|

市場調查報告書

商品編碼

1640636

中東和非洲合約包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Middle East And Africa Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

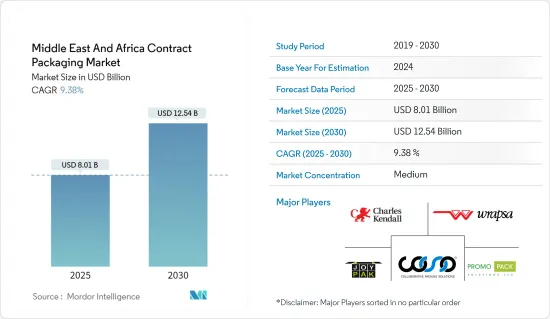

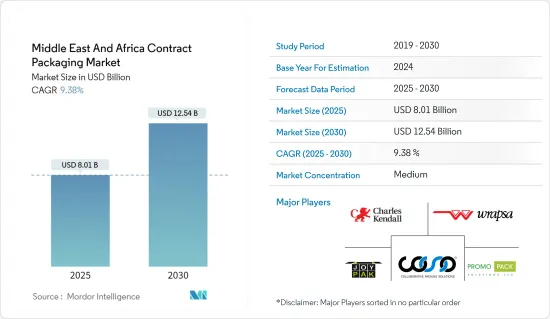

中東和非洲的合約包裝市場規模預計在 2025 年為 80.1 億美元,預計到 2030 年將達到 125.4 億美元,預測期內(2025-2030 年)的複合年成長率為 9.38%。

裝瓶和灌裝服務正在經歷良好的成長勢頭,尤其是在中東和非洲。隨著對食品、飲料和藥品的需求不斷增加,許多公司都將包裝外包以增強安全性。

中東和非洲正在成為全球電子商務市場的主要企業,具有巨大的成長潛力。該地區的許多國家及其二線城市正在積極參與這一趨勢。這種快速成長的動力源自於科技進步和網路普及率上升,使得網路購物變得更加便利。根據 mFilterIt 2023 年 12 月的報告,該地區的零售滲透率約為 11% 至 12%,超過 80% 的購物者使用行動設備,70% 使用社交媒體。為了滿足日益成長的需求,公司正在外包端到端包裝或獨立服務,以迎合喜歡網路購物的消費者。

未來幾年,注射劑預計將比口服藥物等其他給藥方式佔據更大的市場佔有率。因此,預計注射劑合約包裝的需求將會增加,大型製藥商也有望增強其區域能力。

由於食品安全、財務和業務靈活性需求等因素,許多區域品牌選擇共同包裝,而不是建立製造業務。代加工商對於該地區的許多食品和飲料公司來說都是必不可少的,以至於他們可能無法證明投資新設施的合理性,或將生產從設施轉移到生產新的、盈利較低的產品。

然而,內部包裝需求的增加預計將阻礙合約包裝市場的成長。例如,使用外部合約包裝商的公司可以將其分銷週期延長至七天,在此期間,其產品的知名度會降低。對於尋求快速有效地分銷商品的企業來說,這可能是一個障礙。

由於大多數消費者更喜歡網路購物,因此公司正在將端到端或獨立的包裝外包以滿足日益成長的需求。

中東和非洲的合約包裝市場趨勢

電子商務需求的不斷成長是市場的主要動力

- 電商包裝公司是現代科技的關鍵採用者和推動者。全球電子商務業務的興起也刺激了產業對包裝解決方案的需求,以便更好地滿足客戶需求。

- 此外,消費品包裝(CPG) 供應商的高可變性要求以及供應鏈的速度給透過電子商務提供產品的公司帶來了挑戰,因此需要靈活性、敏捷性和足智多謀。可滿足不斷升級的需求合約包裝公司對客製化電子商務包裝解決方案的要求。

- 合約包裝商和履約服務提供者規模小,數量有限,參與決策的人員很少。因此,電子商務支援的包裝創新可以更快實現。此外,與電子商務公司合作可以縮短針對此快速成長的通路最佳化包裝的途徑。

- 根據美國農業部對外農業服務局的數據,阿拉伯聯合大公國零售電子商務銷售稅前價值將達到約 62 億美元,高於前一年的 56 億美元。零售額的成長通常會導致對包裝商品的需求增加,從而鼓勵主要企業將其包裝需求外包給委託包裝公司。需求的激增可能為包裝承包商帶來更多商機,鼓勵他們擴大規模並投資新技術以滿足零售商日益成長的需求。

飲料業正在快速成長

- 隨著對基本加工基礎設施的需求不斷增加,飲料和果汁製造商開始更加關注其核心活動。製造商可以要求包裝供應商提供專門的區域來儲存原料,為委外包裝提供正確的技術專業知識和及時、經濟高效的解決方案,同時考慮到衛生加工標準。 。

