|

市場調查報告書

商品編碼

1628823

資料中心安全 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Data Center Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

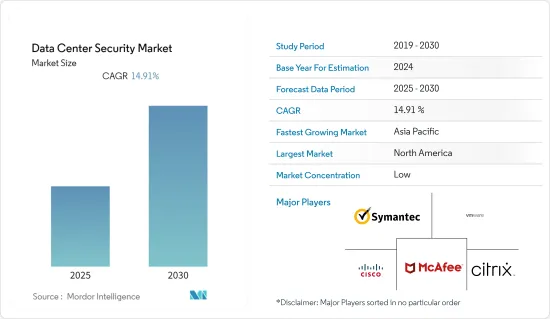

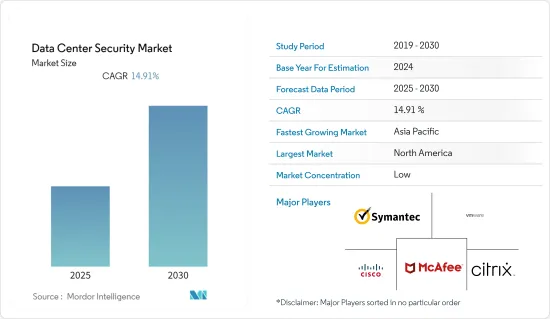

資料中心安全市場預計在預測期內複合年成長率為14.91%

主要亮點

- 資料中心的採用正在重塑世界的 IT 格局,將資料從本地電腦室和 IT 機櫃轉移到大型資料中心樞紐。雲端園區整合工作負載以提供規模經濟,使超大規模營運商能夠快速增加伺服器容量和功率。公司正在目睹大量的客戶資料湧入,並面臨著管理所有關鍵業務資料的壓力。我們也不斷面臨超越當前競爭對手的需要。

- 研究市場的一些主要企業正在大力投資超大規模資料中心。例如,2021年6月,Equinix宣布計畫在全球主要市場建置32個超大規模資料中心。該公司總容量達600兆瓦,投資超過69億美元,旨在開拓新市場,並在不斷成長的超大規模資料中心中更好地定位自己。預計此類發展很快將增加對資料中心安全的需求。然而,由於資料不在本地託管,因此資料外洩的可能性很高,並且客戶對資料隱私的擔憂是一個重大衰退因素。

- 在雲端安全方面,託管安全供應商將在全球範圍內看到巨大的需求。因此,市場上的領導者都專注於投資此類公司,以獲得能力以及區域足跡和市場佔有率。大多數組織都使用多個雲端供應商,這增加了客戶對以統一方式確保安全性的需求。此外,公司正在尋求採用集中方式來應用安全控制和合規措施。

- 此外,政府措施和公共存取平台的數位化是全球資料中心的最大需求來源。為了滿足政府部門日益成長的需求,正在進行一些開發。例如,位於猶他州布拉夫代爾的國家安全局 (NSA)資料中心耗資 15 億美元,其規模對於政府設施來說是獨一無二的,但其設計和用途與外部部署企業資料中心相似。

- 對企業來說,資料中心預算規劃似乎變得越來越困難。這是因為必須考慮許多變量,而不僅僅是透過資源、數量和電力使用來實現成長。傳統的許可證+維護軟體協定已經失去動力。更多供應商透過提供基於訂閱的定價來滿足客戶需求。其中一些包括軟體即服務(SaaS),它消除了資料中心預算中的基本堆疊成本。

資料中心安全市場趨勢

網路威脅的增加將推動資料中心安全市場的成長

- 根據網路安全公司 Cyble Research Labs 最近的一項分析,線上駭客可以存取各種資料中心管理和監控產品的 20,000 多個網路實例,從智慧監控軟體到熱冷卻管理控制系統。在我們的網路安全報告中,我們發現了施耐德電氣、Device42、Sunbird 和 Vertiv 提供的 APC資料中心基礎設施管理 (DCIM) 和監控服務的可存取實例。預設密碼仍然經常用於應用程式安全,並且是許多網路安全事件的原因。

- 當今最常成為攻擊目標的系統是開放的、易受攻擊的、未受保護的並且暴露在網路上。根據電子與電信工程師協會(IETE)、CyberPeace 基金會(CPF) 和Autobot Infosec Private Limited 進行的一項研究,在印度專門模擬的基於資料中心網路的威脅情報感測器網路上,發生了近5100萬次攻擊事件。

