|

市場調查報告書

商品編碼

1626310

歐洲無線感測器:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Wireless Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

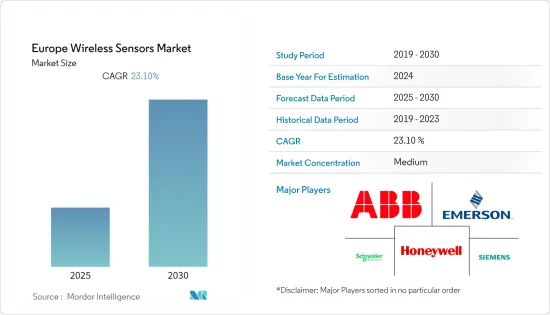

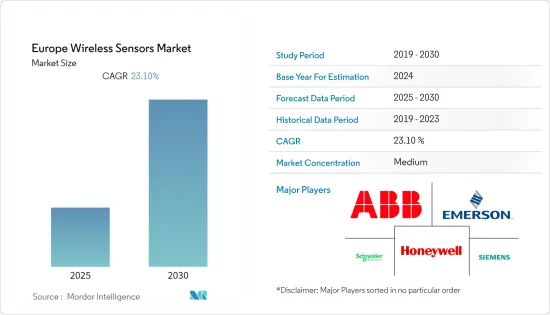

歐洲無線感測器市場預計在預測期內年複合成長率為 23.1%

主要亮點

- 無線感測器市場的成長是由各個最終用戶產業的應用所推動的。製造商正在投資研發工作,以提高無線感測器的準確性和可靠性。無線感測器用於建築自動化、軍事和國防、食品和飲料以及物料輸送等行業中的資料監控和其他類似功能。

- 影響無線感測器市場的主要促進因素是英國對新的可再生能源開發、能源來源和其他快速技術進步的需求不斷成長。它也是智慧電網中用於遠端監控變壓器和電力線以及監控電力線溫度和天氣的重要元件。

- 大多數汽車製造商所在的歐洲預計將在該市場上保持較大佔有率。公司正在亞太地區建立製造地,因為原料豐富且安裝和人事費用較低。供應商預計將接受這一演變,並根據其戰略願景進行研發投資,以建立技術遷移的先發優勢。

- 許多零售店和雜貨店在地板上使用無線感測器來幫助員工為顧客提供積極的體驗。無線推播感應器有助於告訴商店工作人員何時需要清潔。無線氣溫設備也透過同時監控冷藏和非冷藏物品來幫助超市。

- 此外,能源和電力產業對工業應用無線感測器產生了基本需求。隨著節能對於降低電力消耗及其相關成本變得越來越重要,柴油卡車排放測試設備、風工程、風力發電系統、新建築設計的動態、海洋研究、高空都需要具有合適無線技術的精確無線感測器來幫助包括氣象研究氣球、水污染裝置、煙囪汞採樣、大氣調查等。

歐洲無線感測器市場趨勢

汽車預計將佔據較大市場佔有率

- 在過去的幾十年裡,汽車經歷了許多變化。過去,汽車依靠為前燈和火星塞供電的基本電氣系統運作。隨著技術的進步,汽車現在配備了最新的小工具,如收音機、警報器和雨刷。汽車安全方面也取得了各種技術進步,例如安全氣囊的部署。隨著越來越多的功能依賴這些感測器,工程師們正在努力開發更準確的感測器,以適應汽車應用。

- 目前,汽車領域的兩大趨勢是電氣化和自動化。從長遠來看,電動車在行業中的出現對無線感測器的需求產生了巨大影響。電動車的增加意味著對感測器的需求增加,這意味著用於監控廢棄電池、定位和檢測汽車各種運動部件的感測器的激增。

