|

市場調查報告書

商品編碼

1644766

雙極功率電晶體:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Bipolar Power Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

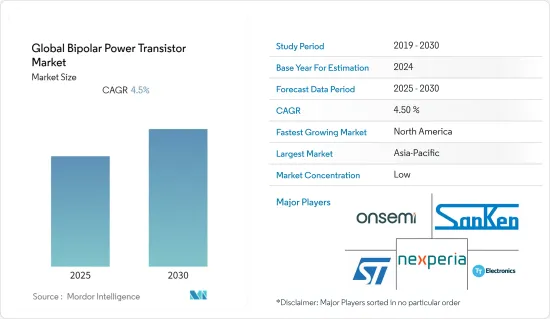

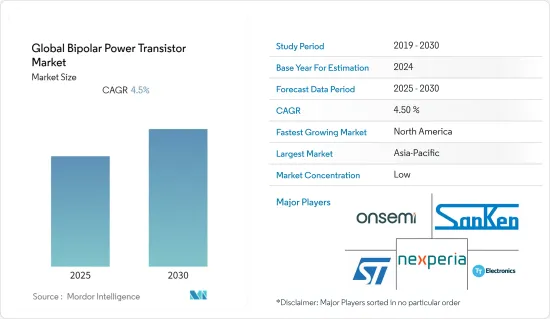

預計預測期內全球雙極功率電晶體市場複合年成長率為 4.5%。

此外,高散熱能力、高溫應用和高能源效率等特性可能會促進汽車市場的發展,而安全、電源管理、負載切換、線性模式穩壓器和工業元件中的背光應用可能會推動市場的發展。雙極功率電晶體用於高壓應用。

根據國際能源總署預測,2021年全球電動車銷量將達660萬輛。電動車佔全球汽車銷量的9%。在電動車中,雙極功率電晶體用於具有高功率發光二極體的汽車頭燈。汽車產業的崛起是雙極功率電晶體市場發展的促進因素。

對整體電路功率控制和小型化的需求不斷增加,推動了雙極功率電晶體市場的發展。例如,恩智浦半導體在保持相同功率性能的同時,將電晶體封裝尺寸縮小了55%。

COVID-19 也影響了主要電子品牌的全球供應鏈。中國是多種電子輸入耗材的最大生產國和出口國之一,包括雙極功率電晶體、電容器、二極體、整流器、擴大機等。中國持續的生產停擺,迫使多家美國和歐洲電子製造商停止生產電子應用成品,導致電子產品出現供需缺口。

雙極功率電晶體市場趨勢

汽車產業可望推動市場成長

雙極功率電晶體市場受到汽車產業技術改進的影響。在電動車中,雙極功率電晶體與高功率發光二極體一起用於汽車頭燈。

隨著電動和混合動力汽車的日益普及,汽車是雙極功率電晶體市場的成長領域之一。預計它將佔據很大的佔有率。自動駕駛技術和高壓應用等創新正在推動對雙極功率電晶體的需求。

此外,政府強制推行的 ADAS(高級駕駛輔助系統)法規也支持了該領域的成長。汽車領域的電子元件對安全至關重要,並且暴露在高電壓和惡劣條件下。製造商正在透過開發新型汽車雙極功率電晶體來應對這一問題。

例如,2022年3月,先進半導體技術製造商瑞薩電子宣布延長與本田在ADAS(高級駕駛輔助系統)的合作。

2021年9月,氮化鎵功率半導體製造商GaN Systems與BMW簽署了GaN功率電晶體的全面產能協議。

根據墨西哥國家統計和地理研究所的數據,2022 年 1 月,墨西哥售出了 237 輛電池電動車。拉丁美洲的哥倫比亞和巴西的電動和混合動力汽車註冊量大幅成長,因為這兩個地區的市場相對穩定。隨著墨西哥開發插電式電動車充電基礎設施,混合動力汽車已成為比傳統汽車更省油的替代品,並受歡迎。

北美可望實現強勁成長

北美是雙極功率電晶體的重要市場之一。半導體產業和雙極功率電晶體製造在生產、設計和研究方面嚴重依賴美國。該地區的重要性不僅推動了電子設備出口的需求,而且還推動了大量利用雙極功率電晶體市場的終端用戶領域數量的成長,例如需要高電壓的家用電器和汽車。

