|

市場調查報告書

商品編碼

1628761

亞太地區光學感測器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Asia Pacific Optical Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

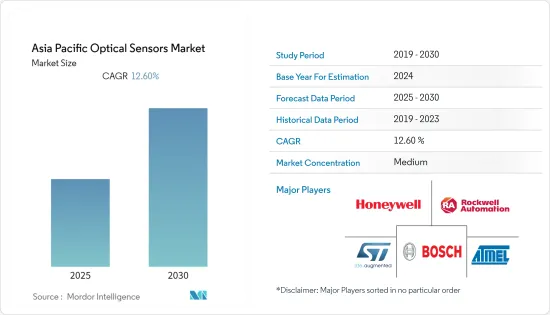

亞太光學感測器市場預計在預測期內複合年成長率為12.6%

主要亮點

- 光學感測器是將光訊號(入射光)轉換為電子訊號的重要電子元件。光學感測器作為獨立組件很少有商業性用途。然而,當與多個測量設備和電氣元件整合為一個系統時,由於許多最終用戶行業中存在廣泛的應用,光學感測器獲得了很高的市場價值。

- 近年來,自動駕駛汽車和 ADAS(高級駕駛輔助系統)的進步增加了對這些感測器的需求。光學感測解決方案擴大用於汽車自動駕駛應用,因為它們被認為是測量距離、位置和位移的卓越技術。光學感測器光源的持續開發也有望在自動駕駛汽車的道路上發揮重要作用。

- 基於奈米級分子印跡奈米材料(MIP)開發的光學感測器優於傳統尺寸的光學感測器。其特點是響應時間快、易於與其他功能整合。此外,在傳輸中使用光纖電流和電壓感測器比傳統電流和電壓測量技術具有顯著優勢,預計將推動市場的發展。

- 日本和印度是擁有眾多電子設備和半導體製造商以及最終用戶的國家。這兩個國家還報告了許多 COVID-19 病例,並且仍在與病毒的傳播作鬥爭。儘管兩國都放鬆了封鎖規定並允許製造工廠營運,但需求和供應的減少對兩國光學感測器市場公司產生了重大影響。

- 然而,正在進行多種類型的研究,以利用光學感測器檢測 COVID-19 病毒。同時,2022 年 4 月,喬治亞大學奈米技術研究小組宣佈開發出一種基於奈米技術的光學感測器,用於快速檢測冠狀病毒。此類光學感測器的開發及其在醫療行業應用的擴展預計將支持市場成長。

亞太地區光學感測器市場趨勢

家電需求擴大推動市場成長

- 消費性電子和醫療設備中光學感測器應用的增加預計將推動對醫療級微型光學感測器的需求。

- 筆記型電腦、平板電腦和智慧型手機等消費性電子設備擴大配備光學感測器,用於各種應用,包括手勢姿態辨識、設備安全和高級生物識別。此外,智慧型手機中對螢幕臉部辨識系統的需求不斷成長可能會推動光學感測器在亞太地區的採用。

- 公司越來越注重像素解析度、數量和尺寸的技術和創新,以提高影像和資料的品質。更好的製造技術和新的物理效應的結合有望為微米和奈米製造的光學感測器開闢新的可能性。

- 亞太地區的客戶越來越關注健康和健身,導致光學感測器在穿戴式應用中使用,例如身體活動、健康和健康追蹤。這些感測器採用穿戴式形式,可實現連續心率檢測和氧飽和度測量。

- 2021 年 6 月,三星和Google宣布,他們將在推出下一代 Galaxy Watch 之前測試穿戴式平台。這項合作最初被宣佈為“統一平台”,允許開發人員為Google的 Wear OS 和三星的智慧型手錶開放原始碼作業系統 Tizen 創建單一應用程式。

- 智慧型手機正在風靡世界。亞太市場的繁榮是巨大的,這使得它成為所有製造智慧型手機的公司的巨大市場。該產業在印度和中國等國家的成長巨大,蘋果、三星、HTC等公司與小米、Oppo、Micromax、Carbon等兩國國產公司之間的激烈競爭正在展開。低成本智慧型手機市場和高階市場都有龐大的需求。

- 例如,小米子品牌紅米宣佈於 2021 年 5 月推出印度首款智慧型手錶。此外,在同期舉行的虛擬活動中,Redmi Note 10S也被發布。 Redmi 目前正在印度銷售健身手環 Redmi Smart Band Black,售價為 1,399 盧比。與此同時,小米正在以 8,999 盧比的價格出售銀色 Mi Watch Revolve Chrome智慧型手錶以及各種 Mi 健身智慧手環。

汽車領域佔有較大佔有率

- 汽車製造商正在透過製造更輕的車輛和使用鋁而不是鋼來滿足對高階汽車、電動車 (EV) 和低油耗的需求。隨著含有鋁和鐵的混合生產線的使用增加,在相同檢測距離下具有足夠長檢測範圍的接近感測器的需求也在增加。

