|

市場調查報告書

商品編碼

1628841

拉丁美洲包裝自動化:市場佔有率分析、行業趨勢和成長預測(2025-2030)LA Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

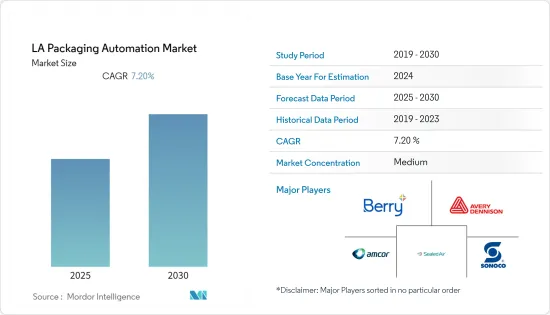

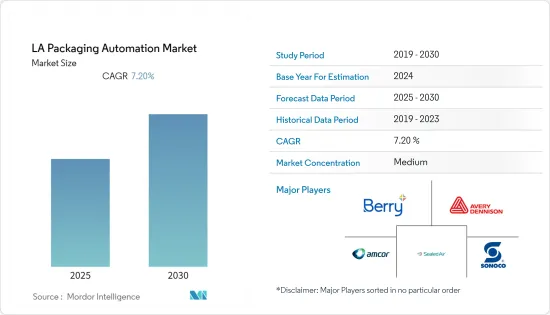

拉丁美洲包裝自動化市場預計在預測期內複合年成長率為 7.2%

主要亮點

- 在包裝自動化對該地區產生影響之前,包裝是一個完全手動的過程。隨著競爭的加劇,製造商採取了削減成本的措施,透過自動化各種手動流程和提高半自動化流程的水平來降低包裝成本。

- 如今,在拉丁美洲,消費者和政府的環保意識日益增強,人們對更輕、可回收和可重複使用的包裝越來越感興趣。必須遵守新的標籤規則,特別是在食品和飲料、麵包店和醫療市場。

- 在墨西哥,公司正專注於包裝產品創新。例如,2021 年 11 月,Festo 和 Hibernya Industrial 為達能和 Danup 優格合裝包開發了自動化包裝解決方案。

- 這對於墨西哥優格包裝產業來說是一個里程碑,因為在墨西哥優格包裝產業創建之前,國內沒有能夠加工這種多品種包裝的設備。這種類型的過程由操作員手動執行,他們從每條生產線取出產品並將其送入包裝機。

- 巴西、墨西哥和阿根廷是該地區填充、貼標、裝袋、堆疊和封蓋等自動化流程的主要推動者。食品、製藥、化妝品、個人護理、食品和飲料甚至倉儲行業的公司擴大轉向這些自動化解決方案來最佳化業務流程並降低營運成本。

拉丁美洲包裝自動化市場趨勢

食品和飲料部門佔營業費用的最大部分。

技術的進步使其更加靈活和可配置,公司正在改善物流和品質。自動化將繼續改變食品和飲料公司的整個供應鏈,一直到客戶手中。

消費品包裝公司需要準確且可重複的包裝流程。高週期單獨包裝是一項挑戰,因此在包裝線上使用機器人技術的公司可以提高吞吐量、效率和品質。從原料處理到初級包裝、二級包裝和碼垛,機器人技術被證明具有巨大的投資回報。

包裝自動化還包括該地區更環保的解決方案,例如可回收、生物分解性和可再填充。研究表明,洗碗機在拉丁美洲的普及率較低,手洗已成為常態,塑膠寶特瓶是該地區的主要產品包裝,且數量不斷成長。

此外,巴西可口可樂公司已採用可重複使用的寶特瓶設計,並投資擴大其重複使用基礎設施,作為其到 2030 年大幅擴大可重複使用包裝的雄心的一部分。所有品牌的通用瓶子設計顯著降低了清洗、填充和退貨運輸的物流成本。

肉類工業及其產品是非洲大陸的重要部門。隨著越來越多的消費者開始關心他們的肉類來自哪裡以及如何加工,企業面臨新的挑戰。 HPP技術可以讓您獲得高品質的已烹調產品,保存期限更長,增加出口到其他國家的可能性。

拉丁美洲的消費者正在開闢新天地,要求更清潔的添加劑、更永續和易於消費。在其他市場,消費者要求為他們購買的產品提供更安全、更永續和安全的包裝,這促使企業透過新的創新來創造新產品。

墨西哥該產業發展迅速

技術創新、永續性問題和有吸引力的經濟效益是包裝自動化近年來在該地區發展如此之快的部分原因,消費者看待包裝和與包裝互動的方式也在改變。

- 墨西哥正走向包裝技術現代化。考慮到當前經濟、商業和政治局勢的穩定性以及國家的預期成長,包裝設備進口預計在不久的將來將繼續成長。

- 預計成長將受到強勁的國內和國際需求以及許多公司對業務現代化以提高效率和競爭的興趣等關鍵因素的推動。

- 幾家使用包裝器材的跨國公司和商業集團表示打算繼續在墨西哥投資,同時了解政治決策將對其業務運作產生的影響。公司正在適應墨西哥的現實,目前墨西哥的需求前景和成長是穩定的。

