|

市場調查報告書

商品編碼

1626890

拉丁美洲氣體感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Latin America Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

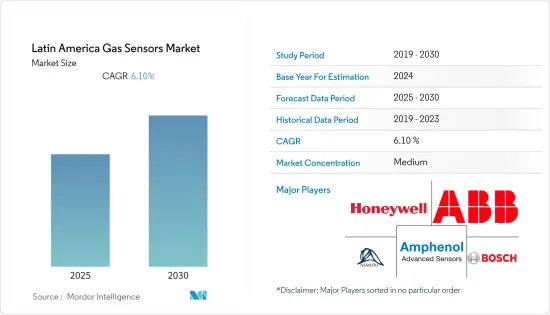

拉丁美洲氣體感測器市場預計在預測期內複合年成長率為 6.1%

主要亮點

- 汽車、製造和採礦業排放氣體中碳含量的增加正在推動氣體感測器市場的成長。例如,根據氣候觀測站發布的一項研究,巴西2020年溫室氣體排放與前一年同期比較增加了9.5%。

- 此氣體感測器結構簡單、精度高。由於其易於使用,它可以整合到各個工業領域使用的廢氣分析儀和空氣品質監測系統中。

- 氣體感測器的需求源於對各種工業過程中氣體排放的持續監控和控制。氣體感測器用於從工業到家庭的各種應用。監測空氣污染、化學過程和內燃機排放只是氣體感測器安裝的眾多應用中的一部分。

- 近年來,各種類型的氣體已被用作各行業的原料。有些氣體對人體具有腐蝕性、爆炸性或毒性。此類氣體對財產和人類生命造成損害的風險很高,因此對其進行控制和監控非常重要。這些因素正在推動所研究市場的成長。

- 然而,感測器高昂的初始成本是採用的主要障礙,並阻礙了市場成長。

拉丁美洲氣體感測器市場趨勢

暖通空調和智慧城市計劃需求的增加推動市場成長

- 基於物聯網的無線氣體感測器在智慧城市中用於偵測空氣污染、預測火災情況、追蹤氣體燃燒等。使用物聯網氣體感測器,可以即時收集、處理和交換空氣品質資料,有可能打造更健康的智慧城市。

- 最重要的組件之一是 HVAC 系統中的氣體檢測。 HVAC 系統中的氣體感測器可用於監測有毒和可燃性氣體氣體,並在達到危險水平時向人員發出警報。

- 例如,由於擴大遵守政府法規以及對職業安全和健康的日益關注,氣體感測器擴大用於暖通空調系統,這推動了氣體感測器市場的成長。

- 例如,哈佛大學的一項新研究發表了空氣污染暴露與冠狀病毒重症病例之間的關聯。 2020 年 4 月,哈佛大學陳曾熙公共衛生學院發布的資料顯示,大氣中細懸浮微粒每立方公尺增加 1 克,COVID-19 死亡率就會增加 15%。

- 因此,有關通風的新政府法規已引入商業空間。此外,BPO 環境中的暖氣、通風和空調 (HVAC) 系統需要特別考慮。必須僱用經過培訓和認證的 HVAC 操作員來正確監控和維護所有 HVAC 系統。

市場區隔:汽車產業佔主要佔有率

- 汽車在拉丁美洲排放量上升中所佔比例最大。拉丁美洲汽車銷售的增加導致排放氣體量上升。

- 例如,根據OICA的數據,2020年巴西和阿根廷註冊和銷售的新車數量分別為205.8萬輛和33萬輛。此外,根據國家統計地理實驗室的數據,截至2020年墨西哥流通的汽車數量為5,034萬輛。

- 廢氣感知器測量廢氣溫度並控制車輛排放氣體。引擎控制單元負責此感知器。防止廢氣流中的車輛零件過熱損壞。

- 此外,在大多數地區經濟復甦的推動下,汽車廢氣感測器市場正迅速接近新冠疫情前的水平,預計在預測期內將實現健康成長。公共運輸頻繁停駛加上病毒的高度傳染性,導致乘用車需求增加,進而帶動對汽車廢氣感知器產品的需求。

