|

市場調查報告書

商品編碼

1549715

合約包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

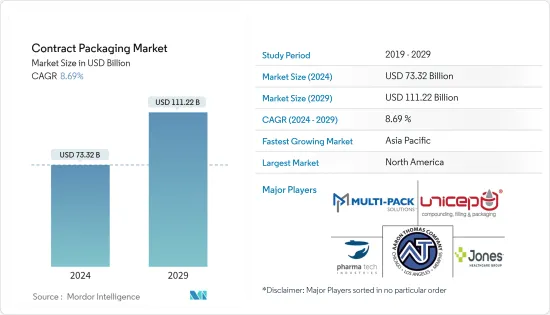

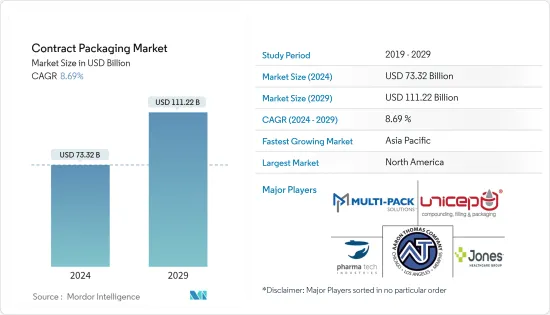

合約包裝市場規模預計到 2024 年為 733.2 億美元,預計到 2029 年將達到 1112.2 億美元,在預測期內(2024-2029 年)複合年成長率為 8.69%。

合約包裝市場在供應鏈中發揮著至關重要的作用,可以提高公司的生產力。許多製造商正在外包包裝,以專注於其核心競爭力,從而推動全球對合約包裝的需求。

主要亮點

- 合約包裝服務具有多種優勢,包括為您的產品提供一致的品質標準以及按照行業標準和政府法規包裝您的產品。合約包裝公司還可以降低製造商的營運成本。合約包裝公司擁有必要的設備、專業知識和材料,可顯著降低製造商的營運成本,促進市場成長。

- 快速成長的全球製藥和化妝品行業正在增加各個階段對合約包裝服務的需求。為了滿足如此嚴格的法規和規範,需要進行多次檢查和品質檢查操作。外包包裝業務意味著滿足這些法規(也稱為軍用規格包裝)的重任由合約包裝公司接管,這就是為什麼許多製造商選擇合約包裝而不是內部業務的原因。

- 消費者對環境問題的認知不斷提高以及生產商對經濟型包裝選擇的需求正在促使包裝承包商採用永續的包裝替代品和環保的包裝設計。此外,永續性和客製化將繼續對合約包裝市場產生積極影響,導致個人護理、食品和飲料等消費品包裝在預測期內成長。

- 2024年4月,美國合約包裝公司Orlandi推出了EcoPro Paper Wrap新產品,旨在滿足日益成長的環保包裝需求。 EcoPro 是一種阻隔性、可熱封的紙質包裝材料,可回收利用,是塑膠薄膜和鋁箔袋的永續替代品。

- 作為擴大策略的一部分,領先的公司正在專注於收購和擴大其地理覆蓋範圍。例如,2024年4月,美國付加包裝經銷商Veritiv Corporation宣布收購美國合約套裝服務供應商Ameripac LLC。此次收購將加強 Veritiv 的基本客群並擴大其在該市場的合約包裝能力。

- 在快速變化的包裝市場中,許多合約包裝供應商發現很難跟上不斷變化的趨勢,這給市場成長帶來了挑戰。為了保持市場競爭力,包裝承包商必須應對不斷變化的消費者偏好並滿足不斷變化的需求。

合約包裝市場趨勢

藥品預計將顯著成長

- 醫藥市場的快速成長是由醫療領域的進步所推動的。研究方法不斷發展,從而顯著改善患者健康的創新治療方法,並推動主要市場對合約包裝服務的需求。

- 合約包裝公司為製藥和醫療產業提供專業的包裝服務,確保產品按照最高品質標準進行包裝,同時遵守法規和安全性至關重要。外包包裝服務正在幫助製藥公司降低包裝、標籤、滅菌和倉儲等領域的成本,從而促進市場成長。

