|

市場調查報告書

商品編碼

1644362

英國瓦楞包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)United Kingdom (UK) Corrugated Board Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

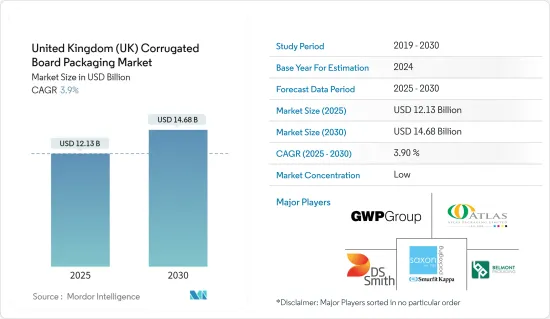

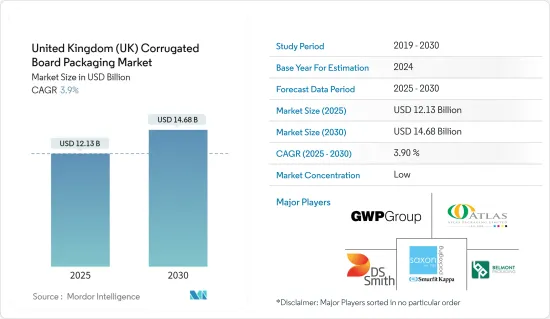

預計 2025 年英國瓦楞包裝市場規模為 121.3 億美元,到 2030 年將達到 146.8 億美元,預測期間(2025-2030 年)的複合年成長率為 3.9%。

瓦楞包裝有多種樣式、形狀和尺寸,取決於用途。由於它 100% 可回收且具有成本效益,因此被廣泛應用於包裝行業。

主要亮點

- 食品包裝的成長和各行業對輕質瓦楞紙箱購買量的增加正在推動對瓦楞包裝的需求。此外,創新的瓦楞設計透過有效的體積利用實現了卓越的印刷效果並節省了成本,從而推動了市場需求。

- 永續包裝解決方案的需求不斷成長以及電子商務平台的包裝需求不斷成長預計將推動市場成長。然而,對耐用性的擔憂限制了市場的成長,因為瓦楞紙板在承受極端壓力或堆疊時會變形。

- 瓦楞包裝製造商正在直接與電子商務供應商合作,以提供更靈活和可客製化的解決方案。根據英國國家統計局的數據,2021 年 1 月,英國網路銷售額佔零售額的 37.8%,隨後有所回落。這可以視為市場穩定效應的下降。

- 國內幾家主要供應商正在創新其產品,以滿足日益成長的瓦楞包裝解決方案需求。例如,2021 年 8 月,總部位於英國的 Mondi 為整個中歐的線上雜貨市場推出了一系列永續紙板包裝解決方案。

- 在新冠疫情爆發後,由於食品和其他消費品、醫療和醫藥產品、紙巾和衛生產品等必需品的運輸包裝需求,該地區對瓦楞包裝的需求顯著成長。此外,俄羅斯和烏克蘭之間的戰爭正在影響整個包裝生態系統。

- 此外,一些公司正在推出新的瓦楞包裝產品,以滿足 COVID-19 危機帶來的需求。例如,DS Smith 開發了一個特殊的緊急配送箱,以滿足食品零售業對更安全的宅配日益成長的需求。

英國瓦楞包裝市場的趨勢

電子商務行業可望刺激需求

- 近年來,電子商務產業已成為英國的重要產業。亞馬遜等知名電子商務公司使用瓦楞紙箱作為主要包裝,並依賴塑膠包裝單一物品。根據GWP集團統計,電子商務佔英國所有業務的20%以上,90%的電子商務訂單都是透過瓦楞紙箱運送的。

- 根據英國國家統計局的數據,2021年英國電子商務銷售額將達到 1,290 億英鎊(1,774.7 億美元)。從產業來看,批發和製造業是今年電子商務銷售額最大的兩個產業。

- 推動瓦楞紙箱取代紙箱的另一個因素是電子商務包裝的引入,以能夠承受運輸測試的紙箱取代輕便、易於打開的紙箱。用於電子商務的瓦楞紙箱更有可能印刷高品質的圖形並根據包裝內容進行客製化,從而節省成本並增加打開時的美感。

- 為了滿足電子商務產業對瓦楞包裝解決方案日益成長的需求,各大供應商都在推出新產品。 2022 年 9 月,VPK 集團推出了新的歐洲折疊瓦楞包裝解決方案品牌 fit2size,以支持其在整個歐洲開發折疊瓦楞包裝解決方案的成長策略。該公司基於其最新的 Fanfold 創新推出了新產品,以滿足日益成長的電子商務和物流包裝需求,進一步加強了其提供卓越永續包裝解決方案的雄心。

