|

市場調查報告書

商品編碼

1548955

MOSFET 功率電晶體:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)MOSFET Power Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

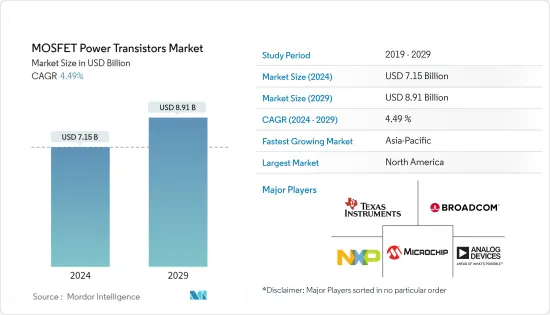

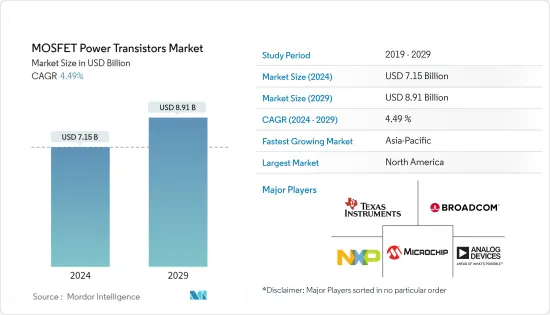

MOSFET功率電晶體市場規模預計到2024年為71.5億美元,預計到2029年將達到89.1億美元,在預測期內(2024-2029年)複合年成長率為4.49%。

主要亮點

- 金屬氧化物半導體場效電晶體,也稱為MOSFET,被廣泛認為是場效電晶體(FET)的主流類型。 MOSFET 既充當電力開關又充當放大器,根據施加到其閘極端子的電壓調節其源極端子和漏極端子之間的電流。 MOSFET 因其低功耗、高開關速度、高效小型化和高密度封裝等優異特性而成為積體電路的首選元件。

- 功率MOSFET在電路中扮演調節大電流和功率的功能。該組件通常是單獨封裝的單一電晶體。常見於開關電源和馬達控制器。電子產業嚴重依賴 MOSFET 功率電晶體。功率 MOSFET 廣泛整合到各種消費性電子產品中。預計消費電子產業將出現顯著成長,並且預測期為市場研究提供了機會。

- 同樣,MOSFET 由於在能源和電力行業的快速採用而變得越來越受歡迎。人們越來越重視節能,隨著石化燃料的消耗,人們開始轉向使用可再生電力源。因此,對功率 MOSFET 的需求正在迅速增加。根據國際能源總署(IEA)預測,根據目前的政策設置,預計到2030年可再生能源將佔新增發電量的80%。這些重大進步預計將進一步推動 MOSFET 的需求。

- 供應商也大力投資其各種產品的技術創新。例如,東芝電子歐洲有限公司於 2023 年 6 月宣布推出新的 N 通道功率 MOSFET 系列。 TK055U60Z1是600V DTMOSVI系列中的首款產品,採用東芝尖端製程-超接面結構。它可用於多種應用,包括資料中心的高效能開關電源、太陽能發電的功率調節器以及不斷電系統系統。

- 此外,MOSFET功率電晶體在航太和國防領域的使用也顯著增加。由於客運量和軍事開支的增加,全球航太業正在經歷顯著成長,預計這將推動對 MOSFET 功率電晶體的需求。此外,研究人員也正在探索新的應用領域,從而開發創新解決方案。例如,2023年6月,GE研究中心的科學家成功展示了一種SiC MOSFET,可以承受超過800攝氏度的溫度,高於先前演示的溫度。這項突破凸顯了 SiC MOSFET 在極端工作條件下支援未來應用的潛力。

- 千禧世代電子設備、醫療保健設備的普及以及混合動力汽車和電動車(HEV 和 EV)的出現有力地支持了電子和汽車行業的快速成長。此外,由於技術的不斷進步和創新技術的引入,MOSFET功率電晶體市場預計將蓬勃發展。這表明MOSFET功率電晶體在可預見的未來具有為不斷擴大的電子和汽車領域做出貢獻的巨大潛力。

- 此外,分立功率 MOSFET 是工業、汽車和家庭中常用的電晶體元件,用於控制高電壓、高電流訊號。這些產業對高效能電源解決方案的需求日益成長,帶來了更高開關頻率、更小尺寸、更輕重量和更好的熱控制等挑戰。

