|

市場調查報告書

商品編碼

1626307

美國無線感測器:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)US Wireless Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

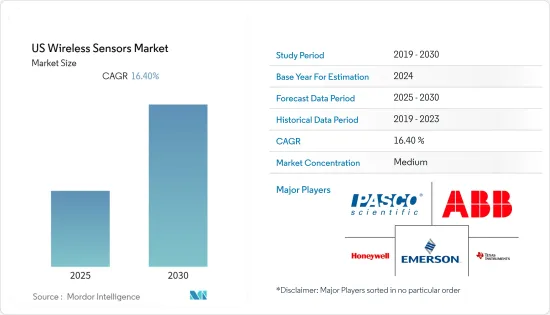

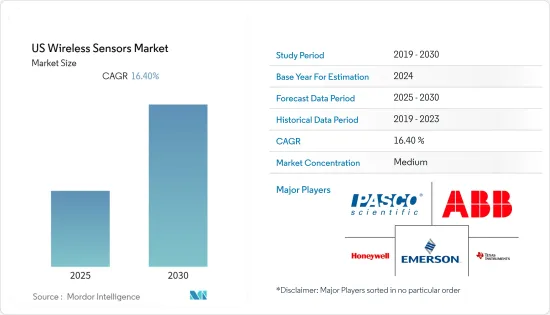

美國無線感測器市場預計在預測期內年複合成長率為 16.4%

主要亮點

- 無線感測器透過 RFID 和藍牙等各種創新技術提供準確性和可靠性等多種優勢。因此,它在過去幾年中獲得了大批追隨者。

- 這些感測器主要在工廠中用於監控生產流程資料。它也應用於其他行業,如國防、建築自動化、物料輸送以及食品和飲料。這是由於新能源來源探索的增加、政府法規、可再生能源的開發以及技術的快速進步。

- 隨著政府法規的增加以增加感測器的使用以確保安全,該地區對無線感測器的需求正在成長。例如,具有極高壓力和溫度等惡劣環境條件的區域。無線感測器可以輕鬆地在安全距離內連續控制和監控您的設施。無線感測器有助於從難以存取的位置捕獲資料。

- 工業 4.0 革命使機器變得更加智慧和直覺,這增加了對無線感測器工業應用的需求。新機器將被設計得更有效率、更安全、更靈活,並且能夠自動監控其性能、使用情況和故障。因此,這些應用正在推動對高靈敏度感測器的需求。

- 物聯網(IoT)在美國的日益普及也是推動市場成長的主要因素。物聯網連接設備的增加預計將推動對無線感測器的需求。

- 此外,智慧家庭、智慧建築、智慧城市、智慧工廠的發展需要利用小外形規格、高精度、低功耗和無線技術來改善智慧家庭的環境參數(濕度、壓力、空氣品質等) .).) 需要使用無線感測器。

美國無線感測器市場趨勢

位置和接近感測器預計將佔據主要市場佔有率

- 位置感測器可以偵測物體的移動或計算其相對於已知參考點的位置。這種類型的感測器也可用於偵測物體是否存在。有許多感測器值得一提,它們的功能與位置感測器相當。動作感測器偵測物體的運動並可用於啟動動作。此外,接近感測器可以識別物體何時進入感測器的範圍。因此,這兩種感測器都被歸類為特殊位置感測器。

- 無線位置感測器在汽車中用於確定方向盤位置、踏板、座椅以及其他閥門、旋鈕和致動器。位置感測器分為三類:角度感測器、旋轉感測器和線性感測器。用於感測這些感測器位置的技術包括雨刷臂電位器、光學反射或影像處理以及霍爾效應感測器。

- 製造需要高精度才能滿足產業需求。為了創造高品質的產品,製造商專注於兩個重要參數:測量精度和徹底的檢查。位置感測器監控多個重要特徵,例如輪廓、寬度、高度、台階、間隙、V 形間隙、邊緣、角度、彎曲、凹槽和表面。

