|

市場調查報告書

商品編碼

1626898

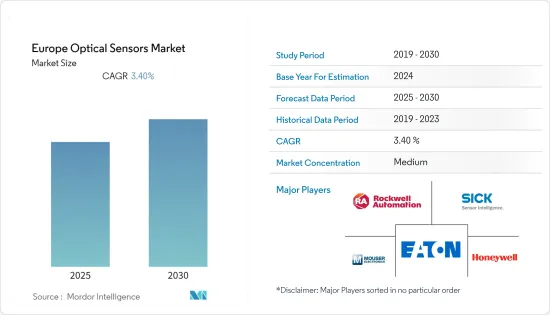

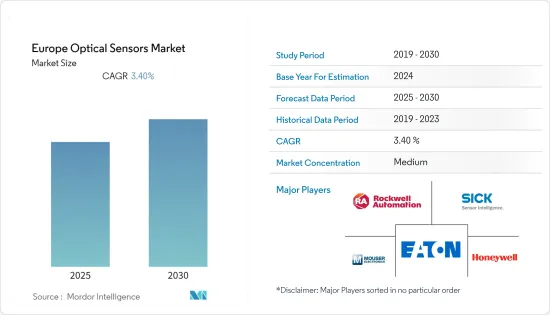

歐洲光學感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Optical Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

歐洲光學感測器市場預計在預測期內複合年成長率為 3.4%

主要亮點

- 此外,由於智慧型手機對先進安全功能的需求不斷增加,螢幕指紋掃描(一種檢測和確認指紋的光學感測器)等功能正在推動光纖感測器市場的發展。

- 環境感測器測量房間內的亮度並相應地調整螢幕亮度。因此,智慧型手機需求的增加預計將推動對這些感測器的需求。

- 光學感測器還提供快速、準確的測量,使其成為製造商節省電力、時間和金錢的重要工具。更重要的是,這些感測器應用於智慧照明,可以根據您家中的自然光打開燈光,而不是依賴手動開關,從而幫助節省能源。

- 影像品質和價格之間的不平衡導致競爭加劇,特別是在消費性電子領域,一些領先公司面臨著同業要求最適定價的壓力。一些規模較小的企業也面臨產品差異化的困難,這是進入大批量應用的潛在障礙。在這種情況下,成功的產品差異化可以將產品從純粹的定價因素轉變為非定價因素。

- 因此,各公司正試圖透過專注於先進、高效的技術來克服這項挑戰,這些技術有助於最大限度地減少感測器並提供卓越的性能。這些感測器在自動化(移動機器人)等非傳統領域的日益普及有望克服這一挑戰。

- COVID-19疫情嚴重影響了半導體產業,抑制了光學感測器產業的需求。根據半導體產業協會的數據,由於 COVID-19 大流行對國際供應鏈活動造成嚴重干擾,2020 年第一季半導體銷售額下降了 3.6%。此外,由於各種政府封鎖情況,幾家主要汽車和消費性電子OEM已停止製造業務,導致光學感測器銷售下降。

歐洲光學感測器市場趨勢

汽車中光學感測器的採用預計將推動市場發展

- 在汽車產業,光學感測器用於多種支援攝影機的系統,包括自動駕駛、高級安全系統和車載資訊娛樂 (IVI) 系統。這些感測器提供各種直覺的功能,包括 3D手勢姿態辨識、車聯網 (V2X)通訊和室內照明控制應用。

- 在德國,ADAS和自動駕駛汽車的發展正在取得進展,市場需求將加速。 BMW集團等汽車行業的主要企業已經開始開發全自動駕駛車型。

- 2020年11月,本田宣布量產整合感測器技術的3級自動駕駛汽車。汽車OEM商的類似努力正在增加市場擴張的機會。

由於家用電器的普及,環境光和接近感測器領域預計將成長

- 根據研究,顯示器背光僅需 40%。環境光和接近感測器(ALS) 非常適合為行動電話和 PDA 等手持電子設備提供自調節節能和背光改善解決方案。最近,用於液晶電視顯示器的環境感測器變得流行。

