|

市場調查報告書

商品編碼

1640657

中東和非洲平板玻璃:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Middle-East and Africa Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

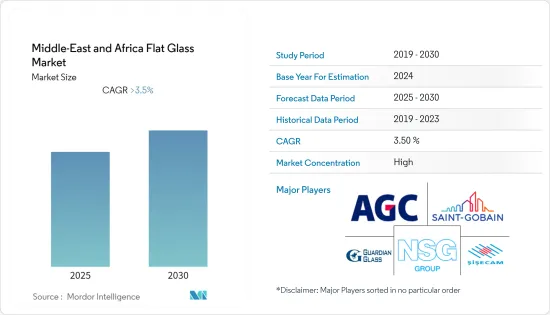

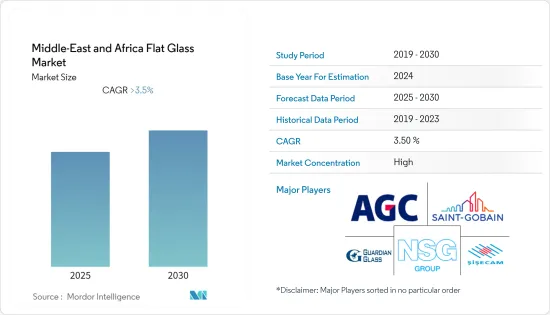

預測期內,中東和非洲的平板玻璃市場預計將以超過 3.5% 的複合年成長率成長。

由於供應鏈中斷,COVID-19 對 2020 年的市場產生了負面影響。疫情期間,許多生產平板玻璃產業原料的工廠停工。然而,由於汽車、建築等各個終端用戶產業的消費增加,市場在 2021-22 年有所復甦。過去兩年來,住宅銷售額的上升以及對新辦公室和零售空間的需求的增加推動了市場的成長。

關鍵亮點

- 短期內,電子顯示器需求的增加和建築業對平板玻璃的需求的上升是推動研究市場成長的關鍵因素。

- 相反,原物料價格的波動可能會阻礙市場成長。

- 汽車產業的進步和太陽能產業的不斷舉措可能會在未來幾年為市場創造機會。

- 預測期內,沙烏地阿拉伯是該地區成長最快的建築市場。

中東和非洲平板玻璃市場趨勢

在建築業的應用日益廣泛

- 平板玻璃因其多種功能而被廣泛應用於建築業,包括隔熱、隔音、安全應用和防曬。它被廣泛用作窗戶、建築幕牆、門、隔間、欄桿、店面、樓梯和陽台欄桿的建築材料。預計這些多樣化的應用將在預測期內推動平板玻璃市場的發展。

- 在建築應用中,平板玻璃主要用於功能性和美觀性的玻璃裝配,使顧客可以看到外面,同時也能保護他們免受有害紫外線的傷害。此外,平板玻璃需要很大的壓力才能破碎。

- 由於對住宅和非住宅計劃的大規模投資,沙烏地阿拉伯建築市場預計將見證顯著的成長和豐厚的潛力。許多工業基地、學校、醫院、房地產、清潔能源基礎設施、智慧城市、旅遊業等正在建設中。

- 根據海灣委員會公司報告,沙烏地阿拉伯計畫藉由私部門的力量,在醫療保健基礎設施方面投資2,500億沙烏地里亞爾(約664.7億美元),到2030年私部門的參與度將達到400億沙烏地裡亞爾。

- 據阿拉伯聯合大公國能源和基礎設施部稱,到 2023 年,美國將向近 130 個國家資助的發展計劃投資 118 億迪拉姆(32 億美元)。該部將實施 17 個用作醫療設施的計劃,並為阿拉伯聯合大公國內政部實施另外 26 個計劃。此外,還計劃興建 12 個教育設施基礎設施和 15 座供公眾使用的政府大樓。

- 根據世界銀行和經合組織的報告,在南非,2021年建設業佔全國GDP總量的24.5%(2020年為23.4%)。

- 據公共工程和基礎設施部稱,南非政府宣布,計劃在 2021 年至 2024 年期間投資 7,912 億蘭特(約 486.5 億美元)用於公共部門基礎設施支出。

- 卡達2030個國家願景和2022年國際足總世界盃是卡達建築業發展的主要推動力。卡達的願景體現在各個領域正在進行的大型開發計劃,包括建築、酒店、旅遊、交通和基礎設施。

- 此外,亞洲供應商對非洲市場的投資不斷增加以及該地區智慧城市計畫的穩定成長,預計將在預測期內推動中東和非洲建築業對平板玻璃的需求。

沙烏地阿拉伯主導市場

- 沙烏地阿拉伯是該地區成長最快的建築市場。大量在建和即將動工的建設計劃預計將增加該國對平板玻璃的需求。

- 沙烏地阿拉伯中央統計和資訊局報告稱,預計該國 2022 年第一季出口額將達到293.67 億沙烏地里亞爾(約78.0822 億美元),而2020 年為292.52 億沙烏地里亞爾(約77.7764億建設業)。

