|

市場調查報告書

商品編碼

1550039

微處理器保護繼電器:市場佔有率分析、行業趨勢和成長預測 (2024-2029)Microprocessor Protective Relay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

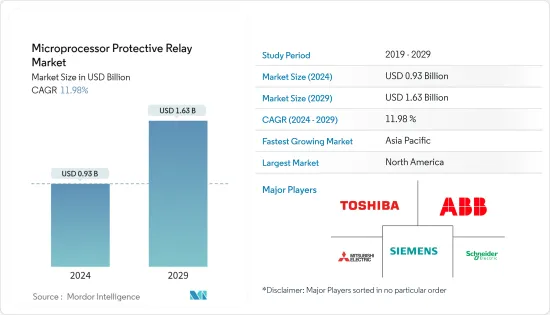

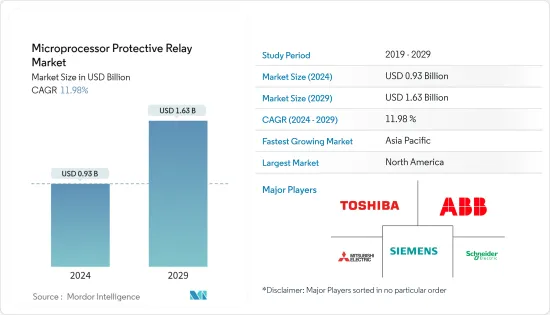

微處理器保護繼電器市場規模預計到2024年為9.3億美元,預計到2029年將達到16.3億美元,在預測期內(2024-2029年)複合年成長率預計為11.98%。

主要亮點

- 由於電力基礎設施的增加、電網現代化的努力、電氣安全意識、智慧電網的努力和政府的支持,微處理器保護繼電器市場預計將顯著成長。隨著電力系統的不斷擴大和技術進步,對微處理器保護繼電器的需求預計將進一步增加。

- 隨著氣候變遷增加了極端天氣事件的發生頻率,國家電網強調加強基礎設施以抵禦更強風暴和氣溫上升的緊迫性。因此,2024 年 3 月,該公司宣布了一項 40 億美元的計劃,旨在加強紐約州北部的電網。這項重大投資將為 70 個計劃提供資金,包括建造新的變電站以及對連接布法羅、羅徹斯特和錫拉丘茲附近城鎮的 1,000 多英里的輸電線進行重大重建。

- 世界新興和已開發國家正在大力投資智慧電網建設,預計這將在未來幾年推動繼電器市場。智慧電網是一種先進的電網基礎設施,旨在提高可靠性和效率,由自動化控制、現代通訊基礎設施、高功率轉換器以及最新的能源管理技術、感測和計量技術提供動力。

- 市場面臨的一個顯著障礙是與這些繼電器相關的高安裝成本。在大型工業環境中,保護繼電器通常需要輔助電路,增加了總成本。此外,定期維護會進一步增加營運成本。此外,市場也面臨來自無組織產業的日益激烈的競爭。

- 整體經濟健康狀況和地緣政治緊張局勢等宏觀經濟因素對於塑造繼電器市場的成長軌跡至關重要。這些因素對製造業、工業和公共產業等關鍵最終用戶部門產生重大影響。最近的衝突,特別是俄羅斯-烏克蘭戰爭和以色列-哈馬斯戰爭,加劇了全球供應鏈挑戰,並導致供應鏈中斷蔓延到所有最終用戶部門。

微處理器保護繼電器市場趨勢

公共產業部門佔據主要市場佔有率

- 保護繼電器的需求將繼續成長,尤其是發電和配電領域的公共事業公司。國際能源總署(IEA)預測,2024年全球電力需求將成長3.3%。隨著人們對電氣安全意識的不斷提高以及最大限度地減少電力系統故障影響的需求,人們越來越重視在公共產業中實施先進的保護系統。微處理器保護繼電器提高了故障偵測和回應的準確性、選擇性和智慧性,以確保電氣設備、人員和整個電力系統的安全。

- 世界各國都在加大投資力度,以實現電力基礎設施的現代化,使其適應可再生能源,並滿足不斷發展的產業的需求。隨著越來越多的可再生能源計劃開發並併網,整個電力系統變得更加複雜和多樣化。微處理器保護繼電器在將這些新的再生能源來源安全可靠地整合到現有電網基礎設施方面發揮著至關重要的作用。

