|

市場調查報告書

商品編碼

1629756

歐洲包裝自動化:市場佔有率分析、行業趨勢和成長預測(2025-2030)Europe Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

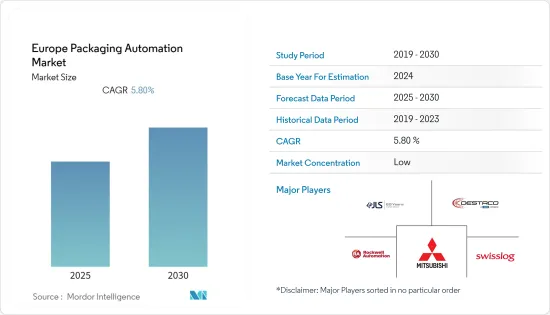

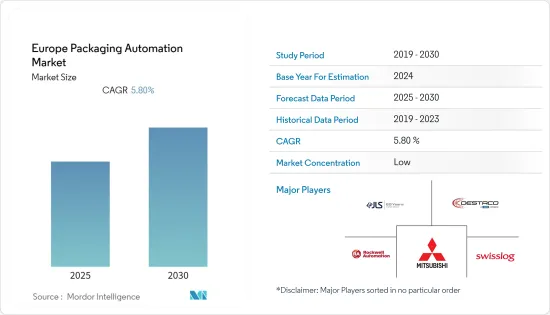

歐洲包裝自動化市場預計在預測期內複合年成長率為 5.8%

主要亮點

- 包裝是任何產品設計中的主導元素。消費品產業正在努力縮短從產品開發到銷售點的交付時間。因此,快速包裝對於將消費品快速推出市場至關重要,並且已成為產品成功的基本要素。市場競爭要求製造商採取大幅降低成本的措施。降低成本的措施意味著將各種手動流程自動化並升級半自動化流程。

- 事實證明,在將工業機器人完全整合到自動化系統的最新進展中,一個大腦可以控制兩個世界,這對包裝產業至關重要,尤其是在高度自動化的生產線上。

- 自主移動機器人 (AMR) 和協作機器人的發展使製造商能夠改善以前未使用機器人的領域的業務,例如最終包裝、重新包裝和內部物流。

- 在包裝自動化解決方案中,由於製藥、化學品和食品加工等關鍵最終用戶產業的需求不斷成長,堆垛機預計將成長最快。先進的機器人碼垛系統可以同時疊棧多條生產線,顯著降低成本並提高生產率。

- 此外,COVID-19 大流行加速了對包裝自動化的需求,尤其是在製藥市場。由於工人在大流行期間減少了體力勞動,自動化系統透過減少接觸來確保患者和藥劑師的安全。藥品包裝和劑量驗證由機器完成,可快速、準確、安全地驗證每個袋子中每種藥物的尺寸、顏色、形狀和數量。

歐洲包裝自動化市場趨勢

電子商務汽車箱和其他包裝的需求仍然很高

倉庫自動化和類似技術正在成為快速發展的電子商務世界中的關鍵差異化因素,保證一到兩天的交貨已成為常態。零售商和品牌正在尋找新的方法來滿足不斷成長的訂單量和客戶對快速交貨的期望。

- 當今的倉庫自動化市場提供了比以往更多的選擇,為了成功的自動化舉措必須考慮這些選擇。除了手動倉庫管理流程外,第三方物流提供者還可以實施各種類型的自動化,包括包裝機,以有效縮短前置作業時間。

- 只需要自動執行一項或兩項任務的小型企業可以從這項技術中受益。自動化解決方案還可以透過將包裝工人重新部署到其他工作崗位來幫助企業緩解勞動力短缺問題。現代包裝自動化解決方案可以部分或完全自動化流程,使公司能夠在不僱用額外員工的情況下提高吞吐量。

