|

市場調查報告書

商品編碼

1626324

歐洲穿戴式感測器 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

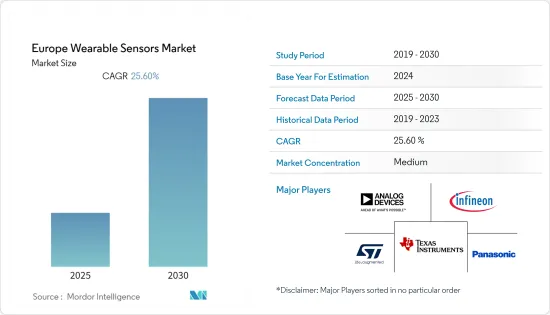

歐洲穿戴式感測器市場預計在預測期內複合年成長率為 25.6%

主要亮點

- 在歐洲,穿戴式感測器廣泛應用於醫療、運動、健身、國防和旅行等領域。這些感測器被軍方用於各種應用,例如抬頭顯示器。這些感測器用於飛行模擬器以及電影院、遊戲和娛樂產業的其他應用。

- 穿戴式感測器市場正在為娛樂領域的擴增實境(AR)市場做出貢獻。歐洲是一個巨大的遊戲市場,Oculus Rift 和索尼 HMZ-T3Q 等產品在遊戲玩家中越來越受歡迎。

- 此外,英國消費者正在積極採用穿戴式技術,其中健身追蹤器尤其成為人們佩戴在手腕上的越來越受歡迎的配件。根據英國國家統計局的數據,英國是歐洲最大的健身市場之一,總銷售額約 53 億歐元。自2012年以來,英國健身設施的數量持續增加。此類案例預計將推動歐洲穿戴式感測器市場的成長。

- 由於 COVID-19 的爆發,預計多家公司將使用接觸者追蹤穿戴式裝置。例如,2020 年 5 月,物聯網連接和安全新興企業Nodle、技術解決方案公司 Avnet 和非營利基金會 Coalition Network 宣布推出一款新型智慧穿戴式接觸者追蹤設備 Nodle M1。 Nodle也宣布,它已經收到了歐洲大型公司對數百萬台產品的興趣。

歐洲穿戴式感測器市場趨勢

擴大工業領域的應用

- 在該地區,頭戴式顯示器的使用正在取得巨大進展。例如,法國達梭系統公司正在致力於在真實環境中創建虛擬製造工廠的混合實境視圖。該公司正在開發可以立即整合到軟體中並直接匯出到頭戴式設備的模型。對於更廣泛的應用來說,將這些設備轉變為合適的工程設計工具是必要的下一步。

- 歐洲5G的發展預計將顯著改善B2B公司頭戴式顯示器的使用。歐盟(EU)正在透過「歐洲5G行動計畫」推動5G的部署。目標是到2020年在歐洲實現5G服務全面商業化。至2025年,所有都市區和主要地面交通幹線實現5G不間斷覆蓋。

- 例如,愛立信表示,到2025年,西歐和中歐和東歐的5G行動用戶數量預計將分別超過2.89億和1.55億。 2020 年 12 月,沃達豐宣布將向歐洲市場的幾家公司提供 Nreal Light 眼鏡,透過沃達豐的Gigabit5G 網路提供混合實境和擴增實境體驗。 Nreal Light 將透過與沃達豐的合作在德國、西班牙和其他歐洲國家推出。

英國穿戴式感測器研發和使用案例快速成長

- 英國人口正在老化,慢性病、跌倒、殘疾和其他負面健康結果的風險不斷增加。穿戴式裝置可用於解決與檢測和管理弱勢老化族群的健康狀況相關的一些困難。此外,英國智慧織物市場的研發活躍,主要得益於歐盟委員會Horizon 2020框架計畫的投資。

- 英國品牌 Xelflex 開發的一項新型穿戴技術將衣服變成主動運動感測器。英國劍橋的科學家正在開發這項技術。透過將彎曲敏感光纖縫在衣服內,Xelflex 可以提供智慧回饋和智慧健康管理,而無需運動員攜帶重型設備。

- 英國正在研究能夠減輕電池重量的輕型軍服。國防企業中心 (CDE) 授予智慧紡織品有限公司 (ITL) 20 萬美元,用於開發減輕士兵負重的智慧紡織品解決方案。

- 該地區在頭戴式顯示器的使用方面也取得了重大發展。例如,總部位於法國的達梭系統公司正在致力於在現實環境中創建虛擬製造工廠的混合實境視圖。穿戴式科技的發展正在推動歐洲穿戴式感測器的發展。

