|

市場調查報告書

商品編碼

1626305

中東和非洲影像感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)MEA Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

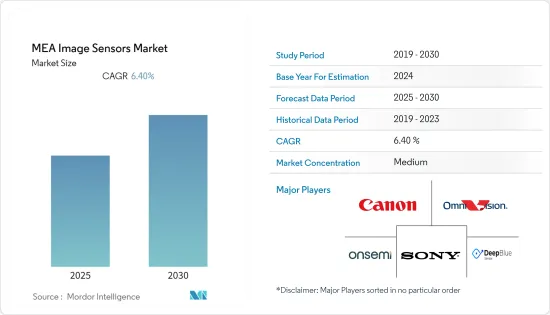

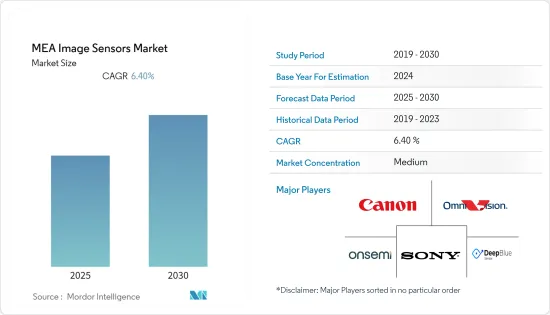

中東和非洲影像感測器市場預計在預測期內年複合成長率為 6.4%

主要亮點

- 影像感測器是一種允許相機將光轉換為電訊號的設備,設備可以解釋該電訊號以創建高解析度影像。市場上的所有數位相機的影像感測器均使用兩種技術之一:CCD 或 CMOS。

- 影像感測器的常見類型是2D設備,它根據透過感測器捕獲的光強度資訊創建數位影像。對高品質影像的需求、使用智慧型手機和平板電腦的消費者數量不斷增加以及它們在家用電器中的使用是推動中東和非洲影像感測器市場高速成長的主要因素。

- 然而,高解析度影像感測器製造流程的複雜性以及CCD影像感測器的高功耗是阻礙中東和非洲影像感測器市場成長的因素。然而,中東和非洲的消費者在技術上的支出正在增加。在影像感測器市場中,消費性電子領域預計將佔據最大的市場佔有率。

- 過去兩年,受 COVID-19 大流行影響,全球半導體和電子產業出現了各種趨勢。由於融資有限和勞動力使用的各種限制,製造業和其他重工業面臨營運挑戰。

- 然而,隨著資料中心服務、雲端運算和其他線上支援領域在該地區受到關注,影像感測器的需求預計將重新獲得動力,而 CMOS 影像感測器市場的最終用戶預計在不久的將來將獲得成長動力預計未來將顯著推動支出。

中東和非洲影像感測器市場趨勢

消費性電子領域佔據主要市場佔有率

- 中東和非洲地區的消費性電子市場前景廣闊,因為該地區的消費行為不斷發展。隨著消費者生活方式變得越來越高度移動和快節奏,消費性電子產品銷售逐漸轉向更緊湊和多功能的設備。

- 影像感測器在消費性電子產品中的主要應用包括行動電話相機、數位相機、平板電腦、玩具、攝影機、個人電腦/筆記型電腦、網路攝影機和智慧電視。

- 對於安裝在消費性電子設備中的影像感測器,CMOS 感測器比 CCD 感測器更受青睞,因為其功耗更低、更容易整合、速度更快且成本更低。

- 此外,中東消費電子市場正處於數位顛覆的邊緣,各公司競相爭奪線上業務,並且存在巨大的未開發市場潛力。例如,2020年,中東和非洲地區的SONY在奈及利亞推出了最新的可換無反光鏡單眼相機α系列。這些無反光鏡相機透過自動對焦 (AF) 和自動曝光 (AE) 提供最快的拍攝速度。

阿拉伯聯合大公國成為市場佔有率較大的地區

- 阿拉伯聯合大公國是智慧型手機普及率最高的國家之一。該地區5G服務的使用量顯著增加,預計這一數字還將進一步增加。

- 全國範圍內的數位轉型也在加速,政府、公共機構、私人公司和發展機構擴大利用數位平台來改善該地區的生計並發展經濟。

- 此外,汽車是影像感測器需求穩定成長的主要產業之一。現代汽車在整個車輛上都配備了鏡頭,包括環景顯示系統、ADAS 應用程式和後視鏡更換,以提高駕駛員的安全性和舒適度。