- 2020 年初,COVID-19 的廣泛爆發對所研究市場的供應鏈和生產造成了重大干擾。此外,市場的許多最終用戶部門受到了 COVID-19 大流行的影響,為市場帶來了不利的後果。然而,隨著2021年停工規定的逐步放鬆,採用MOSFET的產品需求明顯激增,對市場產生了正面影響。

MOSFET功率電晶體市場趨勢

汽車和交通運輸預計將佔據主要市場佔有率

- 由於全球對電動車的需求不斷成長並確保駕駛員的安全,MOSFET功率電晶體廣泛應用於汽車。 MOSFET 功率電晶體有望推動市場需求,因為它們改善了驅動器連接性、駕駛和安全創新。汽車的快速電氣化正在推動汽車MOSFET功率電晶體市場的成長。

- ADAS(高級駕駛輔助系統)的日益普及以及全球範圍內對 ADAS 的政府法規的不斷增加也正在擴大該細分市場的範圍。車載資訊娛樂系統採用率的持續增加預計也將提供成長機會。然而,汽車數位應用日益複雜,需要 MOSFET 功率電晶體和技術不斷發展。

- 在汽車產業,電氣化和自動駕駛技術日益普及,車輛配備了更多的電子和控制單元。例如,比亞迪將在2022年超越特斯拉,成為插電式電動車的最大製造商。年內,比亞迪銷售插電式電動車約185萬輛。此外,人工智慧和物聯網的引入等技術進步,以及有利於自動駕駛、連網型和低排放氣體車輛生產的政府標準,也進一步推動了市場的成長。

- 此外,汽車領域對 MOSFET 不斷成長的需求和用例也推動供應商開發創新解決方案,預計將進一步推動所研究市場的成長。例如,2022年7月,東芝電子元件及儲存裝置宣布開發出低導通電阻並顯著降低開關損耗的碳化矽(SiC)MOSFET。目前,SiC功率裝置擴大應用於鐵路逆變器,但更廣泛的應用前景正在顯現,包括汽車電氣化和工業設備的小型化。

亞太地區預計將佔據主要市場佔有率

- 預計亞太地區將佔據 MOSFET 功率電晶體市場的最高佔有率。這一成長的推動因素包括消費性電子產品的普及、該地區消費者可支配收入的增加、技術進步的不斷發展、基礎設施的蓬勃發展以及該地區技術進步的不斷進步。

- 亞太市場的成長預計也將受到該地區多家功率 MOSFET 製造商的存在以及買家獲得產品的便利性等因素的影響。此外,該地區擁有龐大的消費群體、不斷成長的家電需求以及穩步成長的汽車工業,為MOSFET功率電晶體的發展創造了合適的市場。

- 近幾十年來,由於工業部門的快速發展,中國已成為該地區的主要經濟體。根據世界銀行統計,過去幾十年來,中國工業部門以年均近10%的速度成長,使中國成為全球製造地,並使MOSFET功率電晶體廣泛應用於多種工業部門的產品和設備中。了對MOSFET 功率電晶體的需求。

- 此外,日本在 MOSFET 功率電晶體市場中佔有重要地位,是多家主要製造商以及電子和醫療保健設備行業的所在地。根據日本財務省的數據,2023 年醫療和藥品出口價值為 1,018.15 億日圓(680.86 美元)。此外,近年來,為了振興半導體產業,該國開始專注於吸引半導體企業並與其他國家結盟,這有望促進市場研究機會。

MOSFET功率電晶體產業概況

MOSFET 功率電晶體市場競爭中等,有許多地區性和全球性公司的存在。專注於創新的大公司的各種收購和聯盟預計很快就會發生。主要市場參與者包括 Analog Devices Inc.、德州儀器 (Texas Instruments)、博通 (Broadcom) Inc. 和恩智浦半導體 (NXP Semiconductors)。

- 2023年10月,東芝電子歐洲公司(以下簡稱「東芝」)推出了採用最新U-MOS IX-H製程的汽車級40V N通道功率MOSFET。新裝置採用新封裝S-TOGLTM(小型電晶體輪廓鷗翼引線),為汽車應用提供了許多優勢。

- 2023 年 7 月 Micro Commercial Components Corp. 推出創新 TO 無引線 (TOLL) 封裝,可在小型 N 通道 MOSFET 中實現高電流。該公司表示,這四款新型 TOLL 高功率 MOSFET 是滿足工業應用嚴苛需求的智慧解決方案。此外,這些解決方案還具有額外的功能,可消除尺寸作為設計限制,降低整體組件成本,並提供最大的運作效率。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 擴大 MOSFET 功率電晶體在消費性電子應用的使用

- 智慧型手機和平板設備的高滲透率以及MOSFET功率電晶體的需求不斷成長

- 市場挑戰

- 製造流程複雜

第6章 市場細分

- 按最終用戶產業

- 汽車/運輸設備

- 家電

- 工業的

- 製造業

- 衛生保健

- 航太/國防

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Infineon Technologies AG

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Microchip Technology Inc

- NXP Semiconductors.