- 此外,隨著電動車變得越來越流行,高通等技術先驅開發了高效的汽車無線充電技術。這種無線充電技術為使用者提供了在無線充電站、停車場或家中高效充電的便利。該公司還透過一個主墊片實現了超過 90% 的傳輸效率。該公司相信,未來將能進一步完善這項技術,實現更有效率、更易於理解的實施。

- 支援 ADAS、資訊娛樂和自動駕駛系統的汽車應用中的感測器使用案例數量不斷增加,凸顯了對介面規範的需求。預計它將對未來的需求變得至關重要。

- 隨著 ADAS 應用的發展並變得更加複雜,越來越需要有效的方法來向駕駛員提供安全警告和其他相關資訊。抬頭顯示器(HUD) 是少數將 ADAS資料整合到中央螢幕的新興解決方案之一,使駕駛者能夠在查看擋風玻璃上顯示的警報和警告的同時將注意力集中在道路上。

英國佔最大市場佔有率

- 新能源來源的不斷探索、可再生能源的開發、政府法規以及無線感測器市場的快速技術進步正在推動該國在全國範圍內的良好成長。該國為智慧電網中變壓器和電力線的遠端監控提供了重要組件,用於監測電力線上的溫度和天氣。

- 最近,工業IoT(IIoT)公司Sensemetrics宣佈在該國推出其IIoT平台。在英國,我們與擁有創新結構感測技術的公司 3S'TECH 合作進行了 Sensemetrics 平台的首次商業部署。 3S'TECH 將無線 LoRa 傾斜計感測器連接到其 Sense Metrics 平台,以監控西班牙巴塞隆納附近的 Viladecans 醫院。

- 此外,歐盟研究計劃WSAN4CIP 展示了一種經濟高效的保護電力和供水網路的解決方案。歐洲研究計劃WSAN4CIP 已成功展示了一種基於無線感測器的解決方案,用於經濟高效地監控電力和供水網路。 WSAN4CIP 解決方案基於無線感測器的安全通訊網路。自 2010 年 2 月以來,它已在兩個使用案例:能源部門和水務部門。

- 在西歐和北歐地區強勁成長的推動下,國內物聯網 (IoT) 解決方案市場正在顯著成長。消費者和商業物聯網解決方案在該領域提供了充滿希望的機會,並有望為歐洲無線感測器市場提供競爭優勢。

- 2021 年 5 月,研華推出了一款經過認證的行動通訊模組,用於物聯網 (IoT) 的感測器到雲端連接,採用緊湊的行業標準外形,無需編程。物聯網無線感測器應用包括低溫運輸/冰箱監控、智慧廢棄物管理、資產追蹤、智慧農業、智慧路燈等。

歐洲無線感測器產業概況

歐洲的無線感測器市場競爭非常激烈,因為多家供應商向國內和國際市場提供無線感測器。該市場似乎適度分散,擁有較大市場佔有率的主要參與者專注於擴大其國際基本客群。此外,這些公司不斷創新產品,以擴大市場佔有率並提高盈利。以下是一些近期市場發展趨勢:

- 2021 年 1 月 - Everactive 是一家建立物聯網 (IoT) 解決方案的科技公司,籌集了 3,500 萬美元資金,用於開發無電池無線感測器。這筆資金將用於加速該公司工業無電池無線感測器的銷售、行銷和市場開發。此外,Everactive 的端到端監控解決方案針對目前未監控或監控不善的大量工業資產。

- 2020 年 11 月 - 維爾茨堡大學開發了一種感測器薄膜,可監測飛機和太空船在飛行過程中如何承受機械應力。這部影片使用了檢測法,這在航太領域尚不常見。該薄膜具有軟性,可作為無線感測網路的電路載體,並可應用於飛機和太空船上難以到達的區域。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 無線技術的採用增加(特別是在惡劣的環境中)

- 智慧工廠概念的出現(工業自動化)

- 市場挑戰

- 與感測器產品相關的高安全需求和成本

- 網路安全問題和物聯網領域的最新趨勢

第6章 市場細分

- 按類型

- 壓力感測器

- 溫度感測器

- 化學/氣體感測器

- 位置/接近感測器

- 其他類型

- 按最終用戶產業

- 車

- 衛生保健

- 航太/國防

- 能源/電力

- 飲食

- 其他最終用戶產業

- 按國家/地區

- 英國

- 德國

- 義大利

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Honeywell International Inc.

