|

市場調查報告書

商品編碼

1642150

伺服器微處理器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Server Microprocessor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

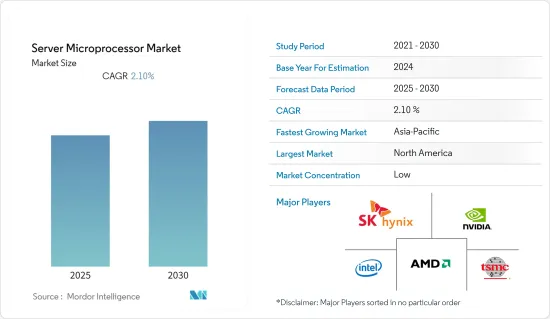

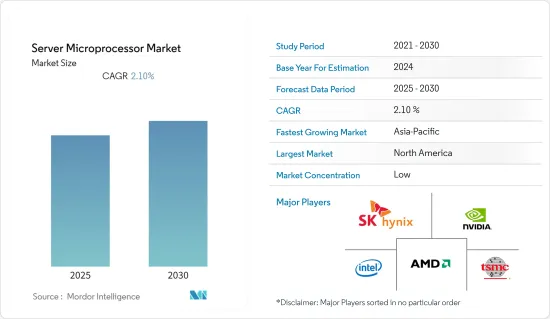

預測期內伺服器微處理器市場預計複合年成長率為 2.1%

關鍵亮點

- 伺服器微處理器技術革新日新月異,為企業帶來品質調整挑戰。衡量微處理器品質的重要特性包括核心、執行緒、基本頻率、渦輪頻率、快取大小和熱設計功率。預計在預測期內,功耗和效能仍將是微處理器的重點。

- 根據美國消費美國美國科技產業零售額將達到創紀錄的4,870億美元,與前一年同期比較成長7.5%。其他國家也出現了類似的趨勢。智慧型手機、平板電腦和其他智慧家庭設備的需求旺盛是推動微處理器需求的主要因素之一。

- 除此之外,智慧家庭產品的日益普及也推動了對微處理器的需求。智慧鎖、火災和煙霧警報系統以及智慧揚聲器等設備正擴大融入人們的生活。特別是在印度和巴西等新興國家,隨著中階消費能力的提高,市場預計將進一步成長。

- 據Cloudscene稱,截至今年,光是北美(美國和加拿大)就擁有約3,029個資料中心,是伺服器微處理器的主要市場。

- 此外,物聯網的快速崛起是推動微處理器(IoT)使用的關鍵原因之一。物聯網技術使微處理器成為可能,因為現在從技術和經濟上來說,從比以前更廣泛的事物中收集資料都是可行的。公司往往低估物聯網產品和平台產生的資料的複雜性和數量,需要解決方案來幫助他們管理和解釋現在收集的所有資料。

- COVID-19 疫情對全球微處理器市場產生了多方面影響。儘管各國大規模封鎖嚴重擾亂了微處理器製造商的供應鏈和製造能力,但醫療和消費性電子領域對這些半導體設備的需求卻大幅增加。預計預測期內伺服器微處理器市場複合年成長率為 2.1%。預計預測期內伺服器微處理器市場複合年成長率為 2.1%。伺服器微處理器正在擴大資料中心的覆蓋範圍,而雲端服務供應商的需求正在推動伺服器微處理器市場的成長。由英特爾和AMD兩大巨頭主導的伺服器微處理器市場正在經歷快速的產品創新。公司正在認知到資料分析、機器學習和人工智慧等現代工作負載的性能需求,並相應地改進其設計。

關鍵亮點

- 伺服器微處理器技術革新日新月異,為企業帶來品質調整挑戰。衡量微處理器品質的重要特性包括核心、執行緒、基本頻率、渦輪頻率、快取大小和熱設計功率。在接下來的幾年裡,微處理器將繼續成為人們關注的焦點,重點在於它的功耗和效能。

- 根據美國消費科技協會(CTA)預測,美國消費科技零售額將達到創紀錄的4,870億美元,與前一年同期比較成長7.5%。其他國家也出現了類似的趨勢。智慧型手機、平板電腦和其他智慧家庭設備的需求旺盛是推動微處理器需求的主要因素之一。