- DDoS 攻擊,也稱為分散式阻斷服務攻擊,多年來一直由網路犯罪分子和駭客實施。當伺服器成為 DDoS 攻擊的目標時,它會發送大量流量,消耗所有可用頻寬,並使合法用戶無法存取服務。

- 在過去的十年中,針對大大小小的公司發生了幾場重大的 DDoS 攻擊,包括 Google、Amazon Web Services、OVH 和 GitHub。根據思科分析,光是 2020 年就會發生超過 1,000 萬次 DDoS 攻擊。報告稱,未來DDoS網路攻擊預計將大幅增加。思科預測,到 2023 年,DDoS 攻擊將增加 100%,達到超過 1,540 萬次攻擊。

- 網路攻擊仍然是所有資料中心的一個主要問題。開發人員可以透過使用各種網路安全解決方案並制定協調的安全策略來保護自己免受這些攻擊。這是資料中心安全市場擴大的唯一主要因素。

亞太地區預計將成為所有地區中成長最快的地區

- 過去幾年,亞太地區四個主要國家的資料中心市場以及資料中心房地產總容量均顯著成長。東京(日本)、新加坡、雪梨(澳洲)和香港特別行政區是亞太地區資料中心的主要層級市場。隨著經濟的快速發展和對資料的高需求,印度具有成為亞太乃至全球整體資料中心(DC)樞紐的巨大潛力。

- Google、亞馬遜、微軟和Equinix等跨國公司更喜歡將亞太地區作為資料中心位置。

- 越來越多的品牌和公司正在將市場擴展到亞太地區。因此,該地區對資料中心提供者的需求正在增加。目前,使東南亞成為資料中心遷移有吸引力的市場的關鍵領域是IT基礎設施、伺服器市場和不斷電系統(UPS)。

- 2022 年 3 月 - CTRL 在海得拉巴建造了一座全新的資料中心設施,電力容量為 18 兆瓦。此外,CTRL還計劃在全國二、三線城市建設500英畝的太陽能發電設施和500個邊緣資料中心,以開展可再生能源業務。

- 隨著該地區資料中心市場的擴大,對資料中心安全的需求也可能會成長。如前所述,該地區面臨許多網路攻擊。根據網路安全公司 Group-IB 的數據,亞太地區是全球第三大受勒索軟體影響最嚴重的地區。 Group-IB 發布了關於這項最大威脅演進的第二份年度指南:《2021/2022 年勒索軟體揭秘》。根據第二版研究報告,勒索軟體產業持續蓬勃發展,平均贖金需求將增加 45%,到 2021 年達到 247,000 美元。

資料中心安全產業概況

該市場高度分散,McAfee Inc.、Juniper Networks Inc.、Schneider Electric SE 和 Citrix Systems Inc. 等主要參與者在擴展公司能力方面發揮關鍵作用。市場導向帶來先進的競爭環境。零售和批發資料中心市場上最大的公司正在透過從競爭對手那裡收購大量資金來增強其主導地位。隨著中小企業尋求擴大規模以參與競爭,二次性市場正在經歷一波整合浪潮。

- 2021 年 2 月 - 全球網路安全解決方案供應商 Check Point Software Technologies Ltd 擴展了其統一雲端原生安全平台 CloudGuard 的功能。該公司新推出了CloudGuard應用程式安全(AppSec)。現在,企業可以保護所有雲端原生應用程式免受已知攻擊和零時差攻擊。為了防止攻擊對雲端應用程式的影響,請使用情境 AI 來消除手動調整的需要和高誤報率。

- 2021 年 1 月 - 物聯網 (IoT) 技術供應商 Ubiquiti, Inc. 警告客戶,由於未授權存取資料庫而導致資料外洩。洩漏的資料包括大量客戶姓名、電子郵件地址、雜湊和加鹽密碼、地址、電話號碼等。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 利用市場促進和市場約束因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 的影響

- 市場促進因素

- 資料流量的增加和對安全連接的需求推動資料中心安全市場的成長

- 網路威脅的增加推動資料中心安全市場的成長

- 市場限制因素

- 有限的 IT 預算、低成本替代方案的可用性以及盜版阻礙了資料中心安全市場的成長潛力

第5章市場區隔

- 按解決方案

- 實體安全解決方案

- 監控解決方案

- 分析和建模

- 視訊監控

- 邏輯安全解決方案

- 合規管理和存取控制

- 威脅和應用安全解決方案

- 資料保護解決方案

- 按行業分類

- 消費品/零售

- 銀行/金融服務

- 電訊/資訊技術

- 醫療保健

- 娛樂媒體

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 其他

- 北美洲

第6章 競爭狀況

- 公司簡介

- Symantec Corporation

- VMware Inc.