拉丁美洲氣體感測器產業概況

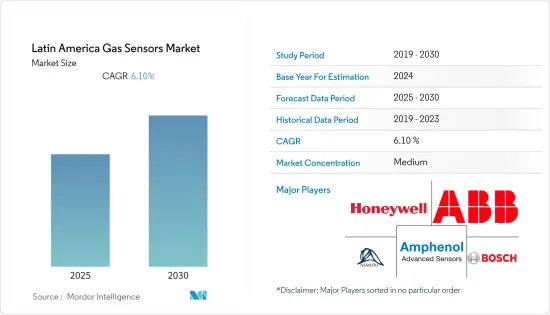

拉丁美洲氣體感測器市場競爭適中,由 ABB Ltd.、Siemens AG、Honeywell International, Ltd. 和 Amphenano Advanced Sensors 等幾家主要參與者組成。從市場佔有率來看,目前該市場由少數大公司主導。預計競爭和快速的技術進步將對預測期內每家公司的市場成長構成威脅。

- 2021 年10 月- 霍尼韋爾在霧、雨、雪和其他惡劣天氣條件下對有害氣體進行持續監測,以確保工業場所對石油和天然氣、石化、化學和其他工人的安全。款新型藍牙連接氣體探測器。新型HoneywellSearchLine Excel Plus 和 SearchLine Excel Edge 採用先進的光學和高功率紅外線技術來創建下一代開放路徑氣體探測器,該探測器在能見度較差的情況下和比以前更遠的距離仍保持活躍。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 暖通空調系統中氣體感知器的出現

- 智慧城市對空氣品質監測的需求不斷成長

- 增加有關廢氣法規的政府標準和法規

- 石油和天然氣產業對安全系統的需求增加

- 市場限制因素

- 設備初始成本高

第6章 市場細分

- 依氣體類型

- 一氧化碳

- 甲烷

- 氫

- 氧

- 二氧化碳

- 其他氣體

- 依技術

- 紅外線氣體感測器

- 光電離感測器

- 電化學氣體感測器

- 熱傳導氣體感測器

- 金屬氧化物氣體感測器

- 催化氣體感測器

- 按最終用戶產業

- 國防/軍事

- 醫療保健

- 消費性電子產品

- 汽車/交通

- 工業

- 其他

- 按國家/地區

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

第7章 競爭格局

- 公司簡介

- ABB Ltd.

- Siemens AG

- Robert Bosch GmbH

- Figaro Engineering Inc.

- Dynament Ltd.

- Membrapor AG.

- Amphenol Advanced Sensors

- Trolex Ltd.

- Honeywell International, Inc.

- Nemoto Sensor Engineering Co., Ltd

第8章投資分析

第9章 未來展望

The Latin America Gas Sensors Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- The rising carbon content of emissions from the automotive, manufacturing, and mining sectors has fueled the growth of the gas sensors market. For instance, Brazil's greenhouse gas emissions increased 9.5 percent in 2020, compared to the previous year, according to a study released by Climate Observatory found.

- The gas sensors provide high precision with simple architecture. They are simple to use, allowing them to be integrated with exhaust gas analyzers and air quality monitoring systems used in a variety of industrial sectors.

- The requirement for gas sensors stems from constantly monitoring and controlling gas emissions from various industrial processes. Gas sensors are used for a variety of purposes ranging from industrial to domestic. Monitoring air pollution, chemical processes, and exhaust from combustion engines are just a few of the many applications for gas sensor installation.

- Various types of gases are being used as raw materials in various industries in recent years. Certain gases are corrosive, explosive, or toxic to humans. Controlling and monitoring these gases becomes critical, as there is a high risk of property and human life damage. These factors are aiding the growth of the studied market.

- However, the high initial cost of the sensors acts as a significant barrier to adoption, stifling market growth.

Latin America Gas Sensors Market Trends

Increasing Demand in HVAC and Smart City Projects is Driving the Market Growth

- IoT-based wireless gas sensors are used in smart cities to detect air pollution, predict fire conditions, and track gas combustion, among other things. Using IoT gas sensors, air quality data can be collected, processed, and exchanged in real-time, potentially leading to healthier smart cities.

- One of the most critical components is gas detection in the HVAC system. The use of gas sensors in HVAC systems monitors toxic and combustible gases and alerts personnel when they reach a dangerous level.

- For example, gas sensors are increasingly being used in HVAC systems due to increased compliance with government regulations and increased concern about occupational health and safety, which drives the market growth of gas sensors.