- HVAC 系統、運輸系統、工業設備、移動油壓設備、智慧建築、重型齒輪和施工機械都可以受益於這些檢測、測量和評估各種物體表面輪廓的感測器。當位置感測器與分析軟體連接時,許多測量任務變得更加容易。因此,無線位置感測器非常適合需要檢測位移、距離、長度和位置參數的自動化、測試和監控任務。

- 此外,位置感測器由來自多個供應商的各種組件組裝,包括位置磁鐵、感測桿、電子機殼、診斷發光二極體(LED) 和連接器。盈利主要取決於原料和零件的可用性和成本,以及將成品推向市場所需的時間。該行業公司面臨的主要挑戰是擴大製造能力,生產更高品質的產品,並降低整體製造成本。

汽車佔據最大市場佔有率

- 在過去的幾十年裡,汽車經歷了許多變化。過去,汽車依靠為前燈和火星塞供電的基本電氣系統運作。隨著技術的進步,汽車現在配備了最新的小工具,如收音機、警報器和雨刷。汽車安全方面也取得了各種技術進步,例如安全氣囊的部署。依賴這些感測器的功能越來越多,促使工程師開發出更準確的感測器來滿足汽車應用的需求。

- 汽車產業採用無線感測器是因為它們體積小、易於安裝、可靠且可自配置。它還有助於提高性能、降低成本並提高可靠性。 Premo 等總部位於西班牙、從事電子元件開發、製造和銷售的公司能夠透過為車內各種非關鍵系統提供無線感測器來改進新一代汽車的無線整合。

- 此外,美國對此類感測器的需求正在增加,汽車領域無線感測器供應商之一的 Phoenix Sensors 等公司正在開發這些感測器,以滿足汽車中使用的無線技術的需求。

- IRN8WS4 是唯一能夠進行無線紅外線 (IR) 輪胎溫度測量的感測器,能夠以 868、902 和 920MHz 的頻率將資料傳輸到通用主接收器。它採用可靠且經過驗證的無線技術(大多數工業、科學和醫療系統的標準)以及小型化工藝,從而形成小型、輕量的感測器。該感測器允許技術人員測量馬達和汽車研發實驗室內的輪胎溫度。

- 此外,隨著電動車變得越來越流行,高通等技術先驅開發了高效的汽車無線充電技術。這種無線充電技術為使用者提供了在無線充電站、停車場或家中高效充電的便利。該公司還透過一個主墊片實現了超過 90% 的傳輸效率。該公司相信未來可以進一步改進這項技術,實現更有效率、更易於理解的實施。

美國無線感測產業概況

美國的無線感測器市場競爭非常激烈,因為多家供應商向國內和國際市場提供無線感測器。該市場似乎適度分散,擁有較大市場佔有率的主要參與者專注於擴大其國際基本客群。此外,這些公司不斷創新產品,以擴大市場佔有率並提高盈利。以下是市場的一些最新發展:

- 2021 年 8 月—麻省大學洛威爾分校和東北大學的研究團隊開發了無線感測網路即時檢測空氣、污水等中的冠狀病毒。該計劃名為“DiSenDa”,代表多模態感測器網路和數據分析的疾病監測。連接到感測器的探針專門設計用於檢測空氣或廢水樣本中是否存在 SARS-CoV-2 生物標記物。

- 2021 年 3 月 - Monit 宣布推出 ALTA 土壤濕度感測器,滿足農業技術市場的需求。這種創新的土壤濕度感測器可幫助農民、商業種植者和溫室管理者輕鬆地將其精準灌溉作業連接到物聯網 (IoT)。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 無線技術的採用增加(特別是在惡劣的環境中)

- 智慧工廠概念的出現(工業自動化)

- 市場挑戰

- 與感測器產品相關的高安全需求和成本

- 網路安全問題和物聯網領域的最新趨勢

第6章 市場細分

- 按類型

- 壓力感測器

- 溫度感測器

- 化學/氣體感測器

- 位置/接近感測器

- 其他類型

- 按最終用戶產業

- 車

- 衛生保健

- 航太/國防

- 能源/電力

- 飲食

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Honeywell International Inc.

