|

市場調查報告書

商品編碼

1627113

亞太地區合約包裝:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Asia Pacific Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

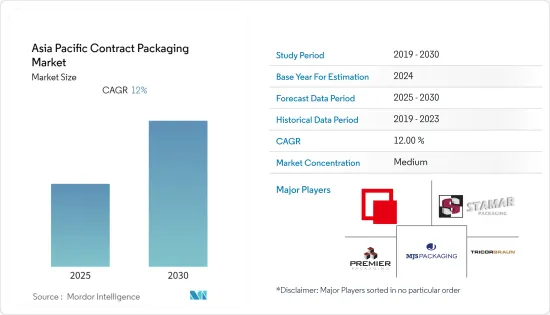

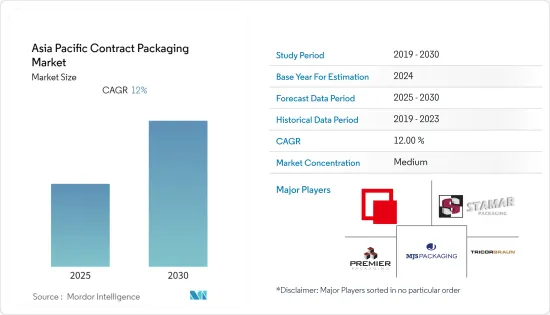

亞太合約包裝市場預計在預測期內年複合成長率為 12%

主要亮點

- 亞太合約包裝市場的成長主要受到製造公司偏好變化的影響,這些公司通常將包裝業務委託給第三方公司。這是因為製造商越來越關注成本最佳化和核心業務。

- 合約包裝有幾個優點。首先,它降低了製造商的營運成本。透過將包裝業務委託給合約包裝公司,由於機械成本和人事費用較低,營運成本可降低7%至9%。

- 市場客戶正在尋找中國聯合包裝的保稅區。保稅區包括廣東省、浙江省、上海市、福田市等沿海地區。這些保稅區擁有強大的貿易和港口網路,對中國製造的產品不徵收關稅,沒有出口許可證問題,也沒有供應商和客戶追蹤。營運保稅倉庫的主要供應商包括 GPA Global、Asiapack 和 Presence Asia Group。

- 由於藥品消費的快速增加以及各製藥業疫苗產量的增加,目前印度對合約包裝的需求正在增加。印度血清研究所 (SII) 是最大的疫苗製造商之一,生產Astra Zeneca的 Covishield 和美國競爭對手 Novavax Inc. 開發的另一種配方。為了應對第二波 COVID-19 浪潮導致的疫苗產量增加,市場供應商將有更多機會推出灌裝服務。還有俄羅斯和烏克蘭之間的戰爭對整個包裝生態系統的影響。

- 在全球各製藥產業的重大發展和投資的推動下,澳洲的聯合包裝服務也出現了強勁成長。例如,PCI Pharma Services (PCI) 收購了澳洲的 Pharmaceutical Packaging Professionals (PPP)。我們滿足該地區的商業性聯合包裝服務需求。

- 在當前情況下,製造商需要根據產量而定的變動成本結構。該數量可以從 100 公升少量到大量不等。然而,由於其總成本,最小訂單包裝可能會對合約包裝商造成損失,並可能導致製造商需要更多時間來外包計劃。

亞太合約包裝市場趨勢

醫藥產業將迎來顯著成長

- 聯合包裝使供應商能夠適應藥品等動態市場的獨特變化。生產線的靈活性使公司能夠避免重新包裝操作,減少營運成本,並減少成品庫存。

- 在亞太地區,隨著中藥和西藥的普及以及大量藥品的生產,中國醫藥市場呈現出巨大的機會。基於同樣的原因,中國已成為高速泡殼包裝最重要的市場。

- 儘管原料藥生產在中國很常見,但大多數 CMO 僅限於生產液體或固態劑型。預計該國領先的製藥公司對初級、二級和三級聯合包裝服務的需求將會增加,包括泡殼包裝、塑膠容器和標籤。

- 由於各製藥業藥品消費量的快速增加以及疫苗產量的增加,目前印度對合約包裝的需求正在增加。此外,該國還被稱為阿育吠陀、同類療法療法藥物和護膚的最大生產國之一。

- 印度是世界第12大藥品出口國。全球有200多個國家出口印度藥品,其中美國是主要市場。印度是全球主要學名藥供應國之一,學名藥佔全球出口量的20%。印度22會計年度和21會計年度的藥品出口總額分別為246億美元和244.4億美元。去年6月,印度醫藥品出口總額為211908萬美元。

