|

市場調查報告書

商品編碼

1644543

微處理器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Microprocessor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

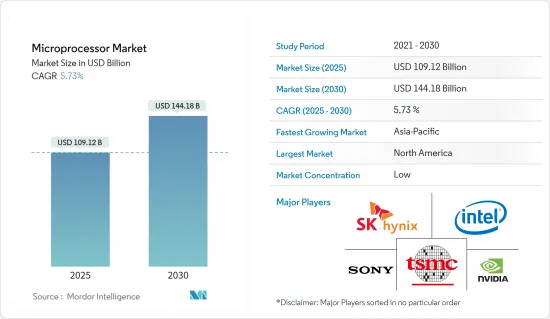

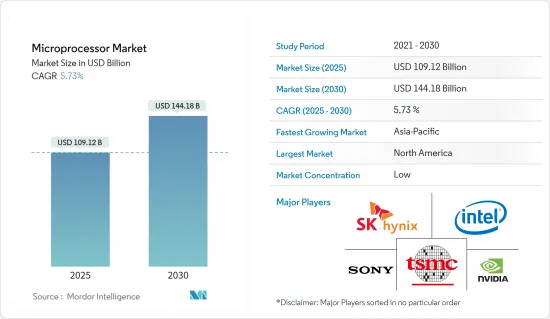

微處理器市場規模預計在 2025 年為 1,091.2 億美元,預計到 2030 年將達到 1,441.8 億美元,預測期內(2025-2030 年)的複合年成長率為 5.73%。

5G 和高效能運算設備的廣泛應用、雲端基礎的軟體和資料中心的日益普及、人工智慧和機器學習解決方案的進步以及對家用電器和汽車的需求不斷成長,可能會推動微處理器市場的成長。

主要亮點

- 微處理器是內建於晶片的微電腦的控制單元,能夠執行算術邏輯單元 (ALU) 運算並與其他連結裝置通訊。微處理器由控制單元、暫存器陣列和 ALU 組成。 ALU 執行算術和邏輯運算,控制單元監督電腦中資料和指令的流動,暫存器陣列存儲累加器和資料。微處理器依照指定的順序取得、解碼和執行。

- 物聯網的快速崛起是推動微處理器使用的關鍵原因之一。由於現在從技術和經濟上都可以從比以前更廣泛的事物中收集資料,因此公司經常忽視物聯網產品和平台生成的資料的複雜性和數量,並需要解決方案來幫助他們管理和解釋他們現在收集的所有資料。因此,作為物聯網基礎設施關鍵組件之一的微處理器的需求預計將成長。

- 此外,對擴增實境和虛擬實境應用和設備、數位相機和遊戲機的需求不斷成長,推動了全球微處理器市場的發展。

- 除此之外,智慧家庭產品的日益普及也推動了對微處理器的需求。智慧鎖、火災和煙霧警報系統以及智慧揚聲器等設備正擴大融入人們的生活。尤其是印度、巴西等新興國家的中階消費能力不斷增強,預計將進一步推動研究市場的成長。

- 此外,由於IT基礎設施、不斷電系統(UPS) 系統、配電單元 (PDU) 和冷卻設備都以某種形式使用微處理器,資料中心產業的擴張也有望為市場成長描繪出有利的前景。此外,採用微型資料中心的多種好處,例如降低交易成本、高功能性和大儲存容量,預計將推動對這些資料中心類型的需求,從而促進研究市場的成長。

- 然而,半導體晶片短缺、生產微處理器積體電路的複雜性、電路設計成本、原料價格上漲、電腦系統出貨量下降以及低成本行動裝置銷售增加等挑戰阻礙了研究市場的成長。

- COVID-19 的影響在微處理器市場顯而易見。微處理器市場受到了 COVID-19 的影響,疫情期間微處理器需求顯著增加,尤其是在消費性電子和醫療保健產業。由於各國實施封鎖措施導致生產能力有限和供應鏈受限,供應商難以滿足需求。

- 不過,隨著大多數半導體製造商加強投資和力度,擴大微處理器和其他半導體產品的生產規模,預計市場將在情況恢復正常後獲得發展動力。此外,自動化、聯網汽車、人工智慧、機器學習和物聯網等技術的不斷滲透,為後疫情時期學習市場的成長創造了有利的市場模式。

微處理器市場趨勢

消費性電子領域推動市場成長

- 由於處理速度快、體積小、維護方便,微處理器擴大被應用於桌上型電腦、智慧型手機、平板電腦和伺服器等消費性電子應用。此多用途電子處理單元可配置為每秒執行約 30 億次操作,在記憶體區域之間快速傳輸資料,並執行浮點運算等高級數學計算。消費性電子領域的成長將對微處理器市場產生正面影響,促進其成長和發展。

