|

市場調查報告書

商品編碼

1626892

北美光學感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)NA Optical Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

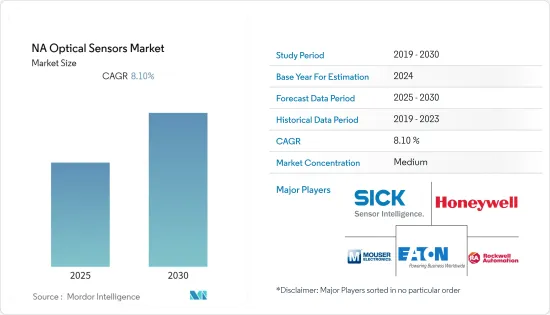

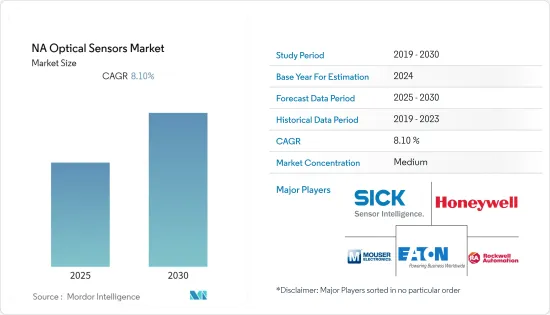

預計北美光學感測器市場在預測期內的複合年成長率為 8.1%。

根據消費者科技協會(CTA)的數據,根據2021年零售額銷售額預測,美國消費性電子產品零售額達4,420億美元。智慧型手機是消費性電子領域零售額最大的產品,2020年銷售額達790億美元。

光學感測器通常內建於智慧型手機、智慧型穿戴裝置和智慧型手錶中,用於環境光和其他用途。物聯網 (IoT)、穿戴式技術以及健康和健身技術正在改變美國市場,是光學感測器需求成長的關鍵驅動力。根據CTA統計,美國智慧型手機家庭普及率已達74%,顯示該國家庭普及潛力巨大。美國市場的主要驅動力是市場上最新的產品創新。

此外,由於其多功能性,智慧型電視預計將在美國和加拿大高速成長。根據 ComScore 的數據,2020 年美國家庭最受歡迎的智慧型電視品牌是三星,佔有率穩定在 32%,其次是阿爾卡特/TCL(14%)和 Vizio(13%)。在美國,智慧型電視預計將普及到每個家庭,未來智慧電視的數量預計將進一步增加,刺激市場成長。

在美國,使用光學感測器的自動駕駛汽車正在興起。 Waymo 等公司正在該國擴大業務,以促進無人駕駛汽車的使用。隨著包括加州在內的全國各州擴大測試規則以支持無人駕駛汽車的開發,光學感測器的銷售量預計將增加。

北美光學感測器市場趨勢

光電感測器有望錄得顯著成長

光電感測器可以高精度檢測物體,並在工業自動化市場中得到了廣泛的應用。這些感測器正在整合到各種自動化機械中,主要用於非接觸式檢測和測量,例如計數、監控、傳送機構、運輸系統、工具機和組裝。

根據《Control Global》雜誌報道,該地區主要自動化供應商包括艾默生、羅克韋爾、ABB、Fortive、Schneider Electric和西門子。艾默生 2020 年銷售額為 52.7 億美元,羅克韋爾自動化 2020 年銷售額緊隨其後,為 37.2 億美元。

隨著工業 4.0 的機器人和自動化趨勢日益成長,迫切需要操作精度。因此,對光電感測器的需求不斷增加。包裝、物料輸送和汽車行業強調了對光電感測器的需求,因為它們與工業物聯網和巨量資料整合,並且依賴智慧感測器的資料。

從包裝(自動化倉儲的成長)到製造、製藥到食品和飲料,每個行業的上升趨勢都將促進預測期內的市場成長。

根據美國勞工統計局的數據,美國的倉庫數量每年都在增加,到2020年將達到19,190個。此外,根據《富比士》對 48 名受訪者的調查,三分之一的受訪者計劃在明年內投資輸送機或自動分類設備。

