|

市場調查報告書

商品編碼

1627128

北美穿戴式感測器:市場佔有率分析、產業趨勢和成長預測(2025-2030)NA Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

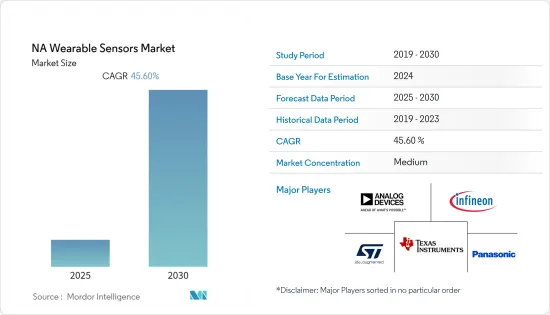

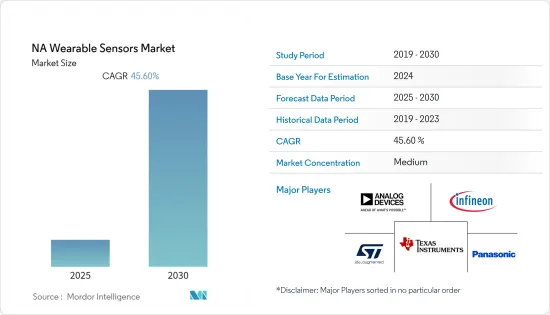

北美穿戴式感測器市場預計在預測期內複合年成長率為 45.6%

主要亮點

- 人們對健康和健身意識的增強推動了市場的發展,其中穿戴式感測器發揮關鍵作用。此外,研發投資降低了用於製造穿戴式感測器的組件的價格,使穿戴式裝置更加便宜。

- 健身、醫療保健和安全領域的穿戴式技術等各個應用領域的需求不斷成長,正在推動北美穿戴式感測器市場的快速成長。

- 在 COVID-19 爆發期間,穿戴式裝置中的感測器的需求激增,這些感測器可以為第一線醫護人員提供即時資料並快速篩檢體溫較高的人。

- 然而,由於持續的晶片短缺,預計晶片供應量將會減少。隨著可供購買的產品減少和需求增加,穿戴式感測器和基於穿戴式感測器的裝置的價格預計將會上漲。

北美穿戴式感測器市場趨勢

對穿戴式健身設備的需求增加推動市場

- 該地區穿戴式感測器的主要市場之一是運動健身市場。市面上不斷出現健身追蹤產品,包括 Nike Fuelband、Jawbone UP、Microsoft Band 和 Fitbit。

- 這些設備可以戴在身上,追蹤步數、行走距離、燃燒卡路里等各種參數,並且可以與行動電話同步,追蹤你的日常進展。這些設備在該地區很受歡迎,因為超重和肥胖是一個嚴重的問題。

- 根據 CDC 的數據,美國65.5% 的成年人和大約 17% 的兒童患有肥胖症。不規則和不健康的飲食習慣以及缺乏運動會加劇這個問題。

- 穿戴式裝置正在幫助改善大眾的健康。穿戴式裝置在運動健身中的應用正在成為北美地區的龐大市場。許多設備製造商都發現健身追蹤解決方案的銷售量增加。

改變消費者對穿戴式科技的觀點

- 在過去的十年中,消費者對穿戴式裝置的觀點發生了變化,由於其功能和不斷發展的技術整合正在改變消費者與環境的互動方式,因此它們越來越受歡迎。

- 在健身追蹤器和智慧型手錶等穿戴式裝置中,最有影響力的因素是年齡、收入和性別。根據 AARP 2020 報告,50 歲以上、50-59 歲、60-69 歲和 70 歲以上的美國成年人中分別有 83%、87%、81% 和 79% 使用穿戴式科技。

- 此外,根據 Attest 的《2019 年消費者研究和世代趨勢報告》,2019 年,32.1% 的英國受訪者擁有智慧型手錶/健康追蹤器計算設備,其中32.7% 的Z 世代和32.7% 的千禧世代擁有智慧手錶/健康追蹤器計算設備X世代佔37.6%,X世代佔31.4%,嬰兒潮世代佔22.2%。

- 此外,隨著科技採用的增加,消費者對這些穿戴裝置的觀點也越來越好,以滿足他們的期望。儘管對增加功能的需求,消費者對使用穿戴式裝置越來越感興趣。這為製造商創造了實現穿戴式產品多樣化並克服消費者強調的問題的機會。

- 此外,隨著物聯網的發展,我們認為消費者將擴大使用穿戴式裝置與周圍的其他裝置和實體物件交換資訊。

北美穿戴式感測器產業概況

北美穿戴式感測器市場適度分散,由少數國際公司和本土企業主導。

- 穿戴式智慧手環製造商的主要供應商包括蘋果、華為科技公司、Polar Electro Oy、Garmin Ltd.、Fitbit Inc.、小米公司和三星電子。他們不斷透過融入最新技術來更新產品,以保持其在市場中的地位和佔有率。

- 2020 年 3 月:市場上的一些供應商已與醫療機構合作,檢測各種與健康相關的疾病和問題,並為其自有品牌智慧型手錶提供競爭優勢。例如,Fitbit 與史克里普斯研究所和史丹佛大學醫學院合作研究,旨在利用 Fitbit資料來幫助檢測、追蹤和遏制 COVID-19 等感染疾病。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 科技的快速發展和感測器的小型化

- 工業領域應用不斷增加

- 市場限制因素

- 大規模引入工業領域初期成本較高

- 產業價值鏈分析

- COVID-19 對市場的影響

- 技術簡介

- 主要技術概述(MEMS、CMOS等)

第5章市場區隔

- 按類型

- 健康感測器

- 環境感測器

- MEMS感測器

- 動作感測器

- 其他

- 按設備

- 手腕佩戴

- 緊身衣和鞋類

- 其他

- 按用途

- 健康與保健

- 安全監控

- 家庭康復

- 其他

- 按國家/地區

- 美國

- 加拿大

第6章 競爭狀況

- 公司簡介

- STMicroelectronics

- Infineon Technologies AG

- Texas Instruments Incorporated

- Analog Devices Inc.