- 許多公司依賴電子商務產品的自動化包裝和揀選解決方案。允許您按照所運輸產品的精確尺寸製作盒子和箱子的解決方案正在成為整個全部區域行業的新興趨勢。

- 隨著電子商務企業面臨的壓力越來越大,保持競爭力變得前所未有的困難。想要取得好的結果是很困難的,特別是如果沒有正確的技能。包裝自動化平台和技術(例如 RFID 庫存追蹤系統)可以為公司的包裝線提供寶貴的支援。隨著網路購物需求的增加,這些系統將變得更加重要。

- 有各種工具可以幫助品牌選擇正確的包裝,其中許多是環保的(例如使用環保的空隙填充和紙膠帶)。透過分析物流問題和儲存環境等關鍵因素,品牌和零售商發現自動化包裝系統非常適合創建客自訂紙箱,消除對塑膠的需求,並提供所需的容量增加。

英國在該地區引領包裝自動化

隨著最近人們對減少食品和包裝廢棄物的關注,使用自動化包裝來製造保存期限長的食品將簡化零售商的採購管理,並為該國的食品提供新的收益來源,它可以幫助您解鎖。

Jacob White的自動裝盒機廣泛應用於英國製造業。 Jacob White 包裝從最精緻的紙製品到藥品、食品和飲料解決方案的所有產品,並且根據英國許多行業的嚴格規定,Jacob White 包裝從英國最大的品牌到小型生產線的所有產品,是一個受歡迎的選擇。 Jacob White 是一家高品質包裝解決方案的全球供應商,在英國擁有大量基本客群。

然而,包裝的重要性不僅限於食品安全。這是一個多步驟的流程,包括食材、包裝和標籤,透過自動化進行持續改進可以快速為您的營運帶來顯著的效益。

此外,一家英國衛生紙製造商正在將大尺寸衛生紙引入其生產線,需要一台衛生紙包裝機來處理較大的產品,同時保持生產線所需的速度和精確度。紙箱由旋轉真空系統自動拾取和回收,完整的紙巾被自動密封並從紙箱機中排放。

智慧包裝設備可以自動計算產品的重量,並收集具有精確指定的目標重量的批次。這可以防止多餘產品的擴散和輕包裝的銷售。自動包裝簡化了訂單處理並提供廣泛的產品。自動化流程也非常靈活,讓您只需按一下按鈕即可管理需求波動。

歐洲包裝自動化產業概況

歐洲包裝自動化市場分散,主要參與者包括: JLS Automation、三菱、羅克韋爾自動化、Swisslog Holding AG 等公司利用歐洲技術投資和創新更多自動化包裝解決方案,從而增加了市場需求。

- 2020 年 3 月 - 瑞仕格物流宣布推出與 Autostore 結合的新機器人物品揀選,稱為 ItemPiQ。 ItemPiQ 讓機器人技術比以往任何時候都更適用的地方。該系統基於輕型6軸KUKA機器人和具有3D相機和智慧型影像識別軟體的視覺系統。

- 2021 年 4 月 - 羅克韋爾自動化與柯馬合作,簡化製造過程中的機器人整合。此次夥伴關係是一種協作開發和銷售模式,將為兩家公司的客戶提供統一的機器人控制產品。這種夥伴關係將有助於滿足從汽車到物流到食品和飲料包裝等多個行業的需求。

- 2021 年 7 月 - JLS 在拉斯維加斯 PAck Expo 展會上展示了機器人紙箱閉合。這是一種名為JLS TRAK的高速紙箱管理系統,與Peregrine的正向紙箱輸送系統結合。這款 JLS TRAK 機器人可同時關閉紙箱、拾取紙箱並將其放置在出口處。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 製造商降低營業成本的壓力越來越大