生鮮食品和農產品產業預計將獲得巨大發展

- 食品業正透過採用瓦楞包裝解決方案迅速向環保包裝邁進。人們對食品包裝衛生的日益關注為包裝行業制定了多項標準,並刺激了該國採用環保包裝解決方案。

- 歐盟關於食品接觸材料的法規 1935/2004 和關於良好生產規範 (GMP) 的法規 2023/2006 是管理歐盟食品應用紙板包裝的法律。這對食品業獲取衛生和永續的包裝解決方案提出了許多挑戰。 2021年11月,代表包括英國在內的整個歐洲瓦楞包裝行業的歐洲瓦楞包裝工業聯合會(FEFCO)發布了《瓦楞包裝可回收性指南》,旨在透過紙和紙板包裝的設計參數來最佳化可回收性。

- 水果易碎且易腐爛,因此必須小心包裝。對於硬質水果運輸包裝來說,瓦楞紙板(CFB)是最環保的解決方案。瓦楞紙箱因其對空運、海運和陸運的適應性提高而受到水果出口商的大量需求。

- 市場上有多家解決方案供應商正在採用可回收包裝解決方案。例如,2022 年 1 月,Oumph!宣布計劃在所有市場使用可回收紙板包裝,並逐步淘汰食品包裝中的塑膠。

英國瓦楞包裝行業概況

英國瓦楞包裝市場比較分散,許多公司都提供新的解決方案。此外,一些跨國公司也正在擴大在英國的業務,以增強其影響力。市場參與者也正在建立策略夥伴關係和聯盟,以增加其市場佔有率並最大限度地提高其市場吸引力。例如

- 2022 年 10 月,VPK Packaging Group NV(VPK)收購了位於英國北剪切機的私營瓦楞紙板公司 CorrBoard UK Ltd 30% 的股份。 CorrBoard UK 將得到 Rigid Containers Ltd. 的全力支持,這是一家 VPK 公司,每年在英國和愛爾蘭加工 3.4 億平方米的瓦楞材料。

- 2022 年 5 月,Smurfit Kappa 收購了瓦楞紙箱公司 Atlas Packaging。 Atlas Packaging 是一家獨立的瓦楞紙包裝供應商,在該國擁有重要業務,生產能力為 500-1000 單位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

- 全球瓦楞包裝市場概況

第5章 市場動態

- 市場促進因素

- 電子商務產業需求強勁

- 輕質材料的日益普及和潛在的印刷創新將推動電子和個人護理行業的成長

- 市場限制

- 對瓦楞產品材料可得性和耐用性的擔憂

第6章 市場細分

- 按最終用戶產業

- 加工食品

- 生鮮食品和水果

- 飲料

- 紙製品

- 其他最終用戶產業(電子等)

第7章 競爭格局

- 公司簡介

- International Paper Company

- Mondi Group

- Smurfit Kappa Group

- DS Smith PLC

- WestRock Company

- Sealed Air Corporation

- GWP GROUP

- The Box Factory Limited

- Belmont Packaging

- Saxon Packaging(Smurfit Kappa Group)

- Atlas Packaging Limited

- The Corrugated Case Company

- NUTTALL Packaging

- Cardboard Box Company

第8章投資分析

第9章:市場的未來

The United Kingdom Corrugated Board Packaging Market size is estimated at USD 12.13 billion in 2025, and is expected to reach USD 14.68 billion by 2030, at a CAGR of 3.9% during the forecast period (2025-2030).

Corrugated packaging is found in different styles, shapes, and sizes, depending on the application. Due to its 100% recyclability and cost-effectiveness, it is widely used in the packaging industry.

Key Highlights

- Food packaging growth and increased purchases of lightweight corrugated boxes across industries are factors driving corrugated board packaging demand. Furthermore, innovative fluting design drives market demand by providing superior printing and cost savings through effective volume utilization.

- Rising demand for sustainable packaging solutions and the growing packaging needs of e-commerce platforms are expected to drive market growth. However, the concern about the durability of corrugated board, as it gets deformed if exposed to extreme pressure or when stacked, is limiting the market's growth.

- Manufacturers of corrugated board packaging work directly with e-commerce vendors to provide more agile and customizable solutions. According to the Office of National Statistics, internet sales in the United Kingdom increased to a record 37.8% of retail sales in January 2021, before declining in the following months. This can be viewed as a diminishing effect of market stabilization.

- Several key vendors in the country are indulging in product innovation to address the rising demand for corrugated packaging solutions. For instance, in August 2021, Mondi, a company headquartered in the United Kingdom, introduced its sustainable range of corrugated packaging solutions for the online grocery market across Central Europe.

- With the outbreak of COVID-19, the demand for corrugated board packaging in the region is witnessing significant growth due to the need for transport packaging of essential products, such as packaging for food and other consumer products, medical and pharmaceutical products, tissues, and hygiene products. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

- Moreover, several companies are launching new corrugated packaging products to meet the requirements arising from the COVID-19 crisis. For instance, DS Smith developed special emergency provision boxes to meet the increased demand for safer home delivery in the food retail sector.

