|

市場調查報告書

商品編碼

1549868

全球資料中心的實體安全:市場佔有率分析、行業趨勢/統計數據和成長預測(2024-2029)Global Data Center Physical Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

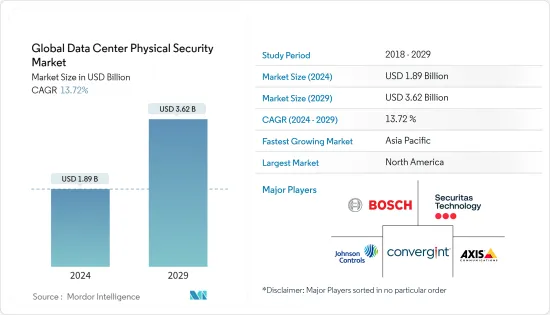

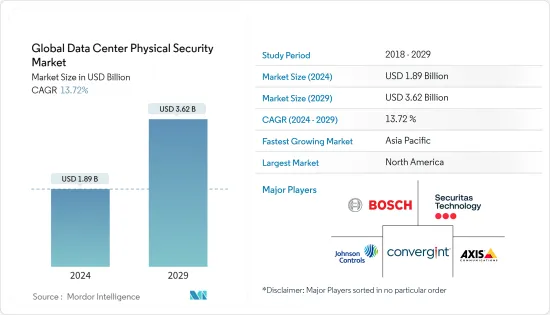

預計2024年全球資料中心實體安全市場規模為18.9億美元,2029年預估達36.2億美元,複合年成長率預估為13.72%。

安全措施可分為四大類:周界安全、機房管理、設施管理、機櫃管理。資料中心安全的第一層可防止、偵測和延遲外圍人員詐欺。如果周邊監控被破壞,第二層防禦將拒絕存取。這是一個使用刷卡和生物識別的存取控制系統。

第三層實體安全涉及監控所有限制區域,部署旋轉門等進入限制,提供生物識別存取控制設備,檢查手指、指紋、虹膜和血管圖案等,並提供 VCA,透過各種檢驗進一步限制存取。例如使用射頻識別。前三層確保只有授權人員才能進入。限制進入的額外安全措施包括櫃子鎖定機制。這一層解決了對惡意員工等「內部威脅」的恐懼。

預計2029年,全球資料中心實體安全市場的IT負載容量將達到71,000兆瓦。

預計到 2029 年,所研究市場的新增占地面積將增加至 2.739 億平方英尺。

到2029年,該地區安裝的機架總數預計將達到1,420萬個。預計到 2029 年,北美安裝的機架數量將最多。

有近500個海底電纜系統連接世界各地,其中許多正在建造中。 CAP-1 就是這樣的一條海底電纜,預計將於 2025 年投入使用,其長度將超過 12,000 公里,登陸點位於美國格羅弗海灘。

全球資料中心實體安全市場趨勢

門禁控制解決方案錄得顯著成長

- 實施強大的存取控制對於維護資料中心安全至關重要。過去曾報道使用 UPS 導致資料中心伺服器被竊的案例。儘管犯罪分子選擇在黑市上出售,但他們並不總是尋求出售完整的 PC 或 UPS 設備。在許多情況下,原料才是有價值的。自2012年以來,英國的金屬竊盜趨勢一直呈下降趨勢,2016年和2017年記錄的犯罪數量最低,為13,033起,但此後趨勢呈上升趨勢,2016年和2017年記錄的犯罪數量達到病例數較低值13,033 例增加了一倍多,達到29,920 例。

- 存取控制是確保資料中心安全的最高效、擴充性且經濟盈利的方法之一。實體安全、資訊安全、資料安全等安全機制構成了存取控制系統。 LenelS2 等公司利用現有的條碼基礎設施為資料中心資產提供強大的追蹤,無需額外的硬體或軟體。

- 存取生物辨識設備的日益便利正在推動門禁產業的成長。指紋認證提供簡單且經濟高效的存取控制,使其廣泛應用並推動市場成長。設備互聯性的增強和安全風險的快速增加也推動了市場的成長。

- 據 IBM 稱,2022 年全球資料外洩平均成本達到 435 萬美元,創歷史新高,兩年內成長約 13%。美國組織每次資料外洩的成本增加了一倍多,達到 944 萬美元。根據 IBM 的一份報告,83% 的受訪組織遭受過一次或多次資料洩露,其中四種最常見的方法(包括盜竊和憑證洩露)做出了重大貢獻。

- 總體而言,由於安全漏洞的增加,預計存取控制解決方案的市場需求在預測期內將會增加。

北美佔據主要市場佔有率

- 由於擴大採用實體安全解決方案,美國成為北美的領先市場。 Demand Sage Inc. 的數據顯示,美國超過 67% 的企業已經部署了雲端基礎的基礎設施。 2023 年,美國IT 總支出中約 20% 將用於雲端服務。此類案例將導致大規模部署資料中心以滿足存取控制的需求。

