|

市場調查報告書

商品編碼

1626306

資料中心邏輯安全:市場佔有率分析、產業趨勢、統計與成長預測(2025-2030)Data Center Logical Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

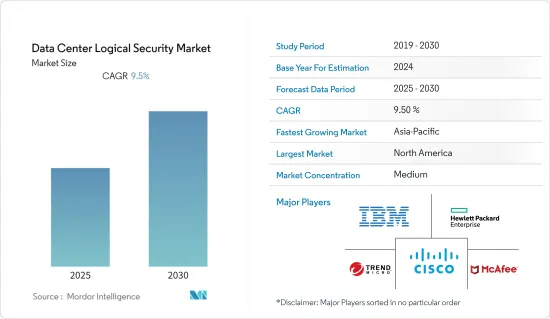

資料中心邏輯安全市場預計在預測期內年複合成長率為 9.5%

主要亮點

- 資料中心安全涉及保護組織的資料免遭未授權存取並資料安全漏洞。網路流量的增加更加強調了資料中心在滿足和管理 COVID-19 大流行期間不斷成長的需求方面的作用。

- 隨著大型企業和服務供應商升級資料中心以處理更多資料和網路攻擊浪潮,資料中心安全成本正在顯著上升。在過去的幾年裡,資料中心安全解決方案變得越來越流行並且成長迅速。

- 資料中心安全市場是由新技術、資料流量增加、虛擬資料中心增加以及網路威脅增加所推動的。替代解決方案的高成本、缺乏對替代解決方案的認知、替代解決方案的數量龐大以及隱私和安全問題正在減緩成長。

- 製造商和供應商對新興國家感興趣,因為它們快速採用雲端運算解決方案、快速採用新技術以及大量新資料中心建設。因此,市場為現有供應商和新供應商提供了許多機會。

- 全球資料中心邏輯安全市場預計在未來幾年將快速成長。據思科稱,全球資料中心數量從2020年的2,060個增加到上一年的2,300個。

自冠狀病毒大流行以來,資料中心市場顯著成長,許多大型設施正在建設中。此外,公司擴大透過採取安全措施來保護客戶資料。隨著越來越多的公司適應遠距工作,雲端儲存和音訊會議服務也在增加。這對所研究的市場產生正面影響。

資料中心邏輯安全市場趨勢

對存取控制和識別解決方案的需求增加

- 近年來,公司在 IAM(識別及存取管理)解決方案上投入巨資,以處理超出人類能力範圍的任務,因為駭客和惡意員工基本上不為人知。

- 有組織犯罪、國家支持的軍隊或其他團體造成的身分管理網路安全漏洞可能會對員工的生產力和士氣、IT 網路以及公司的聲譽產生許多負面影響。這些威脅需要新等級的身分和存取管理解決方案。

- 在雲端中,資料成長得更快,並且可以自由地傳輸到日益移動的勞動力所需的地方。例如,Informatica 提供智慧雲端服務SM,其中包括使用者身份驗證、容錯移轉資料中心、存取控制、作業系統、資料庫和應用層級安全性。

- 此外,人工智慧和機器學習演算法的使用也變得越來越廣泛。該領域的進步導致機器學習演算法被用於這些解決方案。

- 隨著 IAM 越來越依賴物理和行為模式生物特徵辨識以及地理位置資料,我們預計大部分身份驗證將透過機器學習技術來執行。由於這些新增功能預計將增強 IAM 解決方案,因此對這些解決方案的需求預計將會增加。

歐洲市場的解決方案採用加速

- 根據Cloudscene的數據,德國在歐洲的市場佔有率最高,其次是英國和荷蘭。

- 儘管經濟存在不確定性,該地區對資料中心的需求仍然強勁。因此,現有的資料中心很可能會被擴建並新建資料中心。安全性、延遲和連接性要求正在推動企業資料中心的採用。

- 此外,去年4月,TikTok在愛爾蘭都柏林建立了資料中心,以容納來自英國和歐洲經濟區(TikTok)的用戶。 TikTok 應用各種補充性技術、合約和組織保障措施,以確保這些傳輸受到與英國和歐洲經濟區相同程度的資料保護。實際上,這意味著員工需要採取實體和邏輯安全措施以及眾多法規和資料存取限制來保護任何個人資料。

- 例如,去年10月,泛歐洲邊緣資料中心知名供應商AtlasEdge宣布收購Datacenter One (DC1)。 AtlasEdge在歐洲的發展仍在繼續,DC1成為德國頂級資料中心供應商。

