|

市場調查報告書

商品編碼

1628773

亞太地區奈米感測器:市場佔有率分析、產業趨勢和成長預測(2025-2030)APAC Nano Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

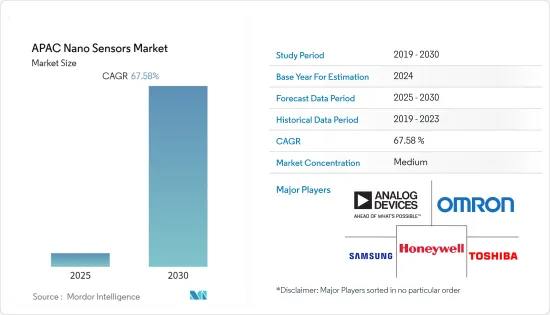

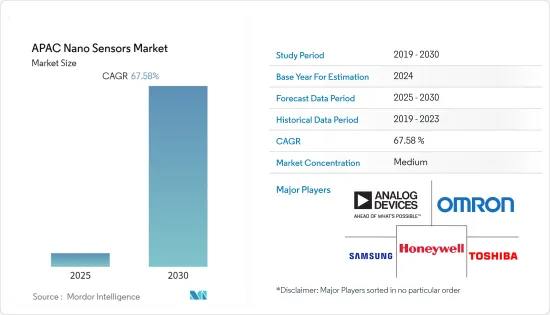

亞太奈米感測器市場預計在預測期內複合年成長率為67.58%

主要亮點

- 亞太地區的奈米感測器市場預計在預測期內將顯著成長。該地區還佔有全球市場的很大佔有率。此外,預計在預測期內,亞太地區奈米感測器的採用率最高。

- 亞太地區在奈米感測器技術的發展方面處於領先地位。韓國在奈米技術市場的專利數量位居全球第二,其次是日本、中國和台灣。奈米技術專利數量的增加預計將推動該地區奈米感測器市場的成長。

- 中國是全球最大的汽車市場,也是全球最大的汽車生產基地,其中包括電動車。馬來西亞還有27家汽車製造和組裝廠。預計該地區的汽車工業也將大幅成長。

- 該地區不斷成長的經濟狀況和投資鼓勵許多奈米感測器供應商在市場上進行創新。來自中國和新加坡的研究人員開發了一種新型光機械奈米感測器,為訊號處理提供了新的可能性。

亞太地區奈米感測器市場趨勢

預計電化學領域在預測期內將佔據顯著佔有率

- 化學奈米感測器測量特定化學物質的濃度和成分,以產生所需的效果。此類感測器中使用奈米碳管來吸收或吸附(取決於所使用的技術),以檢測化學變化。

- 測量的屬性包括化學成分、鍵結和分子水平濃度。這些感測器的優點包括高靈敏度、高選擇性、高吸附性和大表面積。對即時護理 (POC) 設備不斷成長的需求預計將推動化學感測器的發展。石油天然氣和石化產業嚴重依賴此類設備來確保安全的操作環境。

- 在食品工業中,化學奈米感測器具有多種應用,具有多種電極類型,用於檢測水中的糖、葡萄、葡萄酒和亞硫酸鹽等化合物。因此,隨著化學等各種行業釋放污染物和化學物質廢棄物,對這些感測器的需求預計會增加,從而進一步增加對監測解決方案的需求。

醫療保健支出的增加預計將增加對奈米感測器的需求

- 在亞太地區,由於對快速、準確、緊湊和攜帶式診斷感測系統的需求不斷成長,生物醫學和生物醫學領域是奈米感測器最大的新興市場。奈米感測器有能力滿足這項需求。

- 此外,奈米感測器和奈米整合系統預計將在不久的將來用於大量人口的初步診斷和篩檢。醫療保健支出的增加也促進了市場的顯著成長。

- 除此之外,從北美和歐洲等地區到亞太地區的醫療保健旅行的增加也進一步推動了對創新醫療保健解決方案的需求。例如,根據馬來西亞醫療旅遊理事會的數據,冠狀動脈繞道手術手術在美國的費用約為 92,000 美元,而在印度的費用不到 10,000 美元。

- 該地區正在進行各種材料開發和技術研究,預計將推動市場需求。例如,2021年6月,中國科學院上海高等研究院的研究團隊報告了一種利用石墨烯-PDMS(聚二甲基矽氧烷)微球進行微結構感知的新型軟性壓阻感測器。

亞太地區奈米感測器產業概況

儘管很少有大公司在該地區的奈米感測器市場上佔有較大佔有率,但許多正在推進市場發展的公司正在開發基於奈米技術的解決方案。市場尚未整合,但在預測期內正走向整合。

- 2021 年 8 月 -OMRON宣布推出業界首個影像處理技術,可實現電子基板檢查流程自動化,無需專業技能,以滿足第五代行動通訊、電動車和自動駕駛等需求。 。該公司的新提案旨在維持和提高品質和安全。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 小型化趨勢以及各行業擴大使用小型化產品

- 加大創新材料的研發力度

- 市場限制因素

- 奈米感測器製造的複雜性

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 光學感測器

- 電化學感測器

- 電子機械感應器

- 按最終用戶產業

- 家用電子產品

- 發電

- 車

- 石化

- 航太/國防

- 衛生保健

- 產業

- 其他最終用戶產業

第6章 競爭狀況

- 公司簡介

- Analog Devices Inc

- OMRON Corporation

- Samsung Electronics co Limited

- Toshiba Corp.