- 例如,澳洲制定了2030年82%的電力來自太陽能和風電等可再生能源的目標,太陽能發電有望為實現這一目標做出重大貢獻。

- 微處理器保護繼電器有助於檢測和隔離電網內的潛在故障。快速故障偵測可以快速隔離受影響的部分,防止級聯故障並最大限度地減少停機時間。這有助於維持可再生能源系統和整個電網的可靠性和性能。

- 許多地區都有特定的電網規範和標準,可再生能源計劃必須遵守這些規範和標準,才能無縫融入電網。微處理器保護繼電器透過提供並聯型和同步所需的保護和通訊功能來滿足這些標準。

亞太地區佔主要市場佔有率

- 亞太地區微處理器保護繼電器市場的成長受到電力基礎設施增加、電網現代化努力、電氣安全意識、智慧電網計畫和政府支援等因素的推動。隨著電力系統的不斷擴張和技術進步,該地區對微處理器保護繼電器的需求預計將進一步增加。

- 亞太地區正在經歷快速的工業化、都市化和人口成長,對電力的需求不斷增加。隨著該地區國家不斷投資擴建和升級其電力基礎設施,對包括微處理器保護繼電器在內的可靠保護系統的需求不斷增加。例如,根據聯合國的預測,印度預計在未來幾年成為人口最多的國家,2030年將達到15億人口,2050年將達到16.6億人口。

- 亞太地區許多國家都致力於電網現代化,以提高供電效率、可靠性和品質。這包括引進先進的保護和控制技術,例如微處理器保護繼電器。升級老化的電力基礎設施和整合再生能源來源也推動了對先進保護解決方案的需求。

- 2023年10月,印度太陽能公司(SECI)發起競標,在印度市場開發約1吉瓦的州際併網太陽能計劃。正在開發的太陽能計劃開發商與SECI之間將簽訂為期25年的購電協議。吉瓦級太陽能光電競標的開放和計劃的開拓預計將在未來幾年刺激太陽能市場。

- 例如,截至2024年4月,印度可再生能源發電容量(包括水力發電)為191.67GW。到2030年,國家計劃興建500GW可再生能源。因此,該國對可再生能源的需求不斷增加預計將有助於預測期內的市場成長。

- 亞太地區擴大採用智慧電網技術,實現電力系統的先進監測、控制和自動化。微處理器保護繼電器透過提供即時監控、遠端控制和通訊功能來支援電網可靠性和高效運行,在智慧電網應用中發揮著至關重要的作用。

- 亞太地區各國政府正在電力產業實施措施和投資,以滿足不斷成長的能源需求並提高電網可靠性。這些努力通常包括引入先進的保護和控制系統,從而推動對微處理器保護繼電器的需求。

微處理器保護繼電器產業概述

微處理器保護繼電器市場競爭激烈且分散,主要參與者包括ABB、西門子、東芝公司、三菱電機公司和施耐德電氣。市場參與者正在採取聯盟和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

- 2024 年 1 月,Fanox Electronics 實現了一個里程碑,推出了適用於廣泛應用的尖端高保護繼電器解決方案。本公司的旗艦產品SIR-C架空控制與饋線保護系統,具有架空控制/RTU和饋線保護繼電器的雙重作用。此創新系統擁有全面的功能,包括一次和二次配電電流、電壓和頻率監測。此外,SIR-C 透過 24-230 Vdc/ac 輔助電源確保彈性和可靠的性能。

- 2023 年 8 月,西門子推出了 SIRIUS 3UG5 線路監控繼電器,旨在監控電網穩定性、確保系統效率並延長馬達和壓縮機等關鍵零件的使用壽命。這些繼電器特別適用於惡劣環境,例如醫院和製程工業,其中可靠的電源至關重要。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 電力消耗成長

- 增加再生能源來源的使用

- 市場挑戰

- 無組織產業的成本上升和競爭加劇

第6章 市場細分

- 按電壓範圍

- 低電壓

- 中壓

- 高電壓

- 按最終用戶產業

- 公共產業

- 工業的

- 其他最終用戶產業(鐵路、醫院等)

- 按用途

- 輸電線路

- 匯流排

- 餵食器

- 變壓器

- 發電機

- 馬達

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Siemens AG

- Bender GmbH & Co. KG

- Eaton Corporation PLC

- General Electric Company

- Rockwell Automation

- Littelfuse Inc

- Toshiba Corporation

- Schweitzer Engineering Laboratories

- L&T Electrical & Automation(Schneider Electric SE)

- Fanox Electronics

- NR Electric Co. Ltd

第8章市場展望

The Microprocessor Protective Relay Market size is estimated at USD 0.93 billion in 2024, and is expected to reach USD 1.63 billion by 2029, growing at a CAGR of 11.98% during the forecast period (2024-2029).