- 此外,Schneider Electric去年 6 月宣佈在歐洲提供更快的預製資料中心解決方案以及其 Ecostruxure IT 網路管理軟體的「現代化」。

資料中心邏輯安全產業概況

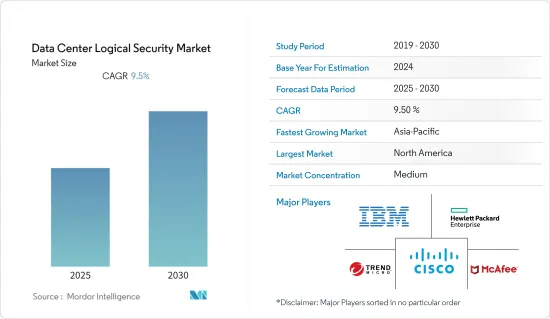

資料中心邏輯安全市場預計將適度集中於多家公司。產品發布、區域擴張、收購和研發活動是這些公司在資料中心邏輯安全市場採取的關鍵策略。主要企業包括 Cisco、IBM、HP、Dell、McAfee 和 Juniper Networks 等大公司。

2022 年 8 月,微軟在卡達開設了一個新的資料中心。透過此次擴展,卡達的消費者、組織和合作夥伴現在可以存取高度可用、可擴展且強大的雲端服務。這有利於智慧雲端服務的使用,加速數位轉型。

2022 年 10 月,IBM 將宣佈在雲端首次發布 Db2 版本 11.5.8。這是一個小更新,包含 50 多項更改,包括載入列式資料時的效能和壓縮改進、將邏輯備份和復原擴展到更多拓撲以及針對 Db2 pureScale 的 AWS IaaS 認證。所有這些變化都是由於 11.5.8 引擎造成的。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈分析

- 市場促進因素

- 人們對商業和資料資料安全的興趣日益濃厚

- 對雲端運算和資料虛擬的需求不斷成長

- 市場限制因素

- 低成本安全軟體的可用性

- 技術簡介

第5章市場區隔

- 按解決方案

- 存取控制和識別解決方案

- 威脅防禦解決方案

- 預防資料外泄解決方案

- 其他解決方案

- 按服務

- 安全諮詢服務

- 安全解決方案實施服務

- 支援和維護服務

- 按最終用戶

- 銀行/金融服務

- 製造業

- 科技

- 能源

- 衛生保健

- 中央/地方政府

- 娛樂和媒體

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 以色列

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- IBM Corporation

- Cisco Systems Inc.

- Hewlett-Packard Enterprise Co.

- Trend Micro Inc.

- McAfee Inc.

- Fortinet Inc.

- VMware Inc.

- Checkpoint Software Technologies Ltd.

- Juniper Networks Inc.

- Dell

第7章 投資分析

第8章 市場機會及未來趨勢

The Data Center Logical Security Market is expected to register a CAGR of 9.5% during the forecast period.

Key Highlights

- Datacenter security deals with protecting organizational data against unauthorized access to safeguard data against security breaches. The increase in internet traffic has placed more importance on the role of data centers in meeting and managing the rising demands during the COVID-19 pandemic.

- Costs for data center security are going up a lot because large companies and service providers are upgrading their data centers to handle more data and the massive waves of cyberattacks.In the past few years, data center security solutions have become more popular and are growing quickly.

- The data center security market is driven by new technologies, more data traffic, a rise in virtualized data centers, and a rise in cyber threats. Along with privacy and security issues, growth is being slowed by the high cost of alternative solutions, the fact that people don't know about them, and the fact that there are so many of them.

- Manufacturers and vendors are interested in emerging economies because of how quickly cloud computing solutions are being adopted, how quickly new technologies are being adopted, and how many new data centers are being built. This gives both established and new vendors in the market a lot of opportunities.

- The global market for logical security for data centers is expected to grow quickly over the next few years.This is because there are more data centers and more cyber threats around the world. According to Cisco, the global data center volume climbed from 2,060 in 2020 to 2,300 in the previous year.

Since the coronavirus pandemic, there has been a lot of growth in the data center market, and many large facilities have been built. Also, companies are working more and more to protect customer data by putting in place security measures. As more businesses adapt to working remotely, there has been a rise in cloud storage and teleconferencing services. This affects the studied market positively.

Data Center Logical Security Market Trends

Increasing Demand for Access Control and Identification Solution

- In recent years, companies have significantly invested in IAM (Identity and Access Management) solutions to perform the jobs that are out of reach for humans since hackers and malicious employees are mostly unknown.

