|

市場調查報告書

商品編碼

1626906

北美平板玻璃:市場佔有率分析、產業趨勢、成長預測(2025-2030)North America Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

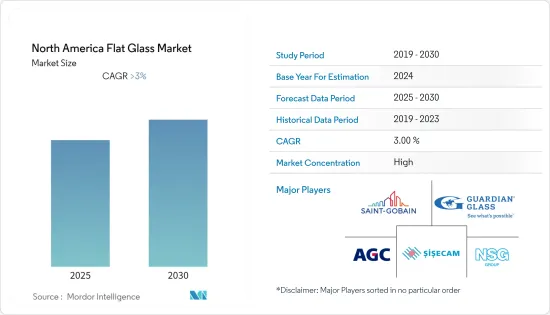

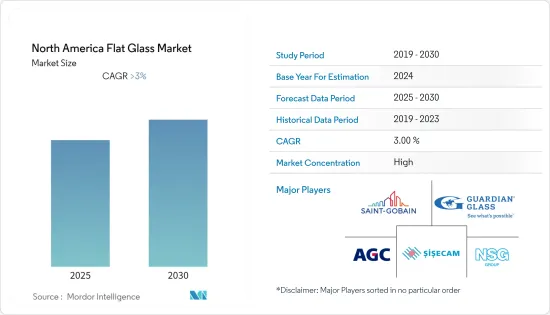

預計北美平板玻璃市場在預測期內複合年成長率將超過 3%。

由於全國範圍內的封鎖和投資減少等多種因素,COVID-19大流行對2020年和2021年北美平板玻璃市場的成長產生了重大影響。然而,在 COVID-19 大流行之後,旅行禁令的放鬆、交通活動的增加以及 2021 年大規模疫苗接種計劃正在支持汽車行業並促進汽車銷售。因此,該地區的平板玻璃需求是由汽車行業的成長所推動的。

主要亮點

- 對電子顯示器的需求不斷成長以及建築行業不斷成長的需求正在推動市場的發展。

- 另一方面,原物料價格的波動阻礙了市場的成長。

- 在不久的將來,市場成長可能會受益於汽車產業的進步。

- 預計美國將佔據北美平板玻璃市場的最大佔有率。

北美平板玻璃市場趨勢

建築業帶動平板玻璃需求

- 建築業是所研究市場中最大的最終用戶部分。此外,加拿大和墨西哥正在進行的智慧城市計劃趨勢預計也將推動平板玻璃的需求。

- 過去十年,加拿大建築業經歷了強勁成長。例如,2021 年 11 月加拿大的建築許可總額躍升 14.1%,達到 110 億美元。

- 此外,加拿大不斷增加的醫療保健投資正在推動所研究市場的成長。 QEII新一代計劃是最大的醫療計劃之一。根據該計劃,醫療保健和健康部等將為公民提供專門的醫療服務。計劃包括亨茨社區醫院、達特茅斯綜合醫院、QEII 癌症中心和哈利法克斯臨終關懷醫院。最近,埃利斯登基礎設施醫療保健 (EDIH) 在加拿大哈利法克斯建立了拜耳湖社區門診中心。該工程將耗資 1.973 億美元,預計將於 2023 年投入運作。

- 玻璃廣泛應用於建築業,以及其他建築構件,例如窗戶、建築幕牆、門、室內隔間、扶手、店面以及樓梯和陽台的欄桿,這使其成為平板玻璃的潛在商機。

- 2021年,墨西哥建築業將從COVID-19造成的急劇下滑中恢復過來,並將錄得32.5%的成長。因此,預計該國建築業投資的增加將創造該國平板玻璃的需求。

- 目前,平板玻璃還可以透過加熱過程使其幾乎熔化,然後用冷空氣將其冷卻至常溫來強化。這種玻璃需要更大的壓力才能破裂。這一特性使這種玻璃適合建築應用。

- 由於這些因素,平板玻璃市場預計在未來幾年將成長。

美國主導市場

- 由於強勁的經濟、有利的商業房地產市場以及聯邦和州對公共工程和設施建設的資助,美國建築業持續成長。

- 美國建築業是北美最大的。例如,2021年新建設金額近1.6兆美元,較2020年成長8.25%。此外,近年來建築支出一直在穩步成長。因此,該國平板玻璃市場的需求呈上升趨勢。