- 各種製藥公司現在將最終產品的業務外包給擁有專門從事藥品包裝的熟練勞動力的公司。藥品包裝極為重要,因為產品必須可供病人安全食用。

- 合約包裝在醫藥市場上越來越受歡迎,特別是隨著複雜藥物和特殊藥物的增加。合約開發和受託製造廠商(CDMO) 為製藥公司提供全面的包裝服務,幫助他們簡化業務並專注於核心競爭力。公司與 CDMO 合作,幫助推動市場開拓,因為 CDMO 擁有先進的基礎設施來支援藥物開發、製造和包裝的每個階段。

- 合約包裝服務為製藥公司提供了靈活性和擴充性,使他們能夠應對市場需求和產量的變化。合約包裝公司可以處理各種包裝形式,包括泡殼包裝、瓶子、管瓶和小袋,以滿足不同藥品和劑型的多樣化需求。

- 此外,合約包裝商經常投資最新的設備和技術來最佳化包裝過程、最大限度地減少錯誤並提高效率。透過委託包裝外包給 CDMO,製藥公司可以擴大生產規模,以滿足不斷成長的需求。

- 根據 Pharmapack Europe 2024 調查結果,合約包裝將在未來 12 個月內成長。特種藥品和生物製藥的激增增加了對專業包裝解決方案的需求,導致製造商尋求合約包裝服務。合約包裝公司提供創建客製化包裝解決方案的專業知識,使藥品製造商能夠有效區分其產品並滿足特種藥品的獨特要求。

預計北美將佔據最大佔有率

- 北美合約包裝市場在藥品、化妝品、個人護理和飲料等多個領域正在經歷快速成長。在製藥業,該地區藥品製造投資的增加和嚴格的包裝監管要求正在推動對合約包裝服務的需求。

- 這家合約包裝公司專門為藥品特定需求提供客製化包裝解決方案,包括泡殼包裝、瓶子和單位劑量包裝。合約包裝公司在法規遵循和品質保證方面擁有專業知識,可確保藥品的包裝安全、準確並符合行業標準,從而推動北美對合約包裝服務的需求。

- 在化妝品行業,合約包裝為品牌提供了將產品推向市場的靈活性和敏捷性。合約包裝公司與化妝品公司合作開發創新的包裝設計並融入增強產品美感和對消費者吸引力的功能。從護膚品到化妝品,合約包裝公司提供廣泛的服務,包括填充、貼標、組裝和運輸。

- 合約包裝公司經常投資先進技術和設備,以滿足化妝品領域對永續包裝解決方案不斷成長的需求,例如使用環保材料和可回收包裝選項,這正在進一步推動市場需求的成長。

- 化妝品個人化包裝的成長趨勢是由包裝技術的進步所推動的,並推動了北美市場的需求。 Cosmopak USA LLC 等公司提供客製化合約包裝服務,以提升您的品牌形象。

合約包裝產業概述

合約包裝市場適度分散,有許多國內和國際公司。該市場上的公司透過聯盟和合併不斷擴大其地理足跡。隨著外包的增加,在提供可靠、快速的服務方面,市場競爭日益激烈。

- 2024 年 1 月 冷藏供應商 Magnavale 宣布擴大其伊斯頓工廠的合約包裝、標籤和日期編碼生產線,顯著提高了產能。全新的高度自動化生產線能夠處理常溫、冷藏和冷凍應用,使 Magnavale Easton 能夠顯著增加其包裝、標籤和日期編碼輸出,從而能夠靈活地應對需求高峰期。

- 2024年1月:美國合約套裝公司Hood Container Corporation宣布收購美國包裝公司Sumter Packaging Corporation。此次收購增強了 Hood 的包裝能力,並提供了利用 Sumter 的製造能力提供垂直供應鏈整合的能力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 尋求透過外包非核心業務來獲得競爭優勢的公司

- 電商產業需求增加

- 對尖端技術和創新包裝的需求不斷成長

- 市場限制因素

- 嚴格的政府法規

- 與內部包裝的競爭

- 行業法規和標準

- 合約包裝的演變

第6章 市場細分

- 按包裝

- 初級包裝

- 二次包裝

- 三級包裝

- 按最終用戶產業

- 食品

- 飲料

- 藥品

- 家居用品/個人護理

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 荷蘭

- 義大利

- 西班牙

- 亞洲

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Aaron Thomas Company

- Multipack Solutions LLC

- Pharma Tech Industries Inc.