- 2021年,中國不僅是亞太地區乘用車產量最多的國家,也是全球產量最多的國家。預計比亞迪汽車等中國製造商將在電動車領域超越特斯拉等美國製造商。

- 此外,羅克韋爾於 2021 年 4 月宣布推出新型 Allen-Bradley 856T 控制塔塔燈系統,作為其智慧型裝置的一部分。這些工業自動化和智慧設備的創新反映了該公司在智慧設備和感測器(包括智慧設備所需的接近感測器)下創新和利用其產品的願望。

- 然而,亞洲許多自動駕駛汽車製造商,例如Cruise,使用了20多個基於光學感測器的模組來實現免持駕駛。然而,大多數汽車仍處於開發的早期階段,可能需要多年的研發和監管核准才能進入消費市場。隨著汽車製造商轉向自動駕駛汽車的商業化生產,亞洲汽車產業對光學感測器模組的需求預計將大幅增加。

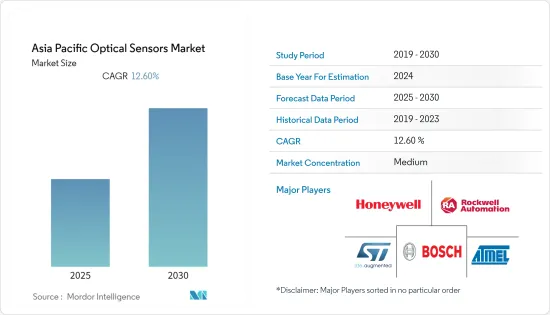

亞太光學感測器產業概況

亞太光學感測器市場分散,主要企業眾多。羅克韋爾自動化公司、愛特梅爾公司、意法半導體、SICK AG 等領先公司都致力於擴大海外基本客群。這些公司正在利用策略合作計劃來提高市場佔有率和盈利。此外,該市場的公司正在收購致力於光學感測器市場技術的新興企業,以增強其產品能力。

- 2022 年6 月- 第一家將MetaOptics 商業化的公司Metalenz 和為整個電子應用領域的客戶提供服務的全球半導體領導者意法半導體(STMicroElectronics) 宣布,意法半導體最近發布了VL53L8 Direct 兩家公司宣布推出一款飛行時間(dToF) 感測器兩家公司於 2021 年 6 月宣布合作開發的元光學設備將在期待已久的市場首次亮相。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 消費性電子產品需求增加

- 物聯網採用率增加

- 市場挑戰

- 對新技術缺乏認知

第6章 市場細分

- 依感測器類型

- 光纖感測器

- 影像感測器

- 位置感測器

- 環境光

- 接近感測器

- 紅外線感測器

- 按用途

- 工業的

- 醫療用途

- 生物識別

- 車

- 家電

- 其他用途

- 按國家/地區

- 中國

- 印度

- 韓國

- 日本

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Honeywell International Inc.

- Rockwell Automation Inc.

- Atmel Corporation

- Robert Bosch GmbH

- STMicroelectronics NV

- Shinkoh Electronics Co. Ltd.

- OZ Optics Ltd.

- SICK AG

- Keyence Corporation

- Neubrex Co. Ltd.

第8章投資分析

第9章市場的未來

The Asia Pacific Optical Sensors Market is expected to register a CAGR of 12.6% during the forecast period.

Key Highlights

- Optical sensors are important electronic components that convert optical signal signals (incident light) into electronic signals. Optical sensors have very few commercial applications as stand-alone components. However, when integrated as a system with several measuring devices and electrical components, optical sensors gain a high market value due to the wide range of applications that exist across numerous end-user industries.

- Advancements in self-driving cars and Advanced Driver Assistance Systems have increased demand for these sensors in recent years. Because optical sensing solutions are considered a superior technology for measuring distances, positions, and displacements, they are increasingly used in self-driving automotive applications. Continuous development of light sources for optical sensors is also expected to play a crucial role on the road to automated, self-driving vehicles.

- Optical sensors developed based on molecularly imprinted nanomaterials (MIP) at the nanoscale outperform their conventional-sized counterparts. They are distinguished by their faster response time and ease of integration with other functionalities. In addition, the use of fiber-optic current and voltage sensors in electricity transmission, which offers significant advantages over traditional current and voltage measurement technologies, is expected to drive the market under consideration.

- Japan and India are the other two countries with a large number of electronics and semiconductor manufacturers as well as end-users. These two countries also reported more COVID-19 infected cases and are still fighting the virus's spread. Though the countries have relaxed the lockdown rules and allowed manufacturing plants to operate, the decrease in demand and supply has significantly impacted the optical sensors market players in both countries.

- However, several kinds of research are being conducted to utilize optical sensors for detecting the COVID-19 virus. In line with this, in April 2022, a nanotechnology research group from the University of Georgia announced the development of nanotechnology-based optical sensors for rapid coronavirus detection. Such developments in optical sensors and their increasing applications in the medical industry are expected to bolster market growth.

APAC Optical Sensors Market Trends

Growing consumer electronics demand will boost the market growth

- The growing number of optical sensor applications in consumer electronics and medical devices is expected to drive demand for medical-grade and miniaturized optical sensors.

