|

市場調查報告書

商品編碼

1627139

專業雲端服務:市場佔有率分析、產業趨勢、成長預測(2025-2030)Professional Cloud Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

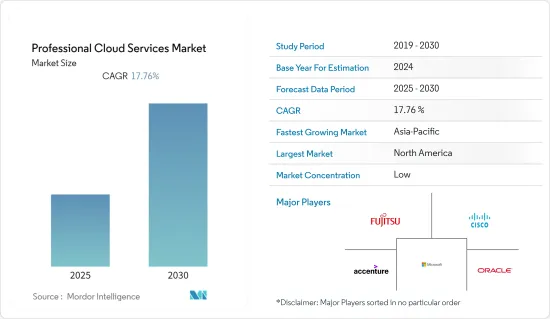

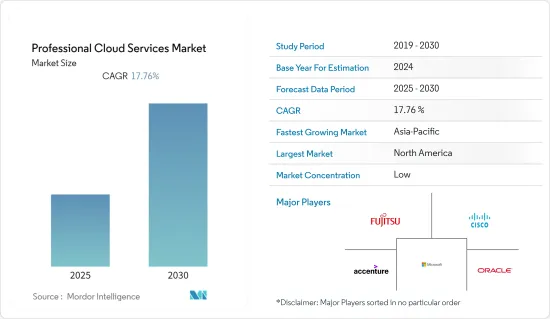

專業雲端服務市場預計在預測期內複合年成長率為17.76%

主要亮點

- 此外,服務型經濟的擴張是推動專業雲端服務市場成長的關鍵因素之一。雲端運算使這成為可能,使您能夠以低成本管理資料庫並從任何地方存取資料。

- 此外,醫療保健的 24/7 需求為產業提供了大量資料,必須為了病人的利益而處理這些數據。雲端服務使醫療保健服務供應商能夠輕鬆共用資料並為患者提供醫療保健解決方案。雲端服務附帶的人工智慧和機器學習可以透過減少醫療保健專業人員分析資料並為患者提供最佳解決方案所需的時間來支持這一點。

- 例如,去年 3 月,微軟宣布了生命科學和醫療保健雲端技術的進步,Azure 健康數據服務全面上市,並更新了專門針對醫療保健的 Microsoft 雲端。隨著最近完成對 Nuance Communications 的收購,微軟正在幫助組織利用可信賴的人工智慧來幫助人們解決最大的問題,並為每個人改變醫療保健的未來。

- 然而,對更多熟練專業人員的需求以及每年不斷增加的網路攻擊數量正在阻礙雲端市場的成長。

- 新興國家大流行期間對公共衛生安全的擔憂導致世界許多國家轉向在家工作政策,需要建立遠距工作基礎設施。因此,在COVID-19之後,包括政府機構在內的各級組織都預計會受到各種影響,包括對虛擬服務的需求增加,這將需要許多雲端基礎的服務。

專業雲端服務市場趨勢

混合雲端市場預計將高速成長

- 混合雲端是公共雲端供應商(例如 Google Cloud 或 Amazon Web Services)與私有雲端(專為單一組織使用而設計的雲)的全面組合。隨著運算需求和成本的變化,混合雲端透過在公共雲端雲和私有雲端之間移動工作負載,為企業提供靈活性和部署資料的方法。

- 如今,許多大大小小的組織正在從傳統業務模式過渡到數位業務。這種轉變正在塑造混合雲端市場,因為它帶來了更低的總擁有成本 (TCO)、更高的安全性、靈活性和敏捷性等優勢。 IBM 表示,89% 的 IT 領導者希望將業務關鍵型工作負載轉移到雲端,而數位化的進步正在推動這一切。

- 各家公司正在推出基於雲端服務的重要服務。例如,邊緣雲端供應商 Ridge 去年 8 月宣布推出新的綜合雲端解決方案混合雲端。 Ridge 表示,其分散式雲端架構使企業能夠統一所有地點的關鍵業務應用程式,無論是 Ridge 管理的還是本地的。該解決方案允許公司透過單一入口網站管理其工作負載,並在所有公共和私人公司地點提供一致的雲端體驗。