UK Corrugated Board Packaging Market Trends

E-commerce Industry Expected to Stimulate Demand

- The e-commerce industry has emerged as a significant sector in recent years in the United Kingdom. Prominent e-commerce companies, such as Amazon, have been using corrugated board boxes for the principal packaging and relying on plastic packaging for individual items. According to GWP Group, e-commerce accounts for more than 20% of the total businesses in the United Kingdom, and 90% of e-commerce orders are shipped in corrugated boxes.

- According to the Office of National Statistics of the United Kingdom, the country's e-commerce revenue stands at GBP 129 billion (USD 177.47 billion) in 2021. On a sectoral basis, wholesale and manufacturing were the two leading industry sectors that generated the most e-commerce sales in the same year

- Another factor allowing corrugated boxes to overtake paperboard cartons is the introduction of e-commerce-ready packaging, which replaces lightweight and easy-to-open cartons with boxes that can withstand shipping rigors. Corrugated boxes used for e-commerce are more likely to be printed with high-quality graphics and customized to fit packaged contents to save on costs and increase the aesthetic impact during unboxing.

- Key vendors are introducing new products in response to the growing demand for corrugated board packaging solutions from the e-commerce industry. In September 2022, VPK Group launched its new European brand fit2size for Fanfold corrugated packaging solutions in response to its growth strategy to develop Fanfold corrugated packaging solutions across Europe. The company has launched a new product based on the latest Fanfold innovation to meet the increasing demand for e-commerce and logistics packaging and further strengthen its ambition to supply excellent sustainable packaging solutions.

Fresh Food and Produce Industry Expected to Gain Significant Traction

- The food industry is rapidly moving toward eco-friendly packaging by adopting corrugated board packaging solutions. The increasing concern for hygiene in food packaging has mandated several standards for the packaging industry and stimulated the adoption of eco-friendly packaging solutions in the country.

- The EU Regulation 1935/2004 on food contact materials and Regulation 2023/2006 on good manufacturing practice (GMP) are the laws applicable to corrugated packaging used in food applications in the EU. Hence, this poses several challenges in acquiring hygienic and sustainable packaging solutions for the food industry. In November 2021, the European Federation of Corrugated Board Manufacturers (FEFCO), which represents the corrugated packaging industry across Europe, including the United Kingdom, released its corrugated packaging recyclability guidelines aimed at optimizing recyclability via design parameters for paper and board packaging.

- Fruit packing necessitates extreme caution due to the product's fragile and perishable nature. Regarding rigid fruit transport packaging, corrugated fiberboard (CFB) is the most environmentally friendly solution. Corrugated boxes have recently gained a significant demand from fruit exporters owing to their improved adaptability for air, sea, and road transport.

- Several solution providers on the market are adopting recyclable packaging solutions. For instance, in January 2022, Oumph! One of the rapidly growing plant-based food producers from the UK announced plans to phase out plastic in its food product packaging by using recyclable cardboard packaging in all of its markets.

UK Corrugated Board Packaging Industry Overview

The United Kingdom corrugated board packaging market is fragmented owing to the presence of many players with new solutions in the country. Also, several global players are expanding their presence by expanding their operations in the United Kingdom. The market players are also forming strategic partnerships and collaborations to boost their market presence and gain maximum market traction. For instance,

- In October 2022, a 30% share in CorrBoard UK Ltd, a privately held corrugated sheet company in North Lincolnshire, United Kingdom, was purchased by VPK Packaging Group NV (VPK). CorrBoard UK would be fully supported by the Rigid Containers Ltd, a VPK company that converts 340 Million m2 corrugated material annually in the United Kingdom and Ireland.

- In May 2022, Smurfit Kappa acquired cardboard box company Atlas Packaging an independent corrugated packaging provider that has a significant domestic presence having production capacity ranging from 500 to 1000 units.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Market

- 4.5 Overview of the Global Corrugated Board Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from the E-commerce Sector

- 5.1.2 Growing Adoption of Light Weighting Materials and Scope for Printing Innovations Propelling Growth in the Electronics and Personal Care Segment

- 5.2 Market Restraints

- 5.2.1 Concerns over Material Availability and Durability of Corrugated Board-based Products

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Processed Foods

- 6.1.2 Fresh Food and Produce

- 6.1.3 Beverages

- 6.1.4 Paper Products

- 6.1.5 Other End-user Industries (Electrical Products and Others)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Mondi Group

- 7.1.3 Smurfit Kappa Group

- 7.1.4 DS Smith PLC

- 7.1.5 WestRock Company

- 7.1.6 Sealed Air Corporation

- 7.1.7 GWP GROUP

- 7.1.8 The Box Factory Limited

- 7.1.9 Belmont Packaging

- 7.1.10 Saxon Packaging (Smurfit Kappa Group)

- 7.1.11 Atlas Packaging Limited

- 7.1.12 The Corrugated Case Company

- 7.1.13 NUTTALL Packaging

- 7.1.14 Cardboard Box Company