- 除此之外,智慧家庭產品的日益普及也推動了對微處理器的需求。智慧鎖、火災和煙霧警報系統以及智慧揚聲器等設備正擴大融入人們的生活。特別是在印度和巴西等新興國家,隨著中階消費能力的提高,市場預計將進一步成長。

- 據Cloudscene稱,截至今年,光是北美(美國和加拿大)就擁有約3,029個資料中心,是伺服器微處理器的主要市場。

- 此外,物聯網的快速崛起是推動微處理器(IoT)使用的關鍵原因之一。物聯網技術使微處理器成為可能,因為現在從技術和經濟上來說,從比以前更廣泛的事物中收集資料都是可行的。公司往往低估物聯網產品和平台產生的資料的複雜性和數量,需要解決方案來幫助他們管理和解釋現在收集的所有資料。

- COVID-19 疫情對全球微處理器市場產生了多方面影響。儘管各國大規模封鎖嚴重擾亂了微處理器製造商的供應鏈和製造能力,但醫療和消費性電子領域對這些半導體設備的需求卻大幅增加。

伺服器微處理器市場趨勢

消費性電子領域可望推動市場需求

- 由於處理速度快、體積小、維護方便,微處理器擴大被應用於桌上型電腦、智慧型手機、平板電腦和伺服器等消費性電子應用。這種通用電子處理設備可配置為每秒執行多達30億次操作,在記憶體區域之間快速傳輸資料,並執行浮點運算等高級數學計算。消費性電子領域的成長預計將對微處理器市場產生積極影響,促進該市場的成長和發展。

- 亞太地區的通訊業者正在利用其行動網路和服務的規模和實用性,幫助大大小小的企業採用新的數位解決方案來實現其工業 4.0 目標。根據 GSMA 去年發布的《行動經濟報告》,印度、印尼和馬來西亞隨著 5G 網路部署的第二階段開始,正在進行一些與 5G 相關的活動。該地區不斷擴展的5G網路能力將推動智慧型手機、平板電腦、電視、AR/VR和其他消費性電子產品市場的發展,從而促進該地區的研究市場。

- 在包括美國、加拿大、西班牙、德國和法國在內的已開發國家,智慧家庭的普及將推動智慧家庭科技產品的採用,並推動產業發展。根據美國消費科技協會去年 7 月發布的新聞稿,美國智慧家居設備銷量超過 1 億台,累計達 150 億美元。去年,家用機器人、智慧音箱等智慧家居技術在美國已廣泛應用。這些設備大量採用了微處理器,在預期時間內提升了市場前景。

- 類比 AI 處理器公司 Mythic 今天發布了 M1076 類比矩陣處理器,該處理器可提供低功耗 AI 處理。該公司使用類比電路而非數位電路製造處理器,這使得將記憶體整合到處理器中變得更加容易,所需的記憶體比典型的系統晶片或圖形處理單元(GPU) 要少10 倍。可以與功耗。

- 綜合 IT 解決方案供應商 Supermicro, Inc. 今天宣布推出基於下一代第四代英特爾至強可擴展處理器的業界最全面的伺服器和儲存系統產品組合。

亞太地區致力於發展關鍵微處理器能力

- 亞太地區是成長最快的地區之一,各領域的成長率都超過北美和歐洲等已開發地區。例如,對微處理器的需求大幅增加的汽車產業在亞太地區呈現最高的成長率。

- 根據OICA統計,中國去年的汽車產量居世界首,達2,600萬輛。日本以784萬台位居第三,印度以439萬台位居第四。

- 隨著汽車產業快速向自動駕駛汽車轉變,預計亞太地區對微處理器的需求將進一步上升。例如,今年7月,中國主要汽車製造商百度推出了自動駕駛計程車RT6。

- 此外,亞太地區消費性電子產業也呈現上升趨勢,受數位化進程加速、高科技設備日益普及等因素影響,需求每年都創下歷史新高。在預測期內,預計該區域市場將受到物聯網 (IoT) 日益普及、政府大量 IT 投資以及對雲端基礎的服務不斷成長的需求的推動。

