|

市場調查報告書

商品編碼

1629761

歐洲奈米感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Nano Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

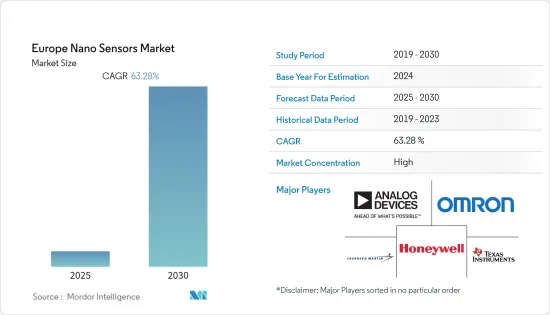

歐洲奈米感測器市場預計在預測期內複合年成長率為63.28%

主要亮點

- 推動歐洲奈米感測器市場的主要趨勢是小型化和改進的通訊能力,允許整合到車輛中而不干擾車輛的基本功能。歐洲汽車感測器市場在過去十年中經歷了重大發展,產生了一系列創新且技術先進的產品。

- 在過去的五年裡,隨著汽車變得越來越複雜,對執行多種功能的各種感測器的需求也隨之增加。由於對增強駕駛員資訊、增強安全控制以及更複雜的引擎管理系統以提高燃油效率和減少排放氣體的需求不斷成長,預計該市場將繼續成長。歐洲奈米感測器市場主要由世界上最大的公司組成,只有少數市場參與企業。

- 由於新治療方法、醫療設備和通訊協定的快速發展,歐洲醫療保健產業正在該地區經歷強勁成長。據估計,政府在醫療保健方面的支出增加將進一步發展該地區的奈米感測器市場。

- 歐盟(EU)也同意透過在2019年和2020年向歐洲國防工業發展計畫撥款5億歐元來加強歐洲陷入困境的國防工業,預計奈米感測器的廣泛使用將在該地區創造需求。

歐洲奈米感測器市場趨勢

電化學和光學生物奈米感測器需求量龐大

- 這些感測器用於監測各種生物過程、抗原、各種生物藥品之間的相互作用等。奈米管用於此類感測器,其中蛋白質或其他物體與奈米管結合並指示變化。

- 各種測量的屬性包括抗原/抗體交互作用、DNA交互作用、酵素交互作用等。這些感測器的優點包括快速同時檢測眾多生物參數、高選擇性和高靈敏度。

- 這些生物奈米感測器的使用對於檢測與肺癌、氣喘發作和流感相關的各種類型的病毒、寄生蟲、瘧疾等非常有益。隨著商業化的進展,市場對此類奈米感測器的需求預計也會成長。

- 生物奈米感測器也用於軍事應用來檢測危險的生技藥品。由於生物戰威脅日益嚴重,許多國家都在增加對此類感測器生產的投資。

醫療保健產業預計將在預測期內推動奈米感測器的成長

- 歐洲是醫療保健行業的最大市場之一,該領域技術的不斷採用預計將進一步增加該地區對奈米感測器的需求。

- 各種監控和資料收集設備正在納入醫療保健產業,人們的注意力集中在開發解決方案上。例如,2021 年 9 月,領先的醫院到家庭和遠距離診斷平台 Nanowear 宣布,Nanowear 推出了獨立的人工智慧和深度學習演算法,可將遠距離診斷作為軟體即醫療設備 (SaMD) 提供資訊。三個FDA 510(k) 許可,以及第一個端到端數位平台的純軟體許可,該平台能夠實施

- 健康疾病的增加加上人口老化正在推動對創新解決方案的需求。例如,德國在歐洲成年人口中糖尿病盛行率最高,2019 年有 15.3% 患有糖尿病,其次是葡萄牙,比例為 14.2%。同時,愛爾蘭的糖尿病盛行率是歐洲最低的,為 4.4%。

- 自 COVID-19 爆發以來,隨著越來越多的人依賴醫療保健技術,該地區對遠端監控和諮詢的需求不斷成長。

歐洲奈米感測器產業概況

奈米感測器市場由幾家擁有創新產品的領先公司主導,包括 Analog Devices、 OMRON和 STMicroElectronics。

- 2021年7月-OMRON將減少空調、電力和太陽能發電系統造成的能源損失,並增加太陽能排放,透過提高能源效率和減少熱量來為減少社會的碳足跡做出貢獻。繼電器“G9KA”。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 擴大醫療保健產業的技術採用

- 加大創新材料的研發力度

- 市場限制因素

- 奈米感測器製造的複雜性

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 光學感測器

- 電化學感測器

- 電子機械感應器

- 按最終用戶產業

- 家用電子產品

- 發電

- 車

- 航太/國防

- 衛生保健

- 產業

- 其他最終用戶產業

第6章 競爭狀況

- 公司簡介

- Analog Devices Inc

- OMRON Corporation

- Lockheed Martin Corporation

- Honeywell International Inc.