- Broadcom Inc.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Vishay Intertechnology Inc.

第8章投資分析

第9章市場的未來

The MOSFET Power Transistors Market size is estimated at USD 7.15 billion in 2024, and is expected to reach USD 8.91 billion by 2029, growing at a CAGR of 4.49% during the forecast period (2024-2029).

Key Highlights

- The metal-oxide-semiconductor field-effect transistor, also known as MOSFET, is widely recognized as the predominant type of field-effect transistor (FET). MOSFETs function as both electrical switches and amplifiers, regulating the flow of electricity between the source and drain terminals in response to the voltage applied to the gate terminal. MOSFETs are favored for their superior characteristics, such as lower power consumption, faster switching speeds, and the ability to be efficiently miniaturized and densely packed, rendering them ideal for integrated circuits.

- Power MOSFETs serve the purpose of regulating high current or power in circuits. These components are typically single transistors packaged individually. They are commonly found in switching power supplies and motor controllers. The electronics industry heavily relies on MOSFET power transistors. Power MOSFETs are extensively integrated into a broad spectrum of consumer electronics. With significant growth projected for the consumer electronics industry, the forecast period will offer opportunities for the market studied.

- Similarly, the rapid adoption of MOSFETs in the energy and power industry has made them increasingly popular. With a growing emphasis on energy conservation and the depletion of fossil fuels, there has been a shift toward utilizing renewable sources of electricity. Consequently, there has been a surge in demand for power MOSFETs. According to the International Energy Agency (IEA), renewables are projected to account for 80% of new power generation capacity by 2030, based on current policy settings. These substantial advancements are anticipated to further drive the demand for MOSFETs.

- Various vendors are also significantly investing in innovating various products. For instance, in June 2023, Toshiba Electronics Europe GmbH unveiled a fresh lineup of N-channel power MOSFETs. The inaugural addition to the 600 V DTMOSVI series is the TK055U60Z1, which incorporates Toshiba's cutting-edge process featuring a super junction structure. These MOSFETs are designed for various applications, including high-efficiency switching power supplies in data centers, power conditioners for photovoltaic generators, and uninterruptible power systems.

- In addition, there is a notable increase in the utilization of MOSFET power transistors in the aerospace and defense sectors. The global aerospace industry is experiencing substantial growth due to the rise in passenger traffic and military spending, which is expected to drive the demand for these transistors. Moreover, researchers are also exploring new application areas, leading to the development of innovative solutions. For example, in June 2023, scientists at GE Research successfully showcased SiC MOSFETs that can withstand temperatures exceeding 800o C, surpassing previous demonstrations. This breakthrough highlights the potential of SiC MOSFETs in supporting future applications in extreme operating conditions.

- The exponential growth of the electronics and automotive industries is strongly backed by the widespread use of electronic devices among millennials, healthcare devices, and the emergence of hybrid and electric vehicles (HEVs and EVs). Additionally, the power MOSFET transistors market is expected to flourish due to continuous technological advancements and the introduction of innovative technologies. This indicates that power MOSFET transistors have immense potential to contribute to the ever-expanding electronics and vehicle sectors in the foreseeable future.

- Additionally, discrete power MOSFETs are transistor components commonly used in industrial, automotive, and consumer settings to control high-voltage and high-current signals. The increasing need for efficient power solutions in these industries presents challenges like elevated switching frequencies, reduced sizes, lighter weights, and enhanced thermal control.

- The widespread outbreak of COVID-19 at the beginning of 2020 resulted in significant disturbances to the supply chain and production in the market studied. Additionally, numerous end-user sectors in the market were affected by the COVID-19 pandemic, causing detrimental consequences on the market. However, with the gradual relaxation of lockdown restrictions in 2021, there was a clear surge in the demand for products incorporating MOSFETs, leading to a favorable influence on the market.

MOSFET Power Transistors Market Trends

Automotive and Transportation is Expected to Hold Significant Market Share

- With the increasing demand for electric vehicles worldwide and to keep drivers safe, MOSFET power transistors are widely used in cars. MOSFET power transistors improve connectivity driving and safety innovation among drivers, which is expected to fuel market demand. The rapid electrification of vehicles is driving the growth of the automotive MOSFET power transistors market.

