|

市場調查報告書

商品編碼

1549825

全球單紙箱市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Mono Cartons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

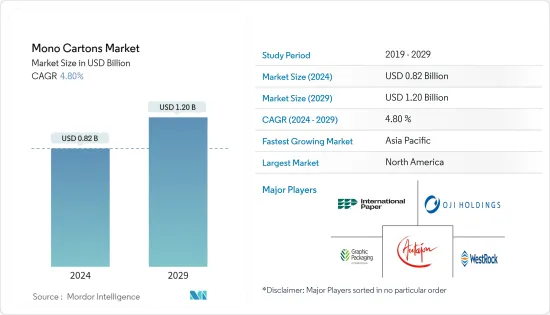

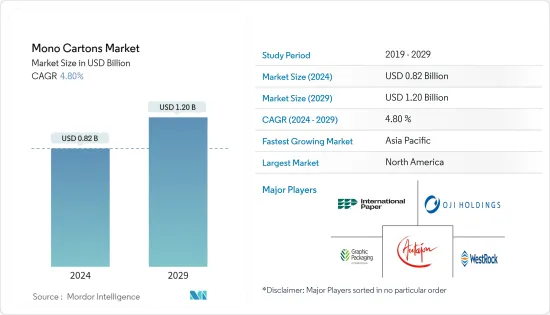

全球單紙箱市場規模預計到 2024 年為 8.2 億美元,預計到 2029 年將達到 12 億美元,在預測期內(2024-2029 年)複合年成長率為 4.80%。

單紙箱是一種輕質且美觀的包裝解決方案。 Monocarton 是一種可折疊紙盒,可提供保護並允許根據各種最終用戶應用的要求定製紙盒。

主要亮點

- 單紙箱用於緊湊地包裝產品,並且高度可客製化,促進了各種最終用戶行業的許多應用。對永續包裝的需求不斷成長正在推動市場成長。塗層和非塗層單紙盒有多種設計、形狀和尺寸,這增加了對有吸引力的設計的需求,並為紙盒創造了成長機會。

- 單紙盒便於儲存和使用。這些紙箱由於其輕質結構有助於減輕包裝重量,並提供適度的強度以確保包裝產品的安全。它還可折疊,提供充足的存儲空間並易於運輸。它的需求量很大,因為它在生產、分銷和消費方面具有成本效益。

- 由於牙膏、肥皂、餅乾和乳霜等小產品的持續儲存和運輸,快速消費品 (FMCG) 產業對單箱的消費至關重要。快速消費品產業也使用印有產品規格標籤的印刷紙盒作為主要包裝材料。由於開發中國家零售店數量的增加和個人可支配收入的增加,預計快速消費品行業的成長將在預測期內推動對單紙盒的需求。

- 電子商務單紙盒作為電子商務包裝的替代品正在引起人們的注意。隨著越來越多的人在網上購買並希望他們的產品安全且狀況良好,單箱已成為重要的選擇。此外,企業可以利用單紙盒的大表面積進行品牌推廣和行銷,增加曝光度並創造更強大的品牌形象。

- 市場正在見證塑膠等替代包裝材料的挑戰。儘管永續包裝越來越受歡迎,但塑膠包裝仍然是市場的關鍵成長要素之一。許多顧客仍然青睞塑膠包裝的舒適度和成本,這使得單紙盒難以普及。要說服消費者和企業放棄塑膠包裝,需要有效的教育和宣導活動,宣傳使用單紙箱的環境效益。

單箱市場趨勢

食品和飲料行業預計將顯著成長

- 食品飲料包裝是食品工業的重要組成部分,對於確保食品飲料安全至關重要。保護食品免受污染和損壞,延長保存期限,並方便運輸和儲存。

- 用於食品包裝的單紙盒由單層紙板製成。單紙盒可回收、耐用且用途廣泛,可用於包裝各種食品,包括生鮮食品、冷凍食品、零嘴零食和烘焙點心。單紙箱包裝可確保食品保持新鮮、受保護且具有視覺吸引力。