- 根據美國人口普查局的數據,2002年至2021年美國公共住宅支出大幅增加。 2021年,公共部門在住宅建設計劃上的支出超過90億美元,較2020年略有下降。此外,美國新住宅的總金額預計在未來幾年將會增加。

- 在美國,由於晶片和半導體持續供不應求,過去七年該國乘用車產量一直在下降。其他導致汽車製造業下滑的原因包括技術創新放緩、原物料成本上升以及供應鏈管理問題。例如,2021年乘用車產量約1,563,060輛,較2020年下降19%,較2019年下降38%。這也可能對該國的平板玻璃市場產生影響。

- 然而,隨著物流和電商產業的發展,輕型商用車的需求也會增加。此外,快速的都市化正在創建需要高效物流的新零售和電子商務平台,從而導致輕型商用車的成長。例如,儘管2020年美國輕型商用車產量下降16.8%,但2021年達到7,315,903輛,較2020年恢復10%。因此,該國的平板玻璃市場正看到輕型商用車領域的需求上升。

- 由於該國建築業的蓬勃發展,還有即將推出的計劃。

- 因此,預計未來幾年該地區對平板玻璃的需求將會增加。

北美平板玻璃產業概況

北美平板玻璃市場正在整合。主要企業包括(排名不分先後)Saint-Gobain、AGC Inc.、Guardian Glass LLC、Nippon Sheet Glass 和 Sisecam Group。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 電子顯示器的需求不斷成長

- 建築業需求增加

- 抑制因素

- 原物料價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 產品類型

- 退火玻璃(包括有色玻璃)

- 鍍膜玻璃

- 反光玻璃

- 加工玻璃

- 鏡子

- 最終用戶產業

- 建造

- 車

- 太陽的

- 其他

- 地區

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- AGC Inc.

- CPS

- BY CARDINAL GLASS INDUSTRIES, INC

- China Glass Holdings Limited

- Fuyao Glass Industry Group Co., Ltd

- Guardian Industries Holdings

- Nippon Sheet Glass Co. Ltd

- Saint-Gobain

- SCHOTT

- Sisecam

- Vitro

第7章 市場機會及未來趨勢

- 汽車工業的進步

The North America Flat Glass Market is expected to register a CAGR of greater than 3% during the forecast period.

The COVID-19 pandemic significantly impacted the North American flat glass market's growth in 2020 and 2021 due to several factors, such as nationwide lockdowns and a decline in investments. However, the post-COVID-19 pandemic, ease in the travel ban, rise in transportation activities, and mass vaccination program in 2021 have aided the automotive industry, fueling automobile sales. So, the demand for flat glass in the region is being fueled by the growth of the auto industry.

Key Highlights

- Growing demand for electronic displays and increasing demand from the construction industry are driving the market.

- On the flip side, fluctuating raw material prices are hindering the growth of the market.

- In the near future, the growth of the market is likely to benefit from the progress in the automotive industry.

- The United States is expected to account for the largest share of the North American flat glass market.

North America Flat Glass Market Trends

Construction Industry to Drive the Demand for Flat Glass

- The construction industry is the largest end-user segment of the market studied. Moreover, the ongoing trend of smart city projects in Canada and Mexico is also anticipated to drive flat glass demand.

- Over the past decade, the construction industry in Canada has experienced high growth. For instance, in 2021, the total value of building permits in Canada jumped 14.1% in November to USD 11.0 billion.

- Moreover, the growing healthcare investments in Canada have been driving the growth of the market studied. The QEII New Generation Project is one of the largest healthcare projects. Under this, the Department of Healthcare and Wellness, along with others, is planning to provide specialized healthcare services to the citizens. The projects include Hants Community Hospital, Dartmouth General Hospital, QEII Cancer Center, Hospice Halifax, and others. The recent one includes the construction of Bayer's Lake Community Outpatient Center in Halifax, Canada, by Ellisdon Infrastructure Healthcare (EDIH). The construction is expected to cost USD 197.3 million and be operational by 2023.

