|

市場調查報告書

商品編碼

1640516

歐洲平板玻璃:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Europe Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

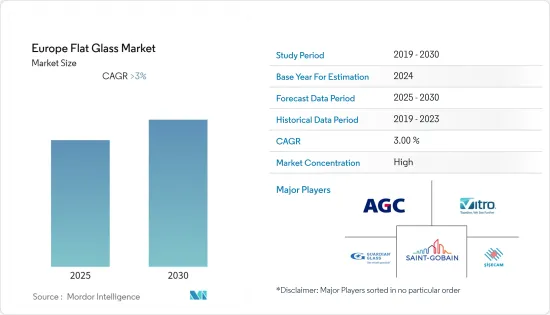

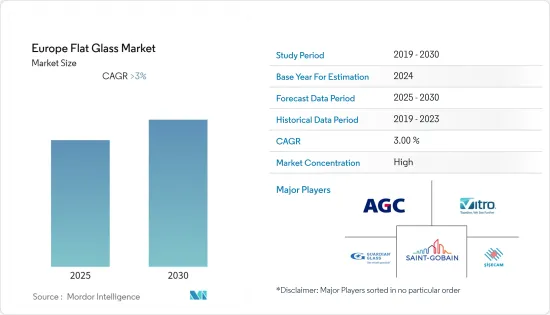

預計預測期內歐洲平板玻璃市場的複合年成長率將超過 3%。

預計 COVID-19 疫情的影響將在未來幾年阻礙市場成長。隨著世界繼續與新病毒株作鬥爭,國際貨幣基金組織修改了其成長預測。展望未來,預計與建設活動相關的嚴重中斷將對市場造成限制。

主要亮點

- 短期內,該地區建設活動的活性化將推動市場成長。

- 然而,預測期內原料和能源價格的波動預計將抑制所研究市場的成長。

- 然而,東南歐清潔能源計畫的增加以及聚合物粉末在工業中的使用可能會在不久的將來為全球市場創造有利的成長機會。

- 預計預測期內德國將佔據市場主導地位並以最快的複合年成長率成長。

歐洲平板玻璃市場趨勢

建築業可望推動平板玻璃需求

- 建築業是所研究市場中最大的終端用戶領域。此外,正在進行的智慧城市計劃預計也將推動平板玻璃的需求。

- 玻璃廣泛用於建設產業,用於窗戶、建築幕牆、門、隔間、欄桿、店面、樓梯和陽台欄桿等建築部件,為浮法玻璃提供了潛在的商機。

- 本體著色浮法玻璃是在熔融狀態下添加著色劑來獲得著色力和吸收太陽輻射性能的新型玻璃。這種玻璃可以節省能源,減少建築物的熱量侵入,並提供令人印象深刻的視覺效果。

- 以前,平板玻璃僅用於住宅的小窗戶,因為較大的窗戶需要強化玻璃。如今,強化玻璃,透過加熱過程使玻璃接近熔化,然後用冷風吹冷至環境溫度。玻璃需要更大的壓力才會破碎,這種特性使其適合用於建築應用。

- 在法國,政府已開始為 2024 年奧運做好國家籌辦工作的第一步。例如,法國政府已批准總計約 33 億美元用於建造冬宮塔(兩座塔高 320 公尺 - 1,050 英尺),預計於 2024 年竣工。舉辦奧運的基本基礎設施將包括為當地居民建造4500套新住宅、為商業建設建造10萬平方公尺的新建築以及為遊客建造2萬間酒店客房。

- 據歐洲玻璃聯盟稱,近年來,歐盟(歐盟28國)的玻璃產量一直穩定成長。 2021年,平板玻璃是歐盟第二大玻璃產業,當年產量為1,170萬噸。

- 根據英國國家統計局的數據,2021 年私人產業建設的總訂單為 9,677 單位,高於 2020 年的 4,810 單位。

- 根據英國國家統計局的數據,2021年新增工業建築訂單最多的地區是東米德蘭,其次是約克郡和亨伯。 2021 年,東米德蘭有 1,614 份訂單,而約克郡和亨伯地區有 1,191 份訂單。威爾斯共獲得 161 個新訂單,蘇格蘭共獲得 567 個建築訂單。

德國可望主導市場

- 建設業在平板玻璃需求中佔有最大的市場佔有率。德國擁有歐洲最大的建築業。該國的建築業正在以中等速度成長,主要原因是住宅建設增加。越來越多的移民前往德國,刺激了住宅的需求。

- 預計未來幾年該國的非住宅和商業建築將顯著成長。這一成長的動力來自於利率下降、實際可支配收入上升以及歐盟和德國政府的大量投資。

- 根據德國聯邦統計局(Statistisches Bundesamt)的數據,2021年德國發放的住宅和非住宅建築許可證數量分別為12.9萬張和2.9萬張。

- 根據德國聯邦統計局的數據,2021年工業平板玻璃製造銷售額為13.6346億美元。

- 根據德國聯邦統計局(Destatis)的數據,2021 年政府總合發放了 380,736 套住宅建築許可,2020 年發放了 368,589 套房屋建築許可。

- 總體而言,預計預測期內德國住宅和商業建設活動的增加將以中等速度推動德國平板玻璃市場的發展。

歐洲平板玻璃產業概況

歐洲平板玻璃市場本質上呈現整合狀態。主要參與者包括 AGC Inc.、Saint-Gobain、Vitro、Guardian Glass 和 Sisecam(不分先後順序)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 該地區建設活動增加

- 其他促進因素

- 限制因素

- 原物料和能源價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依產品類型

- 退火玻璃(包括彩色玻璃)

- 鍍膜玻璃

- 反光玻璃

- 加工玻璃

- 鏡子

- 按最終用戶產業

- 建築和施工

- 車

- 太陽能玻璃

- 其他最終用戶產業

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AGC Inc.