Key Highlights

- The microprocessor protective relay market is projected to grow significantly due to the increasing power infrastructure, grid modernization efforts, electrical safety awareness, smart grid initiatives, and government support. With the continued expansion of power systems and technological advancements, the demand for microprocessor protective relays is expected to increase further.

- With climate change heightening the frequency of extreme weather events, National Grid emphasizes the urgency of bolstering its infrastructure against potent storms and rising temperatures. Consequently, in March 2024, the company unveiled a USD 4 billion initiative aimed at fortifying the power grid in upstate New York. This substantial investment will fund 70 projects, encompassing the construction of new substations and the extensive reconstruction of over 1,000 miles of transmission lines that link towns in proximity to Buffalo, Rochester, and Syracuse.

- Developing and developed countries worldwide are significantly investing in the construction of smart power grids, which is anticipated to propel the market for relays in the coming years. Smart grids are advanced electric power grid infrastructures for enhanced reliability and efficiency and work with automated control, modern communications infrastructure, high-power converters, modern energy management techniques, and sensing and metering technologies.

- The market faces a notable hurdle in the form of the higher installation costs associated with these relays. In large industrial settings, the protection relays often necessitate supplementary circuitry, elevating the total cost. Moreover, their regular maintenance further adds to operational expenses. Compounding this, the market contends with mounting competition from the unorganized sector.

- Macroeconomic factors, like the overall economic health and geopolitical tensions, are pivotal in shaping the growth trajectory of the protective relay market. These factors have a pronounced effect on key end-user sectors, spanning manufacturing, industrial, and utilities. Recent conflicts, notably the Russia-Ukraine and Israel-Hamas wars, have exacerbated global supply chain challenges, leading to disruptions that reverberated across all end-user segments.

Microprocessor Protective Relay Market Trends

Utilities Segment to Hold Significant Market Share

- Protective relays are poised to see continued demand from utilities, particularly in power generation and distribution. The International Energy Agency (IEA) projected that global electricity demand will increase by 3.3% in 2024. With growing awareness of electrical safety and the need to minimize the impact of power system faults, there is an increasing emphasis on deploying sophisticated protection systems in utilities. Microprocessor protective relays offer enhanced accuracy, selectivity, and intelligence in detecting and responding to faults, ensuring the safety of electrical equipment, personnel, and the overall power system.

- Global nations are ramping up investments to modernize their power infrastructures, adapting them for renewable energy and aligning with evolving industry needs. As more renewable energy projects are developed and connected to the grid, the overall power system becomes more complex and diverse. Microprocessor protective relays play a crucial role in ensuring the safe and reliable integration of these new renewable energy sources into the existing grid infrastructure.

- For instance, Australia has set a goal of generating 82% of its electricity through renewable sources like solar PV and wind by 2030, and solar PV is expected to be a significant contributor to achieving this target.

- Microprocessor protective relays are instrumental in detecting and isolating faults that may occur within the power grid. They provide rapid fault detection, allowing for quick isolation of the affected section, preventing cascading failures, and minimizing downtime. This aids in maintaining the reliability and performance of the renewable energy systems and the overall grid.

- Many regions have specific grid codes and standards that renewable energy projects need to adhere to for seamless integration into the power grid. Microprocessor protective relays enable compliance with these codes by providing the necessary protection functions and communication capabilities required for grid connection and synchronization.

Asia-Pacific to Register a Significant Market Share

- The growth of the microprocessor protective relay market in Asia-Pacific is driven by factors like increasing power infrastructure, grid modernization efforts, electrical safety awareness, smart grid initiatives, and government support. With the continued expansion of power systems and advancements in technologies, the demand for microprocessor protective relays is expected to further increase in the region.

