|

市場調查報告書

商品編碼

1690941

北美瓦楞包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)North America Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

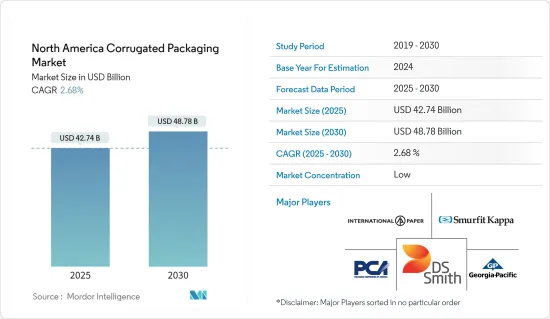

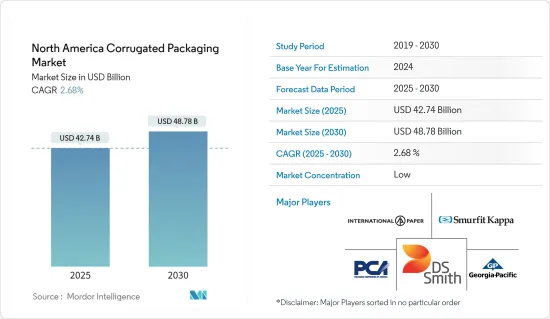

北美瓦楞包裝市場規模預計在 2025 年為 427.4 億美元,預計到 2030 年將達到 487.8 億美元,預測期內(2025-2030 年)的複合年成長率為 2.68%。

瓦楞紙板材料是由瓦楞纖維板製成的。紙板包裝的主要目的是在裝運、運輸和儲存過程中保護產品。由於電子商務、食品飲料和電子行業的快速成長,北美瓦楞包裝市場正在擴大。

主要亮點

- 瓦楞包裝是一種多功能且經濟有效的保護、儲存和運輸各種產品的方法。紙板重量輕、生物分解性、可回收。因此,它已成為包裝行業不可或缺的組成部分,推動市場成長。

- 北美蓬勃發展的電子商務產業是市場成長的主要驅動力。亞馬遜等知名電子商務公司使用瓦楞紙箱作為主要包裝,以保護產品並確保客戶滿意度。用於電子商務的瓦楞紙箱更有可能印刷高品質的圖形並根據包裝內容進行客製化,從而節省成本並增加打開紙箱時的美感。

- 此外,瓦楞包裝製造商正在直接與電子商務供應商合作,以提供更靈活和可客製化的解決方案。亞馬遜致力於透過為每批貨物生產合適尺寸的包裝箱來最大限度地減少客戶的紙板廢棄物並最大限度地提高訂單效率,這有望進一步促進市場成長。

- 該地區的主要企業正在進行各種擴張、收購和合作活動,以增強其市場影響力和地位。例如,2024 年 4 月,美國包裝公司國際紙業(IP)宣布收購英國DS Smith PLC。此次策略性收購預計將透過歐洲和北美的創新和永續性發展增強 IP 的全球包裝業務。

- 消費者對永續包裝意識的不斷提高,促使各製造商和零售商使用環保包裝。公司正專注於投資永續合作,以提高生產能力,為客戶提供服務。例如,2023 年 9 月,愛爾蘭包裝公司 Smurfit Kappa LLC 與美國WestRock 合作,在北美、歐洲和亞洲創造永續瓦楞紙和消費者包裝選擇。

- 由於各種軟包裝選擇的激烈競爭,北美對瓦楞紙箱的需求可能會下降。許多電子商務企業使用軟性包裝選項,因為它們與硬包裝相比重量更輕並且提供最佳的物流解決方案。因此,便利性、節省成本和永續性等因素可能會推動包裝製造商從硬包裝轉向軟包裝,從而阻礙產品需求。

北美瓦楞包裝市場趨勢

預計加工食品領域將穩定成長。

- 北美加工食品和罐裝食品的紙板包裝越來越受歡迎,推動了市場的成長。消費者對穀物、罐裝水果和蔬菜以及鹹味小吃等加工食品的需求不斷增加,推動了該地區對瓦楞包裝的需求。

- 使用紙板包裝有助於保持包裝食品的風味,因為這樣可以讓空氣適當流通,從而增加該地區對加工食品的需求。瓦楞包裝可以根據特定的包裝需求進行客製化,使企業能夠創建自己獨特的食品包裝。