- 截至去年 8 月,Google Cloud Marketplace 提供約 5,000 種服務和產品,其中約 1,230 種屬於虛擬機器類別。 Google Cloud Marketplace 是一個數位目錄,主要是獨立軟體供應商可以在其中列出他們的服務和產品。這使得 Google Cloud 客戶可以從 Google Cloud 上運行的各種解決方案中進行選擇,以滿足不同的特定需求。

- IBM 表示,由於混合平台是支援主要應用程式工作負載的核心策略,組織和企業正在從工作負載效率的提高中廣泛獲得業務效益。去年,IT 領導者報告稱,在混合雲端上運行應用程式最常見的好處是最佳化業務永續營運和災害復原的整體能力。

預測期內,北美將佔據最大的市場佔有率

- 北美佔據專業雲端服務的大部分市場佔有率。這主要是由於該地區存在大公司。主要公司包括思科系統公司、微軟公司、甲骨文公司、惠普公司和 Dell EMC。

- 北美企業積極進行策略併購。例如,去年5月,美國科技巨頭IBM與亞馬遜網路服務公司(AWS)簽訂了策略合作協議(SCA),在AWS上以SaaS(軟體即服務)的形式提供該公司廣泛的軟體目錄。 IBM 和 AWS 之間的這項史無前例的協定意味著,除了 IBM Cloud 上提供的 IBM 軟體之外,基於 AWS 上的 Red Hat OpenShift Service (ROSA) 建置並在 AWS 上雲原生運行的資料還將為客戶和客戶提供服務。

- 該地區的公司正在推出新產品和服務以獲得競爭優勢。例如,惠普企業去年 6 月宣布,Ecrit 採用 HPE GreenLake 邊緣到雲端平台,推出新的雲端產品組合,並擴展其整體基礎設施即服務和託管 IT 服務產品。這套全面的服務使客戶能夠部署自訂的解決方案,為任何工作負載提供擴充性、敏捷、即計量收費的雲端體驗。

- 加拿大公司也擴大接受 BYOD 趨勢。隨著越來越多的公司採用平板電腦和智慧型手機來存取關鍵業務訊息,BYO 預計將在該國擴大,預計也會在預測期內影響專業雲端服務市場。

此外,加拿大政府制定了「雲端優先」策略,在啟動資訊技術投資、措施、策略和計劃時,將雲端服務確定為主要交付選項並對其進行評估。雲端也允許加拿大政府利用私人提供者的創新來使資訊技術更加敏捷。這類計劃可能會為市場帶來許多好處,因為這種模式兼顧了私有雲端的安全性和公有雲的靈活性。

專業雲端服務產業概況

專業雲端服務市場的競爭非常激烈,主要參與者包括思科系統公司、惠普公司、微軟公司、戴爾易安信和富士通有限公司。這些公司在激烈的市場競爭中生存的主要成長策略包括產品發布、高額研發支出、聯盟和收購。

2022 年 9 月,GTC-NVIDIA 宣布推出首款基礎架構和 SaaS 產品 NVIDIA Omniverse Cloud。它主要是一套全面的雲端服務,允許藝術家、開發人員和企業團隊在任何地方發布、設計、操作和體驗元宇宙應用程式。

2022 年 2 月,德勤、KeyBank 和 Google Cloud 宣布擴大多年策略合作關係,以協助 KeyBank 實現成為雲端優先銀行的目標。 KeyBank 將成為美國最大的區域銀行之一,在 Google Cloud 基礎架構上運行其領先的平台和應用程式。這使得金融機構能夠轉變其營運、開發以及向合作夥伴、客戶和團隊成員提供數位體驗的方式,同時保持安全性。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 需要提升買家體驗

- 強調企業生產力

- 市場限制因素

- 網路攻擊增加

第6章 市場細分

- 按發展

- 民眾

- 私人的

- 混合

- 按服務模式

- 平台即服務 (PaaS)

- 軟體即服務 (SaaS)

- 基礎設施即服務 (IaaS)

- 按最終用戶產業

- 政府/公共機構

- 衛生保健

- 銀行、金融、服務和保險 (BFSI)

- 零售

- 資訊科技/通訊

- 媒體娛樂

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- Hewlett-Packard Company

- Cognizant

- Accenture PLC

- Dell EMC

- Microsoft Corporation

- Fujitsu Limited

- Capgemini SE

- Infosys Limited

- HCL Technologies Limited

- Oracle Corporation

- NTT DATA

- Atos

- Amazon Web Services

- SAP SE

第8章投資分析

第9章市場的未來

The Professional Cloud Services Market is expected to register a CAGR of 17.76% during the forecast period.

