|

市場調查報告書

商品編碼

1549706

包裝自動化:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

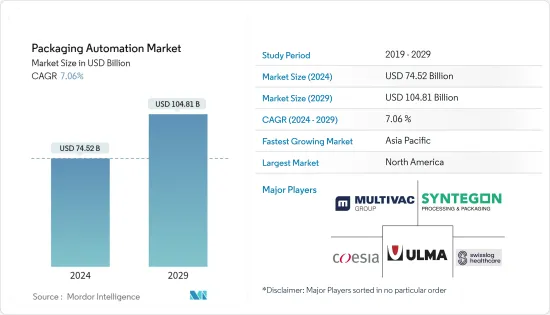

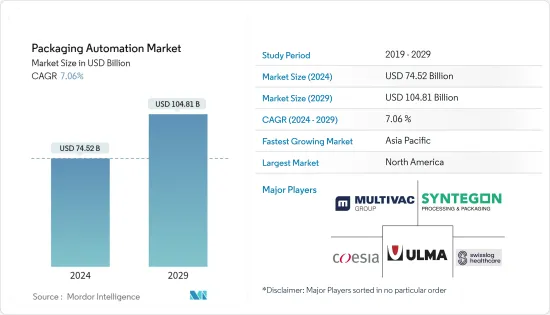

包裝自動化市場規模預計到2024年為745.2億美元,預計到2029年將達到1048.1億美元,在預測期內(2024-2029年)複合年成長率預計為7.06%。

主要亮點

- 自動化提高了二次包裝的效率和生產力。自動化系統擅長紙箱組裝、裝箱、堆疊和貼標等任務,在速度和準確性方面優於手工勞動。這會提高吞吐量並減少勞動力需求,使公司能夠騰出人力資源來執行更具策略性的任務。

- 公司擴大客製化包裝解決方案來滿足客戶的需求。例如,2023年5月,專門從事醫療/製藥和食品行業的ULMA Packaging公司推出了緊湊型全自動包裝線。此生產線處理從產品裝載到最終碼垛的整個包裝過程,適合尋求自動化和簡化包裝業務的公司。這項創新有助於公司最佳化工廠佔地面積並提高整體業務效率。

- 隨著自動化在包裝領域變得越來越普遍,公司正在獲得降低營運成本、提高準確性和增強擴充性的好處。包裝器材製造商正在推出促銷計劃,以進一步推動這一趨勢,使最終用戶行業更容易採用這些先進技術。

- 自動化,特別是與機器人技術相結合,對於釀酒廠和其他消費品企業來說已經變得非常寶貴。儘管許多快速消費品公司已經在實施自動化,但酒廠仍被要求加速採用自動化。其好處包括提高生產效率和產品品質、增強安全和衛生以及資料主導的洞察力。這些技術使釀酒廠能夠保持產品品質的一致性並簡化生產流程。

- 雖然包裝自動化的好處是顯而易見的,但高昂的初始資本支出可能對中小型企業構成阻礙。此外,隨著中國生產成本上升以及人民幣兌美元走強,投資者正在尋找其他生產地點。然而,在這一轉變中,製造商不應忽視品質和環保實踐。對尖端自動化技術的適應是漸進式的,通常需要數年時間才能改善。但緩慢的做法可能會破壞區域成長機會。公司必須平衡創新需求與實施的實用性,以便在不斷變化的市場環境中保持競爭力。

包裝自動化市場趨勢

食品最終用戶部分預計將佔據主要市場佔有率

- 食品包裝自動化對於提高業務效率、維持產品品質和滿足消費者需求至關重要。填充、密封、貼標籤和堆疊等任務的自動化使食品包裝更快、更一致。結果,生產力提高,勞動需求減少。自動化系統可確保準確性和均勻性,這對於維持食品完整性和安全性至關重要。自動化可最大限度地減少人為錯誤和污染的風險,確保更高的衛生標準並遵守嚴格的食品安全法規。

- 自動化正在徹底改變許多行業,食品和飲料行業也不例外。從基本的取放功能到罐頭、袋子和包裝袋製造等複雜流程,機器人解決方案現已涵蓋整個包裝領域。這些包裝創新提高了糖果等日常產品包裝的生產力、成本效率和品質。先進的機器人和自動化技術使製造商能夠適應各種物料輸送和格式,從而提供更大的靈活性和對市場需求的適應性。感測器與即時監控系統的整合進一步提高了自動包裝線的效率和可靠性。