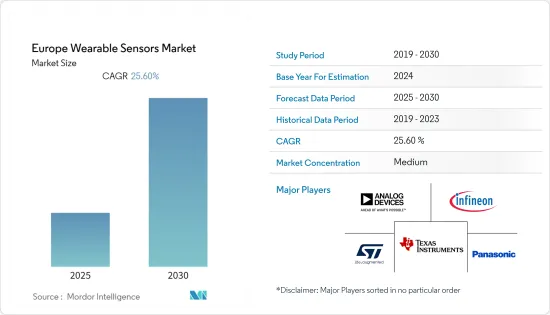

歐洲穿戴式感測器產業概況

歐洲穿戴式感測器市場預計將逐步整合。隨著歐洲各地創新的不斷進行,各公司正在投資無線和穿戴式技術的開發,這些技術可以整合到臨床系統、製造設施、家用電子電器產品中,並具有軍事應用。預計此類舉措將增加預測期內對感測器的需求。

例如,8sense 是一家德國穿戴式新興企業,它製造了世界上第一個帶有虛擬教練的智慧背部感測器。 8sense 系統將位置和變化分析與即時互動和訓練相結合,定期提供使用者姿勢回饋。這款穿戴式教練旨在增強和保護您的健康和工作效率,幫助您更積極地坐著,並告知您在辦公室的實際健身水平。

- 2021 年 8 月,Masimo 宣布獲得 CE 標誌,並在西歐推出“Masimo SafetyNet Alert”,這是一種供家庭使用的動脈血氧飽和度監測和警報系統。 Masimo SafetyNet Alert 採用穿戴式指尖脈搏血氧飽和度感測器,採用訊號擷取技術,並與隨附的家庭醫療中心和智慧型手機應用程式進行無線通訊。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 工業領域應用的增加和電池尺寸的增加

- 開發時尚穿戴式感測器設備

- 市場限制因素

- 由於成本高昂,最終用戶不願意採用新的創新。

- 產業價值鏈分析

- 技術簡介

- 主要技術概述(MEMS、CMOS等)

第5章市場區隔

- 按類型

- 健康感測器

- 環境感測器

- MEMS感測器

- 運動感應器

- 其他

- 按設備

- 手腕佩戴

- 緊身衣/鞋類

- 其他

- 按用途

- 健康與保健

- 安全監控

- 家庭康復

- 其他

- 按國家/地區

- 英國

- 德國

- 法國

- 其他

第6章 競爭狀況

- 公司簡介

- STMicroelectronics

- Infineon Technologies AG

- Texas Instruments Incorporated

- Analog Devices Inc.

- InvenSense Inc.

- Panasonic Corporation

- NXP Semiconductors NV

- TE Connectivity Ltd.

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第7章 投資分析

第8章 市場機會及未來趨勢

The Europe Wearable Sensors Market is expected to register a CAGR of 25.6% during the forecast period.

Key Highlights

- In Europe, wearable sensors are being used in various domains such as healthcare, sports, and fitness, defense, travel, etc. These sensors have been used in the military for various applications like a heads-up display. These sensors are being adopted in cinemas, gaming, and flight simulator in the entertainment industry.

- The wearable sensors market is helping the augmented reality market in entertainment. Products like Oculus Rift and Sony HMZ-T3Q are gaining a lot of popularity among gamers, and Europe is a big gaming market.

- Moreover, consumers in the UK have adopted wearable technology enthusiastically, particularly fitness trackers, becoming an increasingly commonplace accessory on people's wrists. According to the Office for National Statistics (UK), the United Kingdom contains one of Europe's largest fitness markets, with total revenue of about EUR 5.3 billion. Since 2012 there has been a consistent increase in the number of fitness facilities in the UK. Such instances are expected to boost the growth of the European Wearable Sensor market.

- With the outbreak of COVID-19, several enterprises are expected to use contact tracking wearables. For instance, in May 2020, IoT connectivity and security startup Nodle, technology solutions company Avnet, and non-profit foundation Coalition Network announced the creation of a new smart wearable contact tracing device, the Nodle M1. Also, Nodle announced that it had already received interest from large enterprises in Europe for several million units.

Europe Wearable Sensors Market Trends

Increasing applications in the industrial sector

- The region is witnessing significant developments in the usage of head-mounted displays. For instance, Dassault Systemes, a France-based company, works to create Mixed Reality views of its virtual manufacturing plants in real-world environments. The company is developing a model that can instantaneously be built into its software and exported directly to head-mounted devices. It is emerging as the next step necessary for the broader application to transit these devices as a proper engineering design tool.