- Emerson Electric Co.

- Texas Instruments Incorporated

- ABB Ltd.

- Pasco Scientific

- Monnit Corporation

- Phoenix Sensors LLC

- Schneider Electric

第8章投資分析

第9章 市場未來展望

The US Wireless Sensors Market is expected to register a CAGR of 16.4% during the forecast period.

Key Highlights

- Wireless sensors offer several advantages, such as accuracy and reliability, with the help of various innovative technologies, such as RFID and Bluetooth, in addition to the potential to make electronic devices easy to integrate. As a result, they gained significant traction in the past few years.

- These sensors are primarily used in factory settings for data monitoring of production flow. These also find applications in defense, building automation, and other industries, like materials handling and food and beverage, due to the increasing quest for new energy sources, government regulations, renewable energy development, and rapid technological advancements.

- Due to the increased government regulation in the region for the increased use of the sensor for safety, the demand for wireless sensors is growing. For instance, the areas with challenging environmental conditions, such as extreme high pressure, high temperature, etc. With the help of wireless sensors, it becomes easy to control and monitor the facility from a safe distance continually. They help to acquire the data from locations, which are difficult to access.

- Industry 4.0 revolution, in which machines are becoming more intelligent and intuitive, is increasing the need for the industrial applications of wireless sensors. The new machines are to be designed to be more efficient, safe, and flexible, with the ability to monitor their performance, usage, and failure autonomously. Therefore, these applications spur the demand for highly sensitive sensors.

- The rising adoption of IoT (Internet-of-Things) in the United States is another major factor driving the market's growth. This growth in IoT-connected devices is projected to fuel the demand for wireless sensors.

- Further, transforming the development of smart homes and buildings, smart cities, and smart factories demand the use of wireless sensors, owing to the small form factor, high precision, low power consumption, and ability to control and monitor ambient parameters (such as humidity, pressure, and air quality) in smart homes with the help of wireless technologies.

US Wireless Sensors Market Trends

Position and proximity sensor is Expected to Hold Significant Market Share

- Position sensors can detect an object's movement or calculate its relative position relative to a known reference point. Sensors of this type can also be used to detect the presence or absence of an object. Many sensor types perform comparable functions to position sensors that are worth mentioning. Motion sensors detect an object's movement and can be utilized to initiate an action. Proximity sensors can also identify when an object enters the sensor's range. As a result, both sensors could be classified as specialized position sensors.

- Wireless position sensors are used in automobiles to determine the steering wheel's position, pedals, seats, and other valves, knobs, and actuators. Position sensors are divided into three categories: angular, rotational, and linear. Wiper-arm potentiometers, optical reflection or imaging, and Hall-effect sensors are among the technologies used to sense position in these sensors.

- To meet industry requirements, the manufacturing business necessitates a high level of precision. To make high-quality products, manufacturers concentrate on two key parameters: measurement precision and thorough inspection. A position sensor monitors several essential properties, including profiling, width, height, step, gap, V-gap, edge, angle, bend, groove, and surface.

- HVAC systems, transportation systems, industrial equipment, mobile hydraulics, smart buildings, heavy-duty gear, and construction equipment can all benefit from these sensors, which detect, measure, and assess the profiles on various object surfaces. When the position sensor is connected with the analytics software, many measurement jobs become more accessible. As a result, the wireless position sensor is ideal for automating, testing, or monitoring operations where displacement, distance, length, or position parameters need to be detected.

