|

市場調查報告書

商品編碼

1628776

北美合約包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

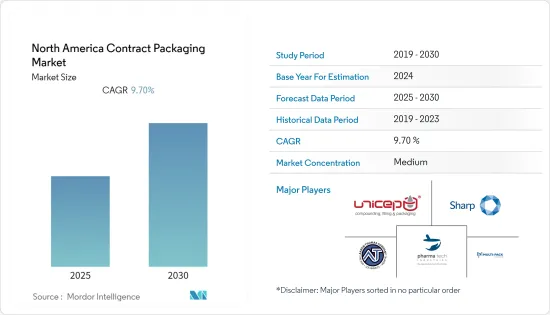

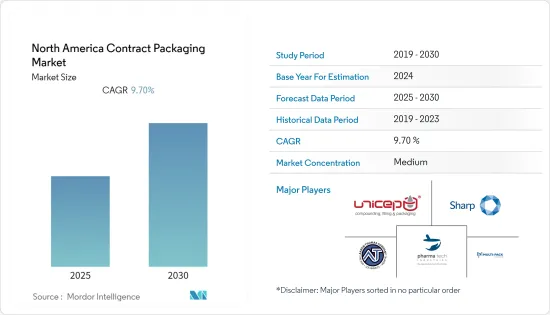

北美合約包裝市場預計在預測期內複合年成長率為 9.7%

主要亮點

- 美國政府對食品、飲料和藥品標籤和包裝實施了各種法律法規,以及需求的增加和製造商對合約包裝公司偏好的變化,這對合約包裝需求產生了積極影響。

- 乾洗手劑和消毒劑等產品的供應短缺迫使美國化妝品製造業重組其設施來生產這些必需品,雖然這提供了機會,但也可能減緩了其常規產品系列的生產。

- 此外,許多政府都對藥品和食品的標籤檢視和包裝制定了嚴格的法律法規,進一步擴大了合約包裝的範圍。例如,在美國,類似的法律意味著企業出於資金和其他原因更願意外包製造和包裝。

- 由於需要使用高品質塑膠,上述因素可能對合約包裝公司構成挑戰,最終可能導致原料和包裝價格上漲。此類法規極大地影響了某些類型包裝材料的成長,進而影響了市場的成長。然而,由於公司的創新,這種威脅現已最小化。

北美合約包裝市場趨勢

食品和飲料行業是市場成長的關鍵因素之一

- 由於食品製造公司對合約包裝商的需求不斷增加和偏好不斷變化,以及食品公司越來越注重成本最佳化和核心業務,食品製造公司許多將其包裝服務活動外包給第三方合約包裝商。

- 此外,許多政府對藥品和食品的標籤和包裝制定了嚴格的法律法規,進一步擴大了合約包裝市場的範圍。例如,在美國,食品業對合約包裝的需求正在增加。

- 這主要發生在 COVID-19 大流行期間,網路購物的需求增加,在線購買的包裝保護層增加,同時食品和飲料、藥品需求、家庭用品和個人用品的包裝需求增加。受疫情影響,該地區的快速消費品公司正在推動供應鏈加快週轉速度並提高靈活性,以適應需求的突然變化。許多公司透過合約包裝公司補充其製造能力,使他們能夠擴展和創新或專注於其核心產品。

- 合約飲料包裝可確保飲料在價值鏈中的可靠分配,並減少生產後的損壞。合約包裝旨在保護產品免受外部和環境的損害。推動合約飲料包裝市場成長的關鍵因素之一是消費者對即飲飲料的偏好日益增加以及消費模式的改變。

- 大麻產業預計將在食品和飲料、健康和保健、化妝品、護膚和外用品、寵物補充品和藥品等領域成長,證明了大麻產業合約包裝的潛力。隨著該行業的不斷發展,大麻公司正在獲得提供合約包裝服務的能力和知識。一些擁有經驗和專業知識的公司也提供標籤和其他二次包裝服務。然而,根據《大麻條例》第 244 條,獲得許可的加工商必須通知加拿大衛生署其出售先前未在加拿大銷售過的大麻產品的意圖。

初級包裝佔據很大佔有率

- 初級包裝是與產品直接接觸或被產品封裝的第一層包裝,可保護和保存產品免受外部污染、損壞和變質。

- 特別是對於需要小批量或頻繁更換的計劃,例如新產品、利基產品或通常不屬於初級生產經濟的季節性需求,合約初級包裝可用於需要小批量或頻繁更換的項目,這些項目通常是在初級生產經濟以外的。