- 由於燃料成本低、進口關稅低、人均可支配收入高和有利的稅收制度等因素,阿拉伯聯合大公國是波灣合作理事會(GCC)地區的主要汽車市場之一。該部門正在推動經濟多元化,並在競爭環境中影響國家戰略。

- 此外,阿拉伯聯合大公國政府最近轉向本地生產,鼓勵全球汽車製造商增加在該地區的投資。 Ashok Leyland、Hafilat Industries、W Motors 和 Zarooq Motors 等公司已在阿拉伯聯合大公國開始生產,還有更多公司可能會在阿拉伯聯合大公國開始生產。

中東和非洲影像感測器產業概況

中東和非洲影像感測器市場的競爭較為溫和,主要有以下主要企業。索尼公司、佳能公司、安森美半導體公司、豪威科技等。

- 2021 年 11 月 - 先進數位成像解決方案開發商 OmniVision Technologies 推出了用於內視鏡和導管的 OVMed OH0FA 影像感測器和 OAH0428 橋接晶片。 OH0FA 影像感測器以 30fps 提供 720x720 解析度,適用於耳鼻喉科、心臟內視鏡檢查、關節鏡檢查、婦產科以及子宮腎內視鏡檢查。

- 2021 年 11 月 - 總部位於澳洲的搜救監視專業提供者 Sentient Vision Systems 與奧地利的 Airborne Technologies 以及總部位於阿拉伯聯合大公國和英國的 Phoenix Aerospace 合作開發感測器,並宣布成立中東一體化中心。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 汽車應用需求增加

- 垂直應用中手勢姿態辨識/控制的需求

- 安裝在電子設備中的 CMOS 影像感測器的價格更低

- 市場限制因素

- 製造成本高,市場競爭加劇

- 儲存空間和電池消耗問題

第6章 市場細分

- 按類型

- 有線

- 無線的

- 依技術

- CMOS

- CCD

- 其他

- 按規格類型

- 加工類型

- 頻譜類型

- 紅外線不可見頻譜

- X光

- 數組類型

- 按用途

- 家用電子產品

- 衛生保健

- 工業的

- 安全/監控

- 汽車/運輸設備

- 航太/國防

- 其他

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他

第7章 競爭格局

- 公司簡介

- Deep Blue Sensor

- Canon Inc.

- Omnivision Technologies Inc.

- ON Semiconductor Corporation

- Samsung Electronics Co., Ltd

- Sony Corporation

- STMicroelectronics NV

- Teledyne DALSA Inc.

- Toshiba Corporation

- SK Hynix Inc.

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 47163

The MEA Image Sensors Market is expected to register a CAGR of 6.4% during the forecast period.

Key Highlights

- An image sensor is a device that allows the camera to convert light into electrical signals that can be interpreted by the device to create a high-resolution picture. All commercially available digital cameras use one of two possible technologies for the camera's image sensor: CCD or CMOS.

- The common type of image sensor is a two-dimensional device that creates a digital picture from light intensity information captured through its sensor. The need for high-quality images, increasing consumer base for smartphones, tablets, and use in consumer electronics, are the key drivers which are making the Middle East and Africa Image Sensors market grow lucratively.

- Although, the Complex manufacturing process of high-resolution image sensors and higher power consumption in CCD image sensors are the factors hindering the growth of the Middle East and Africa image sensors market. However, owing to a rise in consumer spending on technology in the Middle East and Africa. The consumer electronics segment is expected to hold the largest market share in the Image Sensors market.

- Over the past two years, the global semiconductors and electronics industry witnessed diverse trends owing to the COVID-19 pandemic. The manufacturing and other heavy industries faced operational challenges due to restricted cash flow and various restrictions over the use of workforce in the industries; on the other hand, a severe impact on the supply chain was observed during the pandemic.

- However, the demand for image sensors is expected to regain momentum with data center services, cloud computing, and other online supporting sectors gaining traction in the region, which is expected to drive the end-user spending of the CMOS Image Sensors market significantly over the near term future.

MEA Image Sensors Market Trends

Consumer Electronics Segment to Hold Significant Market Share

- The consumer electronics market in the Middle East and African region is quite promising as the consumer behavior in the region has been continuously evolving. The sales of consumer electronics are in the gradual move towards more compact and multifunctional devices, with consumers' lifestyles becoming increasingly highly mobile and fast-paced.