- 食品、飲料、個人護理和製藥行業佔包裝器材需求的大部分。高比例的年輕人和不斷壯大的中階正在推動食品需求。飲料業的軟性飲料、瓶裝水、啤酒和烈酒等產品表現尤其出色。

- 此外,在製藥業,儘管來自學名藥的競爭日益激烈且新增投資水準較低,但製藥業仍具有競爭力,對包裝器材的需求不斷增加。

拉丁美洲包裝自動化產業概況

拉丁美洲的包裝自動化產業較為分散,主要參與者包括 Amcor Flexibles MX、Avery Dennison Corporation、Berry Global Inc. 和 Sonoco Products Company。這些公司投資於產品創新的研發,並回應新的創新以實現成長。

- 2020 年 9 月 - 艾利丹尼森公司推出了一種生物分解性的服裝標籤緊固件,其材料在接觸土壤生物時會在一年內分解,從而取代塑膠。新型 EcoTouch Bio PP 拉鍊在分解時不會留下對環境有害的微塑膠。

- 2021 年 10 月 - Amcor 在哥倫比亞提供僅由回收材料製成的食用油瓶。 Amkor 與 Alianza 團隊合作推出哥倫比亞第一個完全由回收材料製成的食用油瓶。 Amcor 剛性包裝 (ARP) 改進了其瓶子,以確保安全性、口味變化和透明度。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進與市場約束因素介紹

- 市場促進因素

- 製造商降低營業成本的壓力越來越大

- 減少機器停機時間和產品浪費

- 新興市場的崛起導致勞動成本下降和競爭加劇

- 市場限制因素

- 初始投資高

第6章 市場細分

- 依業務類型

- B2B電子商務零售商

- B2C電子商務零售商

- 全通路零售商

- 批發商

- 製造商

- 個人文件運輸公司

- 其他

- 按最終用戶產業

- 食品

- 藥品

- 化妝品

- 家庭使用

- 飲料

- 化學品

- 糖果零食

- 倉庫

- 其他

- 依產品類型

- 填充

- 標籤

- 水平/垂直枕頭

- 箱式包裝

- 套袋

- 碼垛

- 封蓋

- 包裹

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Klabin SA

- Printpack Inc.

- Berry Global Inc.

- Westrock Company

- Constantia Flexibles

- Sealed Air Corporation

- Transcontinental Mexico

- Sonoco Products Company

- Avery Dennison Corporation

- Clifton Packaging Packaging SA de CV

第8章投資分析

第9章市場的未來

The LA Packaging Automation Market is expected to register a CAGR of 7.2% during the forecast period.

Key Highlights

- Before packaging automation made an impact in the region, packaging was a completely manual process. As competition increased, manufacturers took steps to reduce packaging costs and took measures to reduce costs by automating a variety of manual processes and raising the level of semi-automated processes.

- In Latin America today, consumers and governments are increasingly concerned about the environment and are increasingly interested in lighter, recyclable and reusable packaging. New labeling rules must be followed, especially in the food and beverage, bakery, and medical markets.

- In Mexico, companies are focusing on innovations in packaging products. For instance, in November 2021, Festo and Hybernya Industrial developed an automated packaging solution for multi-packs for Danone and Danup yogurts.

- Prior to the creation of the yogurt packaging industry in Mexico, it was a milestone for the Mexican yogurt packaging industry, given that there was no equipment in the country capable of processing this type of multi-sort packaging. This type of process was done manually by operators who took the product from each line and delivered it to the packaging machine.

- Brazil, Mexico, and Argentina are the main drivers for the region, with automated processes such as filling, labeling, bag egging, palletizing, and capping. Various businesses in food, pharmaceutical, cosmetic, personal care, beverage, and even warehouse are increasingly using these automation solutions to optimize business processes and reduce operating costs.

Latin America Packaging Automation Market Trends

Food and Beverage segment to hold biggest operating expense

As technology advances to become more flexible and configurable, companies are improving logistics and quality. Automation will continue to transform food and beverage manufacturing companies throughout the supply chain and to their customer's doors.

Consumer packaged goods companies need accurate and repeatable packaging processes. Individual packaging at high-cycle rates can be challenging, so companies that use robotics in their packaging lines can improve their throughput, efficiency, and quality. From raw product handling to primary packaging, secondary packaging, and palletizing, robotics has proven a high return on investment.