- The growing adoption of advanced driver-assistance systems (ADAS) and increasing government regulations globally mandating ADAS are also expanding the scope of this segment. Also, the ever-increasing adoption of vehicle infotainment is expected to provide growth opportunities. However, the growing complexity of automotive digital applications requires the constant evolution of MOSFET power transistors and technologies.

- With electrification and autonomous technologies becoming prevalent in the automotive industries, more electronic and control units are being installed, which, in turn, is driving the demand for MOSFET power transistors in the market studied. For instance, in 2022, BYD surpassed Tesla as the leading manufacturer of plug-in electric vehicles. Around 1.85 million plug-in electric vehicles were sold by BYD that year. Additionally, technological advancements, such as the implementation of AI, IoT, and favorable government standards for the production of autonomous, connected, and low-emission vehicles, are further fuelling the market's growth.

- Furthermore, the growing demand and use cases of MOSFETs in the automotive sector also encourage the vendors to develop innovative solutions, which is anticipated to further facilitate the studied market's growth. For instance, in July 2022, Toshiba Electronic Devices & Storage Corporation announced the development of silicon carbide (SiC) MOSFETs with low on-resistance and significantly reduced switching loss. While SiC power devices are now increasingly being utilized in inverters for trains, the broader application is on the horizon, coming in vehicle electrification and the miniaturization of industrial equipment.

Asia-Pacific Expected to Witness Significant Market Share

- Asia-Pacific is projected to account for the highest share of the MOSFET power transistors market. The growth can be attributed to factors such as the increasing adoption of consumer electronics devices, growing disposable income of consumers in the region, rising technological advancements, booming infrastructure, and rising technological advancements in the region.

- The growth of the Asia-Pacific market is also anticipated to be influenced by factors such as the presence of several manufacturers of power MOSFET in the region, making it easy for buyers to get the product. Furthermore, the presence of a large consumer base, the expanding demand for consumer electronics products, and the steady growth of automotive industries in the region together create a market suitable for developing MOSFET power transistors.

- In the last few decades, China has emerged as the major economy in this region owing to the rapid development of the industrial sector. According to the World Bank, the industrial sector in China has averaged almost 10% a year in the last few decades, making the country the global manufacturing hub while also driving the demand for MOSFET power transistors as they are widely used in products/equipment across various industries.

- Furthermore, Japan also holds a significant position in the MOSFET power transistors market, home to some substantial manufacturers and the electronics and healthcare equipment industry. According to the Ministry of Finance, Japan, in 2023, exports of medical and pharmaceutical products stood at JPY 101,815 million (USD 680,086). In recent years, the company has also started focusing on luring semiconductor companies and engaging in partnerships with other nations to boost its semiconductor industry, which is anticipated to drive opportunities in the market studied.

MOSFET Power Transistors Industry Overview

The MOSFET power transistors market is moderately competitive, with many regional and global players. Various acquisitions and collaborations of large companies are expected to take place shortly, focusing on innovation. Some key market players include Analog Devices Inc., Texas Instruments, Broadcom Inc., and NXP Semiconductors.

- October 2023: Toshiba Electronics Europe GmbH ("Toshiba") launched a pair of automotive grade 40 V N-channel power MOSFETs based upon its latest U-MOS IX-H process. The new devices use a new S-TOGLTM (Small Transistor Outline Gull-wing Leads) package that provides a number of advantages in automotive applications.

- July 2023: Micro Commercial Components Corp. launched an innovative TO-Leadless (TOLL) package designed to enable high currents in a small N-channel MOSFET. According to the company, the four new TOLL high-power MOSFETs are smart solutions for the stringent demands of industrial applications. Additionally, these solutions are equipped with additional features to remove size as a design constraint, reduce overall component costs, and provide maximum operational efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Usage of MOSFET Power Transistor in Consumer Electronics Applications

- 5.1.2 High Adoption of Smartphones and Tablets and Growing Requirement for MOSFET Power Transistor

- 5.2 Market Challenges

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Automotive and Transportation

- 6.1.2 Consumer Electronics

- 6.1.3 Industrial

- 6.1.4 Manufacturing

- 6.1.5 Healthcare

- 6.1.6 Aerospace and Defense

- 6.1.7 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices Inc.

- 7.1.5 Microchip Technology Inc

- 7.1.6 NXP Semiconductors.

- 7.1.7 Broadcom Inc.

- 7.1.8 Mitsubishi Electric Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Vishay Intertechnology Inc.