- The development of 5G in the European region is expected to significantly improve Head-Mounted Displays usage in B2B enterprises. The European Union is driving the deployment of 5G with its 5G For Europe Action Plan. It aims to roll out fully commercial 5G services in Europe by 2020. All urban areas and primary terrestrial transport paths should have uninterrupted 5G coverage by 2025.

- For instance, the number of 5G mobile subscriptions in Western and Central & Eastern Europe is forecast to exceed 289 million and 155 million, respectively, by 2025, according to Ericsson. In December 2020, Vodafone announced to offer the Nreal Light glasses to several businesses in its European markets, delivering Mixed and Augmented Reality experiences through Vodafone's Gigabit 5G network. Nreal Light will be made available in Germany, Spain, and other European countries in partnership with Vodafone.

United Kingdom experiences rapid growth in research and development and use cases of wearable sensors

- The aging population in the United Kingdom has increased risks for chronic conditions, falls, disabilities, and other adverse health outcomes. Wearable devices could be adopted to address some of the difficulties related to detecting and managing unfavorable aging populations' health conditions. Besides, the United Kingdom has significant research and development activity concerning the smart fabric market, mainly due to the Framework Program Horizon 2020 investments from the European Commission.

- A new wearable technology developed under the British brand Xelflex turns clothes into an active motion sensor. Scientists develop the technology from Cambridge, Great Britain. Xelflex uses bend-sensitive fiber-optic that is stitched inside the clothing to provide intelligent feedback for athletes without burdening them with heavy equipment and exercising smart health control.

- The United Kingdom is focusing on lightweight military uniforms with a reduction in the weights of batteries. The Centre for Defence Enterprise (CDE) has awarded USD 0.2 million to Intelligent Textiles Limited (ITL) to develop smart textile solutions for decreasing the weight load for soldiers.

- The region is also witnessing significant developments in the usage of head-mounted displays. For instance, Dassault Systemes, a France-based company, works to create Mixed Reality views of its virtual manufacturing plants in real-world environments. The development of wearable technology promotes the development of wearable sensors in Europe.

Europe Wearable Sensors Industry Overview

The wearable sensor market in Europe is expected to be moderately consolidated. With the ongoing innovations across Europe, companies are investing in developing wireless and wearable technologies that can be integrated into clinical systems, manufacturing facilities, consumer electronics or have military applications. Such initiatives are expected to increase the demand for the sensors during the forecast period.

For instance, 8sense is a wearable start-up from Germany that makes the world's first smart back sensor with a virtual coach. The 8sense system regularly gives feedback on the user's posture, combining position and movement analysis with real-time interaction and training. Designed to enhance and protect health and productivity, this attachable coach helps to sit more actively and informs about actual fitness levels in the office.

- August 2021: Masimo announced the CE marking and launch in western Europe of Masimo SafetyNet Alert, an arterial blood oxygen saturation monitoring and alert system designed for use at home. Masimo SafetyNet Alert features a Signal Extraction Technology wearable fingertip pulse oximetry sensor that communicates wirelessly to an accompanying Home Medical Hub and smartphone app.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing applications in the industrial sector and improvement in the battery sizes.

- 4.3.2 Development of wearable sensor devices that look fashionable

- 4.4 Market Restraints

- 4.4.1 Reluctance from end users in employing new innovations due to their expensive nature

- 4.5 Industry Value Chain Analysis

- 4.6 Technology Snapshot

- 4.6.1 Key Technology Overview (MEMS, CMOS etc.)

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Health Sensors

- 5.1.2 Environmental Sensors

- 5.1.3 MEMS Sensors

- 5.1.4 Motion Sensors

- 5.1.5 Others

- 5.2 By Device

- 5.2.1 Wristwear

- 5.2.2 Bodywear and Footwear

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Health and Wellness

- 5.3.2 Safety Monitoring

- 5.3.3 Home Rehabilitation

- 5.3.4 Others

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 STMicroelectronics

- 6.1.2 Infineon Technologies AG

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Analog Devices Inc.

- 6.1.5 InvenSense Inc.

- 6.1.6 Panasonic Corporation

- 6.1.7 NXP Semiconductors N.V.

- 6.1.8 TE Connectivity Ltd.

- 6.1.9 Bosch Sensortec GmbH (Robert Bosch GmbH)