- Guardian Glass

- Nippon Sheet Glass Co., Ltd

- OGIS GmbH

- Saint-Gobain

- Sisecam

- Vitro

第7章 市場機會與未來趨勢

- 東南歐清潔能源措施不斷湧現

- 聚合物粉末在工業上的應用

The Europe Flat Glass Market is expected to register a CAGR of greater than 3% during the forecast period.

The impact of the COVID-19 pandemic is expected to hinder the market's growth in the coming years. As the world continued to battle new variants of the virus, the IMF revised the growth rates of various countries. Severe disruptions in the future related to construction activities are expected to act as restraints to the market.

Key Highlights

- Over the short term, increasing construction activities in the region can drive market growth.

- However, fluctuating raw materials and energy prices are expected to restrain the growth of the studied market over the forecast period.

- Nevertheless, increasing clean energy initiatives in southeastern Europe and the use of polymer powder in the industry are likely to create lucrative growth opportunities for the global market soon.

- Germany is expected to dominate the market and is also expected to witness the fastest CAGR during the forecast period.

Europe Flat Glass Market Trends

Construction Industry is Expected to Drive the Demand for Flat Glass

- The construction industry is the largest end-user segment of the market studied. Moreover, the ongoing trend of smart city projects is also anticipated to drive the flat glass demand.

- Glass is used extensively in the construction industry in windows, facades, doors, interior partitions, balustrades, shop fronts, and railings for stairs and balconies, among other building parts, providing potential opportunities to float glass.

- The body-tinted float glass is a new type of glass in which melted colorants are added for coloring and solar-radiation absorption properties. This type of glass saves energy, reduces heat penetration into buildings, and provides a striking visual effect.

- Previously, flat glass was used for smaller windows in domestic housing since larger windows required toughened glass. Currently, flat glass can also be toughened by going through a heating process, which nearly melts it and then cools it to ambient temperatures using a jet of cold air. The glass requires a greater pressure to break, and this characteristic makes the glass suitable for use in building applications.

- In France, the government has started to take the initial steps toward the development of hosting the 2024 Olympics. For instance, the French government has sanctioned a total of approximately USD 3.3 billion for the construction of the Hermitage towers (two 320-meter-1050-foot towers), which are due to be completed by 2024. The essential infrastructure for the Olympic event requires building 4,500 new dwellings for local people, 100,000 square meters for business activities, and 20,000 new hotel rooms for tourists.

- According to the Glass Alliance Europe, the European Union's (EU-28) production of glass has been steadily increasing over the past years. In 2021, flat glass was the second-largest EU glass segment, at 11.7 million metric tons produced that year.

- According to the Office for National Statistics (UK), in 2021, total private industrial construction orders accounted for 9,677 units, compared to 4,810 units in 2020.

- As per Office for National Statistics (UK), East Midlands was the region with the most new industrial construction orders in 2021, followed by Yorkshire and the Humber in Great Britain. In 2021, there were 1,614 orders in the East Midlands, while orders for Yorkshire and the Humber amounted to 1,191 orders. In Wales, there were 161 new orders and Scotland received 567 construction orders.

Germany is Expected to Dominate the Market

- The construction holds the country's largest market share of flat glass demand. Germany possesses the largest construction industry in Europe. The construction industry in the country has been growing at a slow pace, which is majorly driven by the increasing number of new residential construction activities. The increasing migration to the country has stimulated the demand for new residential construction.

- The non-residential and commercial buildings in the country are expected to witness significant growth in the coming years. The growth is supported by lower interest rates, an increase in real disposable incomes, and numerous investments by the European Union and the German government.

- According to the Statistisches Bundesamt, the number of building permits for residential and non-residential buildings in Germany in 2021 accounted for 129,000 and 29,000 buildings, respectively.

- As per the Statistisches Bundesamt, the revenue for the manufacturing of industrial flat glass in 2021 was valued at USD 1,363.46 million.

- According to the Statistisches Bundesamt (Destatis), in 2021, the government granted permits for a total of 380,736 dwellings, and 368,589 dwellings in 2020.

- On the whole, growing residential and commercial construction activities in the country are expected to drive the market for flat glass at a moderate rate in Germany during the forecast period.

Europe Flat Glass Industry Overview

The Europe flat glass market is consolidated in nature. The major players include AGC Inc., Saint-Gobain, Vitro, Guardian Glass, and Sisecam, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in the Region

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Materials and Energy Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Annealed Glass (Including Tinted Glass)

- 5.1.2 Coater Glass

- 5.1.3 Reflective Glass

- 5.1.4 Processed Glass

- 5.1.5 Mirrors

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar Glass

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 Guardian Glass

- 6.4.3 Nippon Sheet Glass Co., Ltd

- 6.4.4 OGIS GmbH

- 6.4.5 Saint-Gobain

- 6.4.6 Sisecam

- 6.4.7 Vitro

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Clean Energy Initiatives in Southeastern Europe

- 7.2 Use of Polymer Powder in the Industry