- 類似的趨勢開始吸引家庭和汽車照明解決方案等應用。例如,房間的照明可以透過 RGB ALS 來改變,它向房間的照明控制系統提供回饋,以調整基於 LED 的燈具的光顏色、強度和色溫輸出。

- 此外,汽車的照明可以透過智慧環境感測器進行調節,以適應白天和夜間的駕駛並反映路燈的亮度,從而節省電力並提供更好的用戶體驗。

- 光學接近感測器幾乎整合到所有智慧型手機和觸控螢幕電子產品中,支援手勢控制、觸發和感測應用,並用於某些工業應用,特別是在確定製造程序線應用中生產的單元數量時。

- 由於通訊業者難以推出 5G 網路,疫情大流行造成了重大挫折。同時,隨著人們在家工作時越來越依賴網際網路,疫情正在推動對科技的需求。

歐洲光學感測器產業概況

歐洲光學感測器市場競爭激烈,由多家大型企業組成。這些公司正在利用策略合作措施來提高市場佔有率和盈利。

- 2020年2月-根據中國國際光電博覽會,艾睿光電生產整合熱感感測器的熱像儀,用於對可能感染新冠病毒的患者進行即時體溫檢測。機場、火車站、工廠和醫院都安裝了這些成像儀,以提醒人們溫度異常。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 智慧型手機普及率擴大

- 各行業對節電裝置的需求增加

- 自動化技術在各行業的市場滲透率不斷提高

- 市場限制因素

- 影像品質和價格之間的不平衡

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 外部光感測器

- 內建光感應器

- 依感測器類型

- 光纖感測器

- 影像感測器

- 光電感測器

- 環境光/接近感測器

- 其他感測器類型

- 按用途

- 工業的

- 醫療用途

- 生物識別

- 車

- 家電

- 其他用途

- 按國家/地區

- 德國

- 英國

- 法國

- 其他歐洲國家

第6章 競爭狀況

- 公司簡介

- Mouser Electronics

- SICK AG

- Rockwell Automation

- Honeywell

- Eaton

- Turck

- Bosch

- Atmel

- STMicroelectronics

- Hitachi

- Omnvision

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 48652

The Europe Optical Sensors Market is expected to register a CAGR of 3.4% during the forecast period.

Key Highlights

- Also, the increasing demand for advanced security features in smartphones has led to features, such as on-screen fingerprint scan, an optical sensor that detects and verifies fingerprints, driving the fiber optic sensor market.

- Ambient sensors measure the light in the room and adjust the screen's brightness accordingly. Thus, the increasing demand for smartphones is expected to drive the demand for these sensors.

- Optical sensors are also becoming an indispensable tool for manufacturers to save power, time, and money, because of the rapid and precise measurements they provide. Moreover, as these sensors have applications in intelligent lighting, they help save power, as they do not rely on a manual on-off switch but turn on light according to the natural light in the premises.

- The imbalance between image quality and price has led to increased competition, particularly for the consumer electronics segment, which has some of the most established players facing peer pressure over optimal pricing. Several small players are also facing difficulty over product differentiation, which leads to a potential barrier for their entry into high-volume applications. In this case, successful product differentiation can move a product from pure pricing to non-pricing factors.

- Thus, companies are vying to overcome this challenge by focusing on advanced and efficient technologies that would help minimize sensors and superior performance. The increasing adoption of these sensors in non-traditional fields, such as automation (mobile robots), is expected to overcome this challenge.

- The COVID-19 pandemic has seriously impacted the semiconductor sector, curbing demand in the optical sensor industry. According to the Semiconductor Industry Association, semiconductor sales in the first quarter of 2020 fell 3.6% due to the severe disruption of international supply chain activities due to the COVID-19 pandemic. In addition, some major automotive and consumer electronics OEMs have shut down manufacturing operations due to various government blockade scenarios, resulting in lower sales of optical sensors.

