|

市場調查報告書

商品編碼

1626321

北美化學感測器:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)NA Chemical Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

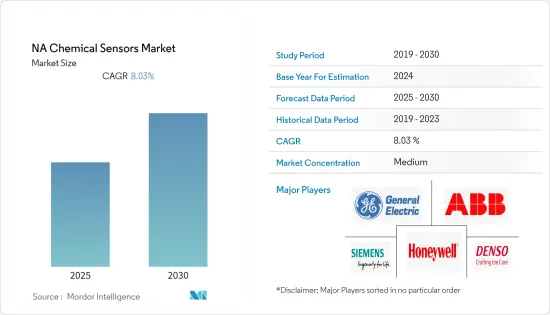

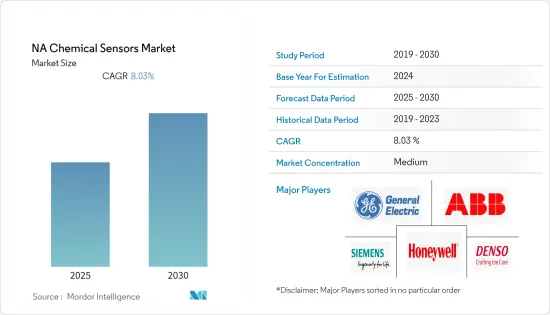

北美化學感測器市場預計在預測期內複合年成長率為 8.03%

主要亮點

- 化學感測器分析各種材料化學成分的能力正在推動其應用。化學感測陣列和高階正交感測器是該產業的兩大發展方向。化學感測器由於其低成本和便攜性預計將變得更加流行。

- 撇開迴路境問題不談,在化學工業製程中使用化學感測器來檢測分析物正受到越來越多的關注。感測器在國防部門、實驗室和醫療保健領域被用作先進工具,推動了市場的發展。

- 隨著人口成長和人們對醫學的興趣日益濃厚,這些感測器用於治療疾病的用途預計將顯著增加。這增加了血糖值監測等各種臨床應用中使用的感測器的需求,並有助於製藥應用的開發。

- COVID-19 的爆發導致汽車、石油和天然氣等多個行業的成長放緩。基於化學的感測器最常用於石油和天然氣領域。由於 COVID-19 的爆發,石油和天然氣行業的許多現有和計劃中的計劃在計劃規劃和執行方面面臨挑戰,導致化學感測器的貢獻減少。

北美化學感測器市場趨勢

化學感測器在醫療領域的快速普及

- 感測器是一種檢測物理、化學或生物訊號並允許測量和記錄這些訊號的設備。它已被應用於醫療、研究、環境監測、自動化生產等各個領域。例如,化學感測器用於檢測體液的成分和濃度,例如Ca+濃度、PH值和葡萄糖濃度。抗原、酵素、抗體、DNA、RNA、荷爾蒙、微生物等都可以透過生物感測器來檢測。

- 肺癌等疾病是全球癌症相關死亡率最高的疾病。患者的預後和治療方法取決於癌症的階段、組織學和遺傳變化。使用交叉反應化學感測器奈米陣列來識別呼出氣樣本和體外肺癌細胞株頂部空間中的揮發性生物標記。

- 此外,雖然吸收和螢光是光學化學感測中最常見的物理現象,但化學發光、拉曼散射和等離子體共振也被利用。光的強度直接由要研究的參數(具有光學性質)或透過化學轉換器來調節,化學轉換器的光學性質隨著要研究的參數的濃度而變化。

化學感測器在各行各業的有益用途

- 強勁的消費者需求和購買力平價支撐了美國汽車產業的潛在需求模式。汽車產業中感測器和測量技術的加強使用提高了引擎性能、提高了能源經濟性並減少了污染排放。

- 一種用於汽車空調控制的新型空氣品質感測器已開發出來。此化學感測器適用於具有活性碳過濾器和進氣風門的空調系統。 NOx和CO是檢測空氣污染最重要的標記。

- 汽車內燃機的有效管理需要高度靈敏的化學感測器。用於氧氣監測的各種陶瓷氧感知器已在汽油和柴油應用中廣泛應用。隨著污染法規變得更加嚴格以及車載診斷技術的出現,人們對監測新廢氣類型的興趣持續成長。由於這一進步,新一代廢氣感測器正在開發中,特別是針對柴油應用。

北美化學感測器產業概況

北美化學感測器市場部分分散。該市場的主要企業包括霍尼韋爾國際公司、電裝公司、ABB 有限公司、西門子公司和通用電氣公司。該領域的策略性舉措包括:

- 2021 年 6 月,通用電氣正在開發一款緊湊型蒸氣化學劑偵測器 (CVCAD),它將在所有天氣和現場條件下向初期應變人員提供危險化學品存在的早期預警。

- 2021 年 6 月,美國的緊湊型蒸氣化學劑探測器 (CVCAD) 專案向 Teledyne Technologies Incorporated 旗下子公司 Teledyne FLIR 授予了一份製造美國軍方首個大規模佩戴的化學劑探測器的合約。該公司獲得初始投資400萬美元。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 化學感測器技術的技術發展加快

- 化學感測器應用的增加

- 市場限制因素

- 技術複雜性

第6章 市場細分

- 依產品類型

- 電化學

- 光學的

- 帕利斯特/觸媒珠

- 其他產品類型

- 按用途

- 醫療用途

- 石油和天然氣

- 環境監測

- 車

- 工業的

- 其他

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

第7章 競爭格局

- 公司簡介

- Honeywell International Inc.