- Emerson Electric Co.

- Schneider Electric

- Siemens AG

- ABB Ltd.

- Pasco Scientific

- Monnit Corporation

- Phoenix Sensors LLC

- Texas Instruments Incorporated

第8章投資分析

第9章 市場未來展望

The Europe Wireless Sensors Market is expected to register a CAGR of 23.1% during the forecast period.

Key Highlights

- The growth of the wireless sensors market is driven by the application in the various end-user industries. Manufacturers invest in R&D activities to improve the accuracy and reliability of wireless sensors. Wireless sensors are used for data monitoring and other similar functions and in building automation, military and defense, and other industries, like food and beverage and material handling.

- The key drivers influencing the wireless sensors market are the increasing need for new renewable energy development, energy sources, and other rapid technological advancements in the United Kingdom. They are also a vital component in smart grids for remote monitoring of transformers and power lines where they are put into service to monitor line temperature and weather conditions.

- Europe, which houses most automotive manufacturers, is expected to retain a substantial share in the market. The abundant availability of raw materials and the low establishment and labor costs have helped companies establish their manufacturing operations in the Asia-Pacific. It is expected that the vendors, to create an advantage of the first mover in technology transitioning, may adopt this evolution and invest in R&D according to their strategic vision.

- Many retailers and grocery stores are using wireless sensors on the floor to help employees create positive experiences for customers. Wireless push sensors can help the shoppers to indicate when cleaning is needed. Wireless air temperature devices are also assisting the superstores in monitoring refrigerators and non-cold merchandise simultaneously.

- Further, the energy and power sector has created an essential demand for wireless sensors in industrial applications. As energy conservation is increasingly important to reduce power consumption and its associated costs, accurate wireless sensors are required with appropriate wireless technologies helpful for testing devices for diesel truck emissions, wind engineering, wind energy systems, concerning new building design aerodynamics, ocean research, high-altitude weather research balloons, water pollution devices, smokestack mercury sampling, and atmospheric studies.

Europe Wireless Sensors Market Trends

Automotive is Expected to Hold Significant Market Share

- Automotive vehicles have undergone various changes over the last few decades. Previously, cars used to work with basic electrical systems that offered power for headlights and spark plugs. As technology progressed, cars were fitted with the latest gadgets, such as radios, alarms, and wipers. Various technological advancements have also been made for vehicles' safety, such as airbag deployment. The increase in these sensor-dependent features has driven engineers to develop more accurate sensors with automotive applications in mind.

- Currently, the two significant trends for the automotive sector are electrification and automation. The emergence of electric vehicles in the industry has dramatically impacted the demand for wireless sensors in the long term. More electric cars mean an increase in demand for sensors, a surge in sensors for used battery monitoring, and various positioning and detection of moving parts of automobiles.

- Moreover, with the increasing use of electric vehicles, technology pioneers like Qualcomm have developed efficient wireless charging technology for cars. This wireless charging technology offers convenience for users to charge their vehicles at wireless charging stations, parking lots, or at home efficiently. The company has also achieved transfer efficiency of more than 90% with a single primary base pad. The company believes that the technology can be further improved for better efficiency and more straightforward implementation in the future.

- As the use cases of sensors continue to increase in automobile applications to support ADAS, infotainment, and autonomous driving systems, the need for interface specifications is apparent. It is expected to be critical for future demand.

- As ADAS applications evolve and become more complex, there has been an increased need for effective methods to present safety alerts and other relevant information to the driver. Head-up displays (HUDs) are among the few emerging solutions for consolidating ADAS data into a centralized screen that allows the driver to keep the eyes on the road while viewing alerts and warnings that appear on the windshield time.