- Consumer electronics devices, such as laptops, tablets, and smartphones, are increasingly being outfitted with optical sensors for a variety of applications, including gesture recognition, device security, and advanced biometrics. Furthermore, the growing demand for on-screen facial recognition systems in smartphones will drive optical sensor adoption in the Asia Pacific region.

- Companies are increasingly focusing on technology and innovation in pixel resolution, count, and size to improve image and data quality. It is expected that the combination of better fabrication techniques and new physical effects will open up new opportunities in micro-engineered and nano-engineered optical sensors.

- Customers in Asia-Pacific are increasingly interested in health and fitness, which has resulted in the use of optical sensors for wearable applications such as tracking physical activity, health, and wellness. In wearable form factors, these sensors enable continuous heart rate detection and oxygen saturation measurements.

- In June 2021, Samsung and Google announced the testing of a wearable platform ahead of the release of the next Galaxy Watch. The collaboration was initially announced as a "unified platform," allowing developers to create a single app for both Google's Wear OS and Tizen, Samsung's open-source operating system for its own smartwatches.

- Smartphones have taken the world by storm. The boom in Asia Pacific markets has been enormous and is a huge market for every company that makes smartphones. The growth of this industry in countries like India and China is huge, with intense competition from companies like Apple, Samsung, and HTC and between home-grown companies in the two countries like Xiaomi, Oppo, Micromax, Karbonn, etc. There is a huge demand in both the low-cost smartphone segment and the high-end segment.

- For instance, Xiaomi sub-brand Redmi announced the launch of its first smartwatch in India in May 2021. Also during the same time, the company introduced the Redmi Note 10S in a virtual event. Redmi currently sells the fitness band Redmi Smart Band Black in India for Rs 1,399. Xiaomi, on the other hand, sells the Mi Watch Revolve Chrome smartwatch in silver for Rs 8,999, alongside various Mi fitness smart bands.

Automotive segment to hold a significant share

- Automobile manufacturers strive to meet the demand for high-profile vehicles and electric vehicles (EVs) and low fuel consumption by building lighter-weight cars and favoring aluminum over iron. As the use of mixed production lines containing aluminum and iron grows, so is the demand for the same sensing distance proximity sensors with sufficiently long sensing ranges.

- In 2021, China produced not only the most passenger cars in the Asia-Pacific region but also the most passenger cars worldwide. It is also expected that Chinese manufacturers such as BYD Auto Co. Ltd. will overtake American manufacturers such as Tesla in the electric car segment.

- Furthermore, Rockwell released the new Allen-Bradley 856T Control Tower Stack Light system as part of smart devices in April 2021. These innovations in industrial automation and smart devices reflect the company's desire for innovation and leverage of its products under sensors, including proximity sensors required for intelligent and smart devices.

- However, many self-driving vehicle manufacturers in Asia, such as Cruise, use over 20 optical sensor-based modules to enable hands-free driving in their vehicles. However, most cars are still in the early stages of development and may require several years of R&D and regulatory approvals before reaching the consumer market. As these manufacturers move toward commercial production of these self-driving vehicles, demand for optical sensor modules from the automotive industry is expected to rise significantly in Asia.

APAC Optical Sensors Industry Overview

The Asia Pacific Optical Sensors Market is fragmented, with several major players. These major players, including Rockwell Automation Inc., Atmel Corporation, STMicroelectronics NV, SICK AG, and many others, are focusing on expanding their customer base in foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. Companies in the market are also acquiring start-ups working on optical sensor market technologies to strengthen their product capabilities.

- June 2022 - Metalenz, the first company to commercialize meta-optics, and STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications, announced that ST's recently released VL53L8 direct Time-of-Flight (dToF) sensor would be the highly anticipated market debut of the meta-optics devices developed through their collaboration, which was announced in June 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing demand from consumer electronics

- 5.1.2 Rising adoption of IoT

- 5.2 Market Challenges

- 5.2.1 Lack of awareness of newer technology

6 MARKET SEGMENTATION

- 6.1 By Sensor Type

- 6.1.1 Fiber Optic Sensors

- 6.1.2 Image Sensors

- 6.1.3 Position Sensors

- 6.1.4 Ambient light

- 6.1.5 Proximity Sensors

- 6.1.6 Infrared Sensors

- 6.2 By Application

- 6.2.1 Industrial

- 6.2.2 Medical

- 6.2.3 Biometric

- 6.2.4 Automotive

- 6.2.5 Consumer Electronics

- 6.2.6 Other Applications

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 South Korea

- 6.3.4 Japan

- 6.3.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Atmel Corporation

- 7.1.4 Robert Bosch GmbH

- 7.1.5 STMicroelectronics NV

- 7.1.6 Shinkoh Electronics Co. Ltd.

- 7.1.7 OZ Optics Ltd.

- 7.1.8 SICK AG

- 7.1.9 Keyence Corporation

- 7.1.10 Neubrex Co. Ltd.