- 由於消費者擴大轉向環保和永續的包裝選擇,公司正在生產更易於回收的瓦楞紙箱。對於許多企業來說,永續紙板具有成本效益,這推動了對該產品的需求。

- 食品公司正在選擇採用最佳材料的客製化包裝解決方案來保護他們的產品,同時減輕重量並優先考慮食品包裝的快速打開方法,從而導致包裝食品領域對瓦楞包裝解決方案的需求增加。

- 雖然人們更傾向於使用輕質、堅固的瓦楞紙箱來運輸和儲存加工食品,但食品和飲料行業方便、經濟高效的瓦楞紙包裝正在推動該地區市場的成長。

- 瓦楞紙箱採用三層層級構造,提供緩衝作用,保護產品在運送過程中免受外力影響。美國加工食品出口的增加進一步推動了對瓦楞包裝的需求。根據美國農業部(USDA)的數據,2023年美國加工食品出口金額為365.1億美元。

預計美國將保持較大的市場佔有率

- 預計美國食品、食品和飲料以及零售業的成長將推動市場成長。消費者和品牌所有者的環保意識越來越強。永續性趨勢、技術創新和誘人的經濟效益是美國瓦楞包裝市場成長的一些原因。

- 使用飲料瓦楞包裝為飲料的安全儲存提供了堅固而靈活的選擇,這是推動市場成長的主要因素。為了消除塑膠的使用,北美的飲料製造商擴大採用紙板包裝。 2023 年 8 月,美國食品、零食和飲料公司百事可樂將開始在美國和加拿大使用紙板包裝其飲料多件裝,促進該地區的循環經濟。

- 該國包裝飲料消費量正在上升,推動了市場的成長。飲料紙板包裝有多種用途。這種包裝有時也用於保護飲料瓶免受洩漏和污染。在某些情況下,它可以用作防止暴露在陽光下的屏障。瓦楞紙箱的成本效益正在推動該國市場的成長。

- 瓦楞紙箱具有高度可客製化性,美國公司提供具有不同瓦楞、厚度和設計的定製印刷紙箱以適合包裝,這推動了該國對該產品的需求。

- 美國電子商務產業的快速成長正在推動對運輸產品的瓦楞紙包裝的需求。根據美國人口普查局的數據,2023 年第一季的電子商務零售額佔總銷售額的 14.9%,而 2024 年第一季這一比例為 15.9%。此外,該機構稱,美國食品和飲料銷售額從 2021 年的 8,906.9 億美元成長到 2023 年的 9,791.6 億美元。

- 根據美國人口普查局的數據,隨著消費者在雜貨店和超級市場對食品和飲料的支出增加,該國的食品和飲料銷售額與前一年同期比較去年同期成長。這導致美國食品工業中紙板包裝的使用量增加。

北美瓦楞包裝行業概況

北美瓦楞包裝市場較為分散,主要參與者包括國際紙業公司、美國包裝公司和Cascades公司。紙板供應商種類繁多,為消費者提供了多個供應商可供選擇,從而加劇了市場上當地企業之間的競爭。參與的公司如下:Smurfit Kappa 和 Sealed Air 旨在將永續發展作為其成長策略的一部分。

- 2024 年 3 月 DS Smith 在北美推出 DryPack 海鮮盒,作為不可回收的發泡聚苯乙烯(EPS)瓦楞紙箱的替代品。 DS Smith DryPak 是一種防漏、防水、可回收的盒子,用冰塊包裝後,可以在低溫運輸操作中將魚在 40°F (4°C) 以下的溫度下保持新鮮度超過 40 小時。據稱,DryPack 是唯一獲得國際航空運輸協會核准用於空運的瓦楞水產品箱,使海鮮加工商能夠安全地運輸新鮮魚類。

- 2023 年 12 月永續包裝供應商 DS Smith 已在其位於南卡羅來納州哥倫比亞的瓦楞紙製造廠完成蒸汽回收技術的安裝,這將使能源消耗永續20%。製造工廠引進的新技術可減少工廠維護停機時間,進而提高生產速度,進而提高生產效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 評估近期地緣政治情勢對產業的影響

第5章 市場動態

- 市場促進因素

- 電子商務產業需求強勁

- 輕質材料和印刷創新的廣泛應用將推動電子和個人護理行業的成長

- 市場挑戰

- 對瓦楞產品材料可得性和耐用性的擔憂

- 主要行業趨勢和發展

- 窄瓦楞產品的出現以及對箱板紙可回收性的日益重視

- 數位印刷和新塗層技術的作用

第6章 市場細分

- 按最終用戶產業

- 加工食品

- 生鮮食品和水果

- 飲料

- 紙製品

- 電器

- 其他最終用戶產業

- 按國家

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- International Paper Company