- For instance, A new Harvard study presented a link between exposure to air pollution and severe cases of coronavirus. In April 2020, the Harvard T.H. Chan School of Public Health released data determining that an increase of 1 gram per cubic meter in the fine particulate matter in the air was connected with a 15 percent increase in the Covid-19 death rate.

- Resultantly, new government regulations for ventilation are among the protocols being put in place for commercial spaces. Additionally, special consideration must be given to the heating, ventilation, and air conditioning (HVAC) systems within the BPO setting. Trained and certified HVAC operators are to be employed for the proper monitoring and maintenance of all HVAC systems.

The Automotive Segment to Hold Major Market Share

- Automotive vehicles hold one of the most significant shares for the rising emission levels in Latin America. The increase in the sale of vehicles in the Latin American region has led to increased emission levels.

- For instance, according to OICA, in 2020, the number of new vehicles registered or sold in Brazil and Argentina amounted to 2.058 million units and 0.33 million units, respectively. Further, according to the National Institute of Statistics and Geography, the number of motor vehicles in circulation in Mexico as of 2020 was 50.34 million units.

- The exhaust gas sensors measure the temperature of the exhaust gas and control the vehicle emissions. The engine control unit is in charge of these sensors. They prevent overheating of vehicle components located in the flow of exhaust gases and damage to vehicle components.

- Further, the Automotive Exhaust Gas Sensors market is rapidly approaching pre-COVID levels, and a healthy growth rate is expected over the forecast period, fueled by economic recovery in most regions. The frequent suspension of public transportation systems, combined with the virus's highly contagious nature, increased the demand for passenger cars, resulting in a demand for Automotive Exhaust Gas Sensors products.

Latin America Gas Sensors Industry Overview

The Latin America gas sensors market is moderately competitive and consists of several major players like ABB Ltd., Siemens A.G, Honeywell International, Ltd., Amphenol Advanced Sensors, etc. In terms of market share, few of the major players currently dominate the market. The competition and rapid technological advancements are expected to pose a threat to the market's growth of the companies during the forecast period.

- October 2021 - Honeywell launched two new Bluetooth-connected gas detectors which can deliver continuous monitoring for hazardous gases even in fog, rain, snow, and other inclement weather, helping facilities keep their oil and gas, petrochemical, chemical, and other workers industrial sites safe. The new Honeywell Searchline Excel Plus and Searchline Excel Edge are the next generations of open path gas detectors that use advanced optics and high-powered infrared technology to stay operational in poor visibility conditions and over longer distances than before.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of to COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence for gas sensors in HVAC system

- 5.1.2 Increasing need for air quality monitoring in smart cities

- 5.1.3 Growth in government standards and regulations concerning emission control

- 5.1.4 Rising Demand for Safety Systems in the Oil and Gas Industry

- 5.2 Market Restraints

- 5.2.1 High initial cost of the device

6 MARKET SEGMENTATION

- 6.1 By Gas Type

- 6.1.1 Carbon Monoxide

- 6.1.2 Methane

- 6.1.3 Hydrogen

- 6.1.4 Oxygen

- 6.1.5 Carbon Dioxide

- 6.1.6 Other Gases

- 6.2 By Technology

- 6.2.1 Infrared Gas Sensor

- 6.2.2 Photo Ionization Sensor

- 6.2.3 Electrochemical Gas Sensor

- 6.2.4 Thermal Conductivity Gas sensor

- 6.2.5 Metal Oxide based Gas Sensor

- 6.2.6 Catalytic Gas Sensor

- 6.3 By End-User Industry

- 6.3.1 Defense and Military

- 6.3.2 Healthcare

- 6.3.3 Consumer Electronics

- 6.3.4 Automotive and Transportation

- 6.3.5 Industrial

- 6.3.6 Other End-User Industries

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Argentina

- 6.4.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Siemens AG

- 7.1.3 Robert Bosch GmbH

- 7.1.4 Figaro Engineering Inc.

- 7.1.5 Dynament Ltd.

- 7.1.6 Membrapor AG.

- 7.1.7 Amphenol Advanced Sensors

- 7.1.8 Trolex Ltd.

- 7.1.9 Honeywell International, Inc.

- 7.1.10 Nemoto Sensor Engineering Co., Ltd