美國在工業和汽車產業擁有巨大的成長機會

光學感測器擴大應用於駕駛輔助系統,例如車道維持輔助系統、停車輔助系統和緊急煞車輔助系統。基於LED和紅外線雷射的感測器是ADAS(高級駕駛輔助系統)的關鍵技術之一,可逐漸減輕駕駛員的負擔。

根據美國經濟分析局 (BEA) 的數據,2020 年美國汽車產量約為 220 萬輛,由於 COVID-19 大流行而大幅減少。然而,這一數字預計在預測期內將會增加,這可能會推動市場成長。根據 OICA(國際汽車製造商組織)的數據,2020 年北美將生產近 1,340 萬輛汽車。

基於紅外線雷射的感測器也擴大整合到各種自動化機械中,主要用於非接觸式檢測,例如輸送機系統、運輸系統和組裝監控。光學感測器在汽車行業的應用已大幅成長,尤其是由於技術進步而使用影像感測器。由於汽車領域成像應用的廣泛,預計汽車行業影像感測器的成長將迅速成長。

2020 年 1 月,全球感測器解決方案供應商艾邁斯半導體 (ams AG) 發布了 CMOS 全域百葉窗感測器 (CGSS) 近紅外線(NIR) 影像感測器 CGSS130。 CGSS130 感測器在近紅外線波長處具有高量子效率,在 940nm 處為 40%,在 850nm 處為 50%。用於製造感測器的層壓 BSI 製程提供了 3.8mm*4.2mm 的小尺寸。

此感光元件可產生有效像素陣列為 1080H x 1280V、最大影格速率率為 120 幀/秒的單色影像。此外,它還提供超過 100dB 的高動態範圍 (HDR) 模式。 CGSS130 對 NIR 波長的敏感度提高了四倍,能夠可靠地偵測 3D 感測系統中低功率紅外線發送器的反射。此感測器用於主動立體視覺、飛行時間和結構光等 3D 感測技術。

北美光學感測器產業概況

北美光學感測器市場較為分散,主要參與者包括知名國際品牌、國內品牌以及形成競爭格局的新參與企業。一些主要參與者越來越希望透過各種策略併購、技術創新和增加研發投資來擴大市場。

- 2021 年 6 月,Mouser Electronics 宣布與 Marktech OptoElectronics 簽訂全球分銷協議,為客戶提供 Marktech OptoElectronics 的發射器和光電二極體系列,用於夜視、安全設備、光纖和貨幣檢驗等應用。近紅外線發射器具有出色的光學和機械軸對準性能,使其適用於條碼讀取器、光纖、光學開關和光學感測器等高精度應用。

- 2021 年 1 月: Honeywell宣布推出光學卡尺測量感測器,旨在最佳化鋰離子電池 (LIB) 生產。該感測器為測量塗層過程中電極材料的真實厚度以及鋰離子電池製造中的壓制站提供了有效的解決方案。光學卡尺測量感測器可偵測0.5mm x 0.5mm (0.019685" x 0.019685")區域內1微米的塗層變化。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 智慧型手機普及率擴大

- 工業節能設備需求增加

- 自動化技術在各行業的市場滲透率不斷提高

- 市場限制因素

- 影像品質與價格不平衡且缺乏標準化

- 對光學感測器缺乏認知與接受

第6章 市場細分

- 依技術

- 高光譜影像

- 近紅外線光譜

- 光聲斷層掃描

- 光學相干斷層掃描

- 依感測器類型

- 光纖感測器

- 影像感測器

- 位置感測器

- 環境光/接近感測器

- 硫化鎘

- 矽

- 砷化鎵感測器

- 擴展 InGaAs 感測器

- 紅外線感測器

- 其他感測器

- 按用途

- 商業的

- 家用電子產品

- 醫療用途

- 車

- 工業的

- 航太/國防

- 光耦合器

- 4針光耦

- 6針光耦

- 高速光耦合器

- 用於 IGBT 閘極驅動器的光耦合器

- 用於隔離放大器的光耦合器

- 其他

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Mouser Electronics Inc.

- Sick AG

- Rockwell Automation

- Honeywell Inc.

- Eaton Corporation

- Turck inc.

- Robert Bosch GmbH

- Atmel Corporation

- ST Microelecronics inc

- Hitachi Ltd

- Omnivision Inc.