- The key applications for image sensors in a consumer electronics device included mobile phone cameras, digital still cameras, tablets, toys, and camcorders, PC/laptops, webcams, and smart televisions.

- For applications in a consumer electronics device, usually, CMOS image sensors are preferred over CCD sensors because of their lower power consumption, ease of integration, speed, and cost factor.

- Furthermore, the Consumer electronics market in the Middle East is on the verge of digital disruption with companies vying for online presence, which has significant untapped market potential. For instance, in 2020, the Sony Middle East & Africa launched the latest range of Alpha mirrorless interchangeable lens cameras in Nigeria. These mirrorless cameras offer the fastest shooting speed with Auto Focus (AF) and Auto Exposure (AE).

United Arab Emirates to be the Region with Significant Market Share

- The United Arab Emirates is among the countries with the highest smartphone penetration. With the availability of 5G services increasing significantly in the region, the number is further expected to increase.

- Additionally, the digital transformation is accelerating across the country as governments, public institutions, private sector players, and development organizations are increasingly using digital platforms to improve lives and power economic growth in the region.

- Furthermore, automotive is one of the key sectors where the demand for imaging sensors is growing steadily. In modern-day automobiles, cameras are being deployed throughout the vehicle to increase driver safety and comfort, including surround-view systems, ADAS applications, and mirror replacement.

- As UAE is among the leading automotive market in the Gulf Cooperation Council (GCC) region due to factors such as low fuel costs, low import tariffs, high per capita disposable income, and a favorable tax regime. The sector encourages economic diversification and influences national strategy for a competitive business environment.

- Moreover, the UAE government's recent shift towards local manufacturing encourages global automobile manufacturers to increase investments in this region. The companies such as Ashok Leyland, Hafilat Industries, W Motors, and Zarooq Motors have started manufacturing in the UAE, and more are likely to follow.

MEA Image Sensors Industry Overview

The Middle East and Africa Image Sensor Market is moderately competitive owing to the presence of key players such as Sony Corporation, Canon Inc., On Semiconductor Corporation, Omnivision Technology, etc. Some of the recent developments in the Market include:

- November 2021 - OmniVision Technologies, a developer of advanced digital imaging solutions, launched the OVMed OH0FA image sensor and OAH0428 bridge chip for endoscopes and catheters. The OH0FA image sensor provides 720x720 resolution at 30 frames per second (fps)the highest available resolution for ENT, cardiac, arthro, OB-GYN, and utero-renal endoscopes, yielding visibility for surgeons to see and diagnose early-stage disease.

- November 2021 - Australian-based search-and-rescue surveillance specialist provider, Sentient Vision Systems, announced that it has teamed with Austria's Airborne Technologies and UAE- and UK-based Phoenix Aerospace to create a Middle East center of excellence for sensor integration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand in Automotive Applications

- 5.1.2 Demand for Gesture Recognition/Control in Vertical Applications

- 5.1.3 Low-Cost Availability of CMOS Image Sensors Deployed in Electronic Devices

- 5.2 Market Restraints

- 5.2.1 High Manufacturing Costs and Increased Market Competition

- 5.2.2 Storage Space and Battery Consumption issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Technology

- 6.2.1 CMOS

- 6.2.2 CCD

- 6.2.3 Others

- 6.3 By Specification Type

- 6.3.1 Processing Type

- 6.3.2 Spectrum Type

- 6.3.2.1 Infrared Invisible Spectrum

- 6.3.2.2 X-Ray Light

- 6.3.3 Array Type

- 6.4 By Application

- 6.4.1 Consumer Electronics

- 6.4.2 Healthcare

- 6.4.3 Industrial

- 6.4.4 Security and Surveillance

- 6.4.5 Automotive & Transportation

- 6.4.6 Aerospace & Defense

- 6.4.7 Others

- 6.5 By Country

- 6.5.1 Saudi Arabia

- 6.5.2 United Arab Emirates

- 6.5.3 South Africa

- 6.5.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Deep Blue Sensor

- 7.1.2 Canon Inc.

- 7.1.3 Omnivision Technologies Inc.

- 7.1.4 ON Semiconductor Corporation

- 7.1.5 Samsung Electronics Co., Ltd

- 7.1.6 Sony Corporation

- 7.1.7 STMicroelectronics N.V

- 7.1.8 Teledyne DALSA Inc.

- 7.1.9 Toshiba Corporation

- 7.1.10 SK Hynix Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219