- Reed Lane Inc.

- Sharp Packaging Services

- UNICEP Packaging LLC

- Green Packaging Asia

- Jones Healthcare Group

- Stamar Packaging Inc.

- Budelpack Poortvliet BV

- Complete Co-Packing Services Ltd

第8章投資分析

第9章 未來展望

The Contract Packaging Market size is estimated at USD 73.32 billion in 2024, and is expected to reach USD 111.22 billion by 2029, growing at a CAGR of 8.69% during the forecast period (2024-2029).

The contract packaging market plays a pivotal role in the supply chain, boosting productivity for businesses. Many manufacturers outsource packaging to focus on their core competencies, boosting the demand for contract packaging globally.

Key Highlights

- Contract packaging services have several advantages, including providing consistent quality standards for products and product packaging that adheres to industry standards and government regulations. Also, contract packaging companies reduce the operational costs of the manufacturers. Since a contract packaging company has the necessary equipment, expertise, and materials, it can significantly reduce manufacturers' operational costs, thus boosting market growth.

- The rapidly growing pharmaceutical and cosmetic industry globally is propelling the need for contract packaging services for every stage. Meeting such stringent rules and norms requires several inspection and quality check operations. By outsourcing packaging activities, the hectic task of meeting such regulations (also known as mil-spec packaging) is passed on to the contract packaging agency, motivating more manufacturers to prefer contract packaging over in-house packaging activities.

- Increasing consumer awareness about environmental concerns and the producer demand for economical packaging options encourage contract packagers to adopt sustainable packaging alternatives and eco-friendly package designs. Furthermore, sustainability and customization will continue to positively impact the contract packaging market, leading to growth in consumer-packaged goods, such as personal care and food and beverages, over the forecast period.

- In April 2024, Orlandi, a United States-based contract packer, launched its new product, EcoPro Paper Wrap, designed to meet the growing demand for eco-friendly packaging. EcoPro is a high-barrier, heat-sealable paper-wrap material that can be recycled and is a sustainable alternative to plastic film or foil pouches.

- As a part of their expansion strategy, major players are focusing on acquisitions and growing their geographical footprint. For instance, in April 2024, Veritiv Corporation, a United States-based distributor of value-added packaging, announced the acquisition of Ameripac LLC, a US contract packaging service provider. The acquisition will likely enhance Veritiv's contract packaging capabilities in the market, along with enhancing its customer base.

- With the rapidly changing packaging market, it is difficult for many contract packaging providers to keep up with the changing trends, which can be challenging for the growth of the market. In order to stay competitive in the market, contract packaging providers need to adjust to shifting consumer preferences in order to fulfill changing demands.

Contract Packaging Market Trends

Pharmaceuticals is Expected to Experience Significant Growth

- The rapidly growing pharmaceutical market is attributable to the advancements in the medical field. Research methods are evolving, leading to significant improvements in innovative treatments for patient well-being, which is enhancing the demand for contract packaging services in major markets.

- Contract packaging companies provide specialized packaging services for pharmaceutical and medical industries, ensuring that the products are packed according to the highest quality standards, where regulatory compliance and safety are most important. Outsourcing packaging services lowers costs in areas such as packaging, labeling, sterilization, and warehousing for pharmaceutical companies, which boosts market growth.

- Various pharmaceutical companies are now outsourcing the job of packaging end-products to companies with skilled labor specialized in handling the packaging of medicines. The pharmaceutical packaging of drugs is vital, as the product should be safe for patient consumption.

- Contract packaging is increasingly gaining popularity in the pharmaceutical market, particularly with the rise of complex medications and specialty drugs. Contract development and manufacturing organizations (CDMOs) offer comprehensive packaging services to pharmaceutical companies, helping them streamline their operations and focus on core competencies. Companies are partnering with CDMOs as they have advanced infrastructure to help through stages of drug development, manufacturing, and packaging, thus boosting market growth.

- Contract packaging services offer pharmaceutical companies flexibility and scalability, allowing them to adapt to changing market demands and production volumes. Contract packers can handle various packaging formats, including blister packs, bottles, vials, and sachets, catering to the diverse needs of different medications and dosage forms.