- Further, position sensors are made/assembled with various components from several vendors, including position magnets, sensing rods, electronics housing fixtures, diagnostic light-emitting diodes (LEDs), and connectors. Profitability is primarily determined by the availability and cost of raw materials and components, as well as the length of time it takes to bring the finished product to market. The main challenge for enterprises in this area is expanding their manufacturing capabilities, producing higher-quality products, and lowering overall production costs.

Automotive Accounts For the Largest Market Share

- Automotive vehicles have undergone various changes over the last few decades. Previously, cars used to work with basic electrical systems that offered power for headlights and spark plugs. As technology progressed, cars were fitted with the latest gadgets, such as radios, alarms, and wipers. Various technological advancements have also been made for vehicles' safety, such as airbag deployment. The increase in these sensor-dependent features has driven engineers to develop more accurate sensors with automotive applications in mind.

- The automotive sector embraces wireless sensors as they are smaller in size, easy to install, reliable, and self-configuring. They also help to improve performance, reduce cost, and enhance reliability. Companies, such as Premo, a Spain-based company engaged in developing, manufacturing, and selling electronic components, use wireless devices embedded in new generation automobiles by offering a full range of wireless sensors for all types of non-critical systems inside vehicles.

- Further, with the growing demand for such sensors in the United States, companies like Phoenix Sensors, one of the suppliers of wireless sensors in the automotive sector, offer these sensors that help match the demand for wireless technology used in automobiles.

- IRN8WS4 is the only sensor available to perform wireless infrared (IR) tire temperature measurements, and it transmits data to a generic master receiver in 868, 902, or 920-MHz frequencies. It uses a reliable, proven wireless technology, standard in most industrial, scientific, and medical systems, and a miniaturization process that results in compact, lightweight sensors. The sensor allows technicians to measure tire temperatures internally in motorsport as well as automotive R&D labs.

- Moreover, with the increasing use of electric vehicles, technology pioneers like Qualcomm have developed efficient wireless charging technology for cars. This wireless charging technology offers convenience for users to charge their vehicles at wireless charging stations, parking lots, or at home efficiently. The company has also achieved transfer efficiency of more than 90% with a single primary base pad. The company believes that the technology can be further improved for better efficiency and more straightforward implementation in the future.

US Wireless Sensors Industry Overview

The United States wireless sensor is highly competitive owing to multiple vendors providing wireless sensors to the domestic and international markets. The market appears to be moderately fragmented, and the major players with a prominent share in the market are focusing on expanding their customer base across international countries. Additionally, these companies are continuously innovating their products to increase their market share and increase their profitability. Some of the recent developments in the market are:

- August 2021 - A team of researchers from UMass Lowell and Northeastern University developed a wireless sensor network to detect coronavirus in the air, wastewater in real-time. The project is called "DiSenDa," which stands for Disease Surveillance with Multi-Modal Sensor Network and Data Analytics. The probes attached to the sensors have been specifically designed to detect the presence of biomarkers for SARS-CoV-2 in the air and wastewater samples.

- March 2021 - Monnit announced the availability of its ALTA Soil Moisture Sensor to meet the AgriTech market's demands. The innovative Soil Moisture Sensor assists farmers, commercial growers, and greenhouse managers in easily connecting their precision irrigation operations to the Internet of Things (IoT).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Wireless Technologies (Especially in Harsh Environments)

- 5.1.2 Emergence of Smart Factory Concepts (Industrial Automation)

- 5.2 Market Challenges

- 5.2.1 Higher Security Needs and Cost associated with the Sensor Products

- 5.2.2 Concerns pertaining to cybersecurity in the IoT space and recent developments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure Sensor

- 6.1.2 Temperature Sensor

- 6.1.3 Chemical and Gas Sensor

- 6.1.4 Position and Proximity Sensor

- 6.1.5 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Energy and Power

- 6.2.5 Food and Beverage

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 ABB Ltd.

- 7.1.5 Pasco Scientific

- 7.1.6 Monnit Corporation

- 7.1.7 Phoenix Sensors LLC

- 7.1.8 Schneider Electric