- 據IBEF稱,印度去年家用電子電器產品產量為7,051.5億印度盧比。此外,亞太地區連網穿戴裝置數量預計也將從 2021 年的 2.582 億大幅成長至今年的 3.11 億。 (圖片來源:思科系統公司)預計這些趨勢將在預測期內推動亞太地區市場的成長。

伺服器微處理器產業概況

過去幾年,伺服器微處理器市場一直由英特爾主導,其最接近的競爭對手是 AMD,參與企業包括 SK 海力士公司和 Nvidia 公司。市場需要在研發和技術合作方面進行大量投資,以滿足伺服器和資料中心的需求。鑑於 AMD 新產品的推出和具有競爭力的定價策略,AMD 很可能會蠶食英特爾在伺服器微處理器市場的較小佔有率。在這個市場中,供應商正在致力於為下一代資料中心產品推出。近期市場發展趨勢如下:

- 2022 年 11 月-AMD 宣布推出 Epyc 伺服器處理器,針對需要高效能運算的雲端供應商、企業和組織。第四代 AMD Epyc 處理器可以幫助企業釋放資料中心資源來處理更多工作並更快地交付輸出。

- 2022 年 4 月-微軟開始提供搭載基於 Arm 的 Ampere Altra 伺服器處理器的新型 Azure虛擬機器。它專為高效運行橫向擴展工作負載、Web 伺服器、應用程式伺服器、開放原始碼資料資料庫、雲端原生和豐富的 .NET、Java 應用程式、遊戲伺服器、媒體伺服器和開放原始碼資料庫而建置。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場概況

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈分析

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 對高效能、節能處理器的需求不斷增加

- 市場限制

- 個人電腦需求下降

第6章 市場細分

- 按類型

- APU

- CPU

- GPU

- FPGA

- 按應用

- 消費性電子產品

- 企業 - 電腦和伺服器

- 車

- 工業的

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 供應商市場佔有率(獨立伺服器微處理器供應商)

- 公司簡介

- Intel Corporation

- Advanced Micro Devices, Inc.

- SK Hynix Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Nvidia Corporation

- Samsung Technologies

- Qualcomm Technologies

- Broadcom Inc.

- Micron Technology

- Sony Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Server Microprocessor Market is expected to register a CAGR of 2.1% during the forecast period.

Key Highlights

- The server microprocessors are bound to rapid technological change, which results in challenging quality adjustments for the companies. Some of the significant characteristics for measuring the quality of microprocessors include cores, threads, base frequency, turbo frequency, cache size, and thermal design power. Power consumption and performance are expected to remain the focus for microprocessors over the forecast period.

- According to the Consumer Technology Association (CTA), retail sales revenue for the consumer technology industry in the United States was forecasted to reach a record-breaking USD 487 billion in the previous year-a 7.5% increase compared to the previous years. A similar trend has been observed in other countries as well. The rapidly expanding demand for smartphones, tablets, and other smart home devices is among the major factors driving the demand for microprocessors, as microprocessors optimize the performance of these devices by improving speed and efficiency.

- Apart from this, the increasing penetration of smart home products also drives the demand for microprocessors. Devices like smart locks, fire and smoke alarm systems, smart speakers, etc. are increasingly taking their place in people's lives. Coupled with the increasing spending capacity of the middle class, especially across developing countries such as India and Brazil, this is expected to support further market growth.

- The growth of big data analytics and cloud computing, as well as the expansion of mobile broadband, drive the demand for new data center infrastructures.According to Cloudscene, North America alone (US and Canada) houses around 3029 data centers as of this year, making it a prominent market for server microprocessors.

- Furthermore, the rapid rise of the Internet of Things is one significant reason for promoting microprocessor usage (IoT). IoT technologies enable microprocessors because it is now technically and economically feasible to collect data from a far wider range of things than was previously conceivable. Companies frequently misjudge the complexity and volume of data generated by IoT products and platforms, necessitating the deployment of solutions to help them manage and interpret all of the data they are now collecting.