- 減少機器停機時間和產品浪費

- 新興市場的崛起導致勞動成本下降和競爭加劇

- 市場限制因素

- 初始投資高

第6章 市場細分

- 依業務類型

- B2B電子商務零售商

- B2C電子商務零售商

- 全通路零售商

- 批發商

- 製造商

- 個人文件運輸公司

- 其他

- 按行業分類

- 食物

- 藥品

- 化妝品

- 家庭使用

- 飲料

- 化學品

- 糖果零食

- 倉庫

- 其他

- 依產品類型

- 填充

- 標籤

- 臥式枕/立式枕

- 箱式包裝

- 套袋

- 碼垛

- 封蓋

- 包裹

- 其他

第7章 競爭格局

- 公司簡介

- JLS Automation

- Mitsubishi Corporation

- Rockwell Automation

- Destaco

- Swisslog Holding AG

- Emerson Industrial Automation

- ULMA Packaging

- ATS Automation Tooling Systems

- ABB

- Massman Automation Designs, LLC

- Schneider Electric

- Denso

- Gerhard Schubert GmBH

第8章投資分析

第9章 市場的未來

The Europe Packaging Automation Market is expected to register a CAGR of 5.8% during the forecast period.

Key Highlights

- Packaging is a dominant element in the design of any product. The consumer goods industry is working to reduce the time between product development and delivery to the point of sale. Therefore, rapid packaging is critical to maintaining the short-term time-to-market for consumer products and is a critical component of product success. The market competition requires manufacturers to take adequate measures to cut costs. Measures to cut costs mean automating various manual processes and raising the level of semi-automated processes.

- Recent advances in fully integrating industrial robots into automation systems that can control both worlds with a single brain have proven crucial in the packaging industry, especially in highly automated lines.

- With the development of autonomous mobile robots (AMRs) and collaborative robots, this means manufacturers can improve operations in areas previously not seen with robots, such as final packaging, repacking, in-house logistics.

- In terms of packaging automation solutions, palletizers are expected to witness the fastest growth due to growing demand from key end-user sectors such as pharmaceutical, chemical, and food processing. The advanced robotic palletizing system can palletize multiple production lines simultaneously, significantly reducing costs and increasing productivity.

- Moreover, the COVID-19 pandemic has accelerated the demand for automated packaging, especially in the pharmaceutical market; as the labor manual count has cut down during the pandemic period, automated systems are keeping the patients and pharmacists safe by reducing contact. Pharmaceutical packaging and medication verification have been done by machines that can check the size, color, shape, and quantity of each medicine in each bag quickly, accurately, and safely.

Europe Packaging Automation Market Trends

eCommerce automated case and other packaging to hold high demand

Warehouse automation and similar technologies are becoming key differentiators in the fast-growing world of e-commerce, where a 1-2-day delivery guarantee is now the norm. Retailers and brands are looking for new ways to meet customer expectations for ever-increasing order volumes and fast delivery.

- Today's warehouse automation market offers more options than ever, which must be considered for any automation initiative to be successful. In addition to manual warehousing processes, third-party logistics providers can implement various types of automation to reduce lead times effectively, including packaging machines.

- Small businesses that only need to automate one or two tasks can benefit from this technology. Automation solutions can also help businesses alleviate labor shortages by relocating packaging workers to other jobs. Modern packaging automation solutions can partially or fully automate processes, allowing businesses to increase throughput without hiring additional staff.

- Many company s are using automated packing and picking solutions for eCommerce products. Solutions that can make boxes and create cases to the exact size of the product that has to be shipped are becoming a new trend in the industry across the region.

- As the pressure on e-commerce businesses grows, staying competitive has never been more challenging. It can be challenging to achieve good results, especially without the right skills. Packaging automation platforms and technologies, such as RFID inventory tracking systems can provide valuable support to a company's packaging lines. As the demand for online shopping grows, these systems will become even more critical.

- Various tools are available to help brands choose suitable packaging, many of which are environmentally friendly (e.g., using environmentally friendly void fillers and paper tape). When analyzing key factors such as logistical issues and storage environments, a brand or retailer may find that an automated packaging system is ideal for creating custom cartons, eliminating the need for plastic, and providing the desired increase in capacity.

United Kingdom to lead the packaging automation in the region

With the recent focus on reducing food and packaging waste, using automated packaging to create longer shelf-life foods could help retailers simplify purchasing management and unlock new revenue streams for the food in the country.

