|

市場調查報告書

商品編碼

1644768

全球射頻和微波功率電晶體 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Global RF & Microwave Power Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

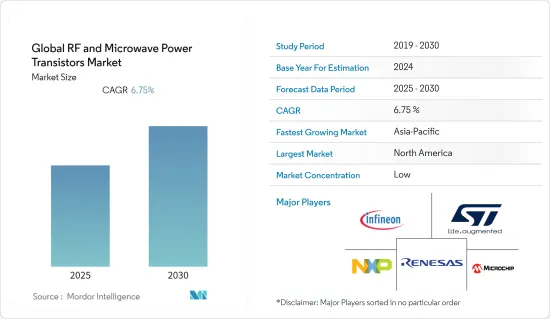

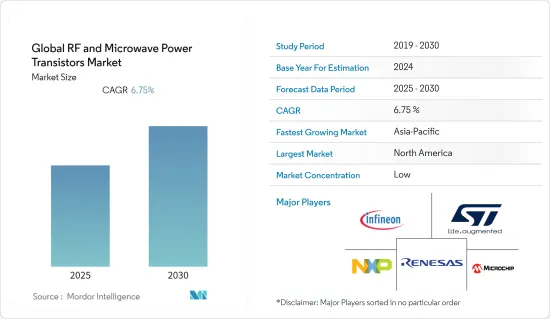

預測期內,全球射頻和微波功率電晶體市場預計複合年成長率為 6.75%。

全球 5G 射頻和微波功率電晶體市場的關鍵促進因素包括需求增加、研發投資增加以及新技術的快速核准。射頻和微波功率電晶體可在航太和軍事應用中提供高功率訊號的放大和切換。雷達系統、通訊系統、電子戰系統和飛彈導引系統都使用它作為發送器或接收器。射頻和微波功率電晶體可提高效率,同時減少這些系統的尺寸和重量。

在通訊領域,射頻和微波功率電晶體用於放大或切換微波傳輸的功率。它們還可以控制訊號的方向並用作放大器或振盪器。它們也可以用作開關設備,在電路的不同區域之間傳導訊號。射頻和微波功率電晶體是微波系統設計的關鍵組件。

近年來,隨著資訊通訊的速度和容量的不斷提高,資訊通訊和電力領域中使用的大功率半導體模組的產量以及單位面積上搭載的半導體晶片的數量不斷增加,過熱問題已成為一大問題。因此,為了實現高熱導率和低熱膨脹性能,金屬-鑽石複合材料受到人們的關注。

Good System已達到全球最佳的散熱特性,熱導率為800W/mK,熱膨脹係數為8ppm,可用作56G無線通訊的射頻(RF)功率電晶體和絕緣柵雙極電晶體高功率絕緣柵雙極電晶體(IGBT)的散熱材料。

此外,COVID-19 疫情對功率電晶體市場產生了重大影響。全球經濟放緩和勞動力短缺導致半導體和電子製造設施停滯。 COVID-19 導致工廠使用率大幅下降、旅行禁令和製造工廠關閉,導致電力傳輸產業成長放緩。

射頻和微波功率電晶體市場趨勢

通訊領域可望推動市場發展

愛立信表示,5G將成為史上應用最廣泛的行動通訊技術,預計2027年將覆蓋全球約75%的人口。

由於資料處理需求的不斷成長和消費量的不斷增加,5G 設備市場將在未來幾年蓬勃發展。為了滿足對 5G 設備日益成長的需求,5G 智慧型手機的半導體製造商將看到對 5G 晶片的需求增加。半導體晶片的增加促進了半導體產業的發展,並帶動了功率電晶體的需求。

矽基射頻氮化鎵在 5G 和 6G 基礎設施中具有巨大潛力。早期的射頻功率放大器以橫向擴散金屬氧化物半導體 (LDMOS) (PA) 為主,這是一種長期存在的射頻功率技術。 GaN 可以為這些 RF PA 提供更好的 RF 特性和比 LDMOS 高得多的輸出功率。此外,它可以在矽或碳化矽(SiC)晶片上製造。

2021 年 12 月,Microchip Technology Inc. 在其支援高達 20吉赫(GHz) 頻率的氮化鎵 (GaN) 射頻 (RF) 功率裝置產品組合中增加了 MMIC 和分立電晶體。該元件將高功率附加效率 (PAE) 與高線性度相結合,為包括 5G、電子戰、衛星通訊、商業和國防雷達系統以及檢查設備在內的廣泛應用帶來新的性能水平。