- Honeywell International Inc

- STMicroelectronics

- Toshiba Corp.

- Teledyne Technologies

- Agilent Technologies

- Nippon Denso Corp.

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 53794

The APAC Nano Sensors Market is expected to register a CAGR of 67.58% during the forecast period.

Key Highlights

- The Asia-Pacific nanosensor market is estimated to grow significantly during the forecast period. The region also accounts for a significant market share in the global market. Also, the adoption of nanosensors is expected to be highest in Asia-Pacific during the forecast period.

- The APAC region leads in the development of nanosensor technology. South Korea has the second-highest patents in the nanotechnology market in the world, followed by Japan, China, and Taiwan. The increasing number of patents in Nanotechnology is estimated to grow the market for nanosensors in the region.

- China has become both the world's largest car market and the world's largest production site for cars, including electric cars. Also, there are 27 automotive manufacturing and assembly plants in Malaysia. The automotive industry is also expected to grow significantly in the region.

- The growing economic condition and investments in the region have motivated many nanosensor vendors to innovate in the market. The researchers from China and Singapore have developed a new Optomechanical Nanosensor, which offers fresh possibilities for signal processing.

APAC Nano Sensors Market Trends

The electrochemical segment is expected to command prominent share over the forecasted period

- Chemical nanosensors measure the concentration and composition of a particular chemical and provide the desired effect. Carbon nanotubes are used in such sensors to absorb or adsorb, depending on the technique used, to detect the chemical changes.

- The measuring attributes include chemical composition and bonding and molecular-level concentration, among others. The benefits of these sensors include high sensitivity, high selectivity, high adsorption, and larger surface area coverage. Growing demand for point-of-care devices is expected to act as a driver for the chemical sensors, as these devices offer an attractive option in this field due to their small footprint and potential for high sensitivity. Oil and gas and petrochemical industries are highly dependent on such devices to ensure a safe environment for the conduction of operations.

- In the food industry, chemical nanosensors have versatile applications with an array of electrode types being used to detect compounds, like Sulfite in sugar, grapes, wine, and water. Thus, the demand for these sensors is expected to increase as various industries, such as chemicals, release pollutants and chemicals as waste, which further increases the need for monitoring solutions.

Growing spending in healthcare is expected to augment the demand for nano sensors

- The biomedical and biomedical sector is the largest initial market for nanosensors in the Asia Pacific region, owing to a growing requirement for rapid, accurate, compact, and portable diagnostic sensing systems. Nanosensors have the capabilities to address this requirement.

- Moreover, nanosensors and nano-enabled integrated systems are expected to be used in large populations in the near future for preliminary diagnosis or screening. The increasing spending on healthcare treatments is also aiding the market in growing significantly.

- In addition to this, the growing healthcare travel towards the Asia Pacific from regions such as North America and Europe is further fueling demand for innovative healthcare solutions. The price parity of healthcare is augmenting the growth of healthcare tourism; for instance, according to the Malaysia Healthcare Travel Council, a coronary artery bypass graft which would cost about USD 92,000 in the United States costs less than USD 10,000 in India.

- Various material development and technology research are underway in the region, which is expected to propel the market demand. For instance, in June 2021, a research team from the Shanghai Advanced Research Institute of the Chinese Academy of Sciences reported a novel flexible piezoresistive sensor with graphene-PDMS (polydimethylsiloxane) microspheres for microstructure perception.

APAC Nano Sensors Industry Overview

The nanosensors market in the region has few major players who command significant shares; however, various other players in the market are developing solutions based on nanotechnology. The market is not consolidated but moving towards consolidation beyond the forecasted period.

- Aug 2021 - Omron launches the "VTS10 Series PCB Inspection System", the industry's first imaging and artificial intelligence technology that automates the electronic substrate inspection process, eliminating the need for specialized skills to meet the needs of fifth-generation mobile communications, electric vehicles, and autonomous driving. The company's new proposal aims to maintain and improve quality and safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Trend of Miniaturization and Use of Miniaturized Products Across Various Industries

- 4.2.2 Increasing research and development in innovative materials

- 4.3 Market Restraints

- 4.3.1 Complexity in Manufacturing Nanosensors

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Optical Sensor

- 5.1.2 Electrochemical Sensor

- 5.1.3 Electromechanical Sensor

- 5.2 By End-User Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Power Generation

- 5.2.3 Automotive

- 5.2.4 Petrochemical

- 5.2.5 Aerospace and Defense

- 5.2.6 Healthcare

- 5.2.7 Industrial

- 5.2.8 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Analog Devices Inc

- 6.1.2 OMRON Corporation

- 6.1.3 Samsung Electronics co Limited

- 6.1.4 Toshiba Corp.

- 6.1.5 Honeywell International Inc

- 6.1.6 STMicroelectronics

- 6.1.7 Toshiba Corp.

- 6.1.8 Teledyne Technologies

- 6.1.9 Agilent Technologies

- 6.1.10 Nippon Denso Corp.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219