二次包裝是推動市場的因素之一

- 對物理保護、屏障保護、二級密封、法規遵循和安全的需求不斷成長,導致二次包裝的採用增加。標準二次包裝包括瓦楞紙箱、瓦楞紙箱、紙板/塑膠板條箱、小型充氣枕、氣泡包裝、散裝填充物和標籤。

- 二次包裝包含包裝層次,因此二次包裝是消費者首先看到的,其重要性極高。因此,業內企業可以將包裝外包,讓自己的產品更具吸引力,吸引顧客。因此,在預測期內促進了市場成長。

- 在全球範圍內,二次委託對於只想專注於藥物開發的製藥公司發揮重要作用。在這種情況下,公司會以合約形式聘請包裝公司。在專注於產品研發的同時,運送產品的業務可能會委託。

- 二次性包裝通常是消費者與品牌的第一次互動,無論是在線上、商店或介於兩者之間。產品類型與典型的包裝類型相關聯,以便可以在過道中識別產品。

- 在當前的包裝市場場景中,由於電子商務和零售的興起,二次包裝外包變得越來越流行。這使我們能夠承擔大型計劃,而無需額外的勞動力或機械。

亞太合約包裝產業概況

亞太合約包裝市場需要變得更有凝聚力。區域市場的發展和當地企業在外國直接投資中所佔佔有率的增加是推動市場碎片化的主要因素。該市場營運的公司包括 Central Glass、MJS Packaging、Stamar Packaging、TricorBraun、Premier Packaging 和 Sharp Packaging Services。

- 2022 年 7 月 - 全球合約包裝和臨床供應服務提供者Sharp Corporation與在中國營運的公司 ClinsChain 合作,擴大其業務和能力。Sharp Corporation將與ClinsChain合作,幫助Sharp Corporation的製藥和生物製藥客戶進入中國市場,並幫助中國創新者擴大其全球足跡。該公司為區域和國際臨床試驗提供臨床供應服務。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 業內競爭對手之間的對抗關係

- 產業政策

第5章市場動態

- 介紹

- 促進因素

- 快速的技術進步

- 零售連鎖發展

- 抑制因素

- 內部包裝

- 機會

- 製藥業

第6章 市場細分

- 按服務

- 初級包裝

- 二次包裝

- 三級包裝

- 按行業分類

- 飲料

- 食品

- 藥品

- 居家及織物護理

- 美麗

- 其他

- 按國家/地區

- 中國

- 印度

- 日本

- 澳洲

- 其他

第7章 競爭格局

- 公司簡介

- Berkeley Contract Packaging

- Central Glass

- Unicep

- MJS Packaging

- Stamar Packaging

- TricorBraun

- Premier Packaging

- DHL

- Sharp Packaging Services

- Multipack

第8章投資分析

第9章 市場未來展望

The Asia Pacific Contract Packaging Market is expected to register a CAGR of 12% during the forecast period.

Key Highlights

- Asia-Pacific contract packaging market growth is mainly influenced by the changing manufacturing firms' preferences, who usually outsource packaging activities to third-party players. It is because manufacturers are increasingly focusing on cost optimization and their core business.

- Contract packaging provides several advantages. Firstly, it reduces the operational costs of the manufacturers. The operating costs can be reduced by 7% to 9% by outsourcing packaging activities to contract packagers due to the reduced costs of machines and lowered labor costs.

- The customers in the market look for bonded zones for co-packaging in China. Some bonded zones include coastal zones such as Guandong, Zhejiang, Shanghai, and Futian. They have robust trade and port networks, no Customs Duty for products made out of China, No Export Licensing Issues, and No Supplier-Client Tracking. Some significant vendors operating in bonded sones are GPA Global, Asiapack, and Presence Asia Group.

- India is currently witnessing an increase in demand for contract packaging due to the sudden surge in medication consumption and increased vaccine production from various pharmaceutical industries. The Serum Institute of India (SII), one of the largest vaccine producers, manufactures AstraZeneca's Covishield and another formulation developed by US rival Novavax Inc. It increases opportunities for vendors in the market to introduce filling services to cater to the increased vaccine production during the second COVID-19 wave. There is also an impact of the Russia-Ukraine war on the overall packaging ecosystem.

- Australia is also witnessing robust growth for co-packaging services, with significant developments and investments made by various pharmaceutical industries worldwide. For instance, PCI Pharma Services (PCI) acquired Australia-based Pharmaceutical Packaging Professionals (PPP), one of the leading packaging, storage, distribution, and trial manufacturing providers. It caters to the need for commercial co-packing services in the region.

- In the current scenario, manufacturers require a variable cost structure based on volume. This volume might differ from a small quantity ranging from 100 l to a large one. However, packaging a minimum order might result in a loss for contract packagers, owing to its total costs, which could lead to manufacturers needing more time to outsource their projects.

