|

市場調查報告書

商品編碼

1686284

GaN 半導體元件:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)GaN Semiconductor Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

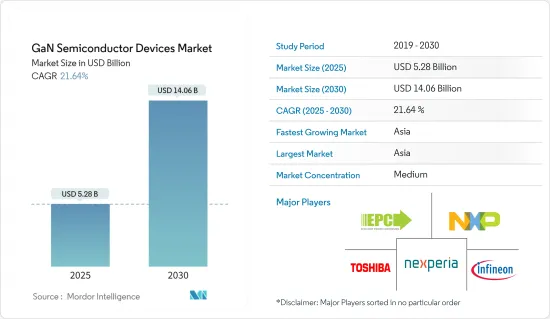

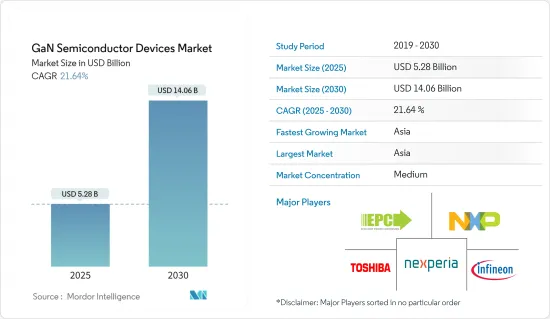

GaN半導體裝置市場規模預計在2025年為52.8億美元,預計到2030年將達到140.6億美元,預測期內(2025-2030年)的複合年成長率為21.64%。

主要亮點

- 對太陽能和風能等可再生能源的需求不斷成長,推動了 GaN 半導體元件在電力轉換系統中的使用。 GaN的高功率密度、更快的開關速度和改進的熱性能可以實現更有效率的能源轉換,減少能源浪費並提高整體系統效率。

- 太陽能是綠色能源中成長最快的領域之一。太陽能板由多個分離式半導體組成,透過光伏效應將陽光轉化為電能。由於政府激勵措施、成本下降和其他因素,太陽能需求不斷上升,導致太陽能板的生產和安裝激增。這導致對使這些面板高效運作所需的離散半導體的需求增加。

- GaN 能夠在高頻下工作、承受惡劣的環境條件並提供高功率,使其非常適合雷達系統、電子戰和通訊系統等應用。 GaN 裝置透過提高性能、可靠性和減小系統尺寸,促進了航太和國防技術的進步。

- 然而,氮化鎵半導體裝置的高成本是研究市場成長的主要限制因素。這些設備的製造過程需要複雜的製造技術和專門的設備,這增加了整體成本。這使得氮化鎵半導體裝置相對於其他半導體材料來說價格相對昂貴,限制了它們在價格敏感型市場的採用。

- 在後疫情時代,遠距工作環境將推動超大規模資料中心的成長,從而增加對智慧型手機、穿戴式裝置、筆記型電腦和其他 IT 裝置的需求。

- 根據印度國家軟體和服務公司協會(NASSCOM)預測,到2025年,印度資料中心的投資金額將達到46億美元。印度資料中心最大的優勢在於,與新興市場相比,無論在開發或營運方面都具有較高的成本效益。目前,資料中心主要位於孟買、班加羅爾、清奈、德里(NCR)、海得拉巴和普納。加爾各答、喀拉拉邦和艾哈默德巴德被計劃作為未來的資料中心所在地。資料中心市場的投資增加正在推動所調查市場的成長。

氮化鎵(GaN)半導體裝置市場趨勢

消費性電子產品佔據很大市場佔有率

- 氮化鎵(GaN)半導體已成為家用電子電器產業的關鍵元件。由於其獨特的性能,這些半導體在電力電子領域迅速普及。與傳統的矽基元件相比,GaN半導體具有更高的擊穿電壓和更低的導通電阻。

- 與傳統的矽基半導體相比,GaN半導體由於其高電子遷移率和寬能隙而表現出更低的功率損耗。在智慧型手機中,基於GaN的電源管理晶片可以實現更快的充電、更長的電池壽命、更少的熱量產生。同樣,GaN半導體可以使筆記型電腦的電源轉換更加高效,從而延長電池壽命並減輕設備重量。