- 許多新時代飲料都有多個製造地,儘管分銷範圍很廣,但銷售量有限,不足以證明工廠參與的必要性。由於對熱填充產品的需求量很大,擁有知名品牌的大型公司正在轉向合約包裝商來滿足其生產需求。

- 根據南非統計局2024年2月的資料,南非食品和非酒精飲料的消費者物價指數(CPI)為113.9點。隨著製造商尋求高效、經濟的解決方案來滿足消費者需求並保持有競爭力的價格,全國對合約包裝服務的需求正在增加。

- 契約製造製造商還提供捆綁服務,例如罐、瓶、罐和紙箱的裝瓶和填充、堆疊、促銷包裝、產品展示、客自訂組裝和手工包裝。食品、食品飲料和製藥業是初級包裝的最大採用者之一。因此,這些行業的整體產能成長預計將推動整個全部區域採用主要合約包裝服務。

- 透過利用合約包裝公司的專業知識和基礎設施,製造商可以從高效靈活的包裝解決方案中受益,同時專注於產品開發和行銷的核心業務。這一趨勢反映出人們越來越認知到合約包裝公司在動態商業環境中最佳化供應鏈營運和增強市場應對力方面所提供的價值主張。

中東和非洲合約包裝產業概況

中東和非洲的合約包裝市場正在變得半固體。區域市場的發展和本地參與者在外國直接投資中的佔有率不斷增加是推動這種分化的主要因素。

- 2023 年 9 月 - Wrapsa 是一家南非第三方藥品製造和包裝公司,提供藥品製造、包裝和內部實驗室,該公司透露了專注於進一步在地化的計劃。該公司可以適應任何藥品形式和包裝,包括錠劑、糖漿、軟膏、粉末、發泡和軟糖。

- 2023 年 1 月 - StrongPack 宣布將於 2023 年初在奈及利亞安裝一台西得樂吹塑成型機,作為其高速 PET 水生產線的一部分。 StrongPack 是奈及利亞一家非酒精飲料聯合包裝商。新的每小時 86,000 瓶高速生產線將成為非洲最快的生產線,標誌著 StrongPack 進入靜水聯合包裝市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力 - 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 科技快速進步

- 零售連鎖發展

- 市場限制

- 原物料和包裝產品成本上漲

第6章 市場細分

- 按服務類型

- 初級包裝

- 二次包裝

- 三級包裝

- 按行業

- 飲料

- 食物

- 藥品

- 居家及織物護理

- 美容護理

- 按國家

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 奈及利亞

第7章 競爭格局

- 公司簡介

- Joypak(Pty)Ltd.

- StrongPack Ltd.

- Collaborative Packing Solutions

- Charles Kendall Group

- Promo Pack Solutions LLC

- Al Bustan Co-Packing LLC

- Al Sharaf Repacking Services

- Gulf Trading and Refrigerating LLC(GULFCO)

- Wrapsa(Pty)Ltd.

- PackMan Packaging

第8章投資分析

第9章:未來市場展望

The Middle East And Africa Contract Packaging Market size is estimated at USD 8.01 billion in 2025, and is expected to reach USD 12.54 billion by 2030, at a CAGR of 9.38% during the forecast period (2025-2030).

Bottling and filling services have particularly experienced promising growth in the Middle East and Africa. Owing to the increased demand for food, beverage, and pharmaceutical needs, many businesses have outsourced their packaging for increased safety.

The Middle East and Africa have emerged as key players in the global e-commerce market, offering substantial potential for growth. Numerous countries in the region and their tier-two cities are actively participating in this trend. This surge is driven by increased accessibility to technology and higher internet penetration rates, amplifying online shopping prospects. According to a report published by mFilterIt in December 2023, retail penetration in the region stands at approximately 11% to 12%, with over 80% of buyers utilizing mobile devices and 70% leveraging social media to engage with sellers, creating opportunities for contract packaging services. To keep up with the growing demand, businesses outsource their packaging end-to-end or standalone services to consumers who prefer to shop online.

Over the upcoming years, injectables are anticipated to gain a market share that surpasses that of other administration methods, such as oral. As a result, contract packaging demand for injectable solutions is expected to rise, and significant pharmaceutical vendors are anticipated to increase their regional capabilities.

Many regional brands opt for co-packing instead of building their manufacturing operations, including food safety and the need for financial and business agility. Co-packers play an essential role for ample food and beverage companies in the region that may be unable to justify spending on new equipment or divert production from equipment to produce new and less profitable products.

However, the growing demand for in-house packaging is anticipated to hinder the market growth for contract packaging. For instance, businesses that use outside contract packagers can extend their distribution cycle by up to seven days, during which their product is less visible. Companies looking to distribute their goods quickly and effectively may find this a barrier.

With most consumers prefer online shopping channels, companies have been outsourcing their packaging end-to-end or standalone services to meet the growing demand.