- 加州透過 CPRA(加州隱私權法案)和維吉尼亞州 CDPA(消費者資料保護法案)修訂了 CCPA,在美國境內實施了嚴格的安全和隱私要求。同樣,在加拿大,《個人資訊保護和電子文檔法》(PIPEDA) 等資料保護條例規定了嚴格的安全和隱私要求。這些法規要求實體安全解決方案必須遵守,這可能會推動所研究市場的需求。

- 市場主要企業正在致力於改進資料中心的實體安全解決方案,以滿足市場需求。 2023年6月,博世推出了針對建築物和限制區域的行動存取解決方案。

- 此行動門禁解決方案與博世成熟的門禁管理系統完全整合,為業主、訪客和員工提供一系列高效、安全和便利的優勢。最初,比荷盧經濟聯盟地區、瑞士、德國、奧地利、加拿大和美國的客戶將符合資格。

全球資料中心實體安全產業概況

全球資料中心實體安全市場高度分散,Axis Communications AB、ABB Ltd 和 Bosch Sicherheitssysteme GmbH 等公司在擴展企業能力方面發揮關鍵作用。市場導向導致競爭激烈的環境。憑藉主導市場佔有率,這些領先公司致力於擴大其在全部區域的基本客群。這些公司正在利用策略合作計劃來提高市場佔有率和盈利。

2023年4月,Schneider Electric推出EcoCare模組化資料中心會員服務。這項創新服務的成員可以獲得透過 24/7 主動遠端監控和基於狀態的維護來最大限度地延長模組化資料中心運作的專業知識。

2023 年 5 月,自主存取控制解決方案領先供應商之一 Alcatraz AI 宣布參加將於 2023 年 6 月舉行的赫爾辛基資料中心論壇。這項活動預計將吸引超過 400 名資料中心專業人士,並為 Alcatraz AI 提供了一個理想的機會來展示其用於資料中心物理安全的創新生物識別存取控制解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 超大規模和主機代管營運商增加了資料中心活動和投資

- 連接到雲端系統的視訊監控系統的進步

- 市場限制因素

- 對營運和投資收益的擔憂

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 影響評估

第5章市場區隔

- 按解決方案類型

- 視訊監控

- 門禁解決方案

- 其他(陷阱、圍籬、監控解決方案)

- 按服務類型

- 諮詢服務

- 專業服務

- 其他(系統整合服務)

- 最終用戶

- 資訊科技/通訊

- BFSI

- 政府機構

- 衛生保健

- 其他最終用戶

- 地區

- 北美洲

- 歐洲

- 亞洲

- 南美洲

- 中東

- 非洲

第6章 競爭狀況

- 公司簡介

- Axis Communications AB

- Convergint Technologies LLC

- Securitas Technology

- Bosch Sicherheitssysteme GmbH

- Johnson Controls International

- Honeywell International Inc.

- Schneider Electric

- AMAG Technology

- Brivo Systems LLC

- Suprema Inc.

- Assa Abloy AB

- Milestone Systems A/S

- Cisco Systems Inc.

- ABB Ltd

- American Integrated Security Group

第7章 投資分析

第8章市場機會與未來趨勢

The Global Data Center Physical Security Market size is estimated at USD 1.89 billion in 2024, and is expected to reach USD 3.62 billion by 2029, growing at a CAGR of 13.72% during the forecast period (2024-2029).

Security measures can be categorized into four, namely perimeter security, computer room controls, facility controls, and cabinet controls. The first layer of data center security discourages, detects, and delays any unauthorized entry of personnel at the perimeter. In case of any infringement in the perimeter monitoring, the second layer of defense denies access. It is an access control system utilizing card swipes or biometrics.

The third layer of physical security further restricts access through various verification methods, including monitoring all restricted areas, deploying entry restrictions such as turnstiles, providing biometric access control devices to verify finger and thumbprints, irises, or vascular patterns, providing VCA, and using radio frequency identification. The first three layers ensure the entry of only authorized people. Further security to restrict admission includes cabinet locking mechanisms. This layer addresses the fear of an 'insider threat,' such as a malicious employee.

The upcoming IT load capacity of the global data center physical security market is expected to reach 71,000 MW by 2029.

The construction of raised floor area in the market studied is expected to increase to 273.9 million sq. ft by 2029.

The region's total number of racks to be installed is expected to reach 14.2 million units by 2029. North America is expected to house the maximum number of racks by 2029.

There are close to 500 submarine cable systems connecting the regions globally, and many are under construction. One such submarine cable that is estimated to start service in 2025 is CAP-1, which stretches over 12,000 km with a landing point in Grover Beach, United States.