- The global outbreak of COVID-19 had a mixed impact on the worldwide microprocessor market. While the widespread lockdown across various countries significantly disrupted microprocessor manufacturers' supply chains and manufacturing capabilities, the demand for these semiconductor devices increased substantially across the healthcare and consumer electronics sectors. The server microprocessor market is expected to register a CAGR of 2.1% over the forecast period. They are increasing their data center footprint, and demand from cloud service providers prompts the growth of the server microprocessor market. Dominated by the duopoly of Intel and AMD, the market for server microprocessors is undergoing product innovations. Companies realize the performance needs for modern workloads such as data analytics, machine learning, and artificial intelligence and are improving their designs accordingly.

- The server microprocessors are bound to rapid technological change, which results in challenging quality adjustments for the companies. Some of the significant characteristics for measuring the quality of microprocessors include cores, threads, base frequency, turbo frequency, cache size, and thermal design power. Over the next few years, microprocessors will likely continue to focus on how much power they use and how well they work.

- According to the Consumer Technology Association (CTA), retail sales revenue for the consumer technology industry in the United States was forecasted to reach a record-breaking USD 487 billion in the previous year-a 7.5% increase compared to the previous years. A similar trend has been observed in other countries as well. The rapidly expanding demand for smartphones, tablets, and other smart home devices is among the major factors driving the demand for microprocessors, as microprocessors optimize the performance of these devices by improving speed and efficiency.

- Apart from this, the increasing penetration of smart home products also drives the demand for microprocessors. Devices like smart locks, fire and smoke alarm systems, smart speakers, etc. are increasingly taking their place in people's lives. Coupled with the increasing spending capacity of the middle class, especially across developing countries such as India and Brazil, this is expected to support further market growth.

- The growth of big data analytics and cloud computing, as well as the expansion of mobile broadband, drive the demand for new data center infrastructures.According to Cloudscene, North America alone (US and Canada) houses around 3029 data centers as of this year, making it a prominent market for server microprocessors.

- Furthermore, the rapid rise of the Internet of Things is one significant reason for promoting microprocessor usage (IoT). IoT technologies enable microprocessors because it is now technically and economically feasible to collect data from a far wider range of things than was previously conceivable. Companies frequently misjudge the complexity and volume of data generated by IoT products and platforms, necessitating the deployment of solutions to help them manage and interpret all of the data they are now collecting.

- The global outbreak of COVID-19 had a mixed impact on the worldwide microprocessor market. While the widespread lockdown across various countries significantly disrupted microprocessor manufacturers' supply chains and manufacturing capabilities, the demand for these semiconductor devices increased substantially across the healthcare and consumer electronics sectors.

Key Highlights

Server Microprocessor Market Trends

Consumer electronics Segment is Expected to Drive the Market Demand

- Microprocessors are increasingly being used in consumer electronics applications, such as desktop PCs, smartphones, tablets, and servers, because of their fast processing speed, small size, and ease of maintenance. This multipurpose electronic processing device may be configured to accomplish 3 billion activities per second, transport data swiftly between memory regions, and conduct sophisticated mathematical calculations, such as floating-point operations. The rising consumer electronic segment will favor the microprocessor market, contributing to market growth and progress for the market under consideration.

- Operators around the Asia-Pacific are leveraging the scale and utility of mobile networks and services to help large and small businesses implement new digital solutions to meet Industry 4.0 goals, in which 5G and the IoT will play significant roles. According to the GSMA's Mobile Economy Report of the last year, the second phase of 5G network rollouts has commenced in the area, marked by several 5G-related activities in India, Indonesia, and Malaysia. The region's expanding 5G network capabilities will enhance the smartphone, tablet, TV, AR/VR, and other consumer electronics markets, thus boosting the researched market in the region.

- The widespread use of smart homes in industrialized economies, including the United States, Canada, Spain, Germany, and France, will expedite the adoption of intelligent home technology goods, hence advancing the industry. According to a Consumer Technology Association news release from July last year, over 100 million smart home gadgets were supplied in the United States, accounting for USD 15 billion in sales. In the last year, smart home technologies, such as house robots and smart speakers, have been widely used in the United States. These gadgets are heavily embedded with microprocessors, propelling market prospects during the anticipated period.