目前,新冠肺炎疫情已導致工廠關閉。這兩家工廠的關閉是由於最近爆發的新冠肺炎疫情。美國政府透過其能源效率和可再生能源辦公室(EERE)的年度預算為電動車研發提供資金。

為了滿足對電動車、家用電子電器以及能源和電力日益成長的需求,該全部區域電子製造業的蓬勃發展,預計將推動雙極功率電晶體市場的成長。

此外,工廠關閉和生產設施利用不足可能導致訂單減少,從而導致銷售減少或延遲。總體而言,TT Electronics和NXP Semiconductors等實力雄厚的電子和半導體公司正在推動該地區雙極功率電晶體產業的發展,終端消費者涵蓋家用電器和汽車零件等多個領域。推動這項需求的因素是全部區域消費性電子產品對高壓應用的需求。

雙極功率電晶體產業概況

雙極功率電晶體市場競爭激烈,多家全球主要企業參與其中。例如,STMicroelectronics、TT Electronics、Nexperia、Sanken Electric 和 Semiconductor Components Industries, LLC 提供雙極功率電晶體。此外,各公司正在推出以雙極功率電晶體為重點的新產品,從而提升市場佔有率。主要企業包括義法半導體(STMicroelectronics)、TT Electronics、Sanken Electric)等。

2021 年 6 月 - Nexperia 推出 MJD2873 NPN 50V 2A 高功率雙極電晶體,採用 TO-252 (SOT428C)表面黏著型元件(SMD) 塑膠封裝。這些設備產生的熱量更少,散熱能力更強,而且更節能。 Nexperia MJD2873 具有低集電極-射極飽和電壓和快速的開關速度。電源管理、負載切換、線性模式電壓調節、恆定電流驅動背光、馬達驅動和繼電器更換都是這些設備的常見應用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 供應鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 汽車和電子領域對高節能設備的需求不斷增加

- 綠色能源發電需求推動市場

- 市場限制

- 由於溫度、頻率等造成的操作限制。

第6章 市場細分

- 按類型

- PNP電晶體

- NPN電晶體

- 按最終用戶

- 消費性電子產品

- 通訊和技術

- 車

- 製造業

- 能源和電力

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- STMicroelectronics

- TT Electronics

- Nexperia

- Sanken Electric Co., Ltd.

- Semiconductor Components Industries, LLC

- Toshiba Electronic Devices & Storage Corporation,

- Renesas Electronics Corporation.

- Solitron Devices, Inc.

- GlobalSpec

- NXP Semiconductors

第8章投資分析

第 9 章:未來趨勢

The Global Bipolar Power Transistor Market is expected to register a CAGR of 4.5% during the forecast period.

In addition, features such as high thermal power dissipation capacity, high-temperature applications, and high energy efficiency boost the automotive market and security, power management, load switching, linear mode voltage regulator, and backlighting applications in industrial parts are likely to drive the market studied. Bipolar power transistors are used in high voltage applications.

According to the IEA, worldwide sales of electric automobiles had reached 6.6 million in 2021. Electric vehicles accounted for 9% of all vehicle sales worldwide. In Electric cars, bipolar power transistors are used in car headlights with high power light emitting diodes. An increase in automotive industries is a driving factor for the bipolar power transistor market.

The growing requirement to control power across circuits and miniaturization drives the bipolar power transistor market. NXP semiconductors, for instance, reduced the packing size of their transistors by 55% while maintaining the same power performance.

COVID-19 has also impacted the global supply chain of major electronic brands. China is one of the largest producers and exporters of various electronics input supplies such as bipolar power transistors, capacitors, diodes, rectifiers, amplifiers etc. Due to the continuous production standstill in China, several electronic manufacturers in the United States and Europe have been compelled to halt production manufacturing of finished electronic applications resulting in a demand-supply gap in electronic products.

Bipolar Power Transistor Market Trends

The Automotive Segment is Expected to Drive the Market Growth

The bipolar power transistor market is being influenced by the automobile industry's rising technical improvements. In Electric cars, bipolar power transistors are used in car headlights with high power light emitting diodes.

With the increased adoption of Electric vehicles and Hybrid vehicles, automotive is one of the rising segments of the bipolar power transistor market. It is expected to have a significant share. Innovations like autonomous car technology, high voltage applications have raised the demand for bipolar power transistors.