- Mondi Group

- Smurfit Kappa Group PLC

- DS Smith PLC

- WestRock Company

- Packaging Corporation of America

- Viking Packaging

- Georgia-Pacific LLC

- Rengo Co. Ltd

- Sealed Air Corporation

第8章投資分析

第9章:市場的未來

The North America Corrugated Packaging Market size is estimated at USD 42.74 billion in 2025, and is expected to reach USD 48.78 billion by 2030, at a CAGR of 2.68% during the forecast period (2025-2030).

Corrugated material is made from corrugated fiberboard. The prime purpose of corrugated packaging is to protect products in shipments, transit, and storage. The market for corrugated packaging is growing, owing to rapidly rising e-commerce, food and beverage, and electronic industries in North America.

Key Highlights

- Corrugated board packaging is a versatile and cost-efficient method to protect, preserve, and transport a wide range of products. A corrugated board is light in weight, biodegradable, and recyclable. Therefore, it is an integral component of the packaging industry and, thus, drives the market's growth.

- The booming e-commerce industry in North America is a significant driving factor in the market's growth. Prominent e-commerce companies, such as Amazon, have been using corrugated board boxes for principal packaging as they provide product protection and ensure customer satisfaction. Corrugated boxes used for e-commerce are more likely to be printed with high-quality graphics and customized to fit packaged contents to save on costs and increase the aesthetic impact during unboxing.

- Furthermore, manufacturers of corrugated board packaging directly collaborate with e-commerce vendors to provide more agile and customizable solutions. Amazon works toward minimizing cardboard waste for the customer to maximize the efficiency of the order by producing the right-sized boxes for each shipment, which is expected to further boost market growth.

- Major players in the region have been involved in various expansion, acquisition, and collaboration activities to enhance their presence and position in the market. For instance, in April 2024, International Paper (IP), a US-based packaging company, announced the acquisition of DS Smith PLC, a UK-based company. This strategic acquisition is likely to strengthen IP's global packaging business through growth in innovation and sustainability across Europe and North America.

- The rising consumer consciousness regarding sustainable packaging is encouraging the use of environment-friendly packaging for various manufacturers and retailers. Various companies have been focusing on investing in sustainable collaborations for enhanced production capabilities to serve customers. For instance, in September 2023, Smurfit Kappa LLC, an Ireland-based packaging company, partnered with WestRock, a US-based company, to create sustainable corrugated and consumer packaging options in North America, Europe, and Asia.

- The demand for corrugated boxes may decline due to significant competition from a variety of flexible packaging options in North America. Many e-commerce companies use flexible packaging options as they are lightweight and provide optimizing logistics solutions compared to rigid packaging. Hence, factors such as convenience, cost-savings, and sustainability can result in packaging manufacturers shifting from rigid to flexible packaging, thus hampering product demand.

North America Corrugated Packaging Market Trends

Processed Foods Segment Expected to Witness Robust Growth

- The growing popularity of the use of corrugated packaging for processed and canned foods in North America has resulted in market growth. Rising consumer demand for processed foods, including cereals, tinned fruits and vegetables, and savory snacks, has boosted the demand for corrugated packaging in the region.

- The use of corrugated packaging helps preserve the flavors of packaged food by enabling proper airflow, which is boosting the demand for processed foods in the region. Corrugated packaging can be customized to meet specific packaging needs, allowing businesses to create unique food packaging.

- The growing consumer shift toward eco-friendly and sustainable packaging options has resulted in companies making corrugated boxes that are easy to recycle. Sustainable corrugated boxes are cost-effective for many companies, thus boosting product demand.

- Food companies opt for customized packaging solutions with optimal material use to protect yet reduce the weight of the product and focus on quick opening methods for the food packets, resulting in the growing demand for corrugated packaging solutions in the processed food segment.

- While the use of lightweight and strong corrugated boxes for shipment and storage of processed food is preferred, convenient and cost-effective corrugated packaging for the food and beverage industry drives market growth in the region.