Global Data Center Physical Security Market Trends

Access Control Solutions to Register Significant Growth

- Implementing strong access controls is vital in maintaining the security of data centers. In the past, instances of UPS theft of servers in data centers have been reported. Criminals choose to sell on the black market, but they are not always looking to sell complete PCs or UPS equipment. For many, the raw materials are where the value exists. UK metal theft offenses have been declining since 2012, reaching a low of 13,033 recorded offenses in 2016 and 2017, but have been on an upward trend since then, more than doubling to 29,920 offenses in 2021 and 2022.

- Access control is one of the most efficient, scalable, and financially profitable ways of securing data centers. Security mechanisms, such as physical security, information security, and data security, comprise the access control system. Players such as LenelS2 provide robust tracking for data center assets utilizing existing barcode infrastructure with no additional hardware or software requirement.

- The growing accessibility to biometric equipment is driving the growth of the access control industry. As fingerprint recognition provides easy and cost-effective access control, it is extensively used, fueling the market growth. The market growth can also be attributed to the increasing interconnectedness of devices and the surging security risks.

- According to IBM, the global average cost of a data breach reached an all-time high of USD 4.35 million in 2022, an increase of almost 13% over two years. The cost for US organizations was more than double at USD 9.44 million per data breach. The IBM report found that 83% of the organizations studied have had more than one data breach, with the four most popular methods, including stolen and compromised credentials, catering to 19% contribution as of 2023.

- Overall, during the forecast period, the market demand for access control solutions is expected to increase with increasing security breaches.

North America to Hold Significant Market Share

- The United States is a prominent market in North America, owing to the growing adoption of physical security solutions. According to Demand Sage Inc., more than 67% of enterprises in the United States have cloud-based infrastructure. Around 20% of total IT spending in the United States in 2023 was on cloud services. Such instances will lead to major data center adoption, catering to the demand for access control.

- California amended the CCPA with the California Privacy Rights Act (CPRA) and Consumer Data Protection Act (Virginia CDPA), which impose strict security and privacy requirements within the United States. Similarly, data protection regulations, such as the Personal Information Protection and Electronic Documents Act ("PIPEDA"), impose strict security and privacy requirements within Canada. These regulations must be complied with physical security solutions, which may propel the demand in the market studied.

- The key players in the market are focused on improving data center physical security solutions to meet the market demand. In June 2023, Bosch introduced a Mobile Access solution to buildings and restricted areas, which allows access without any identification media such as plastic cards.

- This Mobile Access solution is fully integrated into the tried-and-tested Access Management System from Bosch and provides various benefits, including efficiency, security, and convenience for building owners, visitors, and employees. This was initially available to customers in the Benelux region, Switzerland, Germany, Austria, Canada, and the United States..

Global Data Center Physical Security Industry Overview

The global data center physical security market is highly fragmented due to players like Axis Communications AB, ABB Ltd, and Bosch Sicherheitssysteme GmbH, which play a vital role in upscaling the capabilities of enterprises. Market orientation leads to a highly competitive environment. These major players, with a prominent market share, focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In April 2023, Schneider Electric launched EcoCare for Modular Data Centers services membership. Members of this innovative service benefit from specialized expertise to maximize modular data centers' uptime with 24/7 proactive remote monitoring and condition-based maintenance.

In May 2023, Alcatraz AI, one of the prominent providers of autonomous access control solutions, announced its participation at the Data Center Forum Helsinki in June 2023. The event was expected to bring together more than 400 data center professionals and provide Alcatraz AI with an ideal opportunity to demonstrate its innovative biometric access control solution for data center physical security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Data Center Activities and Investment by the Hyperscale and Colocation Operators

- 4.2.2 Advancements in Video Surveillance Systems Connected to Cloud Systems

- 4.3 Market Restraints

- 4.3.1 Operational and Return On Investment Concerns

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Solution Type

- 5.1.1 Video Surveillance

- 5.1.2 Access Control Solutions

- 5.1.3 Others (Mantraps, Fences, and Monitoring Solutions)

- 5.2 By Service Type

- 5.2.1 Consulting Services

- 5.2.2 Professional Services

- 5.2.3 Others (System Integration Services)

- 5.3 End User

- 5.3.1 IT and Telecommunication

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 South America

- 5.4.5 Middle East

- 5.4.6 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Axis Communications AB

- 6.1.2 Convergint Technologies LLC

- 6.1.3 Securitas Technology

- 6.1.4 Bosch Sicherheitssysteme GmbH

- 6.1.5 Johnson Controls International

- 6.1.6 Honeywell International Inc.

- 6.1.7 Schneider Electric

- 6.1.8 AMAG Technology

- 6.1.9 Brivo Systems LLC

- 6.1.10 Suprema Inc.

- 6.1.11 Assa Abloy AB

- 6.1.12 Milestone Systems A/S

- 6.1.13 Cisco Systems Inc.

- 6.1.14 ABB Ltd

- 6.1.15 American Integrated Security Group