Europe Optical Sensors Market Trends

Adoption of opical sensors in automobiles is expected to drive the market

- In the automotive industry, optical sensors are used in several camera-enabled systems, including autonomous driving, advanced safety systems, and in-vehicle infotainment (IVI) systems. These sensors provide a variety of intuitive features such as 3D gesture recognition, Vehicle-to-Everything (V2X) communication, and indoor lighting control applications.

- The growing development of ADAS and self-driving cars in Germany will accelerate market demand. Leading companies in the automotive industry, such as the BMW Group, have already begun developing fully autonomous models.

- In November 2020, Honda announced mass production of Level 3 self-driving cars with integrated sensor technology. Similar initiatives by automotive OEMs add opportunities for expansion to the market.

The ambient light and proximity sensor segment is expected to grow due to increase adoption of consumer electronics

- According to research, backlighting for displays is only required 40% of the time. Ambient light and proximity sensors (ALSs) have been suitable in offering power saving through automatic adjustment and improved backlighting solutions for hand-held electronic devices such as mobile phones, tablets, PDA's, among others. Recently ambient sensors for LCD TV displays have gained traction.

- A similar trend has started to attract applications such as home and automotive lighting solutions. For instance, the room's illumination can be changed through RGB ALSs that provide feedback to a room's lighting-control system to adjust the light color, intensity, and color temperature output of the LED-based luminaires.

- Also, automobile lighting can be adjusted to accommodate day or night driving or reflect the brightness of streetlights through intelligent ambient sensors that offer saving power and provide a better user experience.

- Optical proximity sensors have been integrated into almost every smartphone and touch-screen electronic device to enable gesture control, trigger and detection applications, and some industrial applications such as determining the number of production units in industrial applications, particularly in manufacturing process lines.

- The pandemic has caused significant setbacks as carriers struggle to deploy 5G networks. At the same time, pandemics are driving the demand for technology as people become more and more dependent on the Internet while working from home.

Europe Optical Sensors Industry Overview

The Europe optical sensors market is competitive and consists of several major players. These companies are leveraging strategic collaborative initiatives to increase their market shares and profitability.

- February 2020 - China International Optoelectronic Exposition reports that IRay Technology is manufacturing thermal imagers that incorporate optical sensors for real-time temperature detection of potential COVID-infected patients. Airports, train stations, factories, and hospitals are equipped with this imager that alerts to abnormal temperatures with alarms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Market Penetration of Smartphones

- 4.3.2 Increasing Demand for Power-saving Devices Across Industries

- 4.3.3 Increasing Market Penetration of Automation Techniques Across Various Industries

- 4.4 Market Restraints

- 4.4.1 Imbalance Between the Image Quality and Price

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Extrinsic Optical Sensor

- 5.1.2 Intrinsic Optical Sensor

- 5.2 By Sensor Type

- 5.2.1 Fiber Optic Sensor

- 5.2.2 Image Sensor

- 5.2.3 Photoelectric Sensor

- 5.2.4 Ambient Light and Proximity Sensor

- 5.2.5 Other Sensor Types

- 5.3 By Application

- 5.3.1 Industrial

- 5.3.2 Medical

- 5.3.3 Biometric

- 5.3.4 Automotive

- 5.3.5 Consumer Electronics

- 5.3.6 Other Applications

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mouser Electronics

- 6.1.2 SICK AG

- 6.1.3 Rockwell Automation

- 6.1.4 Honeywell

- 6.1.5 Eaton

- 6.1.6 Turck

- 6.1.7 Bosch

- 6.1.8 Atmel

- 6.1.9 STMicroelectronics

- 6.1.10 Hitachi

- 6.1.11 Omnvision

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219