- 智慧型手機的日益普及也推動了市場的成長。愛立信預計,2023年全球智慧型手機行動網路用戶數將達到近70億,預計2028年將超過77億,其中印度、中國和美國的智慧型手機行動網路用戶數最多。

- GaN半導體在高頻應用中具有卓越的性能,非常適合滿足現代電子設備日益成長的需求。在智慧型手機中,基於 GaN 的射頻 (RF) 擴大機可改善訊號品質,從而實現更清晰的通話和更快的資料傳輸速度。在筆記型電腦中,基於 GaN 的功率放大器可以實現更快的無線連接並提高整體性能。此外,在消費性穿戴產品中,GaN半導體促進了強大的無線通訊並實現了先進的感測器整合。

中國正在經歷快速成長

- 近幾十年來,中國已成為半導體及相關產品的主要製造國和用戶。中國半導體晶片需求的激增,很大程度得益於數位化環境的快速擴張。此外,政府計畫也促進了中國數位技術的廣泛應用。其中一項舉措是“中國製造2025”,旨在鼓勵將機器人、物聯網、自動化、人工智慧、AR/VR和機器學習等先進的ICT解決方案融入工業領域。

- 該國GaN半導體市場的成長也受到智慧型手機、智慧電視、筆記型電腦、平板電腦和家用電器日益普及的推動。由於該材料的成本和效率優勢,消費領域一直是OEM採用 GaN 的主要推動力,預計這一趨勢將持續下去。 GaN將使智慧型手機製造商能夠生產體積小且具有良好性價比的充電器。

- 中國也是汽車製造大國,正在擴大對汽車產業的投資以加強其市場地位。因此,中國政府最近取消了對外商投資的各種限制,以鼓勵國內汽車製造業。

- 此外,由於消費者的可支配收入不斷增加,對豪華汽車的需求不斷增加,由於這些車輛上安裝的電子設備和控制單元數量不斷增加,推動了對 GaN 半導體的需求,從而為研究市場的成長創造了良好的前景。例如,根據中國工業協會(CAAM)的數據,2023年12月中國月度汽車產量為乘用車227.3萬輛,商用車31萬輛。

氮化鎵(GaN)半導體裝置產業概況

GaN半導體裝置市場正走向半固體。市場的主要企業包括東芝電子設備及儲存裝置株式會社、Nexperia Holding BV(聞泰科技)、英飛凌科技股份公司、高效率電源轉換公司和恩智浦半導體公司。為了在預測期內獲得競爭優勢,公司正在建立多種夥伴關係並投資於新產品的推出,以增加市場佔有率。

- 2024 年 6 月 - 英飛凌科技股份公司推出 CoolGaNTransistor 700 V G4 產品系列。這些設備在電源轉換方面表現出色,尤其是在 700 V 電壓範圍內。這些電晶體的輸入/輸出比性能提高了 20%。這種增強意味著更高的效率、最小化的功率損耗和更經濟的解決方案。這些應用包括消費性充電器和筆記型電腦適配器、資料中心電源、可再生能源逆變器和電池儲存解決方案。

- 2024 年 5 月-東芝電子元件及儲存裝置株式會社在石川縣加賀東芝電子株式會社(東芝集團旗下的一家主要公司)舉行了功率半導體 300 毫米晶圓製造設施和辦公大樓的竣工儀式。此次竣工是東芝多年投資計畫第一階段的重要里程碑。該公司將進行設備安裝,並於2024會計年度下半年開始量產。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 5G實施進展帶動通訊基礎設施領域需求強勁

- 高性能和小外形規格等有利特性推動了軍事領域的採用

- 市場限制

- 成本和營運挑戰

第6章 市場細分

- 按類型

- 功率半導體

- 光半導體

- 射頻半導體

- 按設備

- 電晶體

- 二極體

- 整流器

- 電源IC

- 按最終用戶產業

- 車

- 消費性電子產品

- 航太和國防

- 醫療

- 資訊和通訊技術

- 其他最終用戶產業

- 按地區

- 美國

- 歐洲

- 日本

- 中國

- 韓國

- 台灣

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Toshiba Electronic Devices & Storage Corporation

- Nexperia Holding BV(Wingtech Technology Co. Ltd)

- Infineon Technologies AG

- Efficient Power Conversion Corporation

- NXP Semiconductors NV

- Texas Instruments Incorporated

- MACOM Technologies Solutions Holdings Inc.