Key Highlights

- Moreover, the increase in the service-oriented economy is one of the major factors driving the growth of the professional cloud services market. This was made possible by cloud computing, which helps manage databases for less money and lets people access the data from anywhere.

- Furthermore, in healthcare, the need is 24*7, and this industry provides lots of data that needs to be handled for the benefit of the patients. With cloud services, data can be easily shared among medical service providers, providing healthcare solutions to patients. AI and machine learning, which come with cloud services, support this because they shorten the time it takes a healthcare professional to analyze the data and provide patients with the best solution.

- For instance, in March last year, Microsoft Corp. declared advancements in cloud technologies for life sciences and healthcare with the general availability of Azure Health Data Services and updates to Microsoft Cloud, especially for healthcare. With the recent closing of its purchase of Nuance Communications, Microsoft is in a unique position to make it easier for organizations to help people by using trusted AI to solve the biggest problems and change the future of healthcare for everyone.

- However, the need for more skilled professionals and an increase in the number of cyberattacks year after year are acting as hurdles to the growth of the cloud market.

- Due to worries about public health safety during the COVID-19 pandemic, numerous countries worldwide shifted to work-from-home policies, necessitating the development of remote working infrastructure. Because of this, after COVID-19, organizations at all levels, including government agencies, expected a number of possible effects, such as a rise in demand for virtual services, which would lead to the need for a number of cloud-based services.

Professional Cloud Services Market Trends

Hybrid Cloud is Expected to Have High Growth in the Market

- A hybrid cloud is an overall combination of a public cloud provider, such as Google Cloud or Amazon Web Services, with a private cloud, i.e., one designed to be used by a single organization. The hybrid cloud has given businesses more flexibility and more ways to deploy data by letting workloads move between public and private clouds as their computing needs and costs change.

- Currently, many organizations of any size, be they small or large, are transforming from traditional to digital modes of business. This transformation is creating a market for hybrid cloud because of the benefits provided, like reduced total cost of ownership (TCO), high security, flexibility, and agility. IBM stated that 89% of IT leaders expect to move business-critical workloads to the cloud, and the growth in digitization drives all of this.

- Various firms are launching significant offerings based on cloud services. For instance, in August last year, Ridge, an edge cloud provider, introduced a new comprehensive cloud solution, Hybrid Cloud. Ridge stated that its distributed cloud architecture enables businesses to unify business-critical apps across all their locations, whether they are managed or on-premises locations run by Ridge. With the help of this solution, businesses can thus manage their workloads through a single portal, providing companies with a cohesive cloud experience across all public and private locations.

- As of August last year, around 5,000 services and products were offered on the Google Cloud Marketplace, of which about 1,230 belonged to the virtual machine category. The Google Cloud Marketplace is primarily a digital catalog on which independent software vendors can list their total services and products. This allows Google Cloud customers to pick from various solutions that run on Google Cloud to cater to their various specific needs.

- As per IBM, with hybrid platforms as the central strategy for supporting key application workloads, organizations and firms are widely reaping the business benefits of improved workload efficiency. In the last year, the most prevalent advantage of running applications on a hybrid cloud, as reported by IT leaders, was the overall ability to optimize business continuity and disaster recovery.

North America to Have the Largest Market Share Over the Forecast Period

- North America holds a significant portion of the professional cloud services market share. It is primarily due to the presence of large firms in the region. Some key firms include Cisco Systems, Inc., Microsoft Corporation, Oracle Corporation, Hewlett-Packard Company, Dell EMC, and many others.