- Cisco Systems Inc.

- Checkpoint Software Technologies Ltd

- McAfee Inc.

- Citrix Systems Inc.

- Trend Micro Inc.

- Juniper Networks Inc.

- Schneider Electric SE

- Siemens AG

- Dell Inc.

- Honeywell International Inc.

- IBM Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The Data Center Security Market is expected to register a CAGR of 14.91% during the forecast period.

Key Highlights

- The increasing adoption of data centers is reshaping the global IT landscape, shifting data from on-premise computer rooms and IT closets to massive centralized data center hubs. Cloud campuses are consolidating workloads offering economies of scale and enabling hyperscale operators to add server capacity and electric power rapidly. Several companies are witnessing an influx of customer data; thus, they are under pressure to manage all business-critical data. They also face a constant need to outpace their current competitors.

- Some of the major companies in the studies market are investing heavily in hyperscale data centers. For instance, in June 2021, Equinix announced plans to build 32 hyperscale data centers in some of the world's major markets. With a total capacity of 600 megawatts and more than USD 6.9 billion in investment, the company aims to tap new markets and gain a better position in the growing landscape of hyperscale data centers. Such developments are expected to drive the demand for data center security shortly. However, customer concerns relating to data privacy are a significant setback as the data is not being hosted locally, and there are high chances of data leakage.

- In cloud security, managed security providers are expected to see significant global demand. Resultantly, major players in the market are focusing on investing in such firms to gain a regional foothold and market share along with capabilities. Most organizations use multiple cloud providers, and with it, customers' demand for a unified way to secure them is increasing. Also, companies are looking to adopt a centralized way to apply security controls and compliance policies.

- Furthermore, government initiatives and the digitalization of public accessibility platforms are the most significant sources of demand for data centers across the globe. Several developments are taking place to cater to the increasing demand from the government sector. For instance, the USD 1.5 billion National Security Agency data center in Bluffdale, Utah, is unique in its scale for a government facility, 26 but similar in design and purpose to any off-premise enterprise data center.

- Planning a data center budget seems to be getting harder for companies because a lot of variables should be taken into account, not just some form of growth by resource, volume, or power usage. Old-style licenses plus maintenance software agreements are running out of steam. More vendors are responding to customer needs by providing subscription-based pricing. Some of these are via software as a service, which removes underlying stack costs from the data center budget.

Data Center Security Market Trends

Rise in Cyber Threats is Causing the Data Center Security Market to Grow

- According to a recent cyber security firm Cyble Research Labs analysis, over 20,000 web instances of various data center management and monitoring products, ranging from intelligent monitoring software to thermal cooling management control systems, are accessible to online hackers. The cybersecurity report discovered accessible instances of data center infrastructure management (DCIM) and monitoring services provided by APC by Schneider Electric, Device42, Sunbird, and Vertiv. Applications still frequently use default passwords for security, which is the cause of many of these cybersecurity incidents.

- The most frequently targeted systems today are the open, vulnerable ones unprotected and exposed to the internet. According to research conducted by The Institution of Electronics and Telecommunication Engineers (IETE), CyberPeace Foundation (CPF), and Autobot Infosec Private Limited, there have been close to 51 million attack events recorded between April and December 2021 on the Data Centers Network-based Threat Intelligence sensors network specifically simulated in India.

- DDoS assaults, also known as distributed denial of service attacks, have been employed by online criminals and hackers for years. When a server is the target of a DDoS attack, a massive volume of traffic is sent there to consume all available bandwidth and prevent legitimate users from accessing the service.

- In the last ten years, several significant DDoS assaults have occurred on both large and small businesses, including Google, Amazon Web Services, OVH, and GitHub. In 2020 alone, there will be more than 10 million DDoS attacks, according to Cisco's analysis. According to the same report, the future is expected to see a marked increase in DDoS cyberattacks. According to Cisco's prediction, there will be a 100% rise in DDoS attacks by 2023, reaching over 15.4 million.

- For all the data centers, cyber-attacks remain a significant problem. Organizations can better protect themselves from such attacks by using various cyber security solutions and developing a coordinated security strategy. This is the sole primary driver of the Data Center Security Market's expansion.