亞太地區可望創下最快成長

由於東芝公司和三菱電機等大型公司的存在,亞太地區是全球功率電晶體市場成長最快的地區。中國、日本、台灣和韓國是主導半導體製造業並影響市場的少數國家。該地區還擁有巨大的智慧型手機和 5G 技術市場,並且製造業支出正在增加。

隨著各種電子產品不斷轉移到中國,日本、韓國和中國的半導體消費成長速度快於該地區其他國家。此外,亞洲是全球五大家用電子電器產業的所在地,預測期內該全部區域的半導體應用具有巨大潛力。

根據10個政府部門於2021年7月發布的三年計劃,中國計劃在2023年終擁有5.6億5G移動客戶,大型工業企業中高速無線技術的普及率將達到35%。 5G在各產業的應用,對推動經濟社會數位化、網路化、智慧化具有重要意義。

在政府的支持下,台灣的半導體市場也在成長。 2021年4月,國家發展基金宣布,台灣企業計劃在2021年至2025年期間投資1,070億美元用於半導體產業的成長。政府也透過資金和人才招聘計畫支持新半導體技術的發展。

射頻和微波功率電晶體產業概況

由於安森美半導體公司、瑞薩電子公司、英飛凌科技股份公司、德州儀器公司、恩智浦半導體公司、意法半導體公司、三菱電機公司、凌力爾特系統公司和東芝公司等主要參與者的存在,射頻和微波功率電晶體市場競爭激烈。

2022 年 5 月-義法半導體和 MACOM Technology Solutions Holdings Inc. 宣布成功生產高頻矽基氮化鎵 (RF GaN-on-Si) 原型。繼這項成功成果之後,ST 和 MACOM 打算繼續並加強合作。

2021 年 7 月-意法半導體 (STMicroelectronics) 增加了多種產品,擴展了其 STPOWER 系列 RF LDMOS 功率電晶體。為各種工業和商業應用中的射頻功率放大器 (PA) 開發了三種產品系列的電晶體。該公司的 RF LDMOS 元件結合了短傳導通道長度和高擊穿電壓,可提供高效率和低熱阻,同時設計用於承受高 RF 功率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 5G 等先進通訊技術的發展

- 對連網型設備的需求不斷增加

- 市場限制

- 由於溫度、頻率反向阻斷能力等造成的操作限制。

第6章 市場細分

- 按類型

- LDMOS

- GaN

- GaAs

- 其他 (GaN-on-Si)

- 按應用

- 通訊

- 工業的

- 航太和國防

- 其他(科學、醫學)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Infineon Technologies AG

- Renesas Electronics Corporation

- NXP Semiconductors NV

- Texas Instruments Inc.

- STMicroelectronics NV

- Linear Integrated Systems Inc.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Onsemi Corporation

- Microchip Technology Inc.

第8章投資分析

第 9 章:未來趨勢

The Global RF & Microwave Power Transistors Market is expected to register a CAGR of 6.75% during the forecast period.

The major drivers of the Global RF/Microwave Power Transistor for 5G market include rising demand, increased investment in research & development, and rapid approval of new technologies. The RF microwave power transistor amplifies or switches high-power signals in aerospace and the military. Radar systems, communication systems, electronic warfare systems, and missile guidance systems all employ it as a transmitter or receiver. The RF microwave power transistor increases efficiency while reducing size and weight in these systems.

In communication, the RF Microwave Power Transistor is used to amplify or switch the power of microwave transmission. It can also be used to control the signal's direction and as an amplifier or oscillator. It can also be used as a switching device to direct signals between different areas of a circuit. The RF Microwave Power Transistor is an important component in microwave system design.

Due to the recent increase in information speed and capacity, the output of high-power semiconductor modules used in information communication and power fields as well as the number of semiconductor chips mounted per unit area, are increasing, and overheating has emerged as an important issue. In order to produce high thermal conductivity and low thermal expansion characteristics, metal-diamond composite materials are attracting attention.

The Good System has managed to produce the world's best heat dissipation attributes, with 800W/mK-class thermal conductivity and 8PPM thermal expansion coefficient, as a heat dissipation material for radiofrequency (RF) power transistors for 56G wireless communication and high-power insulated-gate bipolar transistors (IGBT) for electric vehicles.

Further, the covid-19 pandemic significantly impacted the market for power transistors. Due to the slowdown and lack of workforce availability around the world, semiconductor and electronic manufacturing facilities came to a standstill. COVID-19 resulted in a major and sustained dip in factory utilization, travel prohibitions, and production site closures, resulting in a slowdown in the power transmission industry's growth.