- 全球對紙板的需求正在成長。根據Suzano Papel e Celulose預測,2022年紙板消費量預計將達到5,400萬噸,2024年將達到5,600萬噸。全球紙箱消費量的增加預計將在預測期內推動市場成長。此外,根據 Frozen & Refrigerated Buyer 和 Circnca 的數據,2023 年,披薩在美國冷凍食品銷售額中位居榜首,達 15,640.4 億美元,其次是冰淇淋,達 1,463.49 億美元。

- 紙箱包裝可以防止產品受潮,並且可以承受較長的運輸時間,因此越來越多的品牌採用它來為消費者提供更好的效果,主要作為二級和三級包裝的手段。麵包、蛋糕和生鮮產品等加工食品需要使用此類包裝材料,並且正在推動需求。

- 各國加工食品、生鮮食品和肉類的消費量正在增加。食品消費的成長持續受到健康和保健趨勢以及消費者日益成長的道德關注的推動。此外,人口成長預計將成為預測期內支持生鮮食品需求的主要驅動力。有機生產食品的趨勢預計將增加現代雜貨零售店中價格分佈永續生鮮食品的數量。

亞太地區預計將經歷最快的成長

- 亞太地區是全球最大的折疊紙盒包裝市場之一,其中包括單紙盒,其巨大的發展潛力很可能會增加需求。亞洲一些新興國家的需求預計將強勁。由於中國和印度等國家對家常小菜的需求不斷成長,亞太地區主導了全球紙盒包裝市場。

- 隨著消費者關注環保和永續實踐的變化,食品和飲料、醫療保健、個人護理和零售等多個區域行業對單紙盒的需求不斷成長。消費者對永續包裝選擇的認知、原料的可用性、紙張的輕質和可回收特性以及森林砍伐都促進了該地區對紙盒包裝的需求。

- Packman團隊於2023年6月進行的一項研究對印度的單箱公司集團進行了財務分析,排名前五的公司營業額超過20億印度盧比,排名最後五的公司營業額在4.5億印度盧比之間。許多公司向食品、酒類和藥品等各個快速消費品領域供應單紙盒。

- 根據日本經濟產業省及廢紙回收促進中心(PRPC)統計,2023年日本紙張產量約1,160萬噸,紙板產量約1,040萬噸。紙和紙板產量增加約2200萬噸。

- 2023 年 5 月,Omya International AG 宣布投資紙和紙板產業。我們在中國和印尼的紙板廠建造了七座現場粉碎和沈澱碳酸鈣工廠。中國的新工廠包括位於廣西、廣東和山東省的三座研磨碳酸鈣(GCC)工廠,位於山東省的兩座沉澱碳酸鈣(PCC)工廠以及位於福建省的另一座PCC工廠。這些用於造紙的原料可改善紙張性能,如印刷適性、光澤度和平滑度。該地區造紙公司的此類擴張預計將在預測期內推動市場成長。

單箱產業概況

單紙箱市場分散,包括各種公司,包括: Graphic Packaging International LLC、Oji Holdings Corporation、Westrock Company 和 International Paper 等營運公司致力於透過投資、合作、併購等方式創新新的解決方案,以擴大其在該地區的業務。

- 2024 年 2 月:王子控股與利樂日本有限公司合作開發日本首個專用無菌包裝的回收系統。此回收系統從各種來源收集無菌包裝包裝,包括零售店、市政收集以及包裝製造商的廢紙。

- 2023 年 9 月:Graphic Packaging International 以 2.625 億美元收購 Bell。貝爾經營三個加工工廠,兩個位於南達科他州,一個位於俄亥俄州。 Graphic先前預計,收購貝爾將增加2億美元的收入和1,000萬美元的利潤。貝爾公司每年在這些工廠消耗 95,000 噸紙板,並將其轉化為折疊紙盒和相關產品。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 對永續包裝解決方案的需求