第8章投資分析

第9章市場的未來

The NA Optical Sensors Market is expected to register a CAGR of 8.1% during the forecast period.

According to the Consumer Technology Association (CTA), based on the projected retail sales for 2021, consumer electronics retail sales in the United States reached USD 442 billion. Smartphones were the products accounting for the largest retail revenue within the consumer electronics sector, comprising USD 79 billion in revenue in 2020.

Optical sensors are typically embedded in smartphones, smart wearable, and smartwatches for ambient light and other purposes. Internet of Things (IoT), wearable technology, and health and fitness technology have transformed the United States market and have been primary drivers for increasing the demand for optical sensors. The smartphone household penetration stands at 74% in the United States, according to CTA, which indicates a high potential for household penetration in the country. The United States market is primarily driven by the latest product innovations in the market.

Smart TVs are also expected to witness high growth in the United States and Canada, owing to high multi-functionality. According to ComScore, In 2020, Samsung remained the most popular smart TV brand among US households, with a steady share of 32%, followed by Alcatel/TCL and Vizio with 14% and 13% market share, respectively. It is expected that smart TVs will be a part of all households in the United States, which is expected to further increase further, thereby fueling the growth of the market.

Autonomous vehicles, which use optical sensors, have been on the rise in the United States. Companies, such as Waymo, are stationed in the country and have been expanding operations to drive the use of driverless cars. Various states in the country, such as California, have been expanding testing rules to aid the development of driverless cars, which is expected to increase the sales of optical sensors.

North America Optical Sensors Market Trends

Photoelectric Sensor is Expected to Register a Significant Growth

Photoelectric sensors have been recognized for their robust use in the industrial automation marketplace, owing to their high precision in detecting objects. These sensors have found a rising integration into a wide range of automated machinery, mainly for non-contact detections and measurements, including counting, monitoring, conveyor mechanisms, transport systems, machine tools, and across assembly lines.

According to Control Global Magazine, some of the leading automation vendors in the region include Emerson, Rockwell, ABB, Fortive, Schneider Electric, Siemens, etc. Emerson had a sales revenue of USD 5.27 Billion in the year 2020, followed by Rockwell Automation with a sales revenue of USD 3.72 Billion in 2020.

With a greater inclination toward employing robotics and automation through Industry 4.0, there is a pressing need for precision in operations. Thus, driving the need for photoelectric sensors. The packaging, material handling, and automotive industries have emphasized the need for photoelectric sensors, owing to their collaboration of IIoT with Big Data and the reliance on data from smart sensors.

The rising trend in sectors, ranging from packaging (the growth of automated warehouses) to manufacturing, and pharmaceuticals to food and beverages, is set to augment the growth of the market over the forecast period.

According to the Bureau of Labor Statistics, the number of warehouses in the United States has been growing at an increasing rate every year, reaching 19,190 in 2020. Forbes survey with 48 respondents also showed that one-third of respondents plan to invest in conveyors or automatic sortation facilities in the next 12 months.

United States witnesses significant growth opportunities in the market in Industrial and Automotive industries

Optical sensors are increasingly used in driver assistance systems for lane-keeping assistants, parking assistants, and emergency brake assistant systems. The sensors, based on LEDs and infrared lasers, are one of the primary technologies for advanced driver assistance systems to reduce the burden on the driver gradually.

According to the U.S. Bureau of Economic Analysis (BEA), In 2020, approximately 2.2 million automobiles were produced in the United States, which has decreased a lot due to the COVID-19 pandemic. However, this number is expected to increase in the forecasted period, which can fuel the growth of the market. Organisation Internationale des Constructeurs d'Automobiles (OICA), almost 13.4 million motor vehicles were produced in North America in 2020.

Sensors based on infrared lasers are also witnessing a rising integration into a wide range of automated machinery primarily for non-contact detection, such as monitoring conveyor systems, transport systems, and assembly lines. The application of optical sensors in the automotive industry is considerably growing, especially with the usage of image sensors due to the advancement of technology. The image sensors growth in the automotive industry is estimated to grow rapidly due to its extensive image applications in the automotive sector.