- The analog AI processor company Mythic launched its M1076 Analog Matrix Processor today to provide low-power AI processing. The company uses analog circuits rather than digital to create its processor, making it easier to integrate memory into the processor and operate its device with ten times less power than a typical system-on-chip or graphics processing unit (GPU).

- Supermicro, Inc., a total IT solution provider, announced the launch of the industry's most comprehensive portfolio of servers and storage systems based on the upcoming 4th generation Intel Xeon Scalable processor in November of this year.

Asia-Pacific Making Efforts to Develop Key Competence in Microprocessors

- The Asia-Pacific region is among the fastest-growing regions and is even outpacing developed regions, such as North America and Europe, in terms of growth rate across various sectors. For instance, the automotive industry, where the demand for microprocessors has been increasing significantly, has witnessed the highest growth rate in the Asia-Pacific region.

- According to OICA, China was the leading producer of motor vehicles last year, with about 26 million vehicles. Japan and India were in the third and fourth spots, with 7.84 million and 4.39 million vehicles produced, respectively.

- With the automotive industry fast moving toward autonomous vehicles, the demand for microprocessors is expected to grow further in the Asia-Pacific region. In July of this year, for example, Baidu, a major automaker in China, showed off the self-driving taxi RT6.

- Furthermore, the consumer electronics industry in the Asia-Pacific region is also witnessing an upward trend, with demand touching record heights every year due to factors such as fast digitalization and increased penetration of high-tech gadgets. During the projection period, the regional market is expected to be driven by increased use of the Internet of Things (IoT), large IT investments by the government, and rising demand for cloud-based services.

- According to IBEF, the value of consumer electronics production in India was INR 705.15 billion last year. Furthermore, the number of connected wearable devices in the Asia-Pacific region is also expected to significantly increase from 258.2 million in 2021 to 311 million in the current year. (Source: Cisco Systems). Such trends are expected to drive the growth of the market studied in the Asia-Pacific region during the forecast period.

Server Microprocessor Industry Overview

The server microprocessor market has been dominated by Intel for the past few years, with AMD as the closest competitor and other players like SK Hynix Inc. and Nvidia Corporation, among others. The market demands strong investments in R&D and technology partnerships to address the needs of servers and data centers. AMD will likely cut through a small share of Intel in the server microprocessor market, considering the new product rollouts and competitive pricing strategy. Vendors in the market have been involved in the launch of new microprocessors for next-generation data centers. Following are the recent developments in the market:

- November 2022 - AMD announced the launch of Epyc server processors for cloud providers, enterprises, and organizations that require high-performance computing. The fourth generation of AMD Epyc processors could help businesses free up data center resources to handle more work and speed up output.

- April 2022 - Microsoft has launched its new Azure virtual machines powered by the Arm-based Ampere Altra server processors. It is made to run scale-out workloads, web servers, application servers, open-source databases, cloud-native and rich.NET and Java applications, gaming servers, media servers, and open-source databases in an efficient way.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for High-performance and Energy-efficient Processors

- 5.2 Market Restraints

- 5.2.1 Decrease in Demand for PCs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 APU

- 6.1.2 CPU

- 6.1.3 GPU

- 6.1.4 FPGA

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Enterprise - Computer and Servers

- 6.2.3 Automotive

- 6.2.4 Industrial

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share(for standalone server microprocessor vendors)

- 7.2 Company Profiles

- 7.2.1 Intel Corporation

- 7.2.2 Advanced Micro Devices, Inc.

- 7.2.3 SK Hynix Inc.

- 7.2.4 Taiwan Semiconductor Manufacturing Company Limited

- 7.2.5 Nvidia Corporation

- 7.2.6 Samsung Technologies

- 7.2.7 Qualcomm Technologies

- 7.2.8 Broadcom Inc.

- 7.2.9 Micron Technology

- 7.2.10 Sony Corporation