- An identity management cybersecurity breach caused by organized crime, state-sponsored militaries, or other groups can have a lot of negative effects on staff productivity and morale, the IT network, and the reputation of the company.These threats demand a new level of identity and access management solutions.

- In the cloud, data is expanding more quickly and is free to move wherever it is needed by a workforce that is becoming more mobile. The data center logical security market is likely to grow because more and more businesses want to protect their data in the cloud.Informatica, for instance, offers Intelligent Cloud ServicesSM, including user authentication, failover data centers, access controls, and security at the operating system, database, and application levels.

- Moreover, the use of AI and machine learning algorithms is also prevalent for the same. Advancements in this segment have led to machine learning algorithms being used in these solutions.

- The bulk of the authentications are expected to be performed by machine learning technology, as IAM increasingly relies on physical and behavioral biometrics for geolocation data. As these additions are anticipated to enhance the IAM solutions, the demand for these solutions is expected to increase.

European Market to Witness High Adoption of the Solutions

- Cloudscene says that Germany has the biggest market share in Europe, followed by the UK and the Netherlands.Other countries that contribute to the European market include France, Italy, and Poland.

- Despite the economic uncertainties, the region's demand for data centers remains strong. This will lead to the expansion of existing data centers and the building of new ones. The security, latency, and connectivity requirements drive enterprises to adopt data centers.

- Moreover, in April last year, TikTok established a data center in Dublin, Ireland, to house UK and EEA (TikTok) users. It applies a variety of complementary technological, contractual, and organizational safeguards to ensure that these transfers are subject to the same degree of data protection as in the UK and EEA. In practice, this implies that a solid set of physical and logical security measures and numerous rules and data access restrictions for workers safeguard any personal data.

- Logical security in data centers in the region is expected to be driven by the growing number of data centers, which is caused by companies investing and growing in the area.For instance, in October last year, AtlasEdge, a prominent provider of pan-European edge data centers, announced the acquisition of Datacenter One ("DC1"). AtlasEdge's European development continues, with DC1 being Germany's top data center supplier.

- Furthermore, in June last year, Schneider Electric announced a faster, prefabricated data center solution in Europe and a "modernization" of its network management software, Ecostruxure IT.

Data Center Logical Security Industry Overview

The data center logical security market is expected to have a medium level of concentration with multiple players. Product launches, geographical expansion, acquisitions, and R&D activities are key strategies these players adopt in the Data Center Logical Security market. Some key players include major companies such as Cisco, IBM, HP, Dell, McAfee, Inc., and Juniper Networks, among many others.

In August 2022, Microsoft opened a new data center in Qatar. This made the country a bigger part of its global business.This expansion gives Qatar's consumers, organizations, and partners access to cloud services that are highly available, scalable, and strong. This promotes the use of intelligent cloud services and speeds up the digital transformation.

In October 2022, IBM will announce that version 11.5.8 of Db2 will be released first in the cloud. This is a minor update with over 50 changes, including improved performance and compression when loading columnar data, expanded logical backup and restoration to more topologies, and AWS IaaS certifications for Db2 pureScale. All of these changes are driven by the 11.5.8 engine.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Safety Concern for Business and Personal Data

- 4.4.2 Increasing Need for Cloud computing and Data Virtualization

- 4.5 Market Restraints

- 4.5.1 Availability of Low Priced Security Software

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Access Control and Identification Solution

- 5.1.2 Threat Protection Solution

- 5.1.3 Data Loss Prevention Solution

- 5.1.4 Other Solutions

- 5.2 By Service

- 5.2.1 Security Consulting Service

- 5.2.2 Security Solution Deployment Service

- 5.2.3 Support and Maintenance

- 5.3 By End-user

- 5.3.1 Banking and Financial Services

- 5.3.2 Manufacturing

- 5.3.3 Technology

- 5.3.4 Energy

- 5.3.5 Healthcare

- 5.3.6 Central/Local Government

- 5.3.7 Entertainment and Media

- 5.3.8 Other end-users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Argentina

- 5.4.4.4 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Israel

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Cisco Systems Inc.

- 6.1.3 Hewlett-Packard Enterprise Co.

- 6.1.4 Trend Micro Inc.

- 6.1.5 McAfee Inc.

- 6.1.6 Fortinet Inc.

- 6.1.7 VMware Inc.

- 6.1.8 Checkpoint Software Technologies Ltd.

- 6.1.9 Juniper Networks Inc.

- 6.1.10 Dell