limited

- 7.1.7 Caruso GmbH

- 7.1.8 SMARTO

- 7.1.9 Continental AG

- 7.1.10 Infosys Limited