- 2023 年 5 月,服務於食品、飲料和化妝品行業的瑞士OEM包裝器材製造商 Rotzinger 與工業無線自動化專家 CoreTigo 在 Interpack 上合作。透過將 CoreTigo 的 IO-Link 無線技術整合到 Rotzinger 的先進封裝設備中,我們的目標是增強功能,並專注於靈活性、吞吐量和永續性。此次合作凸顯了工業自動化採用無線通訊技術的持續成長趨勢,以促進無縫資料交換和遠端監控。此類技術的整合不僅提高了營運效率,而且支援預測性維護並減少停機時間。

- 隨著食品公司增加研發投資以改善其產品並利用自動化來改善衛生、延長保存期限和提高成本效率,包裝自動化的前景必將顯著成長,看起來我們可以期待成長。對研發的關注凸顯了該產業對創新和持續改進的承諾。透過投資先進的自動化技術,食品公司可以實現規模經濟、減少廢棄物並提高市場競爭力。這些先進技術預計將加速整個食品包裝產業自動化解決方案的採用,以支持長期成長和永續性。

預計北美將佔據較大市場佔有率

- 美國是北美領先的包裝市場,Amcor Ltd 和 Mondi PLC 等行業巨頭在創新和研發活動的大量投資方面處於領先地位。對先進封裝技術的日益關注旨在提高生產力、降低人事費用並提供更多客製化的封裝解決方案。值得注意的是,對永續性的日益關注促使公司推出新機械,以最大限度地減少對環境的影響並支持環保包裝實踐。

- 此外,美國利用其強勁的包裝器材出口來鞏固其市場地位。包括博世包裝服務在內的公司已涉足糖果零食、烘焙、新鮮和冷凍食品以及藥品等各個領域。這種多元化策略不僅擴大了我們的市場廣度,而且還提高了各種包裝應用的技術進步和業務效率。

- 智慧輸送技術 (ICT) 系統正在成為傳統機械系統的智慧替代品,克服了吞吐量和物理限制。例如,羅克韋爾自動化的 MagneMove Lite 系統透過實現更快、更靈活的有效負載移動,正在徹底改變操作。該系統提高了更高 SKU 營運的效率,能夠更快地回應不斷變化的生產需求,並減少停機時間。

- 同時,隨著工業 4.0 的進步,加拿大的包裝產業擴大轉向緊湊型自動化解決方案,例如遠端視覺感測器。值得注意的是,人工智慧和機器學習技術正在應用於因空間限制而限制大型自動化機械投資的設施。這些創新,例如解析度更高的遠端感測器,無需人工直接參與即可進行更仔細的檢查,從而提高了準確性並減少了對體力勞動的需求。此外,這些技術有助於即時監控和資料分析,從而做出更明智的決策和最佳化生產流程。

包裝自動化產業概況

包裝自動化市場高度分散,主要參與者包括 Multivac Group、Coesia SpA、ULMA Packaging、Syntegon Technology 和 Swisslog Healthcare。市場上的公司正在進行策略性投資、建立合作夥伴關係並進行合作,以滿足日益成長的水資源管理需求。我們正在擴大我們的產品和解決方案組合,加強我們的分銷網路,並利用先進技術提高生產效率和產品質量,以獲得永續的競爭優勢。

- 2024 年 5 月 包裝自動化領域的先驅 LeafyPack 與軟包裝解決方案的領導者 KindPack 合作,推出業界首個先租後買計畫。這項創新舉措將透過顯著提高包裝自動化的可及性來改變大麻業務。

- 2023 年 12 月,莫迪維克集團在印度開設了新的生產設施、展示室、培訓和應用中心,以滿足南亞地區對食品包裝器材不斷成長的需求。

- 2023 年 11 月 Alma Packaging 成為充滿活力和多元化的蘇格蘭包裝行業的領先公司,提供永續且有競爭力的包裝設備解決方案,滿足客戶需求。我們提供市場上最廣泛的機器和應用,包括流動包裝 (HFFS)、熱成型 (TF)、托盤密封 (TS)、立式 (VFFS)、拉伸膜和 Alma 包裝自動化 (UPA)。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 二次包裝自動化案例增加

- 各行業越來越多採用自動化解決方案

- 市場挑戰/限制

- 高資本成本和網路安全問題

第6章 市場細分

- 依產品類型

- 填充

- 標籤

- 箱式包裝

- 套袋

- 碼垛

- 封蓋

- 包裹

- 其他產品類型

- 按最終用戶

- 食品

- 飲料

- 藥品

- 個人護理和洗護用品

- 工業/化學產品

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Multivac Group

- Coesia Spa

- ULMA Packaging

- Syntegon Technology

- Swisslog Healthcare

- Rockwell Automation Inc.