- Texas Instruments Incorporated

- STMicroelectronics

- Samsung Electronics co Limited

- Teledyne Technologies

- Agilent Technologies

第7章 投資分析

第8章市場機會與未來趨勢

簡介目錄

Product Code: 56095

The Europe Nano Sensors Market is expected to register a CAGR of 63.28% during the forecast period.

Key Highlights

- The major trends driving Europe's nanosensors market are miniaturization and improved communication capabilities, enabling their integration into vehicles without interfering with the basic functionalities of the vehicle. Europe's automotive sensors market has experienced important developments over the past decade, resulting in a wide variety of innovative and technologically superior products.

- There has been an increase in demand for a variety of sensors to perform a multitude of functions as vehicles have become more complex over the last five years. Continued growth is anticipated for this market, propelled by enhanced demand for greater driver information, tighter safety controls, and more sophisticated engine management systems to improve fuel economy and reduce emissions. Europe's nanosensors market mostly consists of large global corporations with a few small market participants.

- The high rate of development for new treatment methods, medical equipment, and protocols in the region are boosting the European healthcare industry to grow significantly. The increasing government expenditure in healthcare is further estimated to develop the market for nanosensors in the region.

- Also, the European Union has agreed to bolster the ailing European defense industry by allocating EUR 500 million in 2019 and 2020 to the European Defence Industrial Development Programme, and the extensive use of nanosensors in this industry is expected to create demand for nanosensors in the region.

Europe Nano Sensors Market Trends

Electrochemical biological nano sensors and photometric biological nano sensors find significant demand

- These sensors are used to monitor various biological processes, antigen bodies, and interactions between various biological agents, etc. Nanotubes are used in such sensors and proteins, or any other bodies bind themselves to the nanotubes, indicating a change.

- The various measuring attributes include Antigen/antibody interaction, DNA interaction, and enzymatic interaction, among others. The benefits offered by these sensors include rapid and simultaneous detection of numerous biological parameters, high selectivity, and high sensitivity.

- The use of these biological nanosensors has been highly beneficial in detecting lung cancer, asthma attacks, various kinds of viruses related to influenza, parasites, malaria, among others. With increased commercialization, the demand for these types of nanosensors is also expected to grow in the market.

- Biological nanosensors are also used in military applications for detecting harmful biological agents. Many countries have been increasingly investing in the manufacturing of such sensors due to the increasing threat of biological warfare.

Healthcare industry is expected to fuel the growth of nano sensors over the forecasted period

- Europe is among the top markets when it comes to the healthcare industry, and the growing adoption of technology in the sector is expected further to augment the demand for nanosensors in the region.

- Various monitoring and data collection devices are being incorporated into the healthcare industry with a growing focus on developing solutions. For example, in September 2021, Nanowear, a leading hospital-at-home and remote diagnostic platform, announced that it received its third FDA 510(k) clearance and first software-only clearance as an end-to-end digital platform enabling Nanowear to implement standalone AI and deep learning algorithms that will inform remote diagnoses as Software-as-a-Medical Device (SaMD).

- The growing number of health ailments combined with the aging population is augmenting the demand for innovative solutions. For instance, Germany had the highest prevalence of diabetes in Europe among their adult population, with 15.3% living with diabetes in 2019, Portugal followed with the second-highest share at 14.2%. On the other hand, Ireland was the country with the lowest prevalence of diabetes in Europe at 4.4%.

- Since the outbreak of the Covid-19, the demand for remote monitoring and consultations has grown in the region, along with growth in the number of people using technology for healthcare.

Europe Nano Sensors Industry Overview

The nanosensor market is consolidated, with a few major players occupying the prominent share of the market with their innovative product offerings-companies such as Analog Devices, Omron, STMicroelectronics, and others.

- Jul 2021 - Omron's contribution to reducing the carbon footprint in society by improving energy efficiency and suppressing the heat, the company introduced the "G9KA" low-temperature high power PCB relay, which improves the power generation efficiency of PV systems by reducing energy losses generated by air conditioners, electricity, and solar systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption of technology in healthcare industry

- 4.2.2 Increasing research and development in innovative materials

- 4.3 Market Restraints

- 4.3.1 Complexity in Manufacturing Nanosensors

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Optical Sensor

- 5.1.2 Electrochemical Sensor

- 5.1.3 Electromechanical Sensor

- 5.2 By End-User Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Power Generation

- 5.2.3 Automotive

- 5.2.4 Aerospace and Defense

- 5.2.5 Healthcare

- 5.2.6 Industrial

- 5.2.7 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Analog Devices Inc

- 6.1.2 OMRON Corporation

- 6.1.3 Lockheed Martin Corporation

- 6.1.4 Honeywell International Inc.

- 6.1.5 Texas Instruments Incorporated

- 6.1.6 STMicroelectronics

- 6.1.7 Samsung Electronics co Limited

- 6.1.8 Teledyne Technologies

- 6.1.9 Agilent Technologies

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219