- InvenSense Inc.

- Freescale Semiconductor Inc

- Panasonic Corporation

- NXP Semiconductors NV

- TE Connectivity Ltd.

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 49683

The NA Wearable Sensors Market is expected to register a CAGR of 45.6% during the forecast period.

Key Highlights

- The market is driven by the rising awareness of health and fitness, where wearable sensors play a vital role. Moreover, due to investments in research and development, the reducing price of the components used to manufacture the wearable sensors is making the wearable devices affordable.

- Increasing demand across various application sectors such as wearable technology for fitness, healthcare, and security is driving the North American wearable sensors market to grow at a rapid rate.

- During the COVID-19 outbreak, the demand for wearable devices' sensors that offer real-time data to frontline healthcare workers and let them quickly screen individuals with a high temperature skyrocketed.

- However, the ongoing chip shortage is expected to result in a decline in chip availability. As fewer products become available to buy, and with increasing demands, prices of wearable sensors and wearable sensor-based devices are expected to increase.

North America Wearable Sensors Market Trends

Increase in demand of wearable fitness devices is driving the market

- One of the major markets for wearable sensors in this region is the sports and fitness market. Products like Nike Fuelband, Jawbone UP, Microsoft Band, and Fitbit have come into the market that is there for fitness tracking.

- These devices are worn on the body to track various parameters such as steps taken, distance traveled, calories burned, etc., and can be synced with the phone to track the progress daily. These devices are getting popular in this region because of the serious problem of people being overweight and obese.

- In the USA, according to CDC, 65.5% of adults and around 17% of children are obese. This problem is growing because of the irregular, unhealthy diet and the lack of exercise.

- Wearable devices are helping the masses to get more fit. The application of wearable devices in sports and fitness is becoming a huge market in the North American region. Many device manufacturers have witnessed growing sales with respect to fitness tracking solutions.

Changing consumer perspective towards wearable technology

- Consumer perspectives towards wearable devices are changing in the last decade owing to features and evolving technology integration that is changing the way consumers interact with the environment, and their popularity is growing.

- Age, income, and gender are the most influencing factor among these wearable devices, such as fitness trackers and smartwatches. According to AARP 2020 report, the age of usage of wearable technology among United States adults aged 50 years and older, between 50-59 years, between 60-69 years, and between 70 years and plus accounted for 83%, 87%, 81%, and 79% respectively.

- Further, according to Attest consumer survey and generational trend report 2019, the share of respondents who own a smartwatch/health-tracker computing device in the United Kingdom in 2019 accounted for 32.1%, where Generation Z, Millenials, Generation X, and Baby boomers accounted for 32.7%, 37.6%, 31.4%, and 22.2% respectively.

- Further, the consumer perspective towards these wearable devices is increasing towards meeting their expectation with the technology adoption rising. Despite the need for improved functionality, an increasing number of consumers are interested in using wearables. This creates opportunities for manufacturers to diversify their wearables offerings and overcome the issues highlighted by consumers.

- Moreover, with the growth of IoT, consumers feel that they will be using wearables to exchange information with other devices and physical things around them.

North America Wearable Sensors Industry Overview

The wearable sensors market in North America is dominated by few international players amongst local players and is moderately fragmented.

- Major vendors of wearable smart bands manufacturers consist of Apple Inc., Huawei Technologies Co. Ltd, Polar Electro Oy, Garmin Ltd, Fitbit Inc., Xiaomi Corporation, and Samsung Electronics Co. Ltd. They keep on updating their products by embedding the latest technologies to retain their market position and share.

- March 2020: Some of the vendors in the market are partnering with healthcare institutes to research various sensors which can be embedded within the device to detect various health-related diseases or problems and provide a competitive advantage to their brand of smartwatches. For instance, Fitbit has collaborated with the Scripps Research Institute and Stanford Medicine on research that is aimed at using Fitbit data to help detect, track, and contain infectious diseases like COVID-19.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Rapid technological developments and miniaturization of sensors

- 4.3.2 Increasing applications in the industrial sector

- 4.4 Market Restraints

- 4.4.1 High initial costs for large scale implementation in industries

- 4.5 Industry Value Chain Analysis

- 4.6 Impact of COVID-19 on the Market

- 4.7 Technology Snapshot

- 4.7.1 Key technology overview (MEMS, CMOS, etc)

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Health Sensors

- 5.1.2 Environmental Sensors

- 5.1.3 MEMS Sensors

- 5.1.4 Motion Sensors

- 5.1.5 Others

- 5.2 By Device

- 5.2.1 Wristwear

- 5.2.2 Bodywear & Footwear

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Health & Wellness

- 5.3.2 Safety Monitoring

- 5.3.3 Home Rehabilitation

- 5.3.4 Others

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 STMicroelectronics

- 6.1.2 Infineon Technologies AG

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Analog Devices Inc.

- 6.1.5 InvenSense Inc.

- 6.1.6 Freescale Semiconductor Inc

- 6.1.7 Panasonic Corporation

- 6.1.8 NXP Semiconductors N.V.

- 6.1.9 TE Connectivity Ltd.

- 6.1.10 Bosch Sensortec GmbH (Robert Bosch GmbH)

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219