- Denso Corporation

- ABB Ltd.

- Siemens AG

- General Electric Co.

- Teledyne Technologies Incorporated

- Smiths Detection Inc.

- Chemring Group PLC

- Bosch Sensortec GmbH

- Smart Sensors, Inc.

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 47458

The NA Chemical Sensors Market is expected to register a CAGR of 8.03% during the forecast period.

Key Highlights

- The capacity of chemical sensors to analyze the chemical composition of various materials is driving their adoption. Chemical sensing arrays and higher-order orthogonal sensors are two major industry developments. Chemical sensors are projected to expand in popularity due to their low cost and portability.

- Aside from environmental concerns, the use of chemical sensors for analytes in chemical industrial processes is gaining traction. Sensors are being used as advanced tools in the defense sector, research labs, and healthcare operations, which is driving the market.

- The rising population and growing medical concerns are expected to result in a significant increase in the use of these sensors to heal illnesses. This will increase demand for sensors used in a variety of clinical applications, such as blood glucose monitoring, and will aid in the development of pharmaceutical applications.

- The COVID-19 epidemic has slowed the growth of several sectors, including automobiles, oil and gas, and others. Chemical-based sensors are most often used in the oil and gas sector. Many existing and planned projects across the oil and gas sector are encountering issues in terms of project planning and execution as a result of the COVID-19 epidemic, leading to a diminished contribution of chemical-based sensors.

North America Chemical Sensors Market Trends

Rapid Growing Adoption of Chemical Sensors in Medical

- Sensors are devices that detect physical, chemical, and biological signals and allow for the measurement and recording of such signals. They've been employed in a variety of sectors, including medical, research, environmental monitoring, and automated production. A chemical sensor, for example, is used to detect the constituent and concentration of bodily fluids such as Ca+ concentration, PH value, glucose concentration, and so on. Antigen, enzyme, antibody, DNA, RNA, hormone, and microorganism are all detected by the biosensor.

- Disease like Lung cancer is the most common cancer-related mortality in the world. The prognosis and therapy of a patient are determined by cancer's stage, histology, and genetic alterations. Cross-reactive chemical sensor nanoarrays were used to identify volatile biomarkers in breath samples and the headspace of in-vitro lung cancer cell lines.

- Furthermore, absorption and fluorescence are the most common physical phenomena utilized in optical chemical sensing; however, chemical luminescence, Raman scattering, and plasmon resonance have also been used. The intensity of the light is directly regulated by the parameter being researched (which possesses optical characteristics) or by a chemical transducer whose optical properties fluctuate with the concentration of the parameter under examination in optical sensors.

Beneficial Usage of Chemical Sensors in Wide-ranging Industries

- Strong consumer demand, along with purchasing power parity, is boosting underlying demand patterns in the automobile industry in the United States, which is, in turn, impacting the expansion of chemical sensors in this industry. Enhanced usage of sensor and measuring technologies in the automobile industry has resulted in improved engine performance, increased energy economy, and lower pollution emissions.

- A novel air quality sensor for automotive climate control has been developed. The chemical sensor is intended for use in air conditioning systems with a charcoal filter and an air intake flap. NOx and CO are the most important markers for detecting air pollution.

- Chemical sensors with high sensitivity are required to manage automobile combustion engines effectively. Various types of ceramic lambda probes for oxygen monitoring are well established for both gasoline and diesel applications. Interest in monitoring new exhaust gas species continues to develop in the face of stricter pollution laws and on-board diagnostics. As a result of this advancement, new generations of exhaust gas sensors are being developed, particularly for diesel applications.

North America Chemical Sensors Industry Overview

North America Chemical Sensors Market is partially fragmented. Some of the major players in the market are Honeywell International Inc., Denso Corporation, ABB Ltd., Siemens AG, General Electric Co., and others. Some of the strategic initiatives made in this sector are:

- In June 2021, General Electric is developing a Compact Vapor Chemical Agent Detector (CVCAD) that will give first responders an early warning of the presence of harmful chemicals in all weather and field circumstances.

- In June 2021, Under the Pentagon's Compact Vapor Chemical Agent Detector (CVCAD) program, Teledyne FLIR, a division of Teledyne Technologies Incorporated, was awarded a contract to build the first mass-wearable chemical detector for US troops. The firm received an initial investment of US$ 4.0 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Development in Chemical Sensing Technologies

- 5.1.2 Increasing Applications for adoption of Chemical Sensors

- 5.2 Market Restraints

- 5.2.1 Technical Complications

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Electrochemical

- 6.1.2 Optical

- 6.1.3 Pallister/Catalytic Bead

- 6.1.4 Other Product Types

- 6.2 By Application

- 6.2.1 Medical

- 6.2.2 Oil and Gas

- 6.2.3 Environmental Monitoring

- 6.2.4 Automotive

- 6.2.5 Industrial

- 6.2.6 Others

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Mexico

- 6.3.4 Rest of North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Denso Corporation

- 7.1.3 ABB Ltd.

- 7.1.4 Siemens AG

- 7.1.5 General Electric Co.

- 7.1.6 Teledyne Technologies Incorporated

- 7.1.7 Smiths Detection Inc.

- 7.1.8 Chemring Group PLC

- 7.1.9 Bosch Sensortec GmbH

- 7.1.10 Smart Sensors, Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219