- 個人電腦、遊戲機和智慧型手機等遊戲設備配備了由眾多執行特定功能的組件組成的嵌入式系統,因此遊戲市場的成長有助於智慧型手機、遊戲機和 VR/AR 設備的成長,最終影響微處理器世界的成長。

- 近年來智慧型手機和平板電腦的普及對個人電腦的需求產生了影響。新一代智慧型手機和平板電腦的便攜性和效能推動了微處理器和 GPU 市場的成長。與智慧型手機和平板電腦中使用的處理器和 GPU 相比,PC 處理器和 GPU 通常更昂貴。由於越來越多的用戶選擇使用智慧型手機和平板電腦等行動裝置來完成日常任務,桌上型電腦是個人電腦類別中降幅最大的產品。此外,個人電腦的生命週期很長,無法在短期內被取代,這推動了整個智慧型手機產業對可以輕鬆升級到新技術和改進技術的設備的需求。

- 此外,由於低延遲、高速網路的出現,5G 的出現預計將大大加速智慧型手機和其他穿戴式裝置的普及,從而產生對微處理器的需求。愛立信預計,全球智慧型手機用戶數量將從 2021 年的 62.6 億增加到 2028 年的 77.9 億。

亞太地區佔較大市場佔有率

- 亞太地區佔據主要市場佔有率,預計在預測期內將成長最快。這是因為該地區智慧型手機和其他設備的使用日益增多,包括筆記型電腦、行動電話、桌上型電腦和平板電腦。由於數位化加快、高科技產品普及率不斷提高以及汽車電子產品的進步等因素,中國和印度等新興經濟體也為市場擴張做出了貢獻。此外,物聯網 (IoT) 的日益普及、政府的大規模 IT 投資以及對雲端基礎的服務的不斷成長的需求將在整個預測期內推動該區域市場的發展。

- 由於近期對具有先進功能的高檔汽車的需求增加,預計汽車產業將對亞太地區的微處理器產生大量需求。此外,政府對乘客和車輛安全的嚴格規定也對亞太地區的市場成長產生了積極貢獻。

- 由於大型家電和汽車製造業的存在,中國有望在研究市場中佔據主導地位。根據中國工業協會統計,2022年4月,中國生產乘用車約99.6萬輛,商用車約21萬輛。此外,同月中國汽車業總合生產汽車約120萬輛。

- 鑑於對半導體晶片的需求不斷成長以及與美國的持續問題,包括阿里巴巴和百度在內的多家中國公司都在投資生產自己的晶片。中國在「十四五」規劃中確定了人工智慧、量子運算、半導體和太空等七個技術領域為重點發展領域,預計將增加研究市場的機會。

- 其他國家也出現了類似的趨勢,它們不斷推出舉措,推動各自地區半導體產業的發展。例如,印度最近公佈的DIR-V計畫旨在透過大規模生產下一代微處理器來啟動該國的半導體生態系統。印度政府希望在2023年12月實現重級商業矽生產和設計勝利。同樣,印度政府也與SONY印度公司、印度太空研究組織和比利時國家實驗室等公司簽署了五份合作備忘錄,以推廣使用其自主開發的 Shakti 和 Vega RISC-V 微處理器。

微處理器產業概況

由於需要較高的初始投資,微處理器市場集中在少數幾家大公司手中。然而,不斷成長的市場需求和穩定的盈利預計將吸引新的參與者進入市場,從而加劇競爭。市場的主要企業包括英特爾、Nvidia 和高通。

2023 年 2 月,印度先進運算發展中心 (C-DAC) 宣布正在開發該國首個自主設計的微處理器系列。該中心的處理器藍圖旨在使該國在微處理器方面自給自足。 C-DAC 的目標是到 2024年終在全國範圍內實現累積運算能力達到 64 千兆次浮點運算 (PF)。

2023年1月,英特爾在CES 2023上發表了最新的第13代H和HX系列筆記型電腦處理器。據該公司稱,這些高效能筆記型電腦處理器將提供多達 24 核心 CPU、DDR5 支援、PCIe Gen5 等。該公司還推出了第 13 代英特爾酷睿 P 和 U 系列處理器,配備改進的 Iris Xe 板載顯示卡和最多 14 個核心的 CPU 設計。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 宏觀趨勢如何影響產業

第5章 市場動態

- 市場促進因素

- 對高效能、節能處理器的需求不斷增加

- 市場限制

- 個人電腦需求下降

第6章 市場細分

- 按類型

- APU

- CPU

- GPU

- FPGA

- 按應用

- 消費性電子產品

- 企業 - 電腦和伺服器

- 車

- 產業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Intel Corporation

- TSMC

- SK Hynix Inc.