APAC Contract Packaging Market Trends

Pharmaceutical Sector is Observing Significant Growth

- Co-packaging allows vendors to adapt to variations specific to a dynamic market, like Pharmaceuticals. Production line flexibilities help companies prevent repackaging work, reduce working capital, and lower finished goods inventories.

- In the Asia-Pacific region, the Chinese Pharmaceutical market offers enormous opportunities as more and more people gain access to Traditional Chinese Medicine (TCM) and Western medicine, produced in huge volumes. For the same reason, China became the most significant market for high-speed blister packaging.

- While API manufacturing is typical in China, most of the country's CMOs are limited to manufacturing liquid or solid dosage formulations. It is expected to increase the demand for co-packaging services on primary, secondary, and tertiary levels, such as blister packaging, plastic containers, and labeling, among others, for major pharmaceutical companies in the country.

- India is currently witnessing an increase in demand for contract packaging due to the sudden surge in medication consumption and increased vaccine production from various pharmaceutical industries. In addition, the country is also known for being one of the largest producers of Ayurvedic and Homeopathic medicine and skincare.

- India is the world's No. 12 exporter of medical supplies. More than 200 nations worldwide receive Indian medications for export, with the US serving as the primary market. The country is the world's leading supplier of generic medicines, with 20% of global exports made up of generic drugs. In FY22 and FY21, Indian medication and pharmaceutical exports totaled USD 24.60 billion and USD 24.44 billion, respectively. In June last year, Indian pharmaceutical and medicine exports totaled USD 2,119.08 million.

Secondary Packaging is One of the Factor Driving the Market

- The increasing need for physical and barrier protection, secondary containment, adherence to regulations, and safety increased secondary packaging adoption. Standard secondary packaging includes cardboard cartons, cardboard boxes and cardboard/plastic crates, small inflatable air pillows, bubble wrap, loose-fill, and labels.

- As secondary packaging involves a packaging level within it, it is the secondary packaging that the consumer gets to see first, making it of prime importance. It is propelling the players in the industry to outsource the packaging that enables them to increase the product's attractiveness and henceforth attract customers. Thus, it boosts market growth over the forecast period.

- Globally, secondary contract packaging plays a vital role for pharmaceutical companies that want to focus solely on developing the drug. In such cases, the company employs packaging companies on a contract basis. It is likely to let them focus on the R&D of the product while the packaging duties of the product for transportation are outsourced.

- Secondary packs are often the first interaction with the brand consumers have, whether online, in-store, or at any point in between. Brands have associated themselves with a typical packaging type so that their products are identified on aisles.

- In the current packaging market scenario, outsourcing secondary packaging is becoming increasingly popular, owing to the rise of e-commerce and retailing. Thus, it aids manufacturers in undertaking large projects without needing extra workforce or machinery while also enabling the company to strengthen its distribution channels.

APAC Contract Packaging Industry Overview

The Asia Pacific Contract Packaging market needs to be more cohesive. Regional market development and increasing local players' shares in foreign direct investments are the major factors promoting the fragmented nature of the market. Some of the players operating in the market Central Glass, MJS Packaging, Stamar Packaging, TricorBraun, Premier Packaging, and Sharp Packaging Services are some of the players.

- July 2022 - Sharp, a global provider of contract packaging and clinical supply services, partnered with ClinsChain, a company with operations in China, to increase its presence and capabilities. To help Sharp's pharma and biopharma clients gain access to the Chinese market while also assisting Chinese innovators in expanding their global footprint, Sharp will work with ClinsChain. This company provides clinical supply services for regional and international clinical trials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industrial Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat from new entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Competitive rivalry within the industry

- 4.4 Industry Policies

5 MARKET DYNAMICS

- 5.1 Introduction

- 5.2 Drivers

- 5.2.1 Rapid Technology Advancements

- 5.2.2 Development in the Retail Chain

- 5.3 Restraints

- 5.3.1 In-house packaging

- 5.4 Opportunities

- 5.4.1 Pharmaceutical Industry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Primary Packaging

- 6.1.2 Secondary Packaging

- 6.1.3 Tertiary Packaging

- 6.2 By Vertical

- 6.2.1 Beverages

- 6.2.2 Food

- 6.2.3 Pharmaceuticals

- 6.2.4 Home and Fabric Care

- 6.2.5 Beauty Care

- 6.2.6 Others

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 Australia

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berkeley Contract Packaging

- 7.1.2 Central Glass

- 7.1.3 Unicep

- 7.1.4 MJS Packaging

- 7.1.5 Stamar Packaging

- 7.1.6 TricorBraun

- 7.1.7 Premier Packaging

- 7.1.8 DHL

- 7.1.9 Sharp Packaging Services

- 7.1.10 Multipack