- 沙烏地阿拉伯政府最近宣布了“2030願景”,旨在注重永續性、改善公民生活品質並為國家建立繁榮的經濟。

- 「2030願景」議程已啟動價值1兆美元的重要基礎設施和房地產計劃。沙烏地阿拉伯擁有價值 1.1 兆美元的計劃儲備,正在尋求擴大其項目組合,包括旅遊目的地 Neom Supercity、334 平方公里的娛樂城市 Qiddiya、聯合國教科文組織世界遺產 AlUla 的開發,以及紅海計劃專注於奢華和永續計劃。

- 此外,沙烏地阿拉伯的其他主要建設計劃包括新塔伊夫計劃、德拉伊耶門計劃、吉達利雅德地鐵、Al Widyan、王國塔、吉達、阿卜杜拉國王經濟城拉比格和傑巴爾奧馬爾。國家轉型計劃(NTP)的宣布帶動了醫療保健和教育等各個領域的投資增加,以支持該國的經濟成長。

- 該國經濟目前正在進入後石油時代,正在建設中的特大城市預計將推動未來市場的成長。據該行業協會稱,目前沙烏地阿拉伯正在實施的建設計劃超過 5,200 個,總價值 8,190 億美元。這些計劃約佔波灣合作理事會(GCC)正在進行的計劃總數的 35%。

- 沙烏地阿拉伯致力於將自己打造為中東新的汽車中心。沙烏地阿拉伯是汽車和汽車零件的進口大國,目前正尋求吸引目標商標產品製造商( OEM )在該國建立生產工廠,以發展國內汽車工業。 2021年,該國汽車銷量成長4%,至556,559輛。

- 該國正計劃建立一個汽車城,為汽車行業的投資者提供福利並節省成本。此外,還計劃在利雅德建立一家輕型汽車製造廠。此外,該公司也正在與豐田和其他主要製造商商談在該國建立製造廠的事宜。如果成功的話,這些發展可能會在預測期內推動市場發展。

- 沙烏地阿拉伯可再生能源發電發展局計畫在2023年將太陽能發電能力提高到20吉瓦,到2030年提高到40吉瓦。

中東及非洲平板玻璃產業概況

中東和非洲的平板玻璃市場本質上呈現整合狀態。該市場的主要企業包括(不分先後順序)AGC Inc.、Saint-Gobain、GUARDIAN GLASS LLC、Nippon Sheet Glass 和 Sisecam Group。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電子顯示器需求不斷成長

- 建築業需求增加

- 限制因素

- 原物料價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(銷售額))

- 產品類型

- 退火玻璃

- 鍍膜玻璃

- 反光玻璃

- 加工玻璃

- 鏡子

- 最終用戶產業

- 建築和施工

- 車

- 太陽的

- 其他

- 地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AGC Inc.

- Asahi India Glass Limited

- Fuyao Glass Industry Group Co. Ltd

- GUARDIAN GLASS LLC

- Nippon Sheet Glass Co. Ltd

- Phoenicia

- Saint-Gobain

- SCHOTT AG

- Sisecam Group

- Vitro

第7章 市場機會與未來趨勢

- 汽車工業的進步

- 太陽能產業不斷成長的舉措

The Middle-East and Africa Flat Glass Market is expected to register a CAGR of greater than 3.5% during the forecast period.

COVID-19 negatively impacted the market in 2020 due to a disruption in the supply chain. During the pandemic, many factories responsible for raw material production for the flat glass industry were shut down. However, the market recovered in the 2021-22 period, owing to rising consumption from various end-user industries such as automotive, construction, and others. Over the past two years, rising home sales and increasing demand for new offices and retail spaces have driven the market's growth.

Key Highlights

- Over the short term, the growing demand for electronic displays and the increasing need for flat glass in the construction industry will be the major factors driving the growth of the studied market.

- Conversely, fluctuating raw material prices may hinder the market's growth.

- Advancements in the automotive industry and rising initiatives in the solar industry are likely to create opportunities for the market in the coming years.

- Saudi Arabia remains the fastest-growing construction market in the region during the forecast period.

Middle East and Africa Flat Glass Market Trends

Increasing Usage in the Construction Industry

- Flat glass is used significantly in the construction industry owing to its wide range of functions, from heat insulation to soundproofing and from safety applications to solar protection. It is extensively used in windows, facades, doors, interior partitions, balustrades, shop fronts, and railings for stairs and balconies, among other building parts. These multiple uses will boost the flat glass market during the forecasted period.

- In building and construction applications, flat glass is majorly used in windows for both functional and aesthetic purposes, which allows clear sight for customers looking out of the window, and at the same time, protects them from harmful UV radiations. Also, flat glasses require greater pressure to break.

- The Saudi Arabian construction market is expected to witness significant growth and lucrative potential due to massive investments in residential and non-residential projects. Construction is underway on many industrial hubs, schools, hospitals, real estate, clean energy infrastructure, smart cities, and tourism.

- As per the Gulf Council Corporation report, Saudi Arabia has planned an investment of SAR 250 billion (~USD 66.47 billion) in healthcare infrastructure with support from the private sector, whose involvement is expected to increase from 40% to 65% by 2030.