- North American companies are actively involved in making strategic mergers and acquisitions. For instance, in May last year, American technology giant IBM declared that it had signed a Strategic Collaboration Agreement (SCA) with Amazon Web Services, Inc. (AWS), with plans to deliver a broad array of its software catalog as Software-as-a-Service (SaaS) on AWS. Building on IBM Software being available as-a-Service (aaS) on IBM Cloud, this first-of-its-kind agreement between IBM and AWS would offer customers and clients easy and quick access to IBM Software that spans data, automation, and AI, security, and sustainability capabilities built on Red Hat OpenShift Service on AWS (ROSA) and runs cloud-native on AWS.

- Companies in the region are introducing new products or services to gain a competitive advantage. For instance, in June last year, Hewlett Packard Enterprise announced that Eclit had selected the HPE GreenLake edge-to-cloud platform to introduce a new cloud portfolio and expand its overall infrastructure as a service and managed IT services offerings. The comprehensive service suite allows customers to deploy custom-built solutions with a scalable, agile, and pay-per-use cloud experience across all workloads.

- Canadian companies are also increasingly adopting the BYOD trend. With the increase in the adoption of tablets and smartphones for accessing business-critical information, the growth of BYOD in the country is expected to increase, which, in turn, is expected to impact the professional cloud services market during the forecast period.

Moreover, the Government of Canada has a "cloud-first" strategy, whereby cloud services are identified and evaluated as the principal delivery option when initiating information technology investments, initiatives, strategies, and projects. The cloud will also allow the government of Canada to harness the innovation of private-sector providers to make its information technology more agile. These kinds of projects are likely to give the market a lot of chances to make money, since this model allows private cloud security and public cloud flexibility.

Professional Cloud Services Industry Overview

The professional cloud services market is very competitive because of the presence of many major players like Cisco Systems Inc., Hewlett-Packard Company, Microsoft Corporation, Dell EMC, and Fujitsu Limited, among others. The main growth strategies used by these businesses to survive the fierce market competition are product launches, high expenditures on research and development, partnerships, and acquisitions.

In September 2022, GTC-NVIDIA announced its first infrastructure- and software-as-a-service offering, NVIDIA Omniverse Cloud. It is mainly a comprehensive suite of cloud services, especially for artists, developers, and enterprise teams to publish, design, operate, and experience metaverse applications anywhere.

In February 2022, Deloitte, KeyBank, and Google Cloud declared an expanded, multi-year strategic relationship to assist KeyBank in achieving its goal of being a cloud-first bank. KeyBank would be one of the largest regional banks in the U.S. to run its main platforms and applications on Google Cloud infrastructure. This would allow the financial institution to change how it runs, develops, and delivers digital experiences to its partners, clients, and teammates, all while keeping security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Delivering Strengthen Buyer Experiences

- 5.1.2 Focus on Business Productivity

- 5.2 Market Restraints

- 5.2.1 Increasing Incidents of Cyber-attacks

6 MARKET SEGMENTATION

- 6.1 By Type of Deployment

- 6.1.1 Public

- 6.1.2 Private

- 6.1.3 Hybrid

- 6.2 By Type of Service Model

- 6.2.1 Platform as a Service (PaaS)

- 6.2.2 Software as a Service (SaaS)

- 6.2.3 Infrastructure as a Service (IaaS)

- 6.3 By End-User Industry

- 6.3.1 Government and Public Sector

- 6.3.2 Healthcare

- 6.3.3 Banking, Finance, Services, and Insurance (BFSI)

- 6.3.4 Retail

- 6.3.5 IT and Telecommunications

- 6.3.6 Media and Entertainment

- 6.3.7 Other End-User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Hewlett-Packard Company

- 7.1.3 Cognizant

- 7.1.4 Accenture PLC

- 7.1.5 Dell EMC

- 7.1.6 Microsoft Corporation

- 7.1.7 Fujitsu Limited

- 7.1.8 Capgemini SE

- 7.1.9 Infosys Limited

- 7.1.10 HCL Technologies Limited

- 7.1.11 Oracle Corporation

- 7.1.12 NTT DATA

- 7.1.13 Atos

- 7.1.14 Amazon Web Services

- 7.1.15 SAP SE