- Sony Corporation

- Nvidia Corporation

- Samsung Electronics Co. Ltd.

- Qualcomm Technologies

- Broadcom Inc.

- Micron Technology

第8章投資分析

第9章:市場的未來

The Microprocessor Market size is estimated at USD 109.12 billion in 2025, and is expected to reach USD 144.18 billion by 2030, at a CAGR of 5.73% during the forecast period (2025-2030).

Due to the growing popularity of 5G and high-performance computing devices, increasing adoption of cloud-based software and data centers, advancements in artificial intelligence and machine learning solutions, and the increasing demand for household appliances and automobiles will likely fuel the microprocessor market growth.

Key Highlights

- A microprocessor is a microcomputer's controlling unit, built on a chip, capable of performing Arithmetic Logic Unit (ALU) operations and communicating with other linked devices. A microprocessor comprises a Control Unit, a Register Array, and an ALU. The ALU performs arithmetic and logical operations; the Control Unit supervises data flow and instructions through the computer, and the Register Array stores accumulators and data. The microprocessor performs Fetch, Decode, and Execute in the provided sequence.

- The rapid rise of the Internet of Things is one significant reason for promoting microprocessor usage. As collecting data from a far wider range of things is now technically and economically feasible than before, companies frequently misjudge the complexity and volume of data generated by IoT products and platforms, necessitating the deployment of solutions to help them manage and interpret all of the data they are now collecting. Microprocessors which are among the major component of IoT infrastructure, are thus expected to grow in demand.

- In addition, the growing demand for Augmented Reality and Virtual Reality apps and devices, as well as digital cameras and gaming consoles, is propelling the worldwide microprocessor market forward.

- Apart from this, the increasing penetration of smart home products is also driving the demand for microprocessors. Devices like smart locks, fire, and smoke alarm systems, smart speakers, etc., are increasingly taking their place in the lives of people. Coupled with the increasing spending capacity of the middle class, especially across developing countries such as India, Brazil, etc., are expected to support the growth of the studied market further.

- The expanding data center industry is also expected to create a favorable scenario for the studied market's growth, as IT infrastructure, UPS (uninterruptible power supply) systems, power distribution units (PDUs), and cooling units all use microprocessors in some form or other. Furthermore, the multiple benefits of adopting micro-data centers, such as decreased transactional costs, high functionality, and high storage, are expected to propel the demand for such data center types, driving the studied market's growth in the process.

- However, the factors such as the shortage of semiconductor chips, the complexity involved in the production of microprocessor integrated circuits, circuit design expenses, escalating raw material prices, decreased shipment of computer systems, and increased sales of low-cost mobile devices are challenging the growth of the studied market.

- A notable impact of COVID-19 was observed on the microprocessors market. Although, the demand increased significantly during the pandemic, especially across the consumer electronics and healthcare industry. The vendors felt it hard to match the demand owing to limited production capabilities and supply chain constraints due to widespread lockdowns imposed across various countries.

- However, with the conditions returning to normalcy, the market is expected to gain traction as a significant portion of the semiconductor manufacturers is increasing their investment and efforts to scale up the production of microprocessors and other semiconductor products. Furthermore, the increasing penetration of technologies such as automation, connected cars, AI, ML, and IoT are creating a favorable market scenario for the growth of the studied market in the post-COVID period.

Microprocessor Market Trends

Consumer Electronics Segment to drive the Market Growth

- Microprocessors are increasingly used in consumer electronics applications such as desktop PCs, smartphones, tablets, and servers because of their fast processing speed, small size, and ease of maintenance. This multipurpose electronic processing device may be configured to accomplish about 3 billion activities per second, transport data swiftly between memory regions, and conduct sophisticated mathematical calculations such as floating-point operations. The rising consumer electronic segment will favor the Microprocessor Market, contributing to market growth and progress for the market under consideration.

- The gaming industry has grown significantly in recent years, rather more dramatically since the outbreak of the pandemic, as gaming devices such as PC, game consoles, smartphones, etc., contain embedded systems comprising many components all serving a specific function, the growing gaming market will contribute to the growth of smartphones, Gaming consoles, and VR/AR devices, ultimately influencing the growth of microprocessors globally.