- 食品、飲料和製藥等行業是初級包裝的最大採用者之一,因此預計這些行業整體產能的成長將推動初級合約包裝服務在全球的採用。

- 過去幾年,初級包裝產品在製藥業中佔據了重要地位,因為它們用於保護藥品免受不良外部因素的影響,例如生物污染、物理損壞、劣化和假冒。合約包裝市場的擴張主要是由研發活動的活性化、包裝材料的新創新、全球學名藥市場的成長以及對可重複使用和環保包裝產品的需求迅速成長所推動的。

- 家庭用品和個人護理等最終用戶行業對初級包裝的需求不斷增加,迫使公司增加最終產品產量,因此必須透過外包包裝業務來縮短上市時間。因此,預計初級包裝合約在預測期內將會增加。

北美合約包裝產業概況

北美合約包裝市場適度整合。北美合約包裝市場競爭激烈,由領導企業組成。就市場佔有率而言,其中一些重要參與者目前控制著市場。這些主要企業擁有龐大的市場佔有率,專注於在國際市場上擴大基本客群。這些公司利用策略合作行動來增加市場佔有率並提高盈利。

- 2021 年 2 月 - 合約包裝製造商協會 (CPA) 與 Nulogy 合作。此次合作將使 CPA 會員免費進入 Nulogy University,這是一個針對合約包裝和契約製造(CP/CM) 業務的獨特線上培訓平台。

- 2021 年 3 月 - ActionPak Inc. 宣布已在新澤西州卡姆登佔地 175,000 平方英尺的新包裝工廠完成 196kW 屋頂太陽能發電設施的安裝。 491 塊太陽能板將抵消新建築 20% 的用電量。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場促進因素

- 食品業需求穩定成長

- 非核心業務外包的最新趨勢

- 製藥業持續的系列化工作

- 市場挑戰

- 監管標準的動態性質

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 按包裝

- 初級包裝

- 二次包裝

- 三級包裝

- 最終用戶>按行業

- 飲料

- 藥品

- 食物

- 其他最終用戶產業

第6章 競爭狀況

- 公司簡介

- Aaron Thomas Company

- Multipack Solutions LLC

- Pharma Tech Industries Inc.

- Reed Lane Inc.

- Sharp Corporation(UDG)

- UNICEP Packaging LLC

- Green Packaging Asia

- Jones Healthcare Group

- Stamar Packaging Inc.

- Genco(FedEx Supply Chain)

- Complete Co-Packing Services Ltd

- MJS Packaging

- Anderson Packaging LLC

- AmeriPac

- Co-Pak Packaging Group

- WG-Pro Manufacturing Inc

第7章 投資分析

第8章 市場未來展望

The North America Contract Packaging Market is expected to register a CAGR of 9.7% during the forecast period.

Key Highlights

- Increasing demand and the changing preference of manufacturing firms toward contract packagers, along with the U.S. government imposing various laws and regulations on the labeling and packaging of food, beverages, and pharmaceutical drugs, there is a positive impact on the demand for contract packaging in the region.

- Contract packaging for household and personal care industry has seen an increasing demand in the region with the pandemic, as there was a shortage in supply of hand sanitizers, disinfectant liquids, etc., which has compelled the U.S. cosmetics manufacturing industry to retrofit their facilities to produce these necessities which, while providing opportunities, may have also slowed production of the usual range of products.

- Many governments are also mandating stringent laws and regulations on the labeling and packaging of drugs and food products, further expanding the scope of contract packaging. For instance, in the United States, due to similar laws, the companies have preferred to outsource their manufacturing and packaging due to capital and others.

- The aforementioned factors might act as a challenge for contract packaging companies, owing to the requirement of using high-quality plastics, which might ultimately lead to increasing prices in raw materials and packaging. Such regulations highly challenge the growth of a specific type of packaging materials and, in turn, challenge the market growth. However, this threat is now minimal due to innovations by companies.

North America Contract Packaging Market Trends

Food and Beverage Industry is one of the Significant Factor for Growth of Market

- With the rising demand and changing preference of food production firms toward contract packagers, and the food companies increasingly focusing on cost optimization and their core business, most of them have been outsourcing their packaging services activities to third party contract food packagers, owing to the demand in the market studied.

- Also, many governments are also mandating stringent laws and regulations on the labeling and packaging of drugs and food products, which is further expanding the scope of the contract packaging market. For instance, the United States witnessed an increase in the demand for contract packaging in the food industries, owing to the inability of an in-house packaging facility for a few companies in this region.

- Rising demand for online shopping, and added layers for packaging protection for online purchases, along with the increasing demand for packaging in food and beverage, pharmaceutical needs, household, and personal items, majorly during the covid-19 pandemic, has increased the demand for contract packaging in the region. With the pandemic, CPG companies in the region have pushed their supply chains for even faster turnarounds and flexibility to adjust to sudden shifts in demand. Many of them have supplemented their manufacturing capabilities through contract packagers, which allowed them also to expand and innovate their products or to focus on their core products.