Asia Pacific is Estimated to Grow the Fastest among all Regions

- Over the past few years, the market for data centers has grown significantly, not just in the four major Asian Pacific countries but also in terms of total data center real estate capacity. Tokyo (Japan), Singapore, Sydney (Australia), and Hong Kong Special Administrative Region are the leading Tier 1 markets for data centers in the Asia Pacific region. Due to its rapidly expanding economy and high need for data, India has a significant potential to become a data center (DC) hub for the Asia Pacific and the entire world.

- MNCs, such as Google, Amazon, Microsoft, and Equinix, are all making the Asia Pacific a favorite destination for the location of their data centers.

- More brands and businesses are expanding their market to the Asia-Pacific region. Hence, there is a need for data center providers in this region. The key segments that make Southeast Asia such an attractive market for data center relocation currently are IT infrastructure, server market, and uninterruptible power supplies (UPSs).

- In March 2022 - In Hyderabad, CTRL constructed a brand-new data center facility with an 18 MW power capacity. In addition, the corporation plans to build a 500-acre solar facility and 500 edge data centers in Tier 2 and Tier 3 cities around the nation to run its operations on renewable energy.

- As the Data Center market flourishes in the region, the demand for Data Center Security will also grow similarly. As already, the region is facing a lot of cyber attacks. The Asia Pacific is the third-most frequently affected region worldwide by ransomware, according to cybersecurity company Group-IB. Ransomware Uncovered 2021/2022, the second annual guide to the evolution of the top threat, has been released by Group-IB. The second edition of the report's findings shows that the ransomware industry continued to prosper, with the average ransom demand increasing by 45% to reach USD 247,000 in 2021.

Data Center Security Industry Overview

The market is highly fragmented due to players like McAfee Inc., Juniper Networks Inc., Schneider Electric SE, Citrix Systems Inc., and other giants, which play a vital role in upscaling the capabilities of enterprises. Market orientation leads to a highly competitive environment. The biggest retail and wholesale data center market companies have further secured their dominance by acquiring hefty rivals. There has been a wave of consolidation in the secondary markets as smaller players seek to scale to compete.

- February 2021 - Check Point Software Technologies Ltd, a provider of cybersecurity solutions globally, extended the capabilities of its unified CloudGuard Cloud Native Security platform. The company launched a new CloudGuard Application Security (AppSec). This enabled the enterprises to secure all cloud-native applications against known and zero-day attacks. It eliminates the need for manual tuning and a high rate of false-positive alerts by using contextual AI to prevent attacks from impacting cloud applications.

- January 2021 - As an Internet of Things (IoT) technology vendor, Ubiquiti, Inc. warned its customers of a data breach caused by unauthorized access to their database. The data exposed included many customer names, email addresses, hashed and salted passwords, addresses, and phone numbers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Introduction to Market Drivers and Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/ Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19

- 4.6 Market Drivers

- 4.6.1 Increasing Data Traffic and Need for Secured Connectivity is Promoting the Growth of the Data Center Security Market

- 4.6.2 Rise in Cyber Threats is Causing the Data Center Security Market to Grow

- 4.7 Market Restraints

- 4.7.1 Limited IT Budgets, Availability of Low-Cost Substitutes, and Piracy is Discouraging the Potential Growth of Data Center Security Market

5 MARKET SEGMENTATION

- 5.1 By Solutions

- 5.1.1 Physical Security Solutions

- 5.1.2 Monitoring Solutions

- 5.1.3 Analysis and Modelling

- 5.1.4 Video Surveillance

- 5.2 Logical Security Solutions

- 5.2.1 Compliance Management and Access Control

- 5.2.2 Threat and Application Security Solution

- 5.2.3 Data Protection Solution

- 5.3 By Industry Vertical

- 5.3.1 Consumer Goods and Retail

- 5.3.2 Banking and Financial Services

- 5.3.3 Telecom and Information Technology

- 5.3.4 Healthcare

- 5.3.5 Entertainment and Media

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Symantec Corporation

- 6.1.2 VMware Inc.

- 6.1.3 Cisco Systems Inc.

- 6.1.4 Checkpoint Software Technologies Ltd

- 6.1.5 McAfee Inc.

- 6.1.6 Citrix Systems Inc.

- 6.1.7 Trend Micro Inc.

- 6.1.8 Juniper Networks Inc.

- 6.1.9 Schneider Electric SE

- 6.1.10 Siemens AG

- 6.1.11 Dell Inc.

- 6.1.12 Honeywell International Inc.

- 6.1.13 IBM Corporation