United Kingdom Accounts for the Largest Market Share

- Due to the increasing quest for new energy sources, renewable energy developments, government regulations, and rapid technological advancements in the wireless sensors market is growing lucratively across the country. The country provides a vital component in smart grids for remote monitoring of transformers and power lines, where they are put into service to monitor line temperature and weather conditions.

- In recent years, Sensemetrics Inc., an industrial IoT (IIoT) company, announced that it is launching its IIoT platform in the country. The initial commercial deployment of the sense metrics platform in the U.K. with 3S'TECH, an innovative structural sensing technology company. 3S'TECH connected wireless LoRa tiltmeter sensors, monitoring the Viladecans Hospital near Barcelona, Spain, to the sense metrics platform.

- Furthermore, EU research project WSAN4CIP demonstrated a cost-effective solution for protecting electricity and water networks. The European research project, WSAN4CIP, successfully demonstrated a wireless sensor-based solution for the cost-effective monitoring of electricity distribution networks and water networks. The WSAN4CIP solution was based on a secure communication network of wireless sensors. Since February 2010, it has been successfully implemented and tested in two use cases, one in the energy sector and one in the water utility sector.

- The country's market for Internet of Things (IoT) solutions is significantly growing, driven by solid growth in western and northern European regions. Both consumer and business IoT solutions offer promising opportunities in the area, which is expected to give the European wireless sensors market competitive advantage.

- In May 2021, Advantech has launched a certified wireless module for sensor-to-cloud connectivity for the Internet of Things (IoT) in a compact industry-standard form factor with no programming required. The IoT wireless sensor applications include cold chain/refrigerator monitoring, smart waste management, asset tracking, smart agriculture, and smart street lighting.

Europe Wireless Sensors Industry Overview

The European wireless sensor is highly competitive owing to multiple vendors providing wireless sensors to the domestic and international markets. The market appears to be moderately fragmented, and the major players with a prominent share in the market are focusing on expanding their customer base across international countries. Additionally, these companies are continuously innovating their products to increase their market share and increase their profitability. Some of the recent developments in the market are:

- January 2021 - Everactive, a technology company that builds the Internet of Things (IoT) solutions, raised USD 35 million in funding to develop its battery-free wireless sensors. The funds will be used to accelerate sales, marketing, and product development of the company's battery-free wireless sensors for industrial applications. Moreover, Everactive's end-to-end monitoring solutions are aimed at high-volume industrial assets that are currently unmonitored or under-monitored due to sheer volume.

- November 2020 - Universitat Wurzburg developed a sensor film to monitor how an aircraft and spacecraft withstand the mechanical stresses of flight. The film uses tomographic measuring methods that are not yet common in aerospace. The film functions as a circuit carrier for a wireless sensor network and can also be attached to hard-to-reach places on aircraft and spacecraft, making it flexible.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Wireless Technologies (Especially in Harsh Environments)

- 5.1.2 Emergence of Smart Factory Concepts (Industrial Automation)

- 5.2 Market Challenges

- 5.2.1 Higher Security Needs and Cost associated with the Sensor Products

- 5.2.2 Concerns pertaining to cybersecurity in the IoT space and recent developments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure Sensor

- 6.1.2 Temperature Sensor

- 6.1.3 Chemical and Gas Sensor

- 6.1.4 Position and Proximity Sensor

- 6.1.5 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Energy and Power

- 6.2.5 Food and Beverage

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 Italy

- 6.3.4 France

- 6.3.5 Rest of the Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Schneider Electric

- 7.1.4 Siemens AG

- 7.1.5 ABB Ltd.

- 7.1.6 Pasco Scientific

- 7.1.7 Monnit Corporation

- 7.1.8 Phoenix Sensors LLC

- 7.1.9 Texas Instruments Incorporated