- Corrugated boxes have a triple-layer structure that creates a cushioning effect that shields the products from any external forces during shipping and transit. The rising exports of processed foods from the United States are further boosting the demand for corrugated packaging. According to the US Department of Agriculture (USDA), the United States exported USD 36.51 billion of processed food in the year 2023.

United States Expected to Hold High Market Share

- The growth in the food, beverage, and retail sectors in the United States is estimated to boost market growth. Consumers and brand owners are becoming more environmentally aware. Growing inclination toward sustainability, technological innovation, and appealing economics are some of the reasons for the corrugated packaging market's growth in the United States.

- The use of corrugated packaging for beverages to provide a sturdy yet flexible option to keep beverages secure is a significant factor driving market growth. Beverage companies are focusing on adapting cardboard packaging in North America with the aim of eliminating the use of plastic. In August 2023, PepsiCo, an American food, snack, and beverage company, started using paperboard packaging on beverage multipacks in the United States and Canada to promote a circular economy in the region.

- The growing consumption of packaged beverages in the country boosts market growth. Corrugated board packaging for beverages serves different purposes. The packaging is sometimes used to protect beverage bottles from any leakage or contamination. In some cases, it may be used as a barrier as a form of protection against sunlight exposure. Corrugated boxes' cost-effective feature has driven the country's market growth.

- Corrugated boxes are highly customizable, and US companies provide customized printed boxes with different fluting, thickness, and designs to make the package fit for its purpose, which drives the product's demand in the country.

- Rapid growth in the e-commerce industry in the United States is driving the demand for corrugated packaging for shipping products. According to the US Census Bureau, e-commerce retail sales in Q1 2023 were 14.9% of total sales, whereas they were 15.9% in Q1 2024. Further, as per the organization, sales of food and beverages in the United States rose from USD 890.69 billion in 2021 to USD 979.16 billion in 2023.

- According to the US Census Bureau, the growing Y-o-Y sales in food and beverage stores in the country are attributable to the growing consumer spending on food and beverages in grocery stores and supermarkets. This is increasing the use of corrugated box packaging in the food industry in the United States.

North America Corrugated Packaging Industry Overview

The North American corrugated packaging market is fragmented, with the presence of significant players like International Paper Company, Packaging Corporation of America, and Cascades Inc. There is increasing competition among local players in the market as consumers can choose from multiple vendors due to the wide range of corrugated board suppliers. Players such as Smurfit Kappa and Sealed Air are aiming to promote sustainability as a part of their growth strategy.

- March 2024: DS Smith launched its DryPack seafood box in North America, replacing non-recyclable expanded polystyrene (EPS) foam boxes. DS Smith's DryPack is a no-leak, water-resistant, and recyclable box that, when packed with ice, can keep fish fresh below 40 degrees Fahrenheit (4 degrees Celsius) for over 40 hours in cold chain operations. DryPack is reportedly the only containerboard seafood box approved for air freight by the International Air Transport Association, enabling seafood processors to ship fresh fish safely.

- December 2023: DS Smith, a provider of sustainable packaging, completed the installation of its steam recycling technology that reduces energy consumption by 20% in its Columbia, South Carolina, corrugated packaging facility. The new technology installed at the manufacturing plant increases productivity by reducing maintenance downtime at the plant, thus enabling faster output.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Recent Geopolitical Scenario on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand From the E-commerce Sector

- 5.1.2 Growing Adoption of Light-Weighting Materials and Scope for Printing Innovations Propelling Growth in the Electronics and Personal Care Segment

- 5.2 Market Challenges

- 5.2.1 Concerns Over Material Availability and Durability of Corrugated Board-Based Products

- 5.3 Key Industry Trends and Developments

- 5.3.1 Emergence of Finer Flute Products and Growing Emphasis on Recyclability of Containerboard Stocks

- 5.3.2 Role of Digital Printing and New Coatings-based Technologies

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Processed Foods

- 6.1.2 Fresh Food and Produce

- 6.1.3 Beverages

- 6.1.4 Paper Products

- 6.1.5 Electrical Products

- 6.1.6 Other End-user Industries

- 6.2 By Country

- 6.2.1 United States

- 6.2.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Mondi Group

- 7.1.3 Smurfit Kappa Group PLC

- 7.1.4 DS Smith PLC

- 7.1.5 WestRock Company

- 7.1.6 Packaging Corporation of America

- 7.1.7 Viking Packaging

- 7.1.8 Georgia-Pacific LLC

- 7.1.9 Rengo Co. Ltd

- 7.1.10 Sealed Air Corporation