Middle East And Africa Contract Packaging Market Trends

Increasing Demand in E-Commerce will Significantly Drive the Market

- E-commerce packaging companies are significant adopters and drivers of modern technology. The increasing number of global e-commerce companies is also fueling the industry's demand for packaging solutions to better cater to customers' needs.

- Additionally, with high variability requirements from Consumer-packaged goods (CPG) providers, customization along with speed in the supply chain creates a challenge for product offering companies via e-commerce, thus escalating the requirements from contract packaging companies for a customized e-commerce packaging solution, as they are built for flexibility, agility, and resourcefulness.

- Contract packers and fulfillment service providers operate on a smaller scale with limited volumes and fewer people involved in decision-making. As a result, they can implement e-commerce-ready packaging innovations more quickly. Furthermore, collaborating with e-commerce companies can shorten the path to optimized packaging for this rapidly growing channel.

- According to the USDA Foreign Agricultural Service, in 2023, the retail value, excluding sales tax of retail e-commerce in the United Arab Emirates, reached around USD 6.2 billion, up from USD 5.6 billion in the previous year. As retail sales increase, there is typically a higher demand for packaged goods, leading companies to outsource their packaging needs to contract packaging firms. This surge in demand can lead to increased opportunities for contract packaging providers, potentially prompting them to expand their operations or invest in new technologies to meet the growing needs of retailers.

Beverage Industry to Witness Significant Growth

- With the increasing demand for essential infrastructure to process, beverage, and juice manufacturers have started focusing more on core activities. Manufacturers are looking forward to packaging vendors with a dedicated area to store the raw material by providing the right technical expertise and timely and cost-effective solutions while keeping in mind hygienic processing standards, which has given rise to the demand for contract beverage packaging services in the region.

- Many new-age beverages have widespread distribution but limited volume, necessitating multiple manufacturing locations for volumes far too small to justify plant involvement. Due to the high demand for hot-fill products, large corporations with well-known brands have turned to contract packers to meet their production requirements.

- As per Statistics South Africa data in February 2024, the Consumer Price Index (CPI) in South Africa was measured at 113.9 points regarding food and non-alcoholic beverages. There is an uptick in demand for contract packaging services in the country as manufacturers seek efficient and cost-efficient solutions to meet consumer demand while maintaining competitive pricing.

- Contract manufacturers also provide bundling services such as bottling and filling, pallet displays, promotional packaging, product displays, custom assembly, manual packaging, etc., for cans, bottles, jars, cartons, etc. The food, beverage, and pharmaceutical industries are some of the biggest adopters of primary packaging. Therefore, the growth in the overall production capacity of these industries is expected to drive the adoption of primary contract packaging services across the region.

- By leveraging the expertise and infrastructure of contract packaging firms, manufacturers can focus on their core competencies, such as product development and marketing, while benefitting from efficient and flexible packaging solutions. This trend reflects a growing recognition of the value proposition offered by contract packaging companies in optimizing supply chain operations and enhancing market responsiveness in a dynamic business environment.

Middle East And Africa Contract Packaging Industry Overview

The Middle East and Africa contract packaging market is semi-consolidated. The development of regional markets and the increasing shares of local players in foreign direct investments are the major factors promoting this fragmentation.

- September 2023 - Wrapsa, a South African third-party pharmaceutical manufacturing and packaging company offering pharma manufacturing, packing, and an in-house laboratory, revealed its plan to focus on more localization. The company can cater to all medicine formats and packaging, including tablets, syrups, ointments, powders, effervescent, or gummies.

- January 2023 - StrongPack announced the installation of a blow-molder from Sidel as part of a high-speed PET water line in Nigeria in early 2023. StrongPack is one of Nigeria's co-packers of non-alcoholic beverages. The new 86,000 bottles per hour (bph) high-speed line is set to be the fastest in Africa, indicating StrongPack's entry into the still water co-packing market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industrial Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's 5 Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Technology Advancements

- 5.1.2 Development in the Retail Chain

- 5.2 Market Restraints

- 5.2.1 Increasing cost of Raw material and Packaging products

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Primary Packaging

- 6.1.2 Secondary Packaging

- 6.1.3 Tertiary Packaging

- 6.2 By End-User Vertical

- 6.2.1 Beverages

- 6.2.2 Food

- 6.2.3 Pharmaceuticals

- 6.2.4 Home and Fabric Care

- 6.2.5 Beauty Care

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 South Africa

- 6.3.4 Egypt

- 6.3.5 Nigeria

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Joypak (Pty) Ltd.

- 7.1.2 StrongPack Ltd.

- 7.1.3 Collaborative Packing Solutions

- 7.1.4 Charles Kendall Group

- 7.1.5 Promo Pack Solutions LLC

- 7.1.6 Al Bustan Co- Packing LLC

- 7.1.7 Al Sharaf Repacking Services

- 7.1.8 Gulf Trading and Refrigerating LLC (GULFCO)

- 7.1.9 Wrapsa (Pty) Ltd.

- 7.1.10 PackMan Packaging