United Kingdom manufacturing industries are widely installed with Jacob White's s automatic cartoning machines across the country. Packaging everything from the most delicate paper products to pharmaceutical, food, and beverage solutions, and with stringent regulations across many of the UK's industries, Jacob White is a popular choice for everything from the UK's biggest brands to the minor production lines. Jacob White has a large customer base in the UK and is a global supplier of high-quality packaging solutions.

But the importance of packaging goes beyond food safety. It is a multi-step process that includes dosing, packaging, and labeling, and continuous improvement through automation can quickly bring significant benefits to your operations.

Further, one of the UK's tissue manufacturers looking to bring large-format tissues to their production lines needed a tissue packaging machine to handle more oversized products while maintaining the speed and delicacy demanded by their production lines. The cartons can be automatically picked and collected by the rotating vacuum system, and the full wipes are automatically sealed and ejected from the carton machine.

Intelligent packaging equipment can automatically calculate product weight to collect batches with precisely specified target weights. This prevents the spread of excess products and the sale of low-weight packages. Automated packaging simplifies order fulfillment and offers a wide range of products. The automated process is also very flexible, allowing you to manage fluctuations in demand at the touch of a button.

Europe Packaging Automation Industry Overview

The Europe Packaging Automation Market is fragmented due to the presence of major players such as JLS Automation, Mitsubishi, Rockwell Automation, Swisslog Holding AG, and more. These players are increasing the market demand by investing and innovating more automated packaging solutions with the use of technologies in Europe.

- March 2020 - Swisslog Logistics unveiled its new robotic item picking paired with Autostore, known as ItemPiQ. ItemPiQ makes robotics available in more places than ever before. The system is based on a lightweight 6-axis KUKA robot and a vision system with a 3D camera and intelligent image recognition software.

- April 2021 - Rockwell Automation has partnered with Comau to simplify Robot Integration for manufacturers. The partnership is a collaborative development and selling model that offers the unified robot control product to both companies' customers. This partnership helps to meet the needs of a variety of industries such as automotive to logistics, food and beverage packaging, and more.

- July 2021 - JLS demonstrated robotic carton closing at PAck Expo Las Vegas. It is called the JLS TRAK, a high-speed carton management system that is combined with Peregrine's positive carton transport system; this JLS TRAK robot simultaneously closes the carton, picks it up, and places it on a discharge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increasing Pressure on Manufacturers to Cut Down Operating Costs

- 5.2.2 Reduces Machine Downtime and Product Waste

- 5.2.3 Emerging Markets are Emerging as Low Cost Labor and Increased Competition

- 5.3 Market Restraints

- 5.3.1 High initial investment

6 MARKET SEGMENTATION

- 6.1 By Businesses Type

- 6.1.1 B2B e-commerce retailers

- 6.1.2 B2C e-commerce retailers

- 6.1.3 Omni Channel Retailers

- 6.1.4 Wholesale Distributors

- 6.1.5 Manufacturers

- 6.1.6 Personal Document Shippers

- 6.1.7 Others

- 6.2 By End-User Vertical

- 6.2.1 Food

- 6.2.2 Pharmaceuticals

- 6.2.3 Cosmetics

- 6.2.4 Household

- 6.2.5 Beverages

- 6.2.6 Chemical

- 6.2.7 Confectionery

- 6.2.8 Warehouse

- 6.2.9 Others

- 6.3 By Product Type

- 6.3.1 Filling

- 6.3.2 Labelling

- 6.3.3 Horizontal/Vertical Pillow

- 6.3.4 Case Packaging

- 6.3.5 Bagging

- 6.3.6 Palletizing

- 6.3.7 Capping

- 6.3.8 Wrapping

- 6.3.9 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JLS Automation

- 7.1.2 Mitsubishi Corporation

- 7.1.3 Rockwell Automation

- 7.1.4 Destaco

- 7.1.5 Swisslog Holding AG

- 7.1.6 Emerson Industrial Automation

- 7.1.7 ULMA Packaging

- 7.1.8 ATS Automation Tooling Systems

- 7.1.9 ABB

- 7.1.10 Massman Automation Designs, LLC

- 7.1.11 Schneider Electric

- 7.1.12 Denso

- 7.1.13 Gerhard Schubert GmBH