- Glasses are being used extensively in the construction industry in windows, facades, doors, interior partitions, balustrades, shop fronts, and railings for stairs and balconies, among other building parts, providing a potential opportunity for flat glasses.

- In 2021, the construction industry in Mexico recovered from a sharp decline due to COVID-19, recording a growth of 32.5% in 2021. Therefore, the increase in investments in the construction industry in the country is estimated to create demand for flat glass in the country.

- Flat glass was previously used for smaller windows in domestic housing because larger windows required toughened glass.Currently, flat glass can also be toughened by putting it through a heating process, which very nearly melts it, and then cooling it to ambient temperatures using a jet of cold air. This glass requires greater pressure to break. This characteristic makes the glass suitable for use in building applications.

- Due to all of these things, the market for flat glass is expected to grow over the next few years.

United States to Dominate the Market

- The US construction industry kept growing thanks to a strong economy, good market fundamentals for commercial real estate, and more money from the federal government and states for public works and institutional buildings.

- The construction industry in the United States is the largest in North America. For instance, the new construction put in place in the United States in 2021 was valued at almost USD 1.6 trillion, which shows an increase of 8.25 percent compared with 2020. Moreover, construction spending has been growing steadily over the last couple of years. Therefore, this has created upside demand for the flat glass market in the country.

- According to the U.S. Census Bureau, the value of public residential construction spending in the United States has significantly risen from 2002 to 2021. In 2021, the public sector spent over $9 billion on residential construction projects, which was a slight decrease in comparison to 2020. Moreover, the overall value of new residential construction put in place in the U.S. is expected to increase over the coming years.

- In the United States, due to the ongoing chip and semiconductor shortages, the production of passenger cars in the country has been declining for the past 7 years. Other reasons that have significantly contributed to the decline of automotive manufacturing are a slowdown in innovation, an increase in the cost of raw materials, and supply chain management issues. For instance, in 2021, approximately 1,563,060 units of passenger cars were produced, which shows a decline of 19% from 2020 and a decline of 38% when compared to 2019. Therefore, this is likely to affect the flat glass market in the country.

- However, as the logistics and e-commerce industries grow, so does the demand for LCVs. Furthermore, rapid urbanization has created new retail and e-commerce platforms, which require efficient logistics, leading to the growth of light commercial vehicles. For instance, even though in 2020, light commercial vehicle production in the United States declined by 16.8%, it reached 73,15,903 units in 2021, which shows a recovery of 10% compared to 2020. Therefore, this has created upside demand for the flat-glass market in the country from the light commercial vehicle segment.

- Some of the upcoming projects that are in the pipeline for the construction sector to boom in the country are:

- Due to all of these things, it is expected that the demand for flat glass in the region will rise over the next few years.

North America Flat Glass Industry Overview

The North American flat glass market is consolidated in nature. The major companies include (in no particular order) Saint-Gobain, AGC Inc., Guardian Glass LLC, Nippon Sheet Glass Co. Ltd., and Sisecam Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Electronic Displays

- 4.1.2 Increasing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Annealed Glass (Including Tinted Glass)

- 5.1.2 Coater Glass

- 5.1.3 Reflective Glass

- 5.1.4 Processed Glass

- 5.1.5 Mirrors

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Automotive

- 5.2.3 Solar

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 CPS

- 6.4.3 BY CARDINAL GLASS INDUSTRIES, INC

- 6.4.4 China Glass Holdings Limited

- 6.4.5 Fuyao Glass Industry Group Co., Ltd

- 6.4.6 Guardian Industries Holdings

- 6.4.7 Nippon Sheet Glass Co. Ltd

- 6.4.8 Saint-Gobain

- 6.4.9 SCHOTT

- 6.4.10 Sisecam

- 6.4.11 Vitro

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in the Automotive Industry