In January 2020, ams AG, a worldwide supplier of sensor solutions, launched the CMOS Global Shutter Sensor (CGSS) Near Infrared (NIR) image sensor, CGSS130, that enables 3D optical sensing applications such as face recognition, payment authentication, among others. The CGSS130 sensor has high quantum efficiency at NIR wavelength up to 40% at 940nm and 50% at 850nm. The stacked BSI process used to fabricate the sensors offer a small footprint of 3.8mm*4.2mm.

The sensor produces monochrome images with an effective pixel array of 1080H X 1280V at a maximum frame rate of 120 frames/s. In addition, it offers a high dynamic range (HDR) mode of more than 100dB. The CGSS130 is 4times more sensitive to NIR wavelengths and reliably detects reflections from very low-power IR emitters in 3D sensing systems. The sensor is used for 3D sensing technologies such as Active Stereo Vision, Time-of-flight, and Structured Ligh.

North America Optical Sensors Industry Overview

The North America Optical Sensors Market is fragmented with few major players, which are various established international brands, domestic brands, as well as new entrants that form a competitive landscape. Some of the major players are increasingly seeking market expansion through various strategic mergers and acquisitions, innovation, increasing investments in research and development.

- June 2021: Mouser Electronics announced a global distribution agreement with Marktech Optoelectronics to offer customers Marktech Optoelectronics' range of emitters and photodiodes for applications, including night vision, safety equipment, fiber optics, and currency validation. The near-IR emitters offer exceptional optical/mechanical axis alignment, making them a suitable choice for high-precision applications, including bar code readers, fiber optics, and optical switches, and optical sensors.

- January 2021: Honeywell announced the introduction of an Optical Caliper Measurement Sensor designed to optimize Lithium-Ion Battery (LIB) production. The sensor provides an effective solution for measuring the true thickness of electrode material during coating as well as at the pressing station during LIB manufacturing. The Optical Caliper Measurement Sensor can detect variations in coatings as small as 1 micron (0.0393701 thousandths of an inch) in areas as small as 0.5 mm x 0.5 mm (0.019685 inches x 0.019685 in).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Market Penetration of Smartphones

- 5.1.2 Increasing Demand for Power-saving Devices Across Industries

- 5.1.3 Increasing Market Penetration of Automation Techniques Across Various Industries

- 5.2 Market Restraints

- 5.2.1 Imbalance Between the Image Quality and Price and Lack of standardization

- 5.2.2 Lack of awareness and acceptability of optical sensors

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Hyperspectral imaging

- 6.1.2 Near IR Spectroscopy

- 6.1.3 Photo-Acoustic Tomography

- 6.1.4 Optical Coherence Tomography

- 6.2 Sensor Type

- 6.2.1 Fiber Optic Sensors

- 6.2.2 Image Sensors

- 6.2.3 Position Sensors

- 6.2.4 Ambient Light and Proximity Sensors

- 6.2.4.1 Cadmium Sulfide

- 6.2.4.2 Silicon

- 6.2.4.3 InGaAs Sensors

- 6.2.4.4 Extended InGaAs Sensors

- 6.2.5 Infrared Sensors

- 6.2.6 Other Sensors

- 6.3 Applications

- 6.3.1 Commercial

- 6.3.2 Consumer Electronics

- 6.3.3 Medical

- 6.3.4 Automotive

- 6.3.5 Industrial

- 6.3.6 Aerospace & Defence

- 6.3.7 Optocouplers

- 6.3.7.1 4-pin Optocouplers

- 6.3.7.2 6-pin Optocouplers

- 6.3.7.3 High speed optocouplers

- 6.3.7.4 IGBT gate driver optocouplers

- 6.3.7.5 Isolation Amplifier Optocouplers

- 6.3.8 Others

- 6.4 Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mouser Electronics Inc.

- 7.1.2 Sick AG

- 7.1.3 Rockwell Automation

- 7.1.4 Honeywell Inc.

- 7.1.5 Eaton Corporation

- 7.1.6 Turck inc.

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Atmel Corporation

- 7.1.9 ST Microelecronics inc

- 7.1.10 Hitachi Ltd

- 7.1.11 Omnivision Inc.