- The popularity of smartphones and tablets in recent years has influenced PC demand. Microprocessor and GPU market growth have been impacted by the portability and performance of new-generation smartphones and tablets. When compared to those utilized in smartphones and tablets, PC processors and GPUs are usually more expensive. Desktop PCs have significantly declined in the PC category as more users chose portable devices such as smartphones and tablets for day-to-day tasks. Furthermore, because PCs have a long lifecycle and cannot be replaced in a short time, there is a growth in overall demand for the smartphone industry, which can be easily upgraded to improved technology quickly.

- Furthermore, the arrival of 5G is expected to significantly expedite the adoption of smartphones and other wearable devices owing to the availability of a low latency and high-speed network, creating the demand for microprocessors in the process. According to Ericsson, global smartphone subscriptions are expected to grow from 6,260 million in 2021 to 7,790 million by 2028.

Asia Pacific to Account for a Significant Market Share

- The Asia-Pacific region commands a significant market share and is predicted to grow the fastest over the forecast period. The increased use of smartphones and other devices in the region, such as laptops, mobile phones, desktop computers, and tablets, is credited with the increase. Due to factors such as fast digitalization, increased penetration of high-tech gadgets, and progress of automotive electronics, developing economies such as China and India are also helping market expansion. Furthermore, increased Internet of Things (IoT) usage, large government IT investment, and rising demand for cloud-based services will drive the regional market throughout the projection period.

- The automotive industry is expected to generate considerable demand for microprocessors as the demand for luxury cars with advanced functionalities has been increasing lately in the Asia Pacific region. Furthermore, stringent government regulations regarding passenger and vehicle safety also contribute positively to the studied market's growth in Asia Pacific.

- China is expected to remain dominant in the studied market due to the presence of a large consumer electronics and automotive manufacturing industry. According to the China Association of Automobile Manufacturers, in April 2022, around 996,000 passenger cars and 210,000 commercial vehicles were produced in China. Additionally, during the month, China's automotive industry produced a total of about 1.2 million vehicles.

- Considering the growing demand for semiconductor chips, and ongoing issues with the United States, various Chinese firms, including Alibaba and Baidu, among others, have been making investments in manufacturing their own chips, a move considered progress toward China's goal of increasing local capabilities in a crucial technology. China has outlined seven technology fields in its 14th five-year plan, including artificial intelligence, quantum computing, semiconductors, and space, as its priority which is expected to drive opportunities in the studied market.

- A similar trend has been observed across other countries as well, which are continuously launching initiatives to drive the semiconductor industry's growth in their respective regions. For instance, India's DIR-V program, which aims to accelerate the country's semiconductor ecosystem by mass-producing next-generation indigenous microprocessors, was recently revealed. By December 2023, the Indian government hopes to have achieved heavy-grade commercial silicon production and design victories. In the same vein, the government has inked five Memorandums of Understanding with companies such as Sony India, ISRO, BEL, and others to promote the usage of the Shakti and Vega RISC-V microprocessors, which were created in-house.

Microprocessor Industry Overview

The Microprocessor Market is concentrated due to the high initial investments and is dominated by a few major players. However, the growing market demand and stable profitability are expected to drive new players into the market, making it more competitive. Some of the key players in the market are Intel, Nvidia, Qualcomm, etc.

In February 2023, India's Centre for Development of Advanced Computing (C-DAC) announced they are working on the country's first indigenously designed family of microprocessors. The organization's roadmap for processors is aimed at helping the country become self-reliant in microprocessors. C-DAC targets to achieve 64 PetaFlops (PF) of cumulative compute power across the country by the end of 2024.

In January 2023, Intel unveiled its latest 13th Gen H and HX series of laptop processors at CES 2023. According to the company, these high-performance laptop processors offer up to 24-core CPU, DDR5 support, PCIe Gen5, and more. The company also announced the 13th Gen Intel Core P and U series of processors with improved Iris Xe onboard graphics and up to 14 core CPU designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in demand for high performance and energy-efficient processors

- 5.2 Market Restraints

- 5.2.1 Decrease in demand for PCs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 APU

- 6.1.2 CPU

- 6.1.3 GPU

- 6.1.4 FPGA

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Enterprise - Computer and Servers

- 6.2.3 Automotive

- 6.2.4 Industrial

- 6.2.5 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 TSMC

- 7.1.3 SK Hynix Inc.

- 7.1.4 Sony Corporation

- 7.1.5 Nvidia Corporation

- 7.1.6 Samsung Electronics Co. Ltd.

- 7.1.7 Qualcomm Technologies

- 7.1.8 Broadcom Inc.

- 7.1.9 Micron Technology