- 電子商務正在推動市場成長

- 市場限制因素

- 與替代包裝解決方案的競爭

第6章 市場細分

- 透過塗層

- 搭配外套

- 沒有外套

- 按最終用戶產業

- 飲食

- 藥品

- 個人護理

- 電子產品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Graphic Packaging International LLC

- Oji Holdings Corporation

- Westrock Company

- International Paper Company

- Stora Enso

- Georgia-Pacific LLC

- Autajon Group

- Parksons Packaging Ltd

- Packman Packaging Private Limited

- Packtek

第8章投資分析

第9章 市場機會及未來趨勢

The Mono Cartons Market size is estimated at USD 0.82 billion in 2024, and is expected to reach USD 1.20 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

Mono cartons are lightweight, esthetically appealing packaging solutions. Mono cartons are a type of folding carton that provides protection, and the cartons can be customized based on the requirements of various end-user applications.

Key Highlights

- Mono cartons are used for compact packaging of products, are highly customizable, and facilitate many applications across various end-user industries. An increase in demand for sustainable packaging is driving the market growth. Coated and uncoated mono cartons are produced in multiple designs, shapes, and sizes, increasing the demand for appealing designs and creating growth opportunities for the cartons.

- Mono cartons facilitate convenience for their storage and usage. These cartons help reduce the weight of the package due to their lightweight structure and offer a reasonable amount of strength to ensure the security of the packaged products. It also comes foldable, providing ample storage and shipment easement. It is cost-effective in production, distribution, and consumption, thus, is in high demand.

- The fast-moving consumable goods (FMCG) industry is critical to the consumption of mono cartons due to the continuous storage and shipment of small-sized products such as toothpaste, soap, biscuits, and face cream. The FMCG industry also uses printed cartons labeled with product specifications as the primary packaging material. Due to the increasing number of retail stores, coupled with rising individual disposable income in developing countries, the growing FMCG industry is anticipated to fuel the demand for mono cartons over the forecast period.

- E-commerce mono cartons have emerged as a favored alternative for e-commerce packaging. Mono cartons are a significant choice as more individuals buy online and want their products to arrive securely and in shape. Furthermore, companies can use the large surface area of mono cartons for branding and marketing, increasing exposure and creating a stronger brand identity.

- The market witnesses challenges due to alternate packaging materials such as plastic. Despite the rising popularity of sustainable packaging, plastic packaging remains one of the market's leading growth drivers. Many customers still favor the comfort and cost of plastic packaging, which makes the widespread adoption of mono cartons difficult. Persuading consumers and businesses to abandon plastic packaging necessitates effective educational and awareness initiatives on the environmental benefits of utilizing mono cartons.

Mono Cartons Market Trends

The Food and Beverage Industry is Expected To Witness Significant Growth

- Food and beverage packaging is a critical part of the industry and essential in ensuring the food or beverage is safe. It protects food from contamination and damage, helps extend its shelf life, and makes it easier to transport and store.

- Mono cartons used for food packaging are made from a single layer of cardboard. Mono cartons are recyclable, durable, and versatile and can package various food products, including fresh and frozen food products, snacks, and baked goods. Mono-carton packaging guarantees the food stays fresh, protected, and visually appealing.

- The demand for carton boards globally is witnessing growth. According to Suzano Papel e Celulose, cartonboard consumption was 54 million tons in 2022 and is expected to reach 56 million tons by 2024. The increase in the worldwide consumption of cartons is expected to drive the market growth over the forecast period. Also, according to Frozen & Refrigerated Buyer and Cirnca, the frozen food sales in the United States in 2023 were topped by pizza at USD 1,564.04 million, followed by ice cream at USD 1,463.49 million.

- As carton packaging keeps moisture away from products and resists long shipping times, it is increasingly being adopted by various brands to offer better results to their consumers, mainly as a means to secondary or tertiary packaging. Processed foods, such as bread, cakes, and perishable items, need such packaging materials to be used, thereby driving the demand.

- Various countries are witnessing a rise in the consumption of processed food, fresh produce, and meat sectors. Food consumption growth continues to be fueled by health and wellness trends and the increase in consumers' ethical concerns. Additionally, population growth is expected to be the key driver behind the demand for fresh food during the forecast period. A trend for organically produced foods is expected to increase the presence of sustainable fresh food at premium price points in modern grocery retailers.