- Additionally, contract packaging providers often invest in modern equipment and technology to optimize packaging processes, minimize errors, and enhance efficiency. By outsourcing packaging to CDMOs, pharmaceutical companies are able to scale production volume to meet the increasing demand.

- According to the Pharmapack Europe 2024 survey results, contract packaging will grow over the coming 12 months. The surge in specialty and biologic medicines has intensified the need for specialized packaging solutions, driving manufacturers to seek contract packaging services. Contract packaging companies offer expertise in creating customized packaging solutions, enabling pharmaceutical manufacturers to effectively differentiate their products and meet the unique requirements of specialty medications.

North America is Expected to Account For the Largest Share

- The contract packaging market in North America is experiencing exponential growth across various segments, including pharmaceuticals, cosmetics, personal care, and beverages. In the pharmaceutical sector, contract packaging services are in high demand due to the growing investment in drug manufacturing and stringent regulatory requirements for packaging in the region.

- Contract packaging companies specialize in providing customized packaging solutions tailored to the unique needs of pharmaceutical products, such as blister packs, bottles, and unit-dose packaging. With expertise in regulatory compliance and quality assurance, contract packagers ensure that medications are packaged safely, accurately, and in accordance with industry standards, which boosts the demand for contract packaging services in North America.

- In the cosmetics industry, contract packaging offers brands flexibility and agility in bringing their products to market. Contract packagers collaborate with cosmetics companies to develop innovative packaging designs, incorporating features that enhance product aesthetics and consumer appeal. From skincare products to make-up items, contract packaging companies offer a wide range of services, including filling, labeling, assembling, and transportation.

- Contract packaging companies often invest in advanced technologies and equipment to meet the growing demand for sustainable packaging solutions in the cosmetics segment, such as the use of eco-friendly materials and recyclable packaging options, which further boosts market growth.

- The growing trend of personalization packaging in cosmetic products is driven by advancements in packaging technologies, boosting the demand in the North American market. Companies such as Cosmopak USA LLC provide customized contract packaging services to enhance brand image.

Contract Packaging Industry Overview

The contract packaging market is moderately fragmented, with the presence of many domestic and international companies. The companies in the market are continually expanding their geographical footprint with the help of partnerships and mergers. With the growth of outsourcing activities among various established players, the market has been witnessing significant competition in terms of providing reliable and quick services, making it a competitive market.

- January 2024: Cold storage provider Magnavale announced the expansion of its contract packing, labeling, and date-coding lines at its Easton facility, allowing a significant boost in capacity. Capable of adapting between ambient, chilled, and frozen applications, these new highly automated lines allow Magnavale Easton to significantly increase packing, labeling, and date-coding output and flexibly adjust to peak-demand periods.

- January 2024: Hood Container Corporation, a United States-based contract packaging company, announced the acquisition of Sumter Packaging Corporation, a packaging company in the United States. The acquisition will improve Hood's packaging strength and provide the ability to offer vertical supply chain integration by leveraging Sumter's manufacturing capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations

- 5.1.2 Increasing Demand from the E-commerce Industry

- 5.1.3 Increasing Need for Latest Technology and Innovative Packaging

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations

- 5.2.2 Competition from In-house Packaging

- 5.3 Industry Regulations and Standards

- 5.4 Evolution of Contract Packaging

6 MARKET SEGMENTATION

- 6.1 By Packaging

- 6.1.1 Primary

- 6.1.2 Secondary

- 6.1.3 Tertiary

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Household and Personal Care

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Netherlands

- 6.3.2.5 Italy

- 6.3.2.6 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aaron Thomas Company

- 7.1.2 Multipack Solutions LLC

- 7.1.3 Pharma Tech Industries Inc.

- 7.1.4 Reed Lane Inc.

- 7.1.5 Sharp Packaging Services

- 7.1.6 UNICEP Packaging LLC

- 7.1.7 Green Packaging Asia

- 7.1.8 Jones Healthcare Group

- 7.1.9 Stamar Packaging Inc.

- 7.1.10 Budelpack Poortvliet BV

- 7.1.11 Complete Co-Packing Services Ltd