Packaging automation also involves greener solutions like recyclable, biodegradable, and refillable methods in the region. According to research conducted, Latin America has a low penetration for dishwashers, and hand washing is dominant where the plastic PET bottle is a dominant product pack and has increased its growth in terms of volume in this region.

Further, Coca-Cola company in Brazil invested in expanding the reuse infrastructure as part of its ambition to incorporate the design of reusable PET bottles and significantly expand reusable packaging by 2030. Universal bottle design for all brands significantly reduces cleaning, filling, and return logistics costs.

The meat industry and its by-products are an important sector on the continent. Companies are facing new challenges as more and more consumers are concerned about the origin and processing of meat. HPP technology allows obtaining high-quality raw or cooked products with a longer shelf life, opening up export possibilities to other countries.

Latin American consumers take on new horizons for cleaner additives, more sustainable, and easy to consume. In other markets, consumers are looking for more secure, sustainable, and safe packaging for the products purchased, and for that reason, companies are innovating new products with new technological innovations.

Mexico to grow significantly in the industry

Technological innovation, sustainability concerns, and attractive economies are some of the reasons packaging automation has grown significantly over the last few years in this region and the way consumers view and interact with packages is also changing.

- Mexico is moving towards modernization for its packaging technologies; considering the stability of the current economic, commercial and political situation and the expected growth of the country; it can be expected that packaging equipment imports will continue to grow in the near future.

- Growth is expected to be driven by key factors such as strong domestic and international demand and the interest of many companies to modernize their operations to improve efficiency and competitiveness.

- Several multinational companies and business groups using packaging machines have indicated that they will continue to invest in Mexico, understanding the impact of political decisions on their operations. Businesses are adapting to the country's realities, and for now, demand prospects and growth in Mexico are stable.

- The food, beverage, personal care, and pharmaceutical industries account for the majority of packaging machinery demand. A high proportion of young people and a growing middle class are driving food demand. The beverage sector performs particularly well in products such as soft drinks, bottled water, beer, and spirits, respectively.

- Further, in the pharmaceutical industry, despite the intensifying competition from generic drugs and low levels of new investments, the pharmaceutical sector continues to keep its sector competitive and in demand for packaging machinery.

Latin America Packaging Automation Industry Overview

Latin America automation packaging is moderately fragmented with the presence of major players in the industry such as Amcor Flexibles MX, Avery Dennison Corporation, Berry Global Inc., Sonoco Products Company, and more. These companies are investing in R&D for product innovations and adapting to new technological innovations for growth.

- September 2020 - Avery Dennison Corporation launched biodegradable apparel tag fasteners made of material that degrades within one year of exposure to soil organisms, replacing the plastic. This new Ecotach bio-PP Fastener degrades without leaving behind microplastics, which are harmful substances for the environment.

- October 2021 - Amcor offered cooking oil bottles made entirely from recycled content in Colombia. Amcor worked with Alianza Team to launch the first bottle in Colombia for cooking oil made with all recycled content. Amcor Rigid Packaging (ARP) refined its bottles to ensure it is safe, causes no change in taste, and is transparent - while maintaining Gourmet's visual branding.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increasing Pressure on Manufacturers to Cut Down Operating Costs

- 5.2.2 Reduces Machine Downtime and Product Waste

- 5.2.3 Emerging Markets are Emerging as Low Cost Labor and Increased Competition

- 5.3 Market Restraints

- 5.3.1 High Initial Investment

6 MARKET SEGMENTATION

- 6.1 Businesses Type

- 6.1.1 B2B e-commerce retailers

- 6.1.2 B2C e-commerce retailers

- 6.1.3 Omni Channel Retailers

- 6.1.4 Wholesale Distributors

- 6.1.5 Manufacturers

- 6.1.6 Personal Document Shippers

- 6.1.7 Others

- 6.2 End-User Vertical

- 6.2.1 Food

- 6.2.2 Pharmaceuticals

- 6.2.3 Cosmetics

- 6.2.4 Household

- 6.2.5 Beverages

- 6.2.6 Chemical

- 6.2.7 Confectionery

- 6.2.8 Warehouse

- 6.2.9 Others

- 6.3 Product Type

- 6.3.1 Filling

- 6.3.2 Labelling

- 6.3.3 Horizontal/Vertical Pillow

- 6.3.4 Case Packaging

- 6.3.5 Bagging

- 6.3.6 Palletizing

- 6.3.7 Capping

- 6.3.8 Wrapping

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Klabin SA

- 7.1.3 Printpack Inc.

- 7.1.4 Berry Global Inc.

- 7.1.5 Westrock Company

- 7.1.6 Constantia Flexibles

- 7.1.7 Sealed Air Corporation

- 7.1.8 Transcontinental Mexico

- 7.1.9 Sonoco Products Company

- 7.1.10 Avery Dennison Corporation

- 7.1.11 Clifton Packaging Packaging SA de CV