- According to the Ministry of Energy and Infrastructure, the United Arab Emirates is investing AED 11.8 billion (USD 3.2 billion) in nearly 130 state-funded development projects by 2023. The ministry will implement 17 projects to be used as health facilities and a further 26 for the UAE's Ministry of Interior. The plans also include 12 infrastructure developments for educational facilities while there are plans to develop 15 government buildings that are accessible to the public.

- According to the report of World Bank and OECD, In South Africa, the construction industry contributed 24.5% in the overall GDP of the country in 2021, as compared to 23.4% in 2020.

- According to Public Works and Infrastructure, the South African government announced its plan to invest ZAR 791.2 billion (~USD 48.65 billion) in public-sector infrastructure spending from 2021 to 2024.

- The Qatar National Vision 2030 and the FIFA World Cup 2022 are major growth drivers for Qatar's construction industry. The ongoing implementation of major development projects across various sectors, including building, hospitality, tourism, transportation, infrastructure, etc., explains Qatar's vision.

- Moreover, the increasing investments of Asian vendors in the African market and a steady growth in the number of smart city initiatives in the region are expected to increase the demand for flat glass in the Middle East and African construction sector during the forecasted period.

Saudi Arabia to Dominate the Market

- Saudi Arabia remains the fastest-growing construction market in the region. Many ongoing and upcoming construction projects are expected to contribute to the demand for flat glass in the country.

- As per the report of the Central Department of Statistics and Information of Saudi Arabia, SAR 29,367 (~USD 7,808.22 million) million was added as the construction industry's value added to the total GDP of the country in Q1 2022, as compared to SAR 29,252 (~USD 7,777.64 million) million in 2020.

- The Saudi Arabian government recently announced its Vision 2030, which aims to focus on sustainability commitments, improving the quality of life for citizens, and building a thriving economy in the country.

- The Vision 2030 agenda has unleashed essential infrastructure and real estate projects worth USD 1 trillion. With its USD 1.1 trillion project pipeline, the country is looking for qualified builders to shape its most ambitious projects, such as the tourist destination of the Neom super-city, the 334 square kilometer entertainment city of Qiddiya, the development of the UNESCO World Heritage site of Al-Ula, and the luxury and sustainable tourism focused Red Sea Project.

- Furthermore, other major construction projects in Saudi Arabia are the New Taif Project, Diriyah Gate Project, Jeddah and Riyadh Metro, Al Widyan, The Kingdom Tower, Jeddah, King Abdullah Economics City of Rabigh, Jabal Omar, etc. The announcement of the National Transformation Plan (NTP) increased investments in various sectors, such as healthcare and education, to support the country's economic growth.

- Currently, the country's economy is entering the post-oil era in which the kingdom's mega-cities, which are under construction, will provide prospective growth to the studied market. According to the Industry Association, more than 5,200 construction projects are currently ongoing in Saudi Arabia at a value of USD 819 billion. These projects account for approximately 35% of the total value of active projects across the Gulf Cooperation Council (GCC).

- Saudi Arabia is focusing on establishing itself as the new automotive hub in the Middle East. Though the country is a large importer of vehicles and auto parts, it is now trying to attract original equipment manufacturers (OEMs) to open their production plants in the country to develop the domestic auto industry. In 2021, the automotive sales in the country increased by 4%, with the sale of 5,56,559.

- The country is planning to establish an auto city to provide advantages and cost savings for investors in the sector. It is planning to establish a lightweight vehicle manufacturing plant in Riyadh. Moreover, there are negotiations going on with Toyota and other major manufacturers to establish manufacturing plants in the country. All such developments, if successful, may drive the market during the forecast period.

- The Renewable Energy Project Development Office of Saudi Arabia is planning to increase its solar power generation capacity to 20GW by 2023 and 40GW by 2030.

Middle East and Africa Flat Glass Industry Overview

The Middle-East and Africa flat glass market is consolidated in nature. Some of the key players in the market include AGC Inc., Saint-Gobain, GUARDIAN GLASS LLC, Nippon Sheet Glass Co. Ltd, and Sisecam Group (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Electronic Displays

- 4.1.2 Increasing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Product Type

- 5.1.1 Annealed Glass

- 5.1.2 Coater Glass

- 5.1.3 Reflective Glass

- 5.1.4 Processsed Glass

- 5.1.5 Mirrors

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Egypt

- 5.3.4 Nigeria

- 5.3.5 South Africa

- 5.3.6 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 Asahi India Glass Limited

- 6.4.3 Fuyao Glass Industry Group Co. Ltd

- 6.4.4 GUARDIAN GLASS LLC

- 6.4.5 Nippon Sheet Glass Co. Ltd

- 6.4.6 Phoenicia

- 6.4.7 Saint-Gobain

- 6.4.8 SCHOTT AG

- 6.4.9 Sisecam Group

- 6.4.10 Vitro

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in the Automotive Industry

- 7.2 Rising Initiatives in Solar Industry