- Asia-Pacific is experiencing rapid industrialization, urbanization, and population growth, leading to an increased demand for electricity. As countries in the region continue to invest in expanding and upgrading their power infrastructure, the need for reliable protection systems, including microprocessor protective relays, is growing. For instance, according to the United Nations, India will become the most populated country in the coming years, with a population of 1.5 billion by 2030 and 1.66 billion by 2050.

- Many countries in Asia-Pacific are focusing on modernizing their power grids to improve efficiency, reliability, and quality of electricity supply. This includes the incorporation of advanced protection and control technologies like microprocessor protective relays. The upgrading of aging power infrastructure and the integration of renewable energy sources also drive the demand for advanced protection solutions.

- In October 2023, the Solar Energy Corporation of India (SECI) launched a tender in the Indian market to develop about 1 GW of interstate transmission grid-connected solar projects. The solar projects to be developed will witness the signing off of a 25-year power purchase agreement between developers and SECI. The onset of such gigawatt-scale solar tenders and the development of projects are expected to create a spur in the solar energy market in the coming years.

- For instance, India's installed renewable power capacity (including hydro) was 191.67 GW as of April 2024. By 2030, the country intends to build 500 GW of renewable energy. Thus, increasing demand for renewable energy in the country is expected to contribute to market growth during the forecast period.

- Asia-Pacific is witnessing the adoption of smart grid technologies, which enable advanced monitoring, control, and automation of power systems. Microprocessor protective relays play a crucial role in smart grid applications by providing real-time monitoring, remote control, and communication capabilities, supporting the reliable and efficient operation of the grid.

- Governments in Asia-Pacific are implementing initiatives and making investments in the power sector to meet the growing energy demand and improve grid reliability. These initiatives often include the deployment of advanced protection and control systems, driving the demand for microprocessor protective relays.

Microprocessor Protective Relay Industry Overview

The microprocessor protective relay market is highly competitive and fragmented, with major players like ABB Ltd, Siemens AG, Toshiba Corporation, Mitsubishi Electric Corporation, and Schneider Electric. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024: Fanox Electronics achieved a milestone by introducing cutting-edge high-protection relay solutions tailored for a wide array of applications. Its flagship offering, the SIR-C Overhead Control and Feeder Protection System, serves a dual role as an overhead control/RTU and a feeder protection relay. This innovative system boasts comprehensive functionalities, including monitoring primary and secondary distribution currents, voltages, and frequencies. Moreover, the SIR-C guarantees a resilient and dependable performance with an auxiliary power supply ranging from 24 to 230 Vdc/ac.

- August 2023: Siemens introduced the SIRIUS 3UG5 line monitoring relays, designed to oversee grid stability, guarantee system efficiency, and prolong the lifespan of crucial components like motors and compressors. These relays are particularly suited for demanding environments, such as hospitals and the process industry, where a reliable power supply is paramount.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Electricity Consumption

- 5.1.2 Increasing Use of Renewable Energy Sources

- 5.2 Market Challenges

- 5.2.1 Higher Cost and Increasing Competition from Unorganized Sector

6 MARKET SEGMENTATION

- 6.1 By Voltage Range

- 6.1.1 Low-voltage

- 6.1.2 Medium-voltage

- 6.1.3 High-voltage

- 6.2 By End-user Industry

- 6.2.1 Utilities

- 6.2.2 Industrial

- 6.2.3 Other End-user Industries (Railway, Hospitals, etc.)

- 6.3 By Application

- 6.3.1 Transmission Line

- 6.3.2 Bus Bar

- 6.3.3 Feeder

- 6.3.4 Transformer

- 6.3.5 Generator

- 6.3.6 Motor

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Schneider Electric SE

- 7.1.3 Mitsubishi Electric Corporation

- 7.1.4 Siemens AG

- 7.1.5 Bender GmbH & Co. KG

- 7.1.6 Eaton Corporation PLC

- 7.1.7 General Electric Company

- 7.1.8 Rockwell Automation

- 7.1.9 Littelfuse Inc

- 7.1.10 Toshiba Corporation

- 7.1.11 Schweitzer Engineering Laboratories

- 7.1.12 L&T Electrical & Automation (Schneider Electric SE)

- 7.1.13 Fanox Electronics

- 7.1.14 NR Electric Co. Ltd