- Contract beverage packaging ensures the reliable distribution of beverages in the value chain and reduces post-production damage. Contract packaging is aimed to protect the product from external and environmental damage. One of the main factors driving the growth of the contract beverage packaging market is the changing consumption patterns of the consumer with an increasing preference for RTD beverages.

- The cannabis industry is anticipating growth in food and beverage, health and wellness, cosmetics, skincare & topicals, pet supplements, and pharmaceuticals, which shows the potential of contract packaging in the cannabis industry. As the industry continues to grow, cannabis companies are gaining the capacity and knowledge to offer contract packaging services. Some of the companies with experience and expertise have contracted out labeling services and other secondary packaging services. However, Under section 244 of the Cannabis Regulations, licensed processors must notify Health Canada of their intent to sell a cannabis product they have not previously sold in Canada.

Primary Packaging Holds a Significant Share

- Primary packaging involves direct contact with the product or is the first packaging layer in which the product is enclosed, which enables the user to protect and preserve the product from external contamination, damage, and spoiling.

- Primary contract packaging provides 'mission-critical' capabilities that may be inaccessible to manufacturers, especially when it comes to projects that require short runs or frequent changeovers, such as new or niche products, or seasonal demand, that are usually outside of primary manufacturing economies.

- Industries such as the food and beverage and pharmaceutical industry are one of the biggest adopters of primary packaging; therefore, the growth in the overall production capacity of these industries is expected to drive the adoption of primary contract packaging services across the globe.

- The primary packaging products have gained significant importance in the pharmaceutical sector during the last few years as they are being used for protecting medicines and drugs against any unfavorable external elements such as biocontamination, physical damage, degradation, and counterfeiting. The contract packaging market expansion is primarily being driven by increased research and development activities, newer innovations in packaging materials, growth in the global generics market, to name a few, as well as the rapidly rising demand for reusable and eco-friendly packaging products.

- The rising demand from end-user industries, such as household and personal care, for the primary packaging, has left the players to increase the production of their end products, thereby making it essential for them to reduce the time to markets by outsourcing the packaging activities. This is expected to boost the primary contract packaging over the forecast period.

North America Contract Packaging Industry Overview

The North America Contract Packaging market is Moderately consolidated. The North America Contract Packaging Market is competitive and consists of some influential players. In terms of market share, some of these important actors currently manage the market. These influential players with a noticeable share in the market are concentrating on expanding their customer base across foreign countries. These businesses are leveraging strategic collaborative actions to improve their market percentage and enhance their profitability.

- Feb 2021- The Association for Contract Packagers and Manufacturers (CPA) partnered with Nulogy. The partnership will grant CPA members complimentary access to Nulogy University, a proprietary online training platform for contract packaging and contract manufacturing (CP/CM) businesses.

- March 2021- ActionPak Inc. has announced that it completed the 196-kW rooftop solar installation on its new 175,000 sq ft packaging facility located in Camden, New Jersey, to do both primary and secondary packaging of food and OTC products under strict SQF and FDA guidelines. The 491 solar panels are said to offset 20% of the electric usage at the newly constructed building.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Steady rise in demand from the food industry

- 4.2.2 Recent trend of outsourcing non-core operations

- 4.2.3 Ongoing efforts towards serialization in the pharmaceutical sector

- 4.3 Market Challenges

- 4.3.1 Dynamic nature of regulatory standards

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Packaging

- 5.1.1 Primary Packaging

- 5.1.2 Secondary Packaging

- 5.1.3 Tertiary Packaging

- 5.2 By End-User Vertical

- 5.2.1 Beverages

- 5.2.2 Pharmaceuticals

- 5.2.3 Food

- 5.2.4 Other End-Users Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Aaron Thomas Company

- 6.1.2 Multipack Solutions LLC

- 6.1.3 Pharma Tech Industries Inc.

- 6.1.4 Reed Lane Inc.

- 6.1.5 Sharp Corporation (UDG)

- 6.1.6 UNICEP Packaging LLC

- 6.1.7 Green Packaging Asia

- 6.1.8 Jones Healthcare Group

- 6.1.9 Stamar Packaging Inc.

- 6.1.10 Genco (FedEx Supply Chain)

- 6.1.11 Complete Co-Packing Services Ltd

- 6.1.12 MJS Packaging

- 6.1.13 Anderson Packaging LLC

- 6.1.14 AmeriPac

- 6.1.15 Co-Pak Packaging Group

- 6.1.16 WG-Pro Manufacturing Inc