- STMicroelectronics NV

- Microchip Technology Inc.

- Soitec

- Qorvo Inc.

- ROHM Co. Ltd

第8章投資分析

第9章:市場的未來

The GaN Semiconductor Devices Market size is estimated at USD 5.28 billion in 2025, and is expected to reach USD 14.06 billion by 2030, at a CAGR of 21.64% during the forecast period (2025-2030).

Key Highlights

- The escalating demand for renewable energy sources, including solar and wind power, has propelled the use of GaN semiconductor devices in power conversion systems. GaN's high-power density, fast switching speeds, and improved thermal performance enable efficient energy conversion, reducing energy wastage and increasing overall system efficiency.

- Solar power is one of the fastest-growing segments in the green energy sector. Solar panels, which consist of multiple discrete semiconductors, transform sunlight into electricity through the photovoltaic effect. The rising demand for solar energy, driven by factors such as government incentives and falling costs, has led to a surge in the production and installation of solar panels. This, in turn, has fueled the demand for discrete semiconductors required for the efficient functioning of these panels.

- GaN's ability to operate at high frequencies, withstand harsh environmental conditions, and deliver high power outputs makes it suitable for applications such as radar systems, electronic warfare, and communication systems. GaN devices offer improved performance, reliability, and reduced system size, contributing to advancements in aerospace and defense technologies.

- However, the high cost associated with gallium nitride semiconductor devices acts as a significant restraint to the growth of the studied market. The production process of these devices requires complex manufacturing techniques and specialized equipment, which adds to the overall cost. This makes gallium nitride semiconductor devices relatively expensive compared to other semiconductor materials, limiting their adoption in price-sensitive markets.

- The remote working environment, in the post-COVID scenario, is leading to the growth in hyper-scale data centers and increased demand for smartphones, wearables, laptops, and other IT equipment, creating a need for memory chips and resulting in increased demand for the market studied.

- As per the the National Association of Software and Service Companies (NASSCOM), India's data center investment is slated to reach USD 4.6 billion by 2025. India's higher cost efficiency in both development and operation is its most significant advantage compared to more mature markets. Currently, India's data centers are primarily located in Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad, and Pune. Calcutta, Kerala, and Ahmedabad are the upcoming data center hubs. These growing data center market investments drive the growth of the market studied.

Gallium Nitride (GaN) Semiconductor Devices Market Trends

Consumer Electronics to Hold Significant Market Share

- Gallium nitride (GaN) semiconductors have emerged as crucial components in the consumer electronics industry. Due to their unique properties, these semiconductors have rapidly gained popularity in power electronics. Compared to traditional silicon-based devices, GaN semiconductors offer higher breakdown voltage and lower on-resistance.

- Compared to traditional silicon-based semiconductors, GaN semiconductors exhibit lower power losses due to their higher electron mobility and wider bandgap. In smartphones, GaN-based power management chips enable faster charging, longer battery life, and reduced heat generation. Similarly, GaN semiconductors allow for more efficient power conversion in laptops, resulting in extended battery life and reduced device weight.

- The increasing penetration of smartphones is likely to aid the growth of the studied market. According to Ericsson, in 2023, the number of smartphone mobile network subscriptions worldwide reached almost seven billion. It is expected to exceed 7.7 billion by 2028. India, China, and the United States have the highest number of smartphone mobile network subscriptions.

- GaN semiconductors perform well in high-frequency applications, making them suitable for the ever-increasing demands of modern electronic devices. In smartphones, GaN-based radio frequency (RF) amplifiers enhance signal quality, leading to improved call clarity and faster data transfer rates. In laptops, GaN-based power amplifiers enable high-speed wireless connectivity and enhance overall performance. Furthermore, in consumer wearables, GaN semiconductors facilitate stable wireless communication and enable the integration of advanced sensors.