The Asia-Pacific Region is Expected to Witness the Fastest Growth

- The Asia-Pacific region is one of the largest global folding carton packaging markets, including mono cartons, and demand is likely to grow due to its significant potential evolution. Demand in some emerging Asian countries is anticipated to be strong. The Asia-Pacific region dominates the global folding carton packaging market due to the rising demand for ready-to-eat meals in China, India, etc.

- As consumers focus on changes to eco-friendly and sustainable practices, mono-carton demand is growing across several regional industries, including food and beverage, healthcare, personal care, retail, etc. Consumer awareness of sustainable packaging choices, raw material availability, paper's lightweight and recyclable characteristics, and deforestation have all contributed to the region's demand for folding carton packaging.

- A survey conducted by the Packman team in June 2023 showed a financial analysis of a group of Indian mono-carton companies; the top five companies had turnovers exceeding INR 200 crore, while the bottom five had turnovers ranging from INR 45 crore to INR 90 crore. Many companies supplied mono cartons for various FMCG segments, including food, alcohol, and pharma products.

- According to METI (Japan) and the Paper Recycling Promotion Center (PRPC), in 2023, the paper production volume in Japan amounted to approximately 11.6 million metric tons, and the production volume for paperboard stood at around 10.4 million metric tons. The paper and paperboard production volume increased to around 22 million metric tons.

- In May 2023, Omya International AG announced investments in its paper and board industry. The company invested in seven onsite plants for ground and precipitated calcium carbonate at paperboard mill locations in China and Indonesia. The new plants in China include three ground calcium carbonate (GCC) plants in Guangxi, Guangdong, and Shandong, two precipitated calcium carbonate (PCC) plants in Shandong, and one more PCC plant in Fujian. These raw materials used for paper manufacturing will improve the paper's properties, such as printability, gloss, smoothness, etc. Such expansions by paper manufacturing companies in the region are expected to drive the market growth over the forecast period.

Mono Cartons Industry Overview

The market is fragmented with the presence of various players such as Graphic Packaging International LLC, Oji Holdings Corporation, Westrock Company, and International Paper. The companies operating are focused on innovating new solutions through investments, collaborations, mergers and acquisitions, etc., to expand their business in the region.

- February 2024: Oji Holdings and Nihon Tetra Pak K.K. partnered to pioneer Japan's first recycling system specifically for aseptic carton packages, a significant step toward gaining a circular economy for paper resources in the country. The recycling system collects aseptic carton packages from various sources, including retail and municipal collections and waste paper from packaging manufacturers.

- September 2023: Graphic Packaging International acquired Bell Inc. for USD 262.5 million. Bell operates three converting facilities: two in South Dakota and one in Ohio. Graphic previously estimated the Bell acquisition would add USD 200 million in sales and yield USD 10 million. Bell consumes an estimated 95,000 tons of paperboard annually at those facilities to convert into folding cartons and related products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Sustainable Packaging Solutions

- 5.1.2 E-commerce to Drive the Market Growth

- 5.2 Market Restraints

- 5.2.1 Competition from Alternative Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Coating

- 6.1.1 Coated

- 6.1.2 Uncoated

- 6.2 By End-User Industry

- 6.2.1 Food & Beverage

- 6.2.2 Pharmaceuticals

- 6.2.3 Personal Care & Comsetics

- 6.2.4 Electronics

- 6.2.5 Other End-User Industries

- 6.3 By Region

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Graphic Packaging International LLC

- 7.1.2 Oji Holdings Corporation

- 7.1.3 Westrock Company

- 7.1.4 International Paper Company

- 7.1.5 Stora Enso

- 7.1.6 Georgia-Pacific LLC

- 7.1.7 Autajon Group

- 7.1.8 Parksons Packaging Ltd

- 7.1.9 Packman Packaging Private Limited

- 7.1.10 Packtek