- Sealed Air Corporation

- Mitsubishi Electric Corporation

- Automated Packaging System LLC(Sealed Air Corporation)

第8章投資分析

第9章市場的未來

The Packaging Automation Market size is estimated at USD 74.52 billion in 2024, and is expected to reach USD 104.81 billion by 2029, growing at a CAGR of 7.06% during the forecast period (2024-2029).

Key Highlights

- Automation enhances efficiency and productivity in secondary packaging. Automated systems excel at tasks like carton erecting, case packing, palletizing, and labeling, outperforming manual processes in speed and accuracy. This translates to increased throughput and reduced labor demands, allowing companies to reallocate human resources to more strategic tasks.

- Companies are increasingly tailoring packaging solutions to meet customer demands. For instance, in May 2023, ULMA Packaging, specializing in medical/pharmaceutical and food sectors, unveiled compact, fully automated packaging lines. These lines handle the entire packaging process, from product loading to final palletizing, catering to businesses seeking to automate or streamline their packaging operations. This innovation helps companies optimize factory footprints and improve overall operational efficiency.

- As automation gains traction in packaging, businesses are reaping its benefits, including reduced operational costs, improved accuracy, and enhanced scalability. Packaging machinery manufacturers are rolling out promotional schemes to further this trend, making it easier for end-user industries to adopt these advanced technologies.

- Automation, especially when coupled with robotics, is proving invaluable for wineries and other consumer-packaged goods businesses. While many CPG companies have already integrated automation, wineries are urged to hasten their adoption. The benefits are vast, spanning from heightened production efficiency and product quality to enhanced safety, hygiene, and data-driven insights. These technologies enable wineries to maintain consistency in product quality and streamline their production processes.

- While the advantages of packaging automation are clear, the substantial initial capital outlay can deter smaller firms. Moreover, with production costs rising in China and the Yuan strengthening against the Dollar, investors are eyeing alternative manufacturing hubs. Yet, amidst these shifts, manufacturers must not lose sight of quality and eco-friendly practices. Adapting to cutting-edge automation technologies is a gradual process, often taking years to refine. However, a sluggish approach risks stunting regional growth opportunities. Companies must balance the need for innovation with the practicalities of implementation to stay competitive in the evolving market landscape.

Packaging Automation Market Trends

Food End-User Segment Expected to Hold Significant Market Share

- Automation in food packaging is pivotal for enhancing operational efficiency, maintaining product quality, and meeting consumer demands. By automating tasks such as filling, sealing, labeling, and palletizing, food packaging operations become faster and more consistent. This, in turn, increases production rates and reduces labor requirements. Automated systems ensure precision and uniformity, which are critical for maintaining the integrity and safety of food products. Automation minimizes human error and contamination risks, thereby ensuring higher standards of hygiene and compliance with stringent food safety regulations.

- Automation has revolutionized various industries, and the food and beverage sector is no exception. From basic pick-and-drop functions to complex processes like can, pouch, or packet manufacturing, robotics solutions now cover the entire packaging spectrum. This transformation in packaging methodologies has led to increased productivity, cost efficiencies, and improved quality, even in the packaging of everyday items like candies. Advanced robotics and automation technologies enable manufacturers to handle a wide range of packaging materials and formats, offering greater flexibility and adaptability to market demands. The integration of sensors and real-time monitoring systems further enhances the efficiency and reliability of automated packaging lines.

- In May 2023, Rotzinger, a Swiss OEM packaging machinery manufacturer serving the food, beverage, and cosmetic sectors, partnered with CoreTigo, a specialist in industrial wireless automation, at Interpack. By integrating CoreTigo's IO-Link wireless technology into Rotzinger's advanced packaging equipment, the collaboration aims to introduce enhanced capabilities, emphasizing flexibility, throughput, and sustainability. This partnership highlights the growing trend of adopting wireless communication technologies in industrial automation, which facilitates seamless data exchange and remote monitoring. The integration of such technologies not only improves operational efficiency but also supports predictive maintenance and reduces downtime.