China to Witness Significant Growth

- China has emerged as the leading manufacturer and user of semiconductors and associated goods in recent decades. The surge in demand for semiconductor chips in China is largely due to the rapid expansion of the digital environment. In addition, government programs contribute to the increased adoption of digital technologies in China. One such initiative is "Made in China 2025," which aims to encourage the integration of advanced technologies like robotics, IoT, automation, and advanced ICT solutions such as AI, AR/VR, and ML in the industrial sector.

- The growth of the country's GaN semiconductor market is also influenced by the rising popularity of smartphones, smart TVs, laptops, tablets, home appliances, etc. The consumer sector has been the primary force behind GaN adoption by OEMs due to the material's cost and efficiency advantages, and this trend is anticipated to continue without deceleration. GaN enables smartphone manufacturers to produce chargers with reduced dimensions and a better price-to-power ratio.

- China is also known as a leading producer of motor vehicles and is expanding its investment in the automotive industry to enhance its market position. As a result, the Chinese government has recently lifted various restrictions on foreign investment to promote automotive manufacturing within the nation.

- Moreover, the growing demand for luxury vehicles owing to the rising disposable income of the consumers is creating a favorable outlook for the studied market's growth as more electronic and control units feature in these vehicles, which drives the demand for GaN semiconductors. For instance, according to the China Association of Automobile Manufacturers (CAAM), in December 2023, monthly automobile production in China stood at 2,273 thousand units of passenger vehicles and 310 thousand units of commercial vehicles.

Gallium Nitride (GaN) Semiconductor Devices Industry Overview

The GaN semiconductor devices market is semi-consolidated. Some of the significant players in the market are Toshiba Electronic Devices & Storage Corporation, Nexperia Holding BV (Wingtech Technology Co. Ltd), Infineon Technologies AG, Efficient Power Conversion Corporation, NXP Semiconductors NV, and many more. The companies are increasing their market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

- June 2024 - Infineon Technologies AG introduced the CoolGaNTransistor 700 V G4 product family. These devices excel in power conversion, specifically in the 700 V voltage range. These transistors boast a 20% performance boost in input and output figures-of-merit. This enhancement translates to heightened efficiency, minimized power losses, and more economical solutions. These applications span from consumer chargers and notebook adapters to data center power supplies, renewable energy inverters, and battery storage solutions.

- May 2024 - Toshiba Electronic Devices & Storage Corporation held a ceremony to mark the completion of a new 300-millimeter wafer fabrication facility for power semiconductors and an office building at Kaga Toshiba Electronics Corporation in Ishikawa Prefecture, Japan, one of Toshiba's key group companies. Completing construction is a significant milestone for Phase 1 of Toshiba's multi-year investment program. Toshiba will now proceed with equipment installation and start mass production in the second half of the fiscal year 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from Telecom Infrastructure Segment Driven by Advancements in 5G Implementation

- 5.1.2 Favorable Attributes Such As High-performance and Small Form Factor to Drive Adoption in the Military Segment

- 5.2 Market Restraint

- 5.2.1 Cost & Operational Challenges

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Power Semiconductors

- 6.1.2 Opto-Semiconductors

- 6.1.3 RF Semiconductors

- 6.2 By Devices

- 6.2.1 Transistors

- 6.2.2 Diodes

- 6.2.3 Rectifiers

- 6.2.4 Power ICs

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Consumer Electronics

- 6.3.3 Aerospace and Defense

- 6.3.4 Medical

- 6.3.5 Information Communication and Technology

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 United States

- 6.4.2 Europe

- 6.4.3 Japan

- 6.4.4 China

- 6.4.5 Korea

- 6.4.6 Taiwan

- 6.4.7 Latin America

- 6.4.8 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toshiba Electronic Devices & Storage Corporation

- 7.1.2 Nexperia Holding BV (Wingtech Technology Co. Ltd)

- 7.1.3 Infineon Technologies AG

- 7.1.4 Efficient Power Conversion Corporation

- 7.1.5 NXP Semiconductors NV

- 7.1.6 Texas Instruments Incorporated

- 7.1.7 MACOM Technologies Solutions Holdings Inc.

- 7.1.8 STMicroelectronics NV

- 7.1.9 Microchip Technology Inc.

- 7.1.10 Soitec

- 7.1.11 Qorvo Inc.

- 7.1.12 ROHM Co. Ltd