Additionally, government rules requiring advanced driver assistance systems (ADAS) have supported the segment's growth. Electronic components in the automobile sector are vital for safety and are exposed to high voltages and extreme Conditions. Manufacturers have responded by creating a new range of bipolar power transistors for automotive applications.

For Instance, In march 2022, Renesas Electronics Corporation, a producer of advanced semiconductor technologies, announced the extension of its advanced driver-assistance system (ADAS) collaboration with Honda.

In September 2021, GaN Systems, a gallium nitride power semiconductor manufacturer, signed a comprehensive capacity agreement with BMW for the company's GaN power transistors, which are designed to increase the efficiency and power density of critical applications in EVs.

According to The National Institute of Statistics and Geography, in January 2022, 237 battery electric vehicles were sold in Mexico. The number of registered electric and hybrid vehicles in Latin America has increased significantly in Colombia and Brazil, where the market has remained relatively stable. Hybrids have become relatively popular for users looking for a petrol-saving alternative to the traditional automobile as Mexico develops its charging infrastructure for plug-in electric vehicles.

North America is Expected to Register the Major Growth

North America is one of the significant markets for bipolar power transistors because of the region's automotive and other sectors. The semiconductor industry and bipolar power transistor manufacturing rely heavily on the United States for production, design, and research. The region's significance fuels demand for electronic equipment exports as well as increasing end-user sectors that utilize large amounts of bipolar power transistor market, such as high voltage required consumer electronics and automobiles.

The current COVID-19 pandemic has resulted in factory closures. For both factories, closures have resulted from the recent outbreak of COVID-19. The United States government is contributing to electric car research and development through annual appropriations to the Office of Energy Efficiency and Renewable Energy (EERE).

The rise in electronic equipment manufacturing across the region to cater to the rising demand for electric vehicles, consumer electronics, and energy & power is expected to foster growth in the bipolar power transistor market.

Furthermore, plant closures or underutilization of production facilities may result in order reductions and, as a result, fewer or delayed sales. Overall, powerful electronics and semiconductor firms like TT Electronics and NXP Semiconductors drive the bipolar power transistor industry in the area, with end-consumers from numerous sectors such as consumer electronics and automotive parts. Demand is fueled by high voltage application consumer electronics demand throughout the region.

Bipolar Power Transistor Industry Overview

The bipolar power transistor market is highly competitive, with various global key market players. For instance, STMicroelectronics, TT Electronics, Nexperia, Sanken Electric Co., Ltd., and Semiconductor Components Industries, LLC provide Bipolar power transistors. The companies are also launching new products that specifically deal with bipolar power transistors to boost the market's share. STMicroelectronics, TT Electronics, Sanken Electric Co., Ltd., and others are key players. Key developments are -

June 2021 - Nexperia launched MJD2873 NPN 50V 2A High Power Bipolar Transistors are packaged in a TO-252 (SOT428C) surface-mounted device (SMD) plastic packaging. Because they generate less heat, these devices have a high thermal power dissipation capability and a high energy efficiency. The Nexperia MJD2873 features a low collector-emitter saturation voltage and switches quickly. Power management, load switching, linear mode voltage regulation, constant current drive backlighting, motor drives, and relay replacement are all common uses for these devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics

- 5.1.2 Demand for Green Energy Power Generation Drives the Market

- 5.2 Market Restraints

- 5.2.1 Limitations in Operations due to constraints like temperature, frequency

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PNP Transistor

- 6.1.2 NPN Transistor

- 6.2 By End User

- 6.2.1 Consumer Electronics

- 6.2.2 Communication and Technology

- 6.2.3 Automotive

- 6.2.4 Manufacturing

- 6.2.5 Energy and Power

- 6.2.6 Other End Users

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 TT Electronics

- 7.1.3 Nexperia

- 7.1.4 Sanken Electric Co., Ltd.

- 7.1.5 Semiconductor Components Industries, LLC

- 7.1.6 Toshiba Electronic Devices & Storage Corporation,

- 7.1.7 Renesas Electronics Corporation.

- 7.1.8 Solitron Devices, Inc.

- 7.1.9 GlobalSpec

- 7.1.10 NXP Semiconductors