- As food companies increase their R&D investments to refine their offerings and leverage automation for improved hygiene, extended shelf life, and cost efficiencies, the outlook for packaging automation appears promising for substantial growth. The focus on R&D underscores the industry's commitment to innovation and continuous improvement. By investing in advanced automation technologies, food companies can achieve economies of scale, reduce waste, and enhance their competitive edge in the market. These advancements are expected to drive the adoption of automation solutions across the food packaging industry, supporting long-term growth and sustainability.

North America Expected to Hold Significant Market Share

- The United States stands out as a leading packaging market in North America, with industry giants like Amcor Ltd and Mondi PLC spearheading significant investments in innovation and R&D activities. This heightened focus on advanced packaging technologies aims to enhance productivity, cut labor expenses, and offer more tailored packaging solutions. Notably, a growing emphasis on sustainability is prompting firms to adopt new machinery that minimizes environmental impact and supports eco-friendly packaging practices.

- Moreover, the United States leverages its robust packaging machinery exports, bolstering its market position. Companies, including Bosch Packaging Services, are diversifying into various sectors such as confectionery, bakery, fresh and frozen foods, and pharmaceuticals. This diversification strategy not only broadens their market reach but also drives technological advancements and operational efficiencies across different packaging applications.

- Intelligent Conveyor Technology (ICT) systems are emerging as a smart alternative to traditional mechanics, overcoming their throughput and physical limitations. Rockwell Automation's MagneMove Lite system, for instance, is revolutionizing operations by enabling faster and more flexible payload movement. This system enhances higher-SKU operations' efficiency, allowing for quicker adaptation to changing production demands and reducing downtime.

- Meanwhile, Canada's packaging sector is increasingly turning to compact, automated solutions like remote vision sensors, aligning with the advancements of Industry 4.0. Notably, AI and ML technologies are finding applications in facilities where space constraints limit investments in larger automation machinery. These innovations, such as remote sensors with enhanced resolution, allow for precise inspections without direct human involvement, improving accuracy and reducing the need for manual labor. In addition, these technologies facilitate real-time monitoring and data analysis, leading to more informed decision-making and optimized production processes.

Packaging Automation Industry Overview

The packaging automation market is highly fragmented, with major players like Multivac Group, Coesia SpA, ULMA Packaging, Syntegon Technology, and Swisslog Healthcare. Companies in the market are strategically investing, forming partnerships, and collaborating to address the increasing demand for water management. They are expanding product or solutions portfolios, enhancing distribution networks, and leveraging advanced technologies to improve production efficiency and product quality to gain sustainable competitive advantage.

- May 2024: LeafyPack, a pioneer in packaging automation, collaborated with KindPack, a leader in flexible packaging solutions, to launch the industry's first Lease-to-Own Program. This innovative initiative is set to transform cannabis operations by significantly enhancing the accessibility of packaging automation.

- December 2023: MULTIVAC Group opened a new site in India with a production facility, showroom, and training and application center to address the growing demand for food packaging machines in the South Asian region.

- November 2023: ULMA Packaging established itself as one of the leaders in the dynamic and diverse Scottish packaging industry, offering sustainable and competitive packaging machinery solutions that meet its customers' needs. The ULMA's unique proposition includes the widest range of machines and applications available on the market, comprising Flow Pack (HFFS), Thermoforming (TF), Traysealing (TS), Vertical (VFFS), Stretch Film packaging technologies, and ULMA Packaging Automation (UPA).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Automation for Secondary Packaging

- 5.1.2 Increasing Adoption of Automation Solutions Across Various Industries

- 5.2 Market Challenges/Restraints

- 5.2.1 High Capital Cost and Cybersecurity Concerns

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Filling

- 6.1.2 Labelling

- 6.1.3 Case Packaging

- 6.1.4 Bagging

- 6.1.5 Palletizing

- 6.1.6 Capping

- 6.1.7 Wrapping

- 6.1.8 Other Product Types

- 6.2 By End-user

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceuticals

- 6.2.4 Personal Care and Toiletries

- 6.2.5 Industrial and Chemicals

- 6.2.6 Other End-users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 South Africa

- 6.3.5.3 Egypt

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Multivac Group

- 7.1.2 Coesia Spa

- 7.1.3 ULMA Packaging

- 7.1.4 Syntegon Technology

- 7.1.5 Swisslog Healthcare

- 7.1.6 Rockwell Automation Inc.

- 7.1.7 Sealed Air Corporation

- 7.1.8 Mitsubishi Electric Corporation

- 7.1.9 Automated Packaging System LLC (Sealed Air Corporation)