RF & Microwave Power Transistor Market Trends

Communication Sector is Expected to Boost the Market

As stated by Ericsson, 5G is anticipated to be the most widely deployed mobile communication technology in history, covering roughly 75% of the global population by 2027.

The 5G enabled devices market is analyzed to grow rapidly in the coming years, owing to rising data processing requirements and increased consumption. To accommodate the growing demand for 5G enabled devices, semiconductor manufacturers for 5G enabled smartphones will experience increased demand for 5G chips. The rise in semiconductor chips will help to advance the semiconductor industry, boosting demand for power transistors.

For 5G and 6G infrastructure, RF GaN-on-Silicon has significant potential. Early-generation RF power amplifiers were dominated by the long-term incumbent RF power technology, laterally-diffused metal-oxide-semiconductor (LDMOS) (PAs). GaN can provide improved RF characteristics and much higher output power for these RF PAs than LDMOS. Additionally, it can be made on silicon or silicon-carbide (SiC) wafers.

In December 2021, Microchip Technology Inc. added additional MMICs and discrete transistors to its Gallium Nitride (GaN) Radio Frequency (RF) power device portfolio, spanning frequencies up to 20 gigahertz (GHz). The devices combine high power-added efficiency (PAE) and high linearity to achieve new levels of performance in a wide range of applications, including 5G, electronic warfare, satellite communications, commercial and defense radar systems, and test equipment.

Asia-Pacific is Expected to Register the Fastest Growth Rate

Asia-Pacific is the fastest-growing area in the global power transistors market due to the presence of large businesses such as Toshiba Corporation and Mitsubishi Electric Corporation. China, Japan, Taiwan, and South Korea are among a few countries that dominate the semiconductor manufacturing industry, thereby impacting the market. The region also has a significant market for smartphones and 5G technologies and an increase in manufacturing expenditures.

Due to the continued transfer of various electronic equipment to China, semiconductor consumption in Japan, South Korea, and China is fast increasing in comparison to other nations in the area. Furthermore, Asia is home to the world's top five consumer electronics sectors, presenting huge prospects for semiconductor adoption across the region in the forecast period.

According to a three-year plan released in July 2021 by ten government entities, China planned to have 560 million 5G mobile customers by the end of 2023 and a 35 percent penetration rate of the fast wireless technology among large industrial firms. It stated that the use of 5G in various industries is significant in driving the digital, networked, and intelligent transformation of the economy and society.

The semiconductor market in Taiwan is also growing due to support from the government. In April 2021, the National development fund announced that between 2021 and 2025, companies of Taiwan planned USD 107 billion investment for the semiconductor industry's growth. The government is also assisting in developing new semiconductor technologies with funding support as well as talent recruitment programs.

RF & Microwave Power Transistor Industry Overview

The RF and Microwave Power Transistors Market is a highly competitive market due to the presence of significant players such as Onsemi Corporation, Renesas Electronics Corporation, Infineon Technologies AG, Texas Instruments Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Mitsubishi Electric Corporation, Linear Integrated Systems Inc. and Toshiba Corporation.

May 2022 - STMicroelectronics and MACOM Technology Solutions Holdings Inc. announced that radio-frequency Gallium-Nitride-on-Si (RF GaN-on-Si) prototypes had been successfully produced. ST and MACOM will continue to collaborate and strengthen the relationship as a result of this accomplishment.

July 2021 - STMicroelectronics expanded the STPOWER family of RF LDMOS Power Transistors with a number of additional products. Three product series of transistors have been developed for RF power amplifiers (PAs) in a variety of industrial and commercial applications. The company's RF LDMOS devices combine a short conduction-channel length with a high breakdown voltage, offering high efficiency and low thermal resistance while being packed to withstand high RF power.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing advanced communication technologies such as 5G

- 5.1.2 Rise in demand for connected devices

- 5.2 Market Restraints

- 5.2.1 Limitations in Operations due to constraints like temperature, frequency reverse blocking capacity, etc

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LDMOS

- 6.1.2 GaN

- 6.1.3 GaAs

- 6.1.4 Others(GaN-on-Si)

- 6.2 By Application

- 6.2.1 Communication

- 6.2.2 Industrial

- 6.2.3 Aerospace and Defense

- 6.2.4 Others (Scientific, medical)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 NXP Semiconductors N.V.

- 7.1.4 Texas Instruments Inc.

- 7.1.5 STMicroelectronics N.V.

- 7.1.6 Linear Integrated Systems Inc.

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 Toshiba Corporation

- 